- Home

- »

- Medical Devices

- »

-

Medical Device Testing Services Market Size Report, 2030GVR Report cover

![Medical Device Testing Services Market Size, Share & Trends Report]()

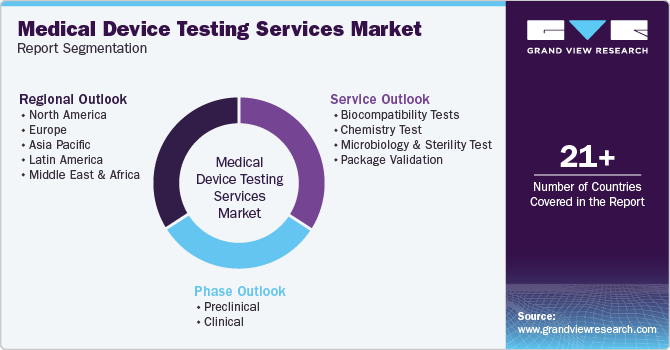

Medical Device Testing Services Market Size, Share & Trends Analysis Report By Service (Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, Package Validation), By Phase, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-115-3

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global medical device testing services market size was valued at USD 8.95 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.44% from 2024 to 2030. Complexity in product design, intensifying competition, increasing number of small-sized medical device manufacturers, and strict approval norms are key factors driving the market. In addition, the COVID-19 pandemic has accelerated the demand for testing services around the globe. Favorable government support is expected to drive the market. To obtain approvals & clearances, companies need to comply with an elaborate list of standards provided by regulatory bodies and maintain complete documentation of the same.

These requirements must be met as per the stipulated formats and specifications to ensure the products are permitted for sale. The regulatory authorities also perform routine post-market surveillance by levying a fee on the manufacturer. Receipt of any complaints about drawbacks of the product can entail its withdrawal from the market, thereby proving the stringent nature of the regulations governing these procedures.

Market Concentration & Characteristics

Market growth stage is stable, and market growth is expected to accelerate over the estimated time period. The Medical Device Testing Services market is characterized by regulatory considerations, evolving technologies, materials innovation, and globalization & outsourcing of services.

Furthermore, outsourcing in the medical device testing services market is substantially growing due to various benefits such as cost-effectiveness, access to specialized expertise, and flexibility in resource allocation. Likewise, outsourcing mitigates risks associated with in-house testing, offering flexibility in resource allocation, scalability, and access to a broader range of testing capabilities based on project requirements, thereby influencing market demand.

In addition, the market is highly competitive, characterized by numerous established and emerging players offering a wide array of testing services. Differentiation based on expertise, technology, regulatory compliance, and service quality is crucial for market positioning. Companies leveraging advanced types of medical device testing technologies and innovative methodologies gain a competitive edge. Investment in cutting-edge equipment and the ability to offer specialized, high-value testing solutions strengthens market growth.

ASCA's emphasis on conformity assessment encourages advancements in testing methodologies and technology adoption. Accredited labs are encouraged to continually improve and innovate, aligning with evolving regulatory expectations. Besides, innovations in testing technologies and methodologies, such as the adoption of AI, IoT, or robotics in testing processes, can significantly influence the medical device testing services market. Businesses need to stay abreast of technological advancements to remain competitive and meet clients' evolving needs.

Regulatory bodies, such as the U.S. FDA and EMA, continually upgrade the regulatory guidelines for safety, efficacy, & quality standards for medical devices. This escalation in regulatory requirements compels medical device manufacturers to conduct more comprehensive and rigorous testing to meet these stringent standards. Stringent approval norms necessitate specialized and extensive testing protocols. Medical device testing service providers offer expertise in conducting various specialized tests, including biocompatibility assessments, chemistry testing, sterility testing, and usability studies aligning with the heightened regulatory requirements, propelling market progression.

Actions and strategies of competitors within the medical device testing services market are crucial influencers. Understanding the competitive landscape helps businesses position themselves effectively and differentiate their offerings. Besides, several key players are acquiring smaller ones to strengthen their market position. Sharing expertise and resources facilitates the development of advanced testing methodologies and accelerates technological advancements in the industry and drives market growth. M&A activities efforts enable companies to increase their capabilities, expand their service portfolios, and improve their competencies, where testing services are tailored to meet specific device needs. This approach emphasizes fostering stronger relationships & delivering more targeted testing solutions.

Medical device companies across the globe are facing a diverse array of socioeconomic challenges. In developed economies, such as the U.S., there is pricing pressure. Hence, operators are exploring ways to reduce costs throughout the value chain. On the other hand, developing economies are showing major growth potential, despite a higher likelihood of being price sensitive. Hence, market players today are striving to reduce the overall cost of devices. Outsourcing testing operations helps companies focus on product development and enhance marketing efforts.Thus, numerous providers are entering in the market to offer robust testing services ensuring quality assurance further mitigating risks associated with product failures, enhancing overall market competitiveness

Changes in global healthcare trends, emerging markets, and shifts in research priorities can impact the demand for medical device testing services. Analyzing market influencers involves understanding the broader industry trends that may shape the market. Besides, the growing presence of local market players along with competitive pricing, rapid technological advancements, growing demand for new & cost-effective medical devices, and high healthcare expenditure fuels the market growth. Other factors contributing to market growth are rising investments, growing medical devices industry, and high standards for medical device development in the country.

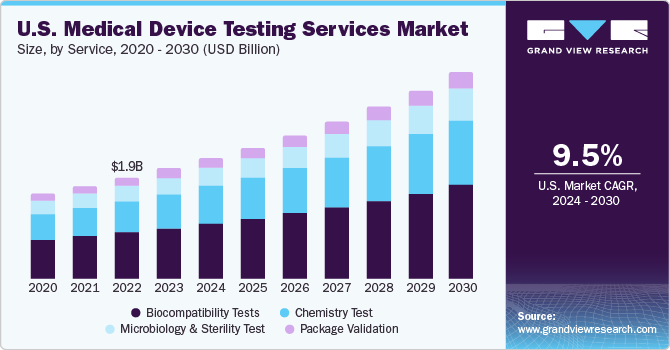

Service Insights

On the basis of service segment, the market is classified into biocompatibility testing, chemistry testing, microbiology & sterility testing, and package validation. Biocompatibility tests held the largest share in 2023. Increasing demand for different types of medical device testing across various healthcare sectors, including cardiovascular, orthopedic, diagnostic devices, and several others, propels the market growth. Furthermore, stringent regulations, technological advancements, and a focus on personalized healthcare are expected to boost the growth of biocompatibility testing within the medical device testing services market.

Besides, the chemistry test segment is expected to grow at a lucrative CAGR of 9.72%. Medical devices are subjected to chemistry tests with pharmaceutical formulations in the medical industry. The chemistry tests support the medical device industry throughout the value chain. These tests ensure that medical devices do not cause reactions when in contact with the human body.

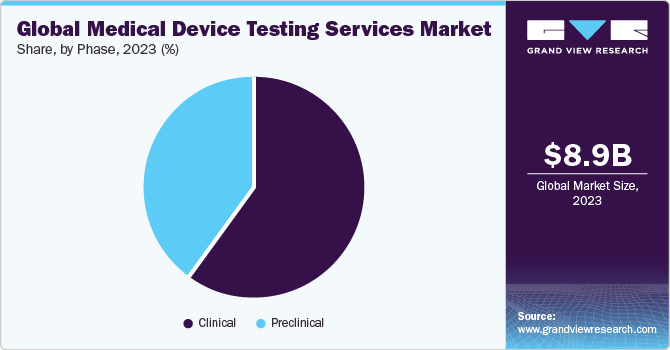

Phase Insights

On the basis of phase segment, the market is segregated into preclinical and clinical. Furthermore, the preclinical segment is subdivided into small animals, large animals, and others. The clinical segment held the largest market share in 2023. The segment growth is due to a rise in product pipeline and continuous upgradation of regulatory standards. Growing emphasis on clinical evidence for new device approvals accelerates the demand for robust testing services during clinical trials. Moreover, the growing preference for market participants that offer advanced testing methodologies with affordable cost & reduced turnaround time for diverse clinical studies is expected to drive segment growth.

The preclinical market accounted for the 39.74% share in 2023. Preclinical testing is crucial in the development & evaluation of medical devices before they are approved for human use. The tests are used to identify the efficacy, safety, and performance of the devices, to mitigate potential risks & enhance patient outcomes. Furthermore, in preclinical among small animals, large animals, and others. The demand for small animal research is increasing due to the rise of domestic medical device manufacturers putting more effort into developing medical devices that can be used for such research. Besides, it helps address regulatory safety concerns and reduce risks associated with product validation. Likewise,large animal research is driven by an increase in the demand for medical device trials in order to bridge translation to human trials. Therefore, such factors are anticipated to contribute to market growth.

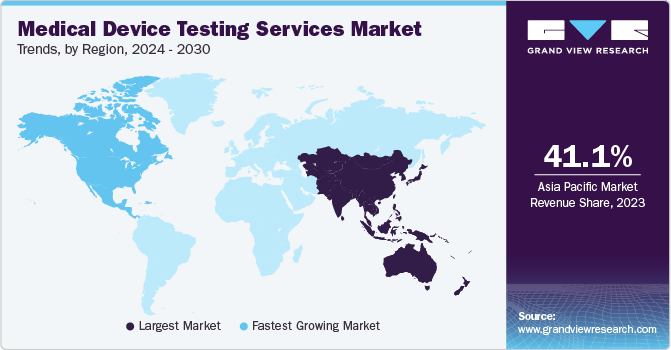

Regional Insights

Asia Pacific dominated the global medical device testing services market in 2023, holding a revenue share of 41.1%. Rapid advancements in healthcare infrastructure, coupled with increasing regulatory management, are driving the region's prominence in the global medical device testing services market. Moreover, the growing demand for various medical device testing methods, favorable pricing model and the rise of local manufacturing hubs propel the need for high-quality testing services, fostering innovation & technological expertise within the region. Moreover, cost-effective testing services and the availability of a skilled workforce are key factors driving regional revenue growth.

North America is estimated to show growth at a lucrative rate in the market over the forecast period. This can be attributed to a continuous owing to the presence of established manufacturing hubs of highly reliable, complex, and high-end medical devices in the region. In addition, many Original Equipment Manufacturers (OEMs) have shifted their focus to electronics manufacturing service providers to efficiently handle the increasing volume of electronic components in current medical devices. This has led to the rise in demand for medical device testing activities for efficient healthcare in the region and is expected to be one of the major factors propelling the development of the market.

Indian Medical Device Clinical Trial Market

In India, the medical device clinical trial is driven by increase in government funding for R&D to accelerate new product development which has the country as favored destinations for manufacturing services. Moreover, the country presents a market opportunity for international medical device manufacturers & is keen to expand its potential as a domestic manufacturing base & climb up the value chain. Therefore, outsourcing medical device testing services to emerging countries, and rising number of clinical trials is anticipated to fuel the global medical device testing services market over the forecast period.

Key Companies & Market Share Insights

Some of the medical device testing companies operating in the market are SGS SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories, Element Minnetonka, North America Science Associates Inc. (NAMSA), Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, and WuXi AppTec among others. Several key players are acquiring various strategic initiatives to strengthen their market position offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures merger, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge. These initiatives may be implemented to expand regionally or widen the global network to reach more customers.

Key Medical Device Testing Services Companies:

The following are the leading companies in the medical device testing services market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these medical device testing services companies are analyzed to map the supply network.

- SGS SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories

- Element Minnetonka

- North America Science Associates Inc. (NAMSA)

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WuXi AppTec

Recent Developments

-

In November 2023, Intertek announced its partnership with Emitech Group, a French independent testing & engineering specialist.

-

In June 2023, TÜV SÜD opened a new laboratory in Minnesota. It is ISO 17025 accredited for the biological & chemical testing of medical devices. It is a part of the company’s commitment to providing high-quality medical device services.

-

In April 2023, Nelson Labs announced that the company is ASCA-accredited testing laboratory by the U.S. FDA within the category of biocompatibility.

Medical Device Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.76 billion

Revenue forecast in 2030

USD 16.78 billion

Growth Rate

CAGR of 9.44% from 2024 to 2030

Historical Year

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Netherlands, Belgium, Switzerland, Japan, China, India, Australia, South Korea, Malaysia, Indonesia, Singapore, Philippines, Thailand, Brazil, Mexico, Argentina, Colombia, Chile, South Africa, Saudi Arabia, UAE, Kuwait, Israel

Key companies profiled

SGS SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories, Element Minnetonka, North America Science Associates Inc. (NAMSA), Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WuXi AppTec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Testing Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical device testing services market report based on service, phase and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biocompatibility Tests

-

Cardiovascular Device's Biocompatibility Tests

-

Orthopedic Device's Biocompatibility Tests

-

Dental Implant Devices' Biocompatibility Tests

-

Dermal Filler's Biocompatibility Tests

-

General Surgery Implantation Devices Biocompatibility Tests

-

Neurosurgical Implantation Devices Biocompatibility Tests

-

Ophthalmic Implantation Device's Biocompatibility Tests

-

Others

-

Chemistry Test

-

Chemical characterization (E&L)

-

Analytical method development and validation

-

Toxicological Risk Assessment and consulting

-

Microbiology & Sterility Test

-

Bioburden Determination

-

Pyrogen & Endotoxin Testing

-

Sterility Test & Validation

-

Antimicrobial Testing

-

Others

-

Package Validation

-

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Preclinical

-

Large animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

Small animal research

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Test

-

-

-

Clinical

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Belgium

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Malaysia

-

Indonesia

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global medical device testing services market size was estimated at USD 8.1 billion in 2022 and is expected to reach USD 8.88 billion in 2023.

b. The global medical device testing services market is expected to grow at a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 16.29 billion by 2030.

b. The Asia Pacific dominated the medical device testing services market with a share of 41.0% in 2022. This is attributable to increasing R&D activities in this region and the growing adoption of new technologies in clinical trials.

b. Some key players operating in the medical device testing services market include SGS S.A., Labcorp (Toxikon, Inc), American Preclinical Services, Sterigenics International LLC, Charles River Laboratories, Element Minnetonka, North America Science Associates Inc., Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc.

b. Key factors that are driving the medical device testing services market growth include increasing demand for in-vitro tests, recent technological advancements, and improving healthcare infrastructure in emerging economies.

Table of Contents

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.1.1 Regional Scope

1.1.2 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Gvr’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.5.1 Region Wise Market Calculation

1.5.2 Region Wise Market: Base Estimates

1.5.3 Global Market: Cagr Calculation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.2 Bottom-Up Approach (Model 2)

1.7 List Of Secondary Sources

1.8 List Of Primary Sources

1.9 List Of Abbreviations

1.10 Objectives

1.10.1 Objective - 1:

1.10.2 Objective - 2:

1.10.3 Objective - 3:

1.10.4 Objective - 4:

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Medical Device Testing Services Market: Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.1.1 Global Healthcare Cro Market

3.1.1.2 Global Medical Device Outsourcing Market

3.1.2 Ancillary Market Outlook

3.1.2.1 Global Pharmaceutical Analytical Testing Outsourcing Market

3.1.2.2 Global Bioanalytical Testing Services Market

3.2 User Perspective Analysis

3.2.1 Consumer Behavior Analysis

3.2.2 Market Influencer Analysis

3.3 Medical Device Testing Services Market Dynamics

3.3.1 Market Driver Analysis

3.3.1.1 Complexity In Product Design Of Medical Device Testing Services

3.3.1.2 Intense Competition In Medical Device Industry

3.3.1.3 Increasing Number Of Smaller Players Lacking In-House Testing Capabilities

3.3.1.4 Strict Approval Norms

3.3.2 Market Restraint Analysis

3.3.2.1 Legal And Regulatory Issues

3.3.2.2 Delays In Contractual Obligations

3.3.3 Industry Challenges

3.3.3.1 Managing Relationships

3.4 Medical Device Testing Services Market Analysis Tools

3.4.1 Porter's Five Forces Analysis

3.4.2 Pestel Analysis

3.5 Covid-19 Impact On Market

3.6 Impact Of Covid-19 On Regulatory Approvals In Eu

3.6.1 Postponement Of Eu-Mdr Applications

3.6.2 European Standards And Other Technical Documents Available For Free

3.6.3 Ppe & Relevant Medical Devices May Be Placed Without Ce Marking

3.6.4 Suspension Of Inspection By Nbs

3.7 Impact Of Covid-19 On Regulatory Approvals In The U.S.

3.8 Impact On Clinical Trials And Irb Reviews

3.9 Fda Asca Impact On Biocompatibility Testing

Chapter 4 Medical Device Testing Services Market: Service Segment Analysis

4.1 Medical Device Testing Services: Market By Molecule Segment: Key Takeaways

4.2 Medical Device Testing Services: Market Share Analysis, 2023 & 2030

4.3 Medical Device Testing Services Market Estimates & Forecast, By Service (USD Million)

4.4 Definitions & Scope

4.5 Biocompatibility Tests

4.5.1 Biocompatibility Medical Device Testing Services Market, 2018 - 2030 (USD Million)

4.5.2 Cardiovascular Device's Biocompatibility Tests

4.5.2.1 Cardiovascular Device's Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.3 Orthopedic Device's Biocompatibility Tests

4.5.3.1 Orthopedic Device's Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.4 Dental Implant Devices' Biocompatibility Tests

4.5.4.1 Dental Implant Devices' Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.5 Dermal Filler's Biocompatibility Tests

4.5.5.1 Dermal Filler's Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.6 General Surgery Implantation Devices Biocompatibility Tests

4.5.6.1 General Surgery Implantation Devices Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.7 Neurosurgical Implantation Devices Biocompatibility Tests

4.5.7.1 Neurosurgical Implantation Devices Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.8 Ophthalmic Implantation Device's Biocompatibility Tests

4.5.8.1 Ophthalmic Implantation Device's Biocompatibility Tests Market, 2018 - 2030 (USD Million)

4.5.9 Others

4.5.9.1 Others Biocompatibility Test Market, 2018 - 2030 (USD Million)

4.6 Chemistry Test

4.6.1 Chemistry Medical Device Testing Services Market, 2018 - 2030 (USD Million)

4.6.2 Chemical Characterization (E&L)

4.6.2.1 Chemical Characterization (E&L) Market, 2018 - 2030 (USD Million)

4.6.3 Analytical Method Development And Validation

4.6.3.1 Analytical Method Development And Validation Market, 2018 - 2030 (USD Million)

4.6.4 Toxicological Risk Assessment And Consulting

4.6.4.1 Toxicological Risk Assessment And Consulting Market, 2018 - 2030 (USD Million)

4.7 Microbiology & Sterility Testing

4.7.1 Microbiology & Sterility Medical Device Testing Services Market, 2018 - 2030 (USD Million)

4.7.2 Bioburden Determination

4.7.2.1 Bioburden Determination Market, 2018 - 2030 (USD Million)

4.7.3 Pyrogen & Endotoxin Testing

4.7.3.1 Pyrogen & Endotoxin Testing Market, 2018 - 2030 (USD Million)

4.7.4 Sterility Test & Validation

4.7.4.1 Sterility Test & Validation Market, 2018 - 2030 (USD Million)

4.7.5 Antimicrobial Testing

4.7.5.1 Antimicrobial Testing Market, 2018 - 2030 (USD Million)

4.7.6 Others Microbiology & Sterility Test

4.7.6.1 Others Microbiology & Sterility Test Market, 2018 - 2030 (USD Million)

4.8 Package Validation

4.8.1 Package Validation Medical Device Testing Services Market, 2018 - 2030 (USD Million)

Chapter 5 Medical Device Testing Services Market: Phase And Service Criss-Cross Segment Analysis

5.1 Medical Device Testing Services: Market By Phase And Service Criss-Cross Segment: Key Takeaways

5.2 Medical Device Testing Services: Market Share Analysis, 2023 & 2030

5.3 Medical Device Testing Services Market Estimates & Forecast, By Phase And Service Criss-Cross (USD Million)

5.4 Definitions & Scope

5.5 Preclinical

5.5.1 Preclinical Market, 2018 - 2030 (USD Million)

5.5.2 Small Animal Research

5.5.2.1 Small Animal Research Market, 2018 - 2030 (USD Million)

5.5.2.2 Biocompatibility Tests

5.5.2.2.1 Biocompatibility Tests Market, 2018 - 2030 (USD Million)

5.5.2.3 Chemistry Test

5.5.2.3.1 Chemistry Test Market, 2018 - 2030 (USD Million)

5.5.2.4 Microbiology & Sterility Test

5.5.2.4.1 Microbiology & Sterility Test Market, 2018 - 2030 (USD Million)

5.5.3 Large Animal Research

5.5.3.1 Large Animal Research Market, 2018 - 2030 (USD Million)

5.5.3.2 Biocompatibility Tests

5.5.3.2.1 Biocompatibility Tests Market, 2018 - 2030 (USD Million)

5.5.3.3 Chemistry Test

5.5.3.3.1 Chemistry Test Market, 2018 - 2030 (USD Million)

5.5.3.4 Microbiology & Sterility Test

5.5.3.4.1 Microbiology & Sterility Test Market, 2018 - 2030 (USD Million)

5.5.4 Others

5.5.4.1 Others Market, 2018 - 2030 (USD Million)

5.6 Clinical

5.6.1.1 Clinical Market, 2018 - 2030 (USD Million)

Chapter 6 Medical Device Testing Services Market: Regional Analysis

6.1 Medical Device Testing Services: Market Share Analysis, 2023 & 2030

6.2 Medical Device Testing Services: Market Estimates And Forecast, By Region (USD Million)

6.3 North America

6.3.1 Competitive Scenario

6.3.2 North America Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.3.3 U.S.

6.3.3.1 Key Country Dynamics

6.3.3.2 Competitive Scenario

6.3.3.3 Regulatory Scenario

6.3.3.4 U.S. Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.3.4 Canada

6.3.4.1 Key Country Dynamics

6.3.4.2 Competitive Scenario

6.3.4.3 Regulatory Scenario

6.3.4.4 Canada Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4 Europe

6.4.1 Competitive Scenario

6.4.2 Europe Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.3 Uk

6.4.3.1 Key Country Dynamics

6.4.3.2 Competitive Scenario

6.4.3.3 Regulatory Scenario

6.4.3.4 Uk Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.4 Germany

6.4.4.1 Key Country Dynamics

6.4.4.2 Competitive Scenario

6.4.4.3 Regulatory Scenario

6.4.4.4 Germany Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.5 France

6.4.5.1 Key Country Dynamics

6.4.5.2 Competitive Scenario

6.4.5.3 Regulatory Scenario

6.4.5.4 Device Classification

6.4.5.5 France Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.6 Italy

6.4.6.1 Key Country Dynamics

6.4.6.2 Competitive Scenario

6.4.6.3 Regulatory Scenario

6.4.6.4 Italy Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.7 Spain

6.4.7.1 Key Country Dynamics

6.4.7.2 Competitive Scenario

6.4.7.3 Regulatory Scenario

6.4.7.4 Spain Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.4.8 Denmark

6.4.8.1 Key Country Dynamics

6.4.8.2 Competitive Scenario

6.4.8.3 Regulatory Scenario

6.4.8.4 Denmark Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.4.9 Sweden

6.4.9.1 Key Country Dynamics

6.4.9.2 Competitive Scenario

6.4.9.3 Regulatory Scenario

6.4.9.4 Sweden Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.4.10 Norway

6.4.10.1 Key Country Dynamics

6.4.10.2 Competitive Scenario

6.4.10.3 Regulatory Scenario

6.4.10.4 Norway Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.4.11 Netherlands

6.4.11.1 Key Country Dynamics

6.4.11.2 Competitive Scenario

6.4.11.3 Regulatory Scenario

6.4.11.4 Netherlands Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.4.12 Belgium

6.4.12.1 Competitive Scenario

6.4.12.2 Regulatory Scenario

6.4.12.3 Belgium Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.4.13 Switzerland

6.4.13.1 Key Country Dynamics

6.4.13.2 Competitive Scenario

6.4.13.3 Regulatory Scenario

6.4.13.4 Switzerland Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.5 Asia Pacific

6.5.1 Competitive Scenario

6.5.2 Asia Pacific Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.3 Japan

6.5.3.1 Key Country Dynamics

6.5.3.2 Competitive Scenario

6.5.3.3 Regulatory Scenario

6.5.3.4 Japan Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.4 China

6.5.4.1 Key Country Dynamics

6.5.4.2 Competitive Scenario

6.5.4.3 Regulatory Scenario

6.5.4.4 China Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.5 India

6.5.5.1 Key Country Dynamics

6.5.5.2 Competitive Scenario

6.5.5.3 Regulatory Scenario

6.5.5.4 India Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.6 Australia

6.5.6.1 Key Country Dynamics

6.5.6.2 Competitive Scenario

6.5.6.3 Regulatory Scenario

6.5.6.4 Australia Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.7 South Korea

6.5.7.1 Key Country Dynamics

6.5.7.2 Competitive Scenario

6.5.7.3 Regulatory Scenario

6.5.7.4 South Korea Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.8 Malaysia

6.5.8.1 Key Country Dynamics

6.5.8.2 Competitive Scenario

6.5.8.3 Regulatory Scenario

6.5.8.4 Malaysia Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.9 Indonesia

6.5.9.1 Key Country Dynamics

6.5.9.2 Competitive Scenario

6.5.9.3 Regulatory Scenario

6.5.9.4 Indonesia Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.10 Singapore

6.5.10.1 Key Country Dynamics

6.5.10.2 Competitive Scenario

6.5.10.3 Regulatory Scenario

6.5.10.4 Singapore Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.11 Philippines

6.5.11.1 Competitive Scenario

6.5.11.2 Regulatory Scenario

6.5.11.3 Philippines Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.5.12 Thailand

6.5.12.1 Key Country Dynamics

6.5.12.2 Competitive Scenario

6.5.12.3 Regulatory Scenario

6.5.12.4 Thailand Medical Device Testing Services Market, 2018 - 2030 (USD Million)

6.6 Latin America

6.6.1 Competitive Scenario

6.6.2 Latin America Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6.3 Brazil

6.6.3.1 Key Country Dynamics

6.6.3.2 Competitive Scenario

6.6.3.3 Regulatory Scenario

6.6.3.4 Brazil Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6.4 Mexico

6.6.4.1 Key Country Dynamics

6.6.4.2 Competitive Scenario

6.6.4.3 Regulatory Scenario

6.6.4.3.1 Medical Device

6.6.4.4 Mexico Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6.5 Argentina

6.6.5.1 Key Country Dynamics

6.6.5.2 Competitive Scenario

6.6.5.3 Regulatory Scenario

6.6.5.4 Argentina Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.6.6 Colombia

6.6.6.1 Key Country Dynamics

6.6.6.2 Competitive Scenario

6.6.6.3 Regulatory Scenario

6.6.6.4 Colombia Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.6.7 Chile

6.6.7.1 Competitive Scenario

6.6.7.2 Regulatory Scenario

6.6.7.3 Chile Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.7 MEA

6.7.1 Competitive Scenario

6.7.2 MEA Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.7.3 South Africa

6.7.3.1 Key Country Dynamics

6.7.3.2 Competitive Scenario

6.7.3.3 Regulatory Scenario

6.7.3.4 South Africa Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.7.4 Saudi Arabia

6.7.4.1 Key Country Dynamics

6.7.4.2 Competitive Scenario

6.7.4.3 Regulatory Scenario

6.7.4.4 Saudi Arabia Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030, (USD Million)

6.7.5 UAE

6.7.5.1 Key Country Dynamics

6.7.5.2 Competitive Scenario

6.7.5.3 Regulatory Scenario

6.7.5.4 Uae Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7.6 Kuwait

6.7.6.1 Key Country Dynamics

6.7.6.2 Competitive Scenario

6.7.6.3 Regulatory Scenario

6.7.6.4 Kuwait Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7.7 Israel

6.7.7.1 Key Country Dynamics

6.7.7.2 Competitive Scenario

6.7.7.3 Regulatory Scenario

6.7.7.4 Israel Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7.8 Egypt

6.7.8.1 Competitive Scenario

6.7.8.2 Regulatory Scenario

6.7.8.3 Egypt Medical Device Testing Services Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 7 Competitive Landscape

7.1. Company Landscape

7.1.1. SGS SA

7.1.1.1. Company overview

7.1.1.2. Financial performance

7.1.1.3. Product benchmarking

7.1.1.4. Strategic initiatives

7.1.2. Laboratory Corporation of America Holdings

7.1.2.1. Company overview

7.1.2.2. Financial performance

7.1.2.3. Product benchmarking

7.1.2.4. Strategic initiatives

7.1.3. Nelson Laboratories, LLC

7.1.3.1. Company overview

7.1.3.2. Financial performance

7.1.3.3. Product benchmarking

7.1.3.4. Strategic initiatives

7.1.4. TÜV SÜD

7.1.4.1. Company overview

7.1.4.2. Financial performance

7.1.4.3. Product benchmarking

7.1.4.4. Strategic initiatives

7.1.5. Charles River Laboratories

7.1.5.1. Company overview

7.1.5.2. Financial performance

7.1.5.3. Product benchmarking

7.1.5.4. Strategic initiatives

7.1.6. Element Minnetonka

7.1.6.1. Company overview

7.1.6.2. Financial performance

7.1.6.3. Product benchmarking

7.1.6.4. Strategic initiatives

7.1.7. North America Science Associates Inc. (NAMSA)

7.1.7.1. Company overview

7.1.7.2. Financial performance

7.1.7.3. Product benchmarking

7.1.7.4. Strategic initiatives

7.1.8. Eurofins Scientific

7.1.8.1. Company overview

7.1.8.2. Financial performance

7.1.8.3. Product benchmarking

7.1.8.4. Strategic initiatives

7.1.9. Pace Analytical Services LLC

7.1.9.1. Company overview

7.1.9.2. Financial performance

7.1.9.3. Product benchmarking

7.1.9.4. Strategic initiatives

7.1.10. Intertek Group Plc

7.1.10.1. Company overview

7.1.10.2. Financial performance

7.1.10.3. Product benchmarking

7.1.10.4. Strategic initiatives

7.1.11. WuXi AppTec

7.1.11.1. Company overview

7.1.11.2. Financial performance

7.1.11.3. Product benchmarking

7.1.11.4. Strategic initiatives

7.2.4 Participant Categorization

7.2.1 Market Leaders

7.2.1.1 Medical Device Testing Services Market Share Analysis, 2023

7.3 Strategy Mapping

7.3.1 Service Launches/Upgrades

7.3.2 Merger/Acquisitions/Joint Ventures Merger

7.3.3 Partnership/Agreements

7.3.4 Expansions

7.3.5 Others

7.4 Market Position Analysis, 2022/2023 (Heat Map Analysis)

Chapter 8 Key Takeaways

List of Tables

Table 1 List of abbreviation

Table 2 North America medical device testing services market, by region, 2018 - 2030 (USD Million)

Table 3 North America medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 4 North America medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 5 U.S. medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 6 U.S. medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 7 Canada medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 8 Canada medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 9 Europe medical device testing services market, by region, 2018 - 2030 (USD Million)

Table 10 Europe medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 11 Europe medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 12 UK medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 13 UK medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 14 Germany medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 15 Germany medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 16 France medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 17 France medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 18 Italy medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 19 Italy medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 20 Spain medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 21 Spain medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 22 Denmark medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 23 Denmark medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 24 Sweden medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 25 Sweden medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 26 Norway medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 27 Norway medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 28 Netherlands medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 29 Netherlands medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 30 Belgium medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 31 Belgium medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 32 Asia Pacific medical device testing services market, by region, 2018 - 2030 (USD Million)

Table 33 Asia Pacific medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 34 Asia Pacific medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 35 China medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 36 China medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 37 Japan medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 38 Japan medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 39 India medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 40 India medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 41 Australia medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 42 Australia medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 43 South Korea medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 44 South Korea medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 45 Malaysia medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 46 Malaysia medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 47 Indonesia medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 48 Indonesia medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 49 Singapore medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 50 Singapore medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 51 Philippines medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 52 Philippines medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 53 Thailand medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 54 Thailand medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 55 Latin America medical device testing services market, by region, 2018 - 2030 (USD Million)

Table 56 Latin America medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 57 Latin America medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 58 Brazil medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 59 Brazil medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 60 Mexico medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 61 Mexico medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 62 Argentina medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 63 Argentina medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 64 Colombia medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 65 Colombia medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 66 Chile medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 67 Chile medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 68 MEA medical device testing services market, by region, 2018 - 2030 (USD Million)

Table 69 MEA medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 70 MEA medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 71 South Africa medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 72 South Africa medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 73 Saudi Arabia medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 74 Saudi Arabia medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 75 UAE medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 76 UAE medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 77 Kuwait medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 78 Kuwait medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 79 Israel medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 80 Israel medical device testing services market, by phase, 2018 - 2030 (USD Million)

Table 81 Egypt medical device testing services market, by service, 2018 - 2030 (USD Million)

Table 82 Egypt medical device testing services market, by phase, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Medical device testing services market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Commodity flow analysis

Fig. 9 Bottom-up approach

Fig. 10 Market snapshot

Fig. 11 Segment snapshot

Fig. 12 Competitive landscape snapshot

Fig. 13 Parent market outlook, 2023 (USD Billion)

Fig. 14 Ancillary market outlook, 2023 (USD Billion)

Fig. 15 Medical device testing services market dynamics

Fig. 16 Porter's five forces analysis

Fig. 17 SWOT analysis, by factor (political & legal, economic, and technological)

Fig. 18 List of FDA-recognized consensus test methods in the ASCA pilot for biocompatibility testing of medical devices

Fig. 19 Medical Device Testing Services market molecule outlook: Segment dashboard

Fig. 20 Medical Device Testing Services market: Molecule movement analysis

Fig. 21 Biocompatibility medical device testing services market, 2018 - 2030 (USD Million)

Fig. 22 Cardiovascular device’s biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 23 Orthopedic device's biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 24 Dental implant devices' biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 25 Dermal filler's biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 26 General surgery implantation devices biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 27 Neurosurgical implantation devices biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 28 Ophthalmic implantation device's biocompatibility tests market, 2018 - 2030 (USD Million)

Fig. 29 Others Biocompatibility test market, 2018 - 2030 (USD Million)

Fig. 30 Chemistry medical device testing services market, 2018 - 2030 (USD Million)

Fig. 31 Chemical characterization (E&L) market, 2018 - 2030 (USD Million)

Fig. 32 Analytical method development and validation market, 2018 - 2030 (USD Million)

Fig. 33 Toxicological risk assessment and consulting market, 2018 - 2030 (USD Million)

Fig. 34 Microbiology & sterility medical device testing services market, 2018 - 2030 (USD Million)

Fig. 35 Bioburden determination market, 2018 - 2030 (USD Million)

Fig. 36 Pyrogen & endotoxin testing market, 2018 - 2030 (USD Million)

Fig. 37 Sterility test & validation market, 2018 - 2030 (USD Million)

Fig. 38 Antimicrobial testing market, 2018 - 2030 (USD Million)

Fig. 39 Others microbiology & sterility test market, 2018 - 2030 (USD Million)

Fig. 40 Package validation medical device testing services market, 2018 - 2030 (USD Million)

Fig. 41 Medical device testing services market phase and service criss-cross outlook: Segment dashboard

Fig. 42 Medical device testing services market: Phase and Service Criss-Cross movement analysis

Fig. 43 Preclinical market, 2018 - 2030 (USD Million)

Fig. 44 Small animal research market, 2018 - 2030 (USD Million)

Fig. 45 Biocompatibility Tests market, 2018 - 2030 (USD Million)

Fig. 46 Chemistry test market, 2018 - 2030 (USD Million)

Fig. 47 Microbiology & sterility test market, 2018 - 2030 (USD Million)

Fig. 48 Large animal research market, 2018 - 2030 (USD Million)

Fig. 49 Biocompatibility Tests market, 2018 - 2030 (USD Million)

Fig. 50 Chemistry test market, 2018 - 2030 (USD Million)

Fig. 51 Microbiology & sterility test market, 2018 - 2030 (USD Million)

Fig. 52 Others market, 2018 - 2030 (USD Million)

Fig. 53 Clinical market, 2018 - 2030 (USD Million)

Fig. 54 Regional market: Key takeaways

Fig. 55 Regional outlook, 2023 & 2030

Fig. 56 Regional outlook, 2023 & 2030

Fig. 57 North America market, 2018 - 2030 (USD Million)

Fig. 58 Key country dynamics

Fig. 59 U.S. Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Key country dynamics

Fig. 61 Canada Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 Europe Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 Key country dynamics

Fig. 64 UK Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 Key country dynamics

Fig. 66 Germany Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 67 Key country dynamics

Fig. 68 France medical device classification

Fig. 69 France Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 Key country dynamics

Fig. 71 Italy Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 72 Key country dynamics

Fig. 73 Spain Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 74 Key country dynamics

Fig. 75 Denmark Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 76 Key country dynamics

Fig. 77 Sweden Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 78 Key country dynamics

Fig. 79 Norway Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 80 Key country dynamics

Fig. 81 Netherlands Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 82 Belgium Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 Key country dynamics

Fig. 84 Switzerland Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 85 Asia Pacific Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 86 Key country dynamics

Fig. 87 Japan Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 88 Key country dynamics

Fig. 89 China Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 90 Key country dynamics

Fig. 91 India Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 92 Key country dynamics

Fig. 93 Australia Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 94 Key country dynamics

Fig. 95 South Korea Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 96 Key country dynamics

Fig. 97 Malaysia Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 98 Key country dynamics

Fig. 99 Indonesia Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 100 Key country dynamics

Fig. 101 Singapore Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 102 Philippines Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 103 Key country dynamics

Fig. 104 Thailand Medical Device Testing Services Market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 105 Latin America Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 106 Key country dynamics

Fig. 107 Brazil Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 108 Key country dynamics

Fig. 109 Mexico Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 110 Key country dynamics

Fig. 111 Argentina Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 112 Key country dynamics

Fig. 113 Colombia Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 114 Chile Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 115 MEA Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 116 Key country dynamics

Fig. 117 South Africa Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 118 Key country dynamics

Fig. 119 Saudi Arabia Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 120 Key country dynamics

Fig. 121 UAE Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 122 Key country dynamics

Fig. 123 Kuwait Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 124 Key country dynamics

Fig. 125 Israel Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 126 Egypt Medical Device Testing Services market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 127 Market participant categorization

Fig. 128 Market participant categorization

Fig. 129 Heat map analysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Medical Device Testing Services market Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Medical Device Testing Services market Phase Outlook (Revenue in USD Million, 2018 - 2030)Preclinical

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Medical Device Testing Services market Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- North America Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- U.S.

- U.S. Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- U.S. Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- U.S. Service Outlook (Revenue in USD Million, 2018 - 2030)

- Canada

- Canada Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Canada Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Canada Service Outlook (Revenue in USD Million, 2018 - 2030)

- North America Service Outlook (Revenue in USD Million, 2018 - 2030)

- Europe

- Europe Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Europe Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- UK

- UK Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- UK Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- UK Service Outlook (Revenue in USD Million, 2018 - 2030)

- Germany

- Germany Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Germany Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Germany Service Outlook (Revenue in USD Million, 2018 - 2030)

- France

- France Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- France Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- France Service Outlook (Revenue in USD Million, 2018 - 2030)

- Italy

- Italy Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Italy Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Italy Service Outlook (Revenue in USD Million, 2018 - 2030)

- Spain

- Spain Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Spain Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Spain Service Outlook (Revenue in USD Million, 2018 - 2030)

- Denmark

- Denmark Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Denmark Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Denmark Service Outlook (Revenue in USD Million, 2018 - 2030)

- Sweden

- Sweden Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Sweden Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Sweden Service Outlook (Revenue in USD Million, 2018 - 2030)

- Norway

- Norway Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Norway Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Norway Service Outlook (Revenue in USD Million, 2018 - 2030)

- Netherlands

- Netherlands Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Netherlands Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Netherlands Service Outlook (Revenue in USD Million, 2018 - 2030)

- Belgium

- Belgium Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Belgium Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Belgium Service Outlook (Revenue in USD Million, 2018 - 2030)

- Switzerland

- Switzerland Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Switzerland Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Switzerland Service Outlook (Revenue in USD Million, 2018 - 2030)

- Europe Service Outlook (Revenue in USD Million, 2018 - 2030)

- Asia Pacific

- Asia Pacific Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

- Biocompatibility Tests

- Asia Pacific Phase Outlook (Revenue in USD Million, 2018 - 2030)

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Clinical

- Large animal research

- Japan

- Japan Service Outlook (Revenue in USD Million, 2018 - 2030)

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests