- Home

- »

- Consumer F&B

- »

-

Meal Kit Delivery Services Market Size & Share Report, 2030GVR Report cover

![Meal Kit Delivery Services Market Size, Share & Trends Report]()

Meal Kit Delivery Services Market Size, Share & Trends Analysis Report By Offering (Heat & Eat, Cook & Eat), By Service (Single, Multiple), By Platform (Online, Offline), Meal Type (Vegan, Vegetarian), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-224-2

- Number of Report Pages: 136

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

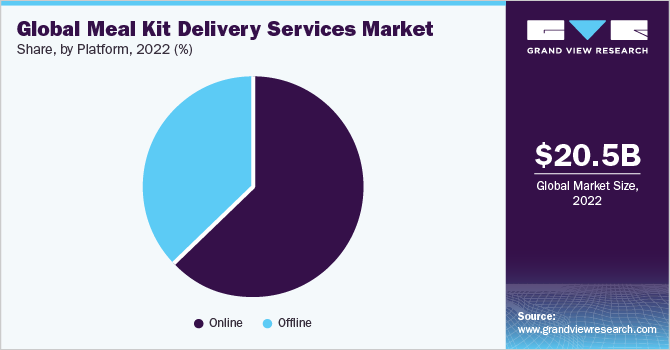

The global meal kit delivery services market size was valued at USD 20.54 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. Increasing preference for home-cooked and chef-cooked food among millennials is a major factor contributing to the growth of the market. The delivery service has been gaining high popularity and adoption among Generation Y and Z. The increasing preference for the product is driven by the benefits of homemade meals, as they are more economical in comparison to take-outs and home delivery services. The COVID-19 pandemic has offered a huge opportunity to the meal kit delivery services market as almost all the restaurants, eateries, and hotels were shut down across the globe. People have started focusing on a healthy diet more than ever to increase their immunity and maintain a balanced diet. As a result, an increasing number of people have been looking for healthy and easy meal options.

Furthermore, key players in the market have witnessed a surge in sales during the pandemic as compared to 2019. Companies like Blue Apron have also reported a hike in global sales, followed by HelloFresh, which doubled its customer base in the U.S. with an increase of 66% in its Y-O-Y revenue.

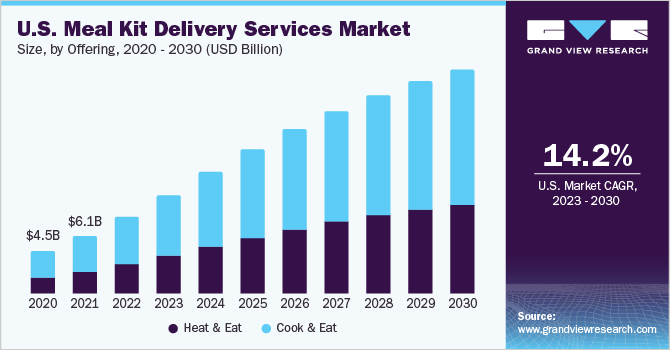

The heat & eat segment has been gaining traction among U.S. consumers as several delivery service companies have been tapping into this segment by launching single and multiple servings for consumers. For instance, homemade food is more economical than eating at a restaurant. Furthermore, the product's availability has made homemade meals more time-saving compared to take-outs and home delivery services. Preparing food at home also gives full control over the ingredients one wishes to use and comes in handy for people who are allergic to certain food ingredients or are trying to avoid specific ingredients.

According to a survey conducted by HUNTER in April 2020, 54% of American consumers cook more than before, and 22% order prepared meal kits more frequently. Dining in is becoming more popular than dining out. Boomers and millennials increasingly prefer staying at home and cooking or ordering in rather than spending money at restaurants. Consumers are also making fewer restaurant visits and opting to stay at home.

One of the key factors contributing to this shift is the attitudes and behaviors of the two largest generational groups—boomers and millennials. While millennials have surpassed baby boomers in number, boomers remain a large population, and their behaviors significantly influence the marketplace that caters to cooking at home.

Meal kit delivery services are an ideal solution since meal planning in advance significantly helps reduce food wastage. Meal kits have ingredients in the exact quantity that is required to prepare a meal since each portion is pre-measured. Several delivery service companies offer larger portions but still provide calorie counts and nutritional information based on the portions.

Offering Insights

Cook & eat meal kit delivery service held a larger market share of 60.6% in 2022 and is expected to maintain dominance over the forecast period. The dominance can be attributed to the popularity of gourmet-style home cooking amongst youngsters. It also lets one try new recipes or gourmet meals without spending extra money eating at restaurants. These recipes are more time intensive than the heat & eat segment but are a big-time saver than the conventional method of cooking. Further, it saves a lot of time going to supermarkets & grocery stores as all the ingredients come pre-portioned in the amount required for a single person or more.

However, the heat & eat segment is projected to register faster growth during the forecast period, with a CAGR of 15.7% from 2023 to 2030. Heat & eat meal kit delivery service providers offer meals prepared by chefs to consumers. The consumers can either choose their ingredients for the food or select from the already available recipes on the website. These kits have been gaining popularity across the globe owing to the comfort and accessibility of products. For instance, Freshly Inc. offers customized meals as well as its signature collection that includes Dijon Pork Chop and Traditional Beef Stew, among others. The average refrigerated shelf life of prepared these is around 3-5 days, and it takes around 5-15 minutes to heat and serve them.

Service Insights

The single delivery service contributed a share of 57.7% of the global revenue in 2022. The single delivery service segment is extremely convenient for bachelors who are studying, pursuing a degree, or are staying away from family and are working or involved in a particular job and are unable to invest enough time in cooking. Furthermore, most of these bachelors are not well versed in healthy cooking. Thus, service providers offer a complete solution to these issues of a single bachelor. Most of these single people have been looking for a healthier diet that benefits both body and mind.

The multiple delivery service segment is expected to register faster growth during forecast years, with a CAGR of 15.7% from 2023 to 2030. Families are becoming busier and more stressed as a large number of families feature two working parents. To reduce this burden, households opt for these delivery services that provide proper solutions to time and effort-intensive cooking tasks. Lack of time is typically the main reason for lack of participation in conventional cooking. The generation of millennials is known for being foodies and thus wants something that falls between conventional cooking and saving time. Thus, these multiple meal kit service providers offer the perfect solution to these problems.

Platform Insights

The online platform accounted for a share of 63.2% of the global revenue in 2022. Companies have established online platforms that are capable of providing client service through greater flexibility by being available round the clock. The majority of companies offer their products through their websites to offer consumers convenience. Customers prefer to visit websites and find out about the weekly and monthly menu and the types of food subscriptions available instead of visiting the service provider in person or over a call. It also helps the companies to serve customers settled across a geographical area.

The offline platform is expected to register faster growth during forecast years, with a CAGR of 15.7% from 2023 to 2030. These products are available at Walmart, Kroger, Tesco, and other major retailers. Both small and large companies offer their products through this channel due to the large consumer base of these stores. Moreover, many consumers like to purchase these products with other grocery items, which is driving the demand through offline platforms. Several retailers such as Raley's, Walmart, and Meijer, Inc. have also begun launching their own meal kits featuring varieties of veg and non-veg dishes, owing to the rising consumer base that does not want the commitment of a subscription.

Meal Type Insights

Non-vegetarian meal kit delivery service held the largest market share of 63.5% in 2022 and is expected to maintain dominance over the forecast period. The segment’s growth can be attributed to the presence of protein and vitamins & minerals such as A, B6, B12, niacin, and thiamine in meat, making it appealing to consumers who want to include lean protein in their diets. Several product delivery service companies offer a diverse variety of fresh, value-added, and healthy meats, driving the consumption of non-vegetarian meal kits. Other factors drive product demand, such as growing awareness of the benefits of consuming non-vegetarian diets, including fish and chicken.

The vegetarian meal kits segment is expected to grow at a CAGR of 15.5% from 2023 to 2030. One of the main reasons why many people follow a vegetarian diet is that they prefer to consume a high proportion of fresh, healthful, plant-based foods, which provide antioxidants and fiber, along with various long-term health benefits. Most likely, the adoption of plant-based and cruelty-free diets is the factor responsible for the increase in the number of vegetarians across the globe. These figures indicate that the demand for vegetarian and vegan kits is expected to increase.

Regional Insights

North America made the largest contribution to the market at 46.01% in 2022. A large number of consumers purchase these kits in the region to save their time and effort. The product has become a healthier and inexpensive alternative to pre-cooked food items available in retail stores, delivery services, or restaurants. Furthermore, companies such as Blue Apron and Sun Basket have witnessed a sharp increase in product demand during the COVID-19 outbreak, as consumers feel it is safer to eat home-cooked food. In March 2020, Blue Apron experienced increased demand for its meal kits, reflecting, in part, changes in consumer behavior in response to the COVID-19 pandemic.

Asia Pacific is the fastest-growing market and is expected to witness a CAGR of 16.7% from 2023 to 2030. The market is expected to witness incredible growth in the region due to the convenience and freshness of the product. The increasing number of time-poor consumers in the region has been propelling the demand for these delivery services. China, Japan, and South Korea are the region's key markets. Furthermore, COVID-19 has increased the interest in home-cooked food and surged the demand for the product in the nation. Countries including Australia, Japan, China, Singapore, Sri Lanka, South Korea, and India are driving the vegetarian and vegan meal kits market.

The European meal kit delivery services market is expected to grow at a CAGR of 15.3% from 2023 to 2030. The market growth in Europe is driven by several factors, including changing consumer lifestyles, the desire for convenient and healthy meal options, and the increasing adoption of online delivery services. The COVID-19 pandemic has further accelerated the market's growth in Europe, as the pandemic has caused a considerable shift in consumer behavior for cooking at home, resulting in a rise in demand for meal kit delivery services.

Due to this emerging trend, companies operating in this space have witnessed significant increases in their revenues in 2020 and 2021. For instance, HelloFresh, a publicly traded meal kit company, has seen a 140% rise in sales for 2020 and a further 61.5% rise in sales in 2021 in the UK. Moreover, many new companies have entered the market over the past few years, such as AllPlants, based in the UK; Frichti, a French startup; and Les Commis, based in Belgium. This is also expected to drive the Europe regional market during the forecast period.

Key Companies & Market Share Insights

The meal kit delivery services market is characterized by the presence of a few well-established players and several small and medium players. Mergers, acquisitions, and product launches remain one of the key strategic initiatives in the industry. For instance:

-

In August 2021, Freshly Inc. launched its first-ever plant-based prepared meals line – ‘Purely Plant’, including six new meals featuring plant-based proteins made with clean, whole-food ingredients to cater to ongoing demand for variety, taste, nutrition, plant-based meal options and convenience among consumers. Meals can be heated and served in three minutes with no preparation required.

-

In November 2020, HelloFresh acquired Factor75, LLC for USD 277 million. The acquisition was aimed at strengthening HelloFresh’s position in the U.S. market and increasing its consumer base across the country.

-

In October 2020, Nestlé acquired Freshly Inc. for USD 950 million. This acquisition aimed to boost the growth opportunities for Freshly Inc. and allowed Nestlé to enter the fast-growing industry in the U.S.

Some of the key players operating in the global meal kit delivery services market include:

-

Blue Apron, LLC

-

Freshly Inc.

-

HelloFresh

-

Sun Basket

-

Relish Labs LLC (Home Chef)

-

Gobble

-

Marley Spoon Inc.

-

Purple Carrot

-

Fresh n' Lean

-

Hungryroot

Recent Developments

-

In April 2023, Blue Apron and Dashmart by DoorDash unveiled the extension of their partnership, enabling the widespread delivery of Blue Apron's Heat & Eat meals in 11 markets, including New York City, through DashMart. This strategic move exemplifies the companies' commitment to expanding their customer base and enhancing product accessibility by leveraging DashMart's platform beyond the successful initial pilot program in Philadelphia

-

In January 2022, Home Chef strategically joined forces with renowned chef and Skinnytaste founder, Gina Homolka, to introduce fresh and nutritionally balanced meals to households across the nation. Throughout the collaboration, Home Chef seamlessly integrated three rotating Skinnytaste recipes into its weekly offerings, presenting customers with a diverse selection of health-conscious and delectable choices, aligning with their goal to cater to the demand for convenient and well-balanced meal options

-

In December 2022, Rachael Ray collaborated with Home Chef to deliver her meal kits to the public, providing pre-portioned ingredients and easy-to-follow instructions. Rachael Ray Home Chef meal kits come with pre-portioned ingredients and user-friendly instructions similar to Blue Apron and Hello Fresh. Home Chef released new Rachael Ray meal kits weekly until March 2023, offering customers a range of convenient and delicious options to try

Meal Kit Delivery Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.29 billion

Revenue forecast in 2030

USD 64.27 billion

Growth rate

CAGR of 15.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updtaed

May 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, service, platform, meal type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia and New Zealand; Brazil

Key companies profiled

Blue Apron, LLC; Freshly Inc.; HelloFresh; Sun Basket; Relish Labs LLC (Home Chef); Gobble; Marley Spoon Inc.; Purple Carrot; Fresh n' Lean; Hungryroot

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meal Kit Delivery Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global meal kit delivery services market report based on offering, service, platform, meal type, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Heat & Eat

-

Cook & Eat

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Single

-

Multiple

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Meal Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Vegan

-

Vegetarian

-

Non-Vegetarian

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia and New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global meal kit delivery services market size was estimated at USD 20.54 billion in 2022 and is expected to reach USD 26.29 billion in 2023.

b. The global meal kit delivery services market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 64.27 billion by 2030.

b. The single service kits captured the largest share of more than 57% in 2022 in the meal kit delivery services market.

b. The online platform accounted for the largest share of more than 63% in 2022, in the global meal kit delivery services market.

b. North America held the largest share of 46.01% in the meal kit delivery services market in 2022. A large number of consumers purchase these kits in the region to save their time and effort.

b. The meal kit delivery services market in the U.K. was valued at USD 896.0 million in 2022 and is expected to grow at a CAGR of nearly 15.9% during the forecast period to reach a market valuation of nearly USD 3 billion by 2030.

Table of Contents

Chapter 1. Meal Kit Delivery Services Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Meal Kit Delivery Services Market: Executive Summary

2.1. Market Outlook

2.2. Offering Outlook

2.3. Service Outlook

2.4. Platform Outlook

2.5. Meal Type Outlook

2.6. Competitive Insights

Chapter 3. Meal Kit Delivery Services Market: Variables, Trends & Scope

3.1. Market Introduction

3.2. Penetration & Growth Prospect Mapping

3.3. Impact of COVID-19 on the Meal Kit Delivery Services Market

3.4. Industry Value Chain Analysis

3.4.1. Sales/Retail Channel Analysis

3.4.2. Profit Margin Analysis

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. Business Environment Analysis

3.6.1. Industry Analysis – Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.7. Roadmap of Meal Kit Delivery Services Market

3.8. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

4.1. Demographic Analysis

4.2. Consumer Trends and Preferences

4.3. Factors Affecting Buying Decision

4.4. Consumer Product Adoption

4.5. Observations & Recommendations

Chapter 5. Meal Kit Delivery Services Market: Offering Estimates & Trend Analysis

5.1. Offering Movement Analysis & Market Share, 2022 & 2030

5.2. Heat & Eat

5.2.1. Heat & eat meal kit delivery service market estimates and forecast,2017 - 2030 (USD Million)

5.3. Cook & Eat

5.3.1. Cook & eat meal kit delivery service market estimates and forecast, 2017 - 2030 (USD Million)

Chapter 6. Meal Kit Delivery Services Market: Service Estimates & Trend Analysis

6.1. Service Movement Analysis & Market Share, 2022 & 2030

6.2. Single

6.2.1. Single meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

6.3. Multiple

6.3.1. Multiple meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

Chapter 7. Meal Kit Delivery Services Market: Platform Estimates & Trend Analysis

7.1. Platform Movement Analysis & Market Share, 2022 & 2030

7.2. Online

7.2.1. Market estimates and forecast, through online platform, 2017 - 2030 (USD Million)

7.3. Offline

7.3.1. Market estimates and forecast, through offline platform, 2017 - 2030 (USD Million)

Chapter 8. Meal Kit Delivery Services Market: Meal Type Estimates & Trend Analysis

8.1. Meal Type Movement Analysis & Market Share, 2022 & 2030

8.2. Vegan

8.2.1. Vegan meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

8.3. Vegetarian

8.3.1. Vegetarian meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

8.4. Non-Vegetarian

8.4.1. Non-vegetarian meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

Chapter 9. Meal kit delivery services Market: Regional Estimates & Trend Analysis

9.1. Regional Movement Analysis & Market Share, 2022 & 2030

9.2. North America

9.2.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.2.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.2.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.2.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.2.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.2.6. U.S.

9.2.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.2.6.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.2.6.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.2.6.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.2.6.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.2.7. Canada

9.2.7.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.2.7.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.2.7.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.2.7.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.2.7.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.2.8. Mexico

9.2.8.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.2.8.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.2.8.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.2.8.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.2.8.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3. Europe

9.3.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3.6. Germany

9.3.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.6.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.6.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.6.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.6.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3.7. UK

9.3.7.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.7.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.7.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.7.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.7.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3.8. France

9.3.8.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.8.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.8.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.8.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.8.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3.9. Italy

9.3.9.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.9.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.9.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.9.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.9.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.3.10. Spain

9.3.10.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.3.10.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.3.10.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.3.10.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.3.10.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.4.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.4.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.4.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.4.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.4.6. China

9.4.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.4.6.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.4.6.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.4.6.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.4.6.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.4.7. Japan

9.4.7.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.4.7.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.4.7.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.4.7.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.4.7.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.4.8. India

9.4.8.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.4.8.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.4.8.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.4.8.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.4.8.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.4.9. Australia and New Zealand

9.4.9.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.4.9.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.4.9.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.4.9.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.4.9.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.5. Central & South America

9.5.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.5.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.5.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.5.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.5.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.5.6. Brazil

9.5.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.5.6.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.5.6.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.5.6.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.5.6.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Market estimates and forecast, 2017 - 2030 (USD Million)

9.6.2. Market estimates and forecast, by offering, 2017 - 2030 (USD Million)

9.6.3. Market estimates and forecast, by service, 2017 - 2030 (USD Million)

9.6.4. Market estimates and forecast, by platform, 2017 - 2030 (USD Million)

9.6.5. Market estimates and forecast, by meal type, 2017 - 2030 (USD Million)

Chapter 10. Competitive Analysis

10.1. Key global players, recent developments & their impact on the industry

10.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

10.3. Vendor Landscape

10.3.1. Key company market share analysis, 2022

Chapter 11. Company Profiles

11.1. Blue Apron, LLC

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.1.4. Strategic Initiatives

11.2. Freshly Inc.

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. Product Benchmarking

11.2.4. Strategic Initiatives

11.3. HelloFresh

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. Product Benchmarking

11.3.4. Strategic Initiatives

11.4. Sun Basket

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. Product Benchmarking

11.4.4. Strategic Initiatives

11.5. Relish Labs LLC (Home Chef)

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. Product Benchmarking

11.5.4. Strategic Initiatives

11.6. Gobble

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. Product Benchmarking

11.6.4. Strategic Initiatives

11.7. Marley Spoon Inc.

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. Product Benchmarking

11.7.4. Strategic Initiatives

11.8. Purple Carrot

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. Product Benchmarking

11.8.4. Strategic Initiatives

11.9. Fresh n' Lean

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. Product Benchmarking

11.9.4. Strategic Initiatives

11.10. Hungryroot

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. Product Benchmarking

11.10.4. Strategic Initiatives

List of Tables

1. Meal kit delivery services market - Key market driver analysis

2. Meal kit delivery services market - Key market restraint analysis

3. Global heat & eat meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

4. Global cook & eat meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

5. Global single meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

6. Global multiple meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

7. Global meal kit delivery services market estimates and forecast through online, 2017 - 2030 (USD Million)

8. Global meal kit delivery services market estimates and forecast through offline, 2017 - 2030 (USD Million)

9. Global vegan meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

10. Global vegetarian meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

11. Global non-vegetarian meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

12. North America meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

13. North America meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

14. North America meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

15. North America meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

16. North America meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

17. U.S. meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

18. U.S. meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

19. U.S. meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

20. U.S. meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

21. U.S. meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

22. Canada meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

23. Canada meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

24. Canada meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

25. Canada meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

26. Canada meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

27. Mexico meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

28. Mexico meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

29. Mexico meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

30. Mexico meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

31. Mexico meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

32. Europe meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

33. Europe meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

34. Europe meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

35. Europe meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

36. Europe meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

37. Germany meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

38. Germany meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

39. Germany meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

40. Germany meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

41. Germany meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

42. UK meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

43. UK meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

44. UK meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

45. UK meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

46. UK meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

47. France meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

48. France meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

49. France meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

50. France meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

51. France meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

52. Italy meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

53. Italy meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

54. Italy meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

55. Italy meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

56. Italy meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

57. Spain meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

58. Spain meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

59. Spain meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

60. Spain meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

61. Spain meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

62. Asia Pacific meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

63. Asia Pacific meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

64. Asia Pacific meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

65. Asia Pacific meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

66. Asia Pacific meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

67. China meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

68. China meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

69. China meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

70. China meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

71. China meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

72. Japan meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

73. Japan meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

74. Japan meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

75. Japan meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

76. Japan meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

77. India meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

78. India meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

79. India meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

80. India meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

81. India meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

82. Australia and New Zealand meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

83. Australia and New Zealand meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

84. Australia and New Zealand meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

85. Australia and New Zealand meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

86. Australia and New Zealand meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

87. Central & South America meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

88. Central & South America meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

89. Central & South America meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

90. Central & South America meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

91. Central & South America meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

92. Brazil meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

93. Brazil meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

94. Brazil meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

95. Brazil meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

96. Brazil meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

97. Middle East & Africa meal kit delivery services market estimates and forecast, 2017 - 2030 (USD Million)

98. Middle East & Africa meal kit delivery services market revenue estimates and forecast by offering, 2017 - 2030 (USD Million)

99. Middle East & Africa meal kit delivery services market revenue estimates and forecast by service, 2017 - 2030 (USD Million)

100. Middle East & Africa meal kit delivery services market revenue estimates and forecast by platform, 2017 - 2030 (USD Million)

101. Middle East & Africa meal kit delivery services market revenue estimates and forecast by meal type, 2017 - 2030 (USD Million)

102. Vendor landscape

List of Figures

1. Meal kit delivery services market snapshot

2. Meal kit delivery services market segmentation & scope

3. Meal kit delivery services market penetration & growth prospect mapping

4. Meal kit delivery services market value chain analysis

5. Meal kit delivery services market dynamics

6. Meal kit delivery services market Porter's analysis

7. Meal kit delivery services market: Offering movement analysis

8. Meal kit delivery services market: Service movement analysis

9. Meal kit delivery services market: Platform movement analysis

10. Meal kit delivery services market: Meal Type movement analysis

11. Meal kit delivery services market: Regional movement analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Meal Kit Delivery Services Offering Outlook (Revenue, USD Million, 2017 - 2030)

- Heat & Eat

- Cook & Eat

- Meal Kit Delivery Services Service Outlook (Revenue, USD Million, 2017 - 2030)

- Single

- Multiple

- Meal Kit Delivery Services Platform Outlook (Revenue, USD Million, 2017 - 2030)

- Online

- Offline

- Meal Kit Delivery Services Meal Type Outlook (Revenue, USD Million, 2017 - 2030)

- Vegan

- Vegetarian

- Non-Vegetarian

- Meal Kit Delivery Services Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- North America Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- North America Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- North America Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- U.S.

- U.S. Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- U.S. Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- U.S. Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- U.S. Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- U.S. Meal Kit Delivery Services Market, By Offering

- Canada

- Canada Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Canada Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Canada Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Canada Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Canada Meal Kit Delivery Services Market, By Offering

- Mexico

- Mexico Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Mexico Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Mexico Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Mexico Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Mexico Meal Kit Delivery Services Market, By Offering

- North America Meal Kit Delivery Services Market, By Offering

- Europe

- Europe Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Europe Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Europe Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Europe Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Germany

- Germany Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Germany Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Germany Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Germany Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Germany Meal Kit Delivery Services Market, By Offering

- U.K.

- U.K. Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- U.K. Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- U.K. Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- U.K. Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- U.K. Meal Kit Delivery Services Market, By Offering

- France

- France Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- France Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- France Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- France Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- France Meal Kit Delivery Services Market, By Offering

- Italy

- Italy Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Italy Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Italy Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Italy Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Italy Meal Kit Delivery Services Market, By Offering

- Spain

- Spain Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Spain Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Spain Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Spain Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Spain Meal Kit Delivery Services Market, By Offering

- Europe Meal Kit Delivery Services Market, By Offering

- Asia Pacific

- Asia Pacific Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Asia Pacific Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Asia Pacific Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Asia Pacific Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- China

- China Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- China Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- China Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- China Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- China Meal Kit Delivery Services Market, By Offering

- Japan

- Japan Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Japan Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Japan Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Japan Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Japan Meal Kit Delivery Services Market, By Offering

- India

- India Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- India Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- India Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- India Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- India Meal Kit Delivery Services Market, By Offering

- Australia and New Zealand

- Australia and New Zealand Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Australia and New Zealand Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Australia and New Zealand Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Australia and New Zealand Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Australia and New Zealand Meal Kit Delivery Services Market, By Offering

- Asia Pacific Meal Kit Delivery Services Market, By Offering

- Central & South America

- Central & South America Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Central & South America Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Central & South America Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Central & South America Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Brazil

- Brazil Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Brazil Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Brazil Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Brazil Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Brazil Meal Kit Delivery Services Market, By Offering

- Central & South America Meal Kit Delivery Services Market, By Offering

- Middle East & Africa

- Middle East & Africa Meal Kit Delivery Services Market, By Offering

- Heat & Eat

- Cook & Eat

- Middle East & Africa Meal Kit Delivery Services Market, By Service

- Single

- Multiple

- Middle East & Africa Meal Kit Delivery Services Market, By Platform

- Online

- Offline

- Middle East & Africa Meal Kit Delivery Services Market, By Meal Type

- Vegan

- Vegetarian

- Non-Vegetarian

- Middle East & Africa Meal Kit Delivery Services Market, By Offering

- North America

Meal Kit Delivery Services Market Dynamics

Driver: Increasing Fondness For Cooking At Home

Dining in is gaining popularity over dining out, with both boomers and millennials increasingly favoring home-cooked meals or takeout. This shift is largely influenced by the attitudes and behaviors of these two significant generational groups. Despite millennials outnumbering boomers, the latter’s behaviors still significantly impact the home-cooking market. Millennials, having experienced multiple recessions and burdened with debts, are more inclined to save money by cooking at home. This, coupled with a demand for gourmet and luxurious food, has spurred the growth of meal kit delivery services. As restaurant visits decline, these services are flourishing, further fueled by shifting demographics, evolving meal compositions, and a growing preference for fresh foods. This trend indicates a promising future for the meal kit delivery industry.

Driver: Increasing Consumer Awareness Toward Reducing Wastage Of Food

Food wastage is a significant issue, often overlooked by many. The U.S. Environmental Protection Agency reports that 94% of discarded food ends up in landfills or combustion facilities. In 2017 alone, the U.S. disposed of 38.1 million tons of food waste. According to Foodprint, about 40% of U.S. food, equivalent to 125 to 160 billion pounds, is wasted annually. Much of this wasted food is edible and nutritious. Overproduction, overbuying, poor planning, and confusion over labels and safety contribute to this wastage. The financial cost of food waste is staggering, amounting to approximately USD 218 billion per year. Moreover, uneaten food wastes valuable resources like water and farmland, putting unnecessary strain on the environment. With 12% of U.S. households facing food insecurity, reducing food waste by just 15% could feed over 25 million people annually. This highlights the urgent need for effective strategies to reduce food waste.

Restraint: Unaffordability Of Meal Kit Delivery Services

While meal kit services offer convenience and can be cheaper than dining out, they are often seen as an added expense. The average cost per meal, per person, is around USD 10, which can exceed the cost of self-bought groceries. Despite customization options, there’s a risk of not enjoying a meal, leading to potential waste and dissatisfaction. Subscription services may limit meal choice, posing a challenge for picky eaters and potentially leading to more food waste. Portion sizes may not meet everyone’s needs, with some finding them too small. Additionally, the perishable nature of meal kits necessitates prompt cooking, adding a layer of responsibility for consumers. While meal kit services have their advantages, they also come with drawbacks such as cost, potential for waste, portion size issues, and the need for timely cooking. These factors should be considered when deciding whether such a service is suitable.

What Does This Report Include?

This section will provide insights into the contents included in this meal kit delivery services market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Meal kit delivery services market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Meal kit delivery services market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the meal kit delivery services market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for meal kit delivery services market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of meal kit delivery services market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Meal Kit Delivery Services Market Categorization:

The meal kit delivery services market was categorized into five segments, namely offering (Heat & Eat, Cook & Eat), service (Single, Multiple), platform (Online, Offline), meal type (Vegan, Vegetarian, Non-Vegetarian), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa).

Segment Market Methodology:

The meal kit delivery services market was segmented into offering, service, platform, meal type, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The meal kit delivery services market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into thirteen countries, namely, the U.S.; Canada; Mexico; Germany; the UK; France; Italy; Spain; China; Japan; India; Australia and New Zealand; Brazil

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Meal kit delivery services market companies & financials:

The meal kit delivery services market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Blue Apron, LLC - Blue Apron, established in 2012, is a U.S.-based meal kit service that provides a variety of ingredients and corresponding recipes. The company went public in June 2017 and by 2019, it had delivered over 8 million meal kits nationwide. Blue Apron collaborates with farms that limit the use of agricultural chemicals and engage in crop rotation, growing specialty crops specifically for the company to enhance soil health. In addition to meal kits, Blue Apron offers wines, kitchen utensils, aprons, and an assortment of spices. Their meal kits are designed to serve two or four people, with special options available for vegetarians, diabetics, and those mindful of their health. The meal kits encompass a wide array of offerings, including fish, meat, and plant-based meat (Beyond Meat) options, each accompanied by unique recipes. This diverse selection caters to a broad range of dietary preferences and needs, making Blue Apron a versatile choice for meal planning and preparation. Through its services, Blue Apron aims to make home cooking accessible while supporting a more sustainable food system and fostering community among its customers.

-

Freshly Inc. - Established in 2012 and based in New York, Freshly Inc. offers a diverse range of over 30 heat-and-eat meals. These pre-cooked meals, which require just three minutes of heating, are low in sugar (averaging 8 grams per meal) and contain fewer processed ingredients. Each meal is balanced with carbs, proteins, and healthy fats. Freshly caters to various dietary needs with meal plans that are dairy-free, gluten-free, soy-free, high in protein, low in carbs, low in sodium, and low in calories. The company is also environmentally conscious, using non-toxic, biodegradable, recyclable, or reusable packaging for its products. In January 2021, Freshly launched FreshlyFit, a new line of meals designed to support health goals and promote an active lifestyle. These meals, which are clean-label and gluten-free, are made with whole-food ingredients. They are balanced in terms of carbohydrates and calories and cater to keto, paleo, and plant-based diets. The FreshlyFit line includes over 25 single-serve meals, further expanding the company’s offerings. Through its diverse and health-conscious meal options, Freshly aims to make nutritious eating convenient and accessible.

-

HelloFresh - HelloFresh, founded in 2011 and based in Berlin, Germany, is the leading meal kit provider in the U.S. and has a presence in numerous countries worldwide. The company was listed on the Frankfurt Stock Exchange in November 2017. HelloFresh offers a diverse menu of approximately 19 recipes catering to various meal plans such as meat & veggies, veggies, family-friendly, calorie smart, quick and easy, and pescatarian. In addition to meal kits, the company also provides wines in the U.S. The majority of HelloFresh’s revenue is generated from its U.S. operations. In 2019, the company delivered over 10 million orders globally, demonstrating its extensive reach and popularity. Through its varied offerings and international presence, HelloFresh continues to make home cooking accessible to a wide audience.

-

Relish Labs LLC (Home Chef) - Relish Labs LLC, also known as Home Chef, is a U.S.-based company founded in 2013 and headquartered in Illinois. It provides pre-portioned ingredients and recipes to customers across the U.S. The company’s meals cater to various dietary needs, including calorie-conscious, carb-conscious, and vegetarian options, and most can be prepared in less than 30 minutes. Home Chef’s rotating menu features over 15 meals, offering a diverse range of choices to its customers. As of 2019, the company employed over 700 individuals across various divisions, including production, technology, design, marketing, product, and customer service. In 2018, Home Chef delivered more than 10 million meals, demonstrating its wide reach and popularity. The company operates distribution centers in Chicago, Los Angeles, and Georgia, enabling it to cater to 48 states in the U.S. Through its services, Home Chef aims to make home cooking convenient and accessible, while also catering to a variety of dietary preferences and needs.

-

Sun Basket - Sun Basket was founded in 2014 and is headquartered in California, U.S. This meal kit service provider operating in the U.S. offers sustainable and organic ingredients along with recipes. The ingredients used by the company are USDA-certified organic and are sourced from farms in California. Sun Basket offers meal kits for different diets like paleo, vegetarian, lean & clean, gluten-free, carb-conscious, Mediterranean, fresh & ready, diabetes-friendly, and pescatarian. As of 2019, the company employed more than 330 people across the U.S.

-

Gobble - Established in 2010, Gobble is a California-based company that specializes in providing chef-curated meals. These meals are designed with fresh ingredients that are pre-portioned, chopped, and simmered, making them easy to prepare in just about 15 minutes with the help of straightforward recipes. Gobble caters to a variety of dietary preferences, offering low-calorie options, vegetarian dishes, comfort food classics, and meals that are kid-friendly. Their product range is comprehensive, encompassing breakfast, lunch, dinner, and desserts. Every week, Gobble introduces its seasonal menus, keeping the offerings fresh and exciting for its customers. With offices in California, Toronto, and Pennsylvania, Gobble has a wide reach, serving 47 states across the U.S. and Canada. In summary, Gobble is a convenient solution for those seeking quick, easy-to-prepare meals without compromising on taste or dietary requirements. Its broad product portfolio and extensive service area make it a popular choice for many households. Whether you’re a busy professional, a health-conscious individual, or a parent looking for kid-friendly options, Gobble has something for everyone. Its commitment to quality and variety ensures a satisfying and enjoyable mealtime experience.

-

Marley Spoon Inc. (Dinnerly) - Marley Spoon Inc. was founded in 2014 and is headquartered in Berlin, Germany. The company offers an easy-to-cook meal made with fresh, pre-portioned, and seasonal ingredients. The company is also known as Martha & Marley Spoon as it was founded by Martha Stewart. Marley Spoon operates in several countries, including Austria, Australia, Belgium, Germany, Denmark, the Netherlands, Sweden, and the U.S. It provides 22 recipes each week from 5 different categories: health & diet, meat & fish, vegetarian & vegan, family-friendly, and under 30 minutes.

-

Purple Carrot- Purple Carrot, established in 2014 and based in Massachusetts, U.S., specializes in plant-based meals. The company offers a variety of meals for breakfast, lunch, dinner, and snacks, available in servings of two or four. Key ingredients in their dinner kits include chickpeas, tofu, potatoes, and superfruits, and they offer a range of dishes such as tacos, sandwiches, and soups. Purple Carrot categorizes its meals into three types: quick and easy, high protein, and gourmet meals. In summary, Purple Carrot is a go-to solution for those seeking plant-based meal options. Its diverse menu and flexible serving sizes cater to a variety of dietary needs and preferences, making it a popular choice for those pursuing a plant-based diet.

-

Fresh n' Lean - Fresh n' Lean was founded in 2010 and is headquartered in Anaheim, California, U.S. It is an organic ready-to-eat meal delivery service company. The company uses USDA-certified organic, non-GMO, natural, gluten-free, and certified-humane animal proteins for its meals. It offers a wide range of meal plans, including keto, plant-based, paleo, low-carb, and protein. Fresh n' Lean has an employee strength of more than 225 people. As of 2019, the company delivered over seven million meals across the U.S.

-

Hungryroot - Established in 2015 and based in New York, U.S., Hungryroot is a company that offers meal planning support along with healthy foods and recipes. The meals provided by Hungryroot are nutritious, made with whole and reliable ingredients, and are free from partially-hydrogenated oils, artificial sweeteners, colors, preservatives, and high-fructose corn syrup. Hungryroot caters to special dietary needs, offering meals suitable for vegan and gluten-free diets. In essence, Hungryroot is committed to promoting healthy eating habits by providing nutritious meals and supporting meal planning, making it a popular choice for those seeking a balanced and healthy lifestyle. Its focus on using clean ingredients and catering to special diets sets it apart in the meal delivery industry.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Meal Kit Delivery Services Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Meal Kit Delivery Services Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."