Medical Biomimetics Market Size & Trends

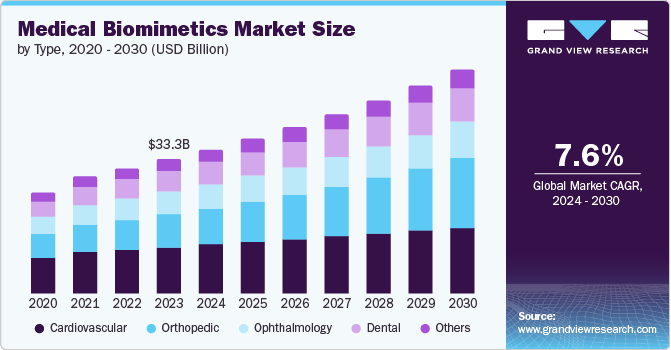

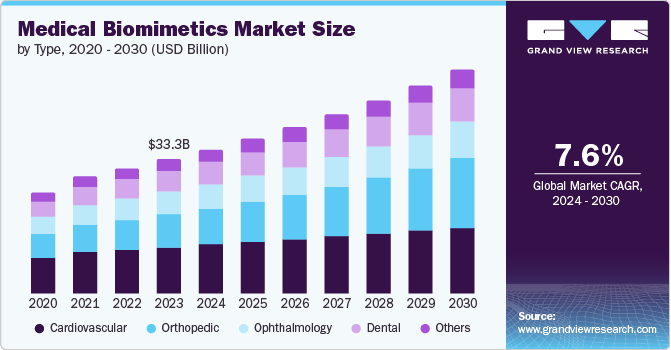

The global medical biomimetics market size was valued at USD 33.28 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. Innovation in nanotechnology is one of the driving forces in market growth, and the advancement of the drug delivery system has positively impacted the growth of medical biomimetics. Due to their biocompatibility properties, nanomaterials are attractive for use in biomedical applications and have huge potential in biomimetic medicine.

Increasing demand for implants and prostheses to meet the needs of organ transplants, especially in the geriatric population, is anticipated to drive medical biomimicry market growth. The market is expected to increase in the coming years due to the new application of biomimetic technology for organ regeneration.

The rise of chronic diseases, an aging population, and growing demand for pharmaceuticals drive the need for new biomaterials to improve medical outcomes, improve patient care, and reduce healthcare costs. Increasing demand for biomedical applications and expanding R&D activities are expected to drive market growth.

Type Insights & Trends

Cardiovascular dominated the market and accounted for a share of 34.8% in 2023. The growth in the segment is owing to the growing prevalence and increasing CVD implants. For instance, according to the secondary analysis, with 17.9 million deaths per year, CVD is the leading cause of death worldwide. Every year, more than 2.1 million people have CVD implants to prolong their lives.

Orthopedics is expected to register the fastest CAGR during the forecast period. According to estimates by the Association for Safe International Road Travel, between 20 and 50 million non-fatal injuries result in permanent disability. Therefore, the sector's growth is expected to increase.

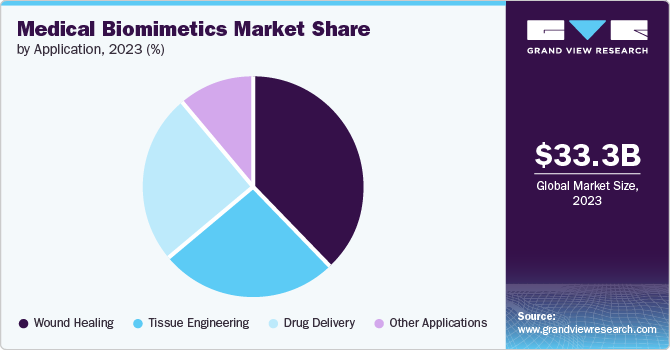

Application Insights & Trends

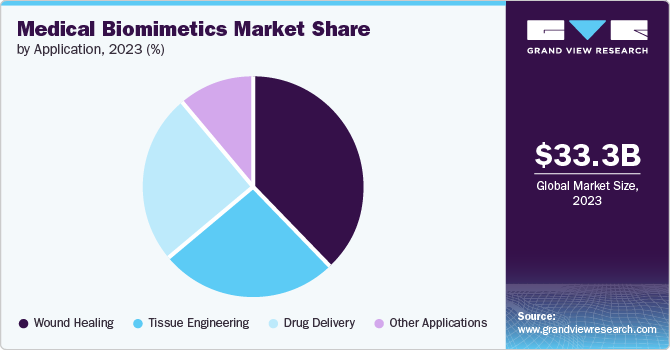

The wound healing segment dominated the market in 2023 with a share of 38.1%.With the increase in the number of surgical cases and the increase in chronic diseases worldwide, the demand for wound healing and care products is increasing. In addition, this segment is expected to grow due to various demographic factors, including an aging population, rising rates of diabetes and obesity, and increased vulnerability to injuries.

The drug delivery segment is anticipated to witness a significant CAGR of 9.9% over the forecast period. This follows changes in patient demand for drug delivery systems and increased research and development. Albumin-based delivery has been shown to be the most effective biomimetic therapy, with drugs containing Abraxane, Liraglutide, Semaglutide, and Albiglutide on the market.

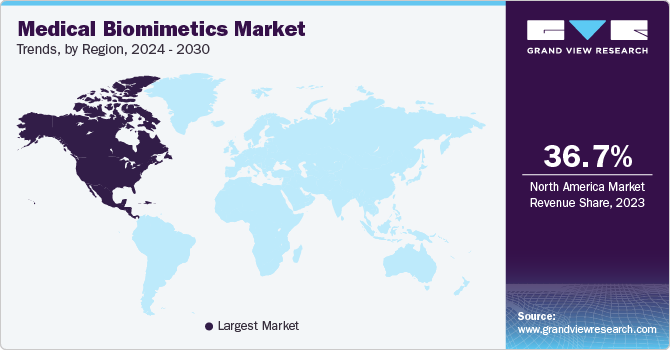

Regional Insights & Trends

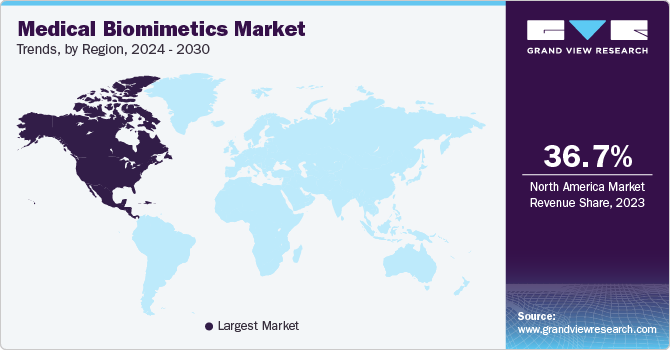

North America medical biomimetics market dominated the market in 2023.This is due to the region's concentration of medical device companies committed to the research and development of biomimetic technologies. Additionally, an aging population with an increasing burden of chronic diseases such as arthritis and heart failure is driving demand for the advanced implants and therapies that biomimicry can offer. Furthermore, strong government support for medical innovation and reimbursement policies greatly encouraged the adoption of these new technologies.

U.S. Medical Biomimetics Market Trends

The medical biomimetics market in the U.S. is expected to witness a CAGR of 7.7% over the forecast period due to factors such as research and development efforts, a favorable regulatory environment, and a large number of chronic diseases.

Europe Medical Biomimetics Market Trends

Europe medical biomimetics market was identified as a lucrative region in this industry due to factors such as increased government funding for biomimetic research, aging population that demands innovative healthcare solutions, and growing need for personalized medicine.

The medical biomimetics market in UK is expected to grow rapidly in the coming years due to increasing demand for innovative treatments, aging population and chronic diseases, and increased government support for biomimetic research.

Asia Pacific Medical Biomimetics Market Trends

Asia Pacific medical biomimetics market is anticipated to witness significant growth in in the coming years. The increasing incidence of cancer in countries such as India and China is expected to drive the market growth in this region. For instance, as per the U.S. Department of Health and Human Services (HHS), 14,61,427 incident cases of cancer were determined to be the projected total in India for 2022. In India 1 out of 9 people has a lifelong risk of developing cancer. The advancements in biomimetic materials is expected to contribute in the R&D for cancer.

The medical biomimetics market in China held a substantial market share in 2023 owing to large and aging population susceptible to chronic diseases, increasing healthcare expenditure, and government initiatives promoting domestic innovation in the medical field.

Key Medical Biomimetics Company Insights

Some of the key companies in medical biomimetics include Abbott, Stryker, SynTouch Inc.

-

Abbott is a global healthcare company with a wide range of medical devices, diagnostics, and pharmaceuticals. The company develops innovative solutions for various health concerns including heart diseases, diabetes, chronic pain, and nutrition.

-

Stryker is a global medical technology company that focuses on providing innovative medical equipment and devices for a wide range of specialties. This includes implants for joint replacements and surgeries, surgical tools with navigation systems, and even emergency medical equipment.

Key Medical Biomimetics Companies:

The following are the leading companies in the medical biomimetics market. These companies collectively hold the largest market share and dictate industry trends.

- Otsuka Medical Devices Group

- Stryker

- Abbott

- AVINENT Science and Technology

- SynTouch Inc.

- Osteopore International Pte Ltd

- Vandstrom, Inc.

- Biomimetics Technologies Inc

- Swedish Biomimetics 3000 ApS

- Keystone Dental Group

- LifeMatrix

- Curasan, Inc.

- CorNeat Vision

Recent Developments

Medical Biomimetics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 35.68 billion

|

|

Revenue forecast in 2030

|

USD 55.36 billion

|

|

Growth rate

|

CAGR of 7.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

Otsuka Medical Devices Group, Stryker, Abbott, AVINENT Science and Technology,

SynTouch Inc., Osteopore International Pte Ltd, Vandstrom, Inc., Biomimetics Technologies Inc, Swedish Biomimetics 3000 ApS, Keystone Dental Group, LifeMatrix, Curasan, Inc.

CorNeat Vision

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

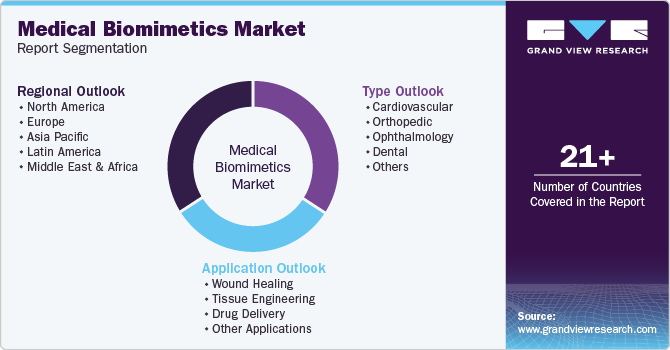

Global Medical Biomimetics Market Report Segmentation

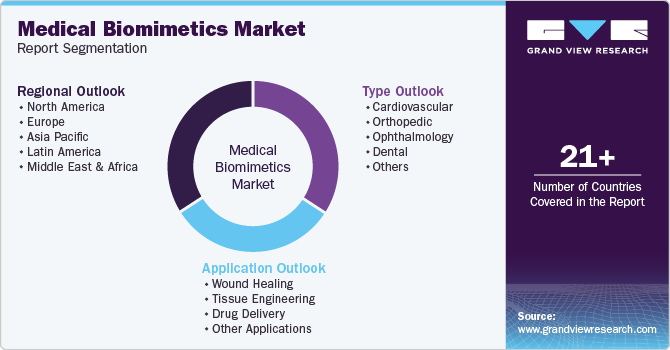

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global medical biomimetics report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Orthopedic

-

Ophthalmology

-

Dental

-

Others

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Healing

-

Tissue Engineering

-

Drug Delivery

-

Other Applications

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait