- Home

- »

- Medical Devices

- »

-

Medical Cyclotron Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Cyclotron Market Size, Share & Trends Report]()

Medical Cyclotron Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (10-12 MeV, 16-18 MeV, 19-24 MeV, 24 MeV & Above), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-159-7

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Cyclotron Market Size & Trends

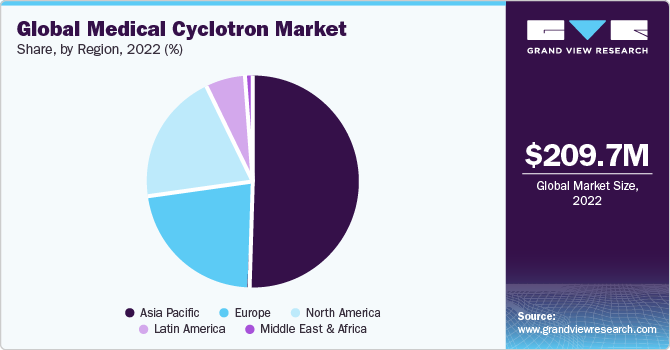

The global medical cyclotron market size was valued at USD 209.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.0% from 2023 to 2030.One of the primary factors for the market growth is the increasing prevalence of cancer cases. According to the report published by the American Cancer Society, around 1.9 million new cancer cases are anticipated to be diagnosed with around 609,820 deaths in 2023 in the U.S.

Factors such as rising investments in cutting-edge cancer treatment methods, rising demand for nuclear scans to deliver an accurate diagnosis, the economy's expansion and lifestyle shifts, raising consumer knowledge of the use of medical cyclotrons for deep-lying tumor diagnostics and applications are expected to drive the medical cyclotron market over the forecast period.

The demand for nuclear scans has increased globally as a result of the rising incidence of cancer cases. In addition, hospitals and diagnostic facilities are increasingly using medical cyclotrons in the fields of oncology, neurology, and cardiology. Additionally, the top competitors are releasing technologically cutting-edge diagnostic tools, which is projected to increase their overall market share and have a favorable impact on the global demand for medical cyclotron.

It is estimated that in developed economies, one in 50 patients use nuclear medicines for diagnosis each year and around 10% of this population is treated with radioisotopes. Radiotherapy is one of the technologically advanced methods used in the diagnosis and treatment of cancerous cells. According to the World Nuclear Association, about 40 million procedures are carried out each year globally with nuclear medicines, with an annual growth rate of 5.0% per annum. However, Demand for medical cyclotrons is anticipated to be constrained by the government's strict rules, the procedure's expensive costs, and the lack of experience with it.

Regional insights

Asia Pacific dominated the global medical cyclotron market and accounted for the largest revenue share of over 50% in 2022, due to the increasing need for nuclear scansandthe growing population of cancer patients, the area is predicted to continue to dominate during the forecastperiod. The closure of nuclear reactors, increasing expenditures in healthcare infrastructure, and rising consumer desire for affordable solutions are all factors that are fostering regional market expansion.

Middle East & Africa is expected to grow at the fastest CAGR of 16.7% during the forecast period. This growth can be attributed to the factors such as the increase in the number of cancer cases and the increasing trend towards accurate diagnosis using nuclear scans. The Cancer Association of South Africa states that each year, 1,15,000 South Africans are given cancer diagnoses. The Middle East and Africa market is also being driven by the expansion of synthetic radionuclides and the rise in the number of cancer treatment regimens. As per WHO, long-term forecasts indicate that, by 2030, there would be a 1.8 times increase in cancer incidences in the Gulf nations and the Eastern Mediterranean Region (EMR) countries.

Product Insights

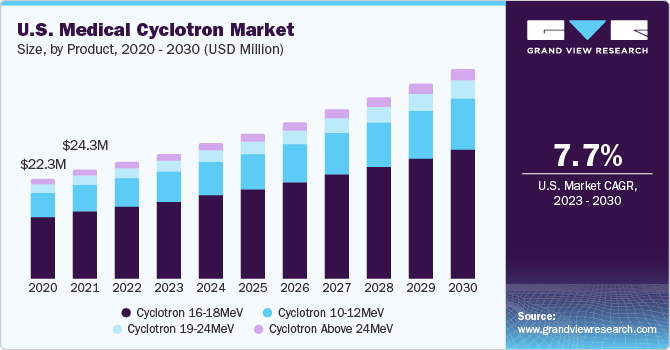

Based on product, the market has been segmented into 10-12 MeV, 16-18 MeV, 19 -24 MeV, and 24 MeV and above. The 16-18 MeV segment dominated the market in 2022 and accounted for over 55% of the overall market revenue. The segment's expansion can be linked to the rising demand for nuclear scans, the rise in cancer prevalence, and increased public awareness of the disease. The Asia Pacific area has the highest density of cyclotron in 16-18 MeV segment due to rising demand for nuclear scans at medical facilities and diagnostic centers.

Cyclotrons with energies between 10 and 12 MeV also hold a sizable market share. Their widespread utilization for nuclear scans in hospitals and diagnostic facilities can be ascribed to their popularity.

Cyclotrons with energies between 10 and 12 MeV are smaller than those found in other particle accelerators. Since they come in protected and unshielded varieties, healthcare workers have several alternatives. Based on dual-target irradiations, such as proton beam currents of 60 A to 130 A and deuteron beam currents of 60 A, these devices have dual-particle capacity.

The cyclotron 19-24 MeV segment is expected to grow at the fastest CAGR of 12.1 % over the forecast period of 2023-2030. Cyclotron 19-24 MeV can be used for affordable production of single-photon emission computed tomography (SPECT) and Positron Emission Tomography (PET) radioisotopes used for medical purposes and at research institutions. The SPECT isotopes I-123, Ge-68, Ga-67, and In-111 along with several conventional PET isotopes are produced in industrial quantities using these medium-energy, high-current accelerators. They better meet the needs of clients for different products of research, diagnosis, and therapy.

The need for medical cyclotrons is expected to increase as PET-associated medical accelerators become more widely accepted for use in cancer treatment and diagnosis. The prevalence of nuclear scans is rising along with cancer awareness. The global medical cyclotron market is anticipated to be driven by rising nuclear scan demand and rising cancer awareness.

Key Companies & Market Share Insights

High market entry hurdles, tight regulatory compliance, and greater manufacturing costs are challenges faced by manufacturers. Very few businesses outperform rivals in terms of market share. However, some companies such as TeamBest are developing innovative products with a 400 MeV capacity for heavy ion particle therapy. As a result, better disease detection and care will be possible.

Key Medical Cyclotron Companies:

- Siemens Medical Solutions USA, Inc

- IBA Radiopharma Solutions

- GE HealthCare

- Advanced Cyclotron Systems, Inc

- TeamBest

- Sumitomo Heavy Industries, Ltd

Medical Cyclotron Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 229.8 million

Revenue forecast in 2030

USD 477.9 million

Growth rate

CAGR of 11.0 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

IBA Radiopharma Solutions; GE HealthCare; Siemens Medical Solutions USA, Inc; Advanced Cyclotron Systems, Inc; Sumitomo Heavy Industries, Ltd, TeamBest

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Cyclotron Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical cyclotron market on the basis of product and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Cyclotron 10-12MeV

-

Cyclotron 16-18MeV

-

Cyclotron 19-24MeV

-

Cyclotron above 24MeV

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical cyclotron market size was estimated at USD 209.7 million in 2022 and is expected to reach USD 229.8 million in 2023.

b. The global medical cyclotron market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 477.9 million by 2030.

b. Cyclotron 16-18 MeV dominated the medical cyclotron market with a share of 56.7% in 2022. This is attributable to the soaring demand for nuclear scans, increasing prevalence of cancer, and raising cancer awareness.

b. Some key players operating in the medical cyclotron market include IBA; GE Healthcare; Siemens Medical Solutions USA, Inc.; Advanced Cyclotron Systems; Sumitomo Heavy Industries, Ltd.; and TeamBest (Best Medical International, Inc.).

b. Key factors that are driving the medical cyclotron market growth include the increasing prevalence of cancer, growing inclination towards nuclear scans for accurate diagnosis, and availability of technologically advanced diagnostic devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.