- Home

- »

- Pharmaceuticals

- »

-

Nuclear Medicine Market Size, Share, Industry Report, 2030GVR Report cover

![Nuclear Medicine Market Size, Share & Trends Report]()

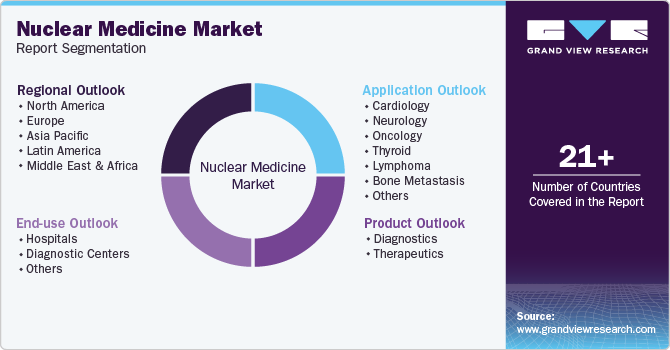

Nuclear Medicine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostics, Therapeutics), By Application (Cardiology, Neurology, Oncology), By End Use (Hospitals, Diagnostic Centers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-086-6

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nuclear Medicine Market Summary

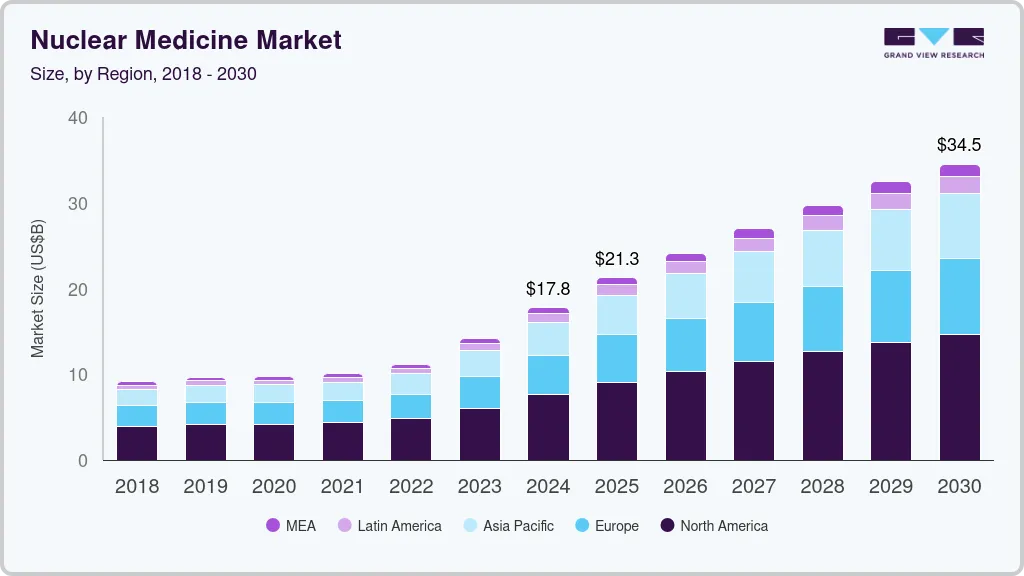

The global nuclear medicine market size was estimated at USD 17.77 billion in 2024 and is projected to reach USD 34.51 billion by 2030, growing at a CAGR of 10.16% from 2025 to 2030. The industry is witnessing growth due to the presence of a robust product pipeline and favorable government initiatives to improve access to nuclear medicine.

Key Market Trends & Insights

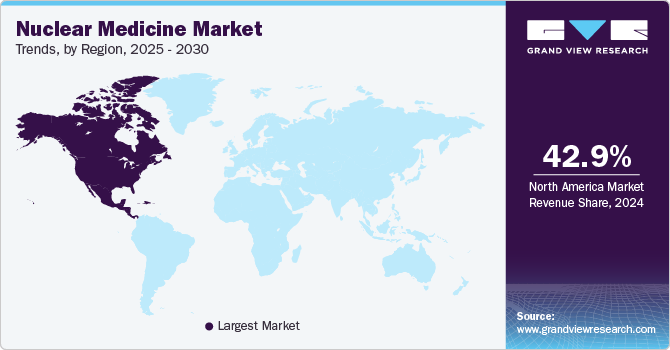

- North America nuclear medicine market accounted for a 42.87% share in 2024.

- The nuclear medicine market in the U.S. dominated the North America market in 2024.

- By product, the diagnostics segment dominated the market and accounted for a 76.55% share in 2024.

- By application, the urology segment dominated the market and accounted for a 22.62% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.77 Billion

- 2030 Projected Market Size: USD 34.51 Billion

- CAGR (2025-2030): 10.16%

- North America: Largest market in 2024

Currently, betalutin, omburtamab, yttrium-90 microspheres, PNT2003, 177Lu‑PNT2002, are some of the products under clinical trials. The industry has been moderately impacted due to SARS-CoV-2. The operation of reactors has been largely classified as an essential service, given its criticality.

Therefore, nuclear reactors were not shut down during the SARS-CoV-2 lockdown. For instance, under Section 71 of the Labour Act 66 of 1995 in South Africa, its SAFARI-1 reactor remained operational during the lockdown enforced in the country post March 2020.

According to the World Health Organization (WHO), in 2022, there were an estimated 20 million new cancer cases and 9.7 million deaths worldwide. Additionally, 53.5 million people were reported to be alive within five years following a cancer diagnosis. Approximately 1 in 5 people develop cancer in their lifetime, with about 1 in 9 men and 1 in 12 women succumbing to the disease. Nuclear medicine plays a significant role in targeting specific cancer cells, delivering radiation directly to the tumor site while sparing health tissues. This targeted approach reduces side effects and increases the effectiveness of treatment.

Furthermore, the presence of a robust product pipeline and favorable government initiatives to improve access to nuclear medicine. Currently, betalutin, yttrium-90 microspheres, PNT2003, 177Lu‑PNT2002, are some of the products under clinical trials. In December 2023, Lantheus Holdings, Inc. and POINT Biopharma Global Inc. (POINT) announced the topline results from the pivotal Phase 3 SPLASH study. This study assessed the efficacy and safety of 177Lu-PNT2002, a PSMA-targeted radioligand therapy (RLT), in patients with metastatic castration-resistant prostate cancer (mCRPC) who have progressed following treatment with an androgen receptor pathway inhibitor (ARPI). Thus, growing investment in the field of research is anticipated to drive market growth.

The presence of a favorable reimbursement scenario for radiopharmaceuticals in the U.S. is anticipated to boost the market growth. In 2020, the Center for Medical Services (CMS) offered a USD 10 add-on payment for Tc-99m derived from non-highly enriched uranium (HEU) for hospital outpatient service in addition to payment for imaging procedures. The initiatives, in turn, led to greater patient access for much-needed diagnostic nuclear medicines used for life-threatening diseases.

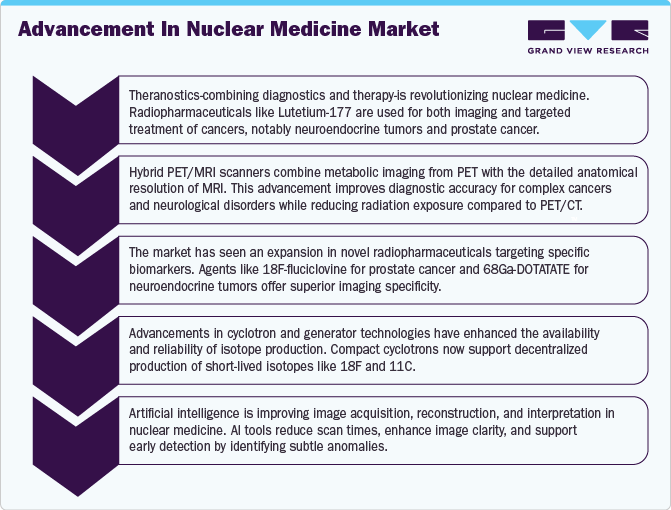

Increasing advancements in the diagnosis and treatment of diseases, and the approval of new nuclear-medicine-based devices, help in addressing patients' treatment needs. For instance, in September 2021, GE Healthcare announced the launch of the novel scanner with a new automated workflow feature that offers an exceptional view of cardiac anatomy and pathology to help physicians decide the right treatment for a patient.

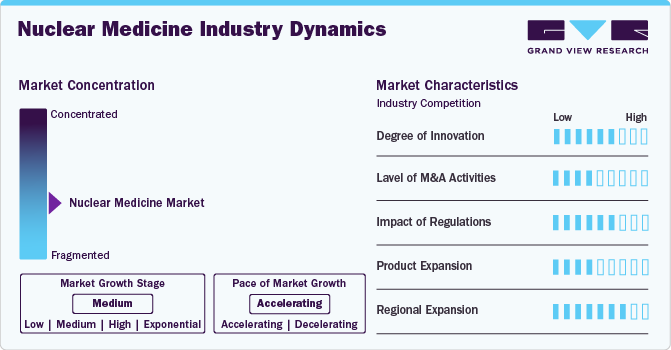

Market Concentration & Characteristics

Market growth stage is high, and the pace of growth is accelerating. The radiopharmaceuticals are characterized by a high degree of innovation. This can be attributed to the advanced technologies and methodologies for transforming treatment practices. In the space, Novartis' milestone achievement with the FDA's approval for Pluvicto production at the Milburn facility in April 2023. This move is poised to shape the market landscape, reflecting a strategic response to the growing demand for advanced solutions. The space witnesses notable M&A activities by the leading players. Leading players are strategically joining forces to expand and enhance their services, gain access to new technologies, consolidate in the rapidly growing market, and address the increasing strategic importance of nuclear medicine.

The level of mergers and acquisitions is moderate in the industry. Leading players are strategically joining forces to expand and enhance their services, gain access to innovative technologies, consolidate in the rapidly growing market, and address the increasing strategic importance of nuclear medicine. In March 2023, Life Healthcare Group acquired TheraMed Nuclear’s non-clinical imaging business which includes scanning services for the detection and treatment of diseases, such as cancer and organ dysfunction. This acquisition is expected to drive market growth.

The industry is also subject to increasing regulatory scrutiny. Rapid advancements in technology require continuous updates to regulatory frameworks to address new challenges and opportunities. Title 21 of the Code of Federal Regulations governs the use of radiopharmaceuticals in the U.S. The diagnostics and therapeutic applications of radiopharmaceuticals are covered separately under this title in Part 315 & Part 361, respectively. In addition, the Nuclear Regulatory Commission (NRC) regulates the use of radiopharmaceuticals in 37 states. The NRC authorizes the utilization and possession of radioactive source material, byproduct, and special nuclear material. The Center for Devices and Radiology Health (CDRH) governs the use of radiopharmaceuticals and the use of electron-emitting products, including medical devices.

Nuclear medicine methods are more accurate than traditional diagnostic and treatment methods. However, the higher price of radiopharmaceuticals is increasing the chances of usage of substitute products. Thus, the threat of substitution is expected to be moderate during the forecast period. Traditional chemotherapy agents and radiation therapy can be used, as these are comparatively cheaper substitutes for radiopharmaceuticals.

Increasing access to healthcare services and the establishment of specialized medical facilities are driving market growth in this region. Developing regions are experiencing rapid growth in the nuclear medicine market due to increasing healthcare expenditure, rising prevalence of cancer, and growing awareness.

Product Insights

The diagnostics segment dominated the market and accounted for a 76.55% share in 2024. The presence of a large patient base and availability of advanced technologies such as Single-Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET). According to the World Nuclear Association Analysis 2024, about 50 million nuclear medicine procedures are performed annually and the demand for radioisotopes increases by around 5% every year. A wide range of radiotracers that are currently employed in the diagnosis of tumors, coupled with technological advancements, are contributing to the growth of the segment.

The therapeutic segment is further divide into alpha emitters, beta emitters, and brachytherapy. The robust product pipeline, coupled with the approval and commercialization of nuclear medicine therapeutics, may fuel the segment's growth. For instance, in October 2021, the U.S. FDA approved and granted breakthrough designation to diffusing alpha-emitters Radiation Therapy (DaRT) for the treatment of patients suffering from recurrent glioblastoma multiforme (GBM). It is a standalone therapy when other therapies have failed to work in patients with GBM. Currently, radium (Ra-223) is the most widely used alpha emitter in therapeutics. Development of potential radioisotopes, such as Terbium (Tb-149), Bismuth (Bi-212), and Actinium (Ac-225), is expected to augment market growth.

Application Insights

The urology segment dominated the market and accounted for a 22.62% share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing prevalence of urological diseases like prostate cancer and high demand for novel products for diagnosis and treatment. According to the World Cancer Research Fund International, in 2022, there were around 1,467,854 new cases of prostate cancer reported worldwide. It is the second most common cancer diagnosed in men. Globally, countries like the U.S., China, Japan, Brazil, Germany, France, the UK, Russia, Italy, and India reported the highest cases of prostate cancer due to the rising men population and changed lifestyle of people.

The Endocrine tumors segment is estimated to grow at a significant CAGR over the forecast period. The competitive landscape is influenced by the strategic initiatives of key players. For instance, a recent collaboration between Jubilant Draximage Inc. (Jubilant Radiopharma) and Evergreen Theragnostics, Inc. in June 2023. Jubilant Radiopharma, with its Radiopharmacy business division holding one of the largest nuclear medicine pharmacy networks in the U.S., entered into an agreement with Evergreen Theragnostics. This agreement focuses on Jubilant’s radiopharmacy business, preparing, selling, and distributing doses of OCTEVY, a diagnostic agent pending FDA approval for PET imaging of somatostatin receptor-positive neuroendocrine tumors (NETs).

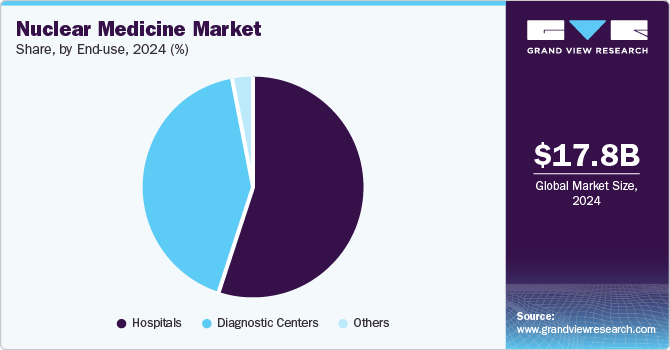

End Use Insights

The hospitals segment dominated the market and accounted for a 55.0% share in 2024. Most of the therapeutic nuclear medicine procedures are conducted in hospitals. According to The Society of Nuclear Medicine & Nuclear Imaging, in 2023, around 20 million nuclear medicine procedures were performed annually in the U.S. The recent approval of multiple therapeutic radioisotopes such as Pluvicto, Lutathera, and others is expected to boost the adoption of these Products in hospitals and drive segment growth.

The segment is also expected to grow at a significant CAGR during the forecast period. Most of the therapeutic nuclear medicine procedures are conducted in hospitals. The recent approval of multiple therapeutic radioisotopes such as Pluvicto, Lutathera, and several other products in the pipeline, such as Lu 177 PSMA I&T and Lu 177 edotreotide, is expected to drive the segment.

Regional Insights

North America nuclear medicine market accounted for a 42.87% share in 2024. The region's sustained dominance is driven by the rapid adoption of advanced imaging technologies and the increased use of innovative therapeutic radiopharmaceuticals. Furthermore, the rising prevalence of various cancers and chronic conditions is expected to significantly boost market growth in North America during the forecast period.

U.S. Nuclear Medicine Market Trends

The nuclear medicine market in the U.S. dominated the North America market in 2024, owing to the increasing prevalence of cardiac patients and the widespread adoption of precise imaging technologies enabled by diagnostic equipment such as PET and SPECT. However, market expansion faces obstacles such as supply chain limitations, logistical challenges, and a shortage of skilled medical personnel.

Europe Nuclear Medicine Market Trends

The nuclear medicine market in Europe is growing due to its expanding healthcare infrastructure. The rising number of hospitals and clinics across the region has significantly boosted the demand for nuclear medicine products. This growth is fueled by increasing patient visits for advanced diagnostic imaging and targeted treatment, particularly in oncology and cardiology, driving market expansion.

The UK nuclear medicine market is expected to grow over the forecast period due to the technological advancements in nuclear imaging techniques, such as PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography) are increasing the diagnostic capabilities and accuracy of nuclear medicine procedures in the UK.

The nuclear medicine market in Germany dominated the European region in 2024. This can be attributed to the increasing prevalence of chronic diseases like cancer, cardiovascular disorders, and neurological conditions underscores the growing necessity for nuclear medicine in both diagnostic procedures and therapeutic interventions.

France nuclear medicine market is anticipated to grow during the forecast period. This can be attributed to supportive governmental healthcare policies and investments in medical infrastructure are pivotal in fostering the expansion of nuclear medicine services throughout France. In July 2022, Framatome acquired a minority share in Global Morpho Pharma, enhancing its involvement in product development. This move expands Framatome's support for the supply chain of Lutetium-177 and other promising isotopes used in therapeutic applications.

Asia Pacific Nuclear Medicine Market Trends

The nuclear medicine market in Asia Pacific is anticipated to witness the fastest growth over the coming years. Increased awareness about nuclear medicine therapies and rising investment in the market space. For instance, in March 2022, Penang Adventist Hospital (PAH) announced the launch of a private nuclear medicine center in the northern part of Thailand. This launch is anticipated to have a positive impact on the Asian Market.

China nuclear medicine market is expected to witness significant growth over the forecast period. In China, dementia stands out as a prominent chronic disease that can be diagnosed using nuclear imaging techniques. The prevalence of dementia among elderly populations in cities such as Xiamen underscores the substantial demand for nuclear imaging services aimed at diagnosing and treating this condition.

The nuclear medicine market in Japan held a considerable revenue share in 2024. The rising incidence of coronary heart disease (CHD) in urban areas underscores the demand for advanced diagnostic technologies provided by nuclear medicine. Furthermore, the significant prevalence of end-stage kidney failure (ESKF) in Japan, frequently associated with diabetes and hypertension, emphasizes the critical role of nuclear imaging in the management of these conditions.

Latin America Nuclear Medicine Market Trends

The nuclear medicine market in Latin America was identified as a lucrative region in this industry. This can be attributed to recent product launches and technological advancements, such as single-photon emission computed tomography (SPECT) and positron emission tomography (PET), significantly enhancing the capabilities of nuclear medicine. These innovations provide enhanced diagnostic accuracy and treatment options for a wide range of diseases, including cancers and chronic conditions such as hyperthyroidism and blood disorders.

Brazil nuclear medicine market dominated the Latin American region. Brazil's substantial socioeconomic disparities contribute to unequal access to nuclear medicine services. The country's vast geographic expanse further complicates the delivery of radiopharmaceuticals and nuclear medicine services, underscoring the imperative to expand access, particularly for marginalized populations.

MEA Nuclear Medicine Market Trends

The nuclear medicine market in the ME&A was identified as a lucrative region in this industry. Governments in the MEA region are strategically investing in research and development initiatives aimed at advancing existing products. This includes enhancing existing Products and developing new ones, which collectively drive growth in the nuclear medicine market.

Saudi Arabia nuclear medicine market is projected to grow over the forecast period. Nuclear medicine plays a crucial role in oncology for diagnostic imaging and radiation therapy purposes in Saudi Arabia. Their application in cardiology, neurology, and endocrinology offers critical insights into organ and system functionality.

Key Nuclear Medicine Companies Insights

Key players operating in the nuclear medicine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Nuclear Medicine Companies:

The following are the leading companies in the nuclear medicine market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Jubilant Life Sciences Ltd

- Nordion (Canada), Inc.

- Bracco Imaging S.P.A

- The institute for radioelements (IRE)

- NTP Radioisotopes SOC Ltd.

- The Australian Nuclear Science and Technology Organization

- Eczacıbaşı-Monrol

- Lantheus Medical Imaging, Inc

- Eckert & Ziegler

- Mallinckrodt

- Cardinal Health

Recent Developments

-

In October 2024, Sanofi and Orano Med entered into a strategic agreement to leverage their complementary expertise in advancing treatments for rare cancers. The collaboration aims to accelerate the development of next-generation radioligand therapies. Sanofi and Orano are focusing on jointly investing in a new entity, which will operate under the Orano Med brand and focus on the discovery, design, and clinical development of next-generation radioligand therapies (RLTs) leveraging lead-212 (²¹²Pb), an alpha-emitting isotope.

-

In March 2024, the Ministry of Health of the Republic of Serbia and Rosatom State Corporation signed a Memorandum of Understanding (MoU) regarding cooperation in nuclear medicine. This cooperation is expected to boost market growth over the forecast period.

-

In January 2024, Lantheus Holdings, Inc. (Lantheus) recently solidified its position in the U.S. nuclear medicine market through strategic agreements with Perspective Therapeutics, Inc. The agreements include an exclusive licensing option for Perspective's Pb212-VMT-⍺-NET, an advanced therapy for neuroendocrine tumors, and co-development opportunities for early-stage prostate cancer treatments. Lantheus made a substantial upfront payment of USD 28 million in cash.

-

In December 2023, Bristol Myers Squibb entered into an agreement to acquire RayzeBio for USD 4.1 billion. RayzeBio is currently conducting clinical trials for two potential cancer therapies using actinium-255. In addition, Point, a company associated with RayzeBio, has two lutetium-177 therapies undergoing phase 3 trials. This acquisition reflects Bristol Myers Squibb's strategic move to expand its portfolio.

-

In April 2023, the U.S. FDA approved Novartis’ Milburn facility for the commercial production of Pluvicto. The facility is anticipated to boost the company’s production capabilities.

-

In January 2023, NorthStar Medical Radioisotopes notably progressed its technology to produce molybdenum-99 without uranium. This strategic move positions the company at the forefront of the nuclear medicine market, addressing critical supply chain issues.

Nuclear Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.27 billion

Revenue forecast in 2030

USD 34.51 billion

Growth rate

CAGR of 10.16% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; and Kuwait

Key companies profiled

Eckert & Ziegler; Mallinckrodt; GE Healthcare; Jubilant Life Sciences Ltd.; Nordion (Canada); Inc.; Bracco Imaging S.P.A.; IRE; Australian Nuclear Science and Technology Organization; NTP Radioisotopes SOC Ltd.; Eczacıbaşı-Monrol; Lantheus Medical Imaging, Inc.; Cardinal Health.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nuclear Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nuclear medicine market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

SPECT

-

TC-99m

-

TL-201

-

GA-67

-

I-123

-

Others

-

-

PET

-

F-18

-

SR-82/RB-82

-

PYLARIFY (piflufolastat F 18)

-

Illuccix (gallium Ga 68 gozetotide)

-

Others

-

-

-

Therapeutics

-

Alpha Emitters

-

RA-223

-

Others

-

-

Beta Emitters

-

I-131

-

Y-90

-

SM-153

-

Re-186

-

Lu-177

-

Others

-

-

Brachytherapy

-

Cesium-131

-

Iodine-125

-

Palladium-103

-

Iridium-192

-

Others

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

SPECT

-

PET

-

Therapeutic Applications

-

-

Neurology

-

Oncology

-

Thyroid

-

SPECT

-

Therapeutic Applications

-

-

Lymphoma

-

Bone Metastasis

-

SPECT

-

Therapeutic Applications

-

-

Endocrine Tumor

-

Pulmonary Scans

-

Urology

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nuclear medicine market size was valued at USD 17.77 billion in 2024 and is anticipated to reach USD 21.27 billion in 2025.

b. The global nuclear medicine market is expected to witness a compound annual growth rate of 10.16% from 2025 to 2030 to reach USD 34.51 billion by 2030.

b. Based on product, the diagnostics segment accounted for a share of 76.55% in 2024 due to the large target disease population, and availability of SPECT and PET imaging systems.

b. Some of the key players in nuclear medicine market are Eckert & Ziegler; Mallinckrodt; GE Healthcare; Jubilant Life Sciences Ltd.; Nordion (Canada), Inc.; Bracco Imaging S.P.A.; IRE, the Australian Nuclear Science and Technology Organization; NTP Radioisotopes SOC Ltd.; Eczacıbaşı-Monrol; Lantheus Medical Imaging, Inc.; Cardinal Health.

b. The major factors driving the nuclear medicine market growth are the increasing prevalence of target diseases, increasing approval of radiotherapeutic drugs, and growing demand for accurate diagnostic methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.