- Home

- »

- Medical Devices

- »

-

Medical Device Validation & Verification Market Report, 2030GVR Report cover

![Medical Device Validation & Verification Market Size, Share & Trends Report]()

Medical Device Validation & Verification Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapeutic Area (Cardiovascular, Dermatology), By Application, By Implants, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-408-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

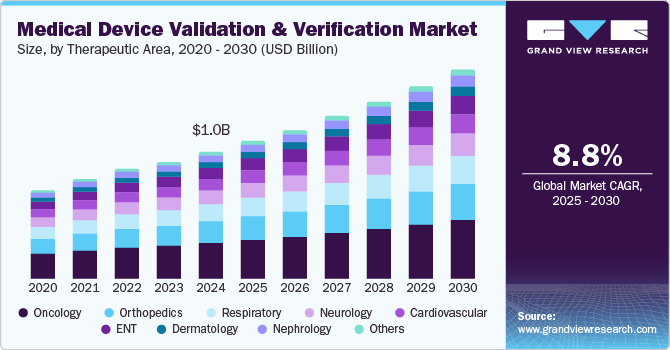

The global medical device validation & verification market size was estimated at USD 1.04 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030. This growth is largely attributed to the increasing need for regulatory compliance to ensure market approval and enhance patient safety by minimizing risks. In addition, rapid technological advancements require updated testing standards, further driving the demand for validation and verification services. Therefore, these factors contribute to the dynamic growth of the medical device validation and verification market.

Rising demand for advanced and quality medical products and patient safety are fundamental driving factors in medical device validation and verification. This ensures that devices are accurately designed and tested to minimize risks and prevent user harm. This safety assurance directly informs quality practices, which maintain high standards throughout the product lifecycle by implementing systematic checks and thorough documentation. Therefore, these factors raise trust in medical technologies and significantly improve overall healthcare quality and outcomes.

Constant medical device validation and verification developments include updates to regulatory guidelines emphasizing ongoing safety and effectiveness through post-market surveillance. Advanced testing methods, such as in-silico simulations and virtual testing, enhance performance validation. Integrating automation and AI streamlines processes, improves data analysis while focusing on cybersecurity, and addresses the risks associated with connected devices. Additionally, user-centric design principles and sustainability considerations are increasingly shaping validation and verification practices to meet evolving healthcare needs.

Therapeutic Area Insights

The oncology segment dominated the market, with a revenue share of 26.5% in 2024, driven by the rising incidence of cancer globally, demanding advanced medical devices for diagnosis, treatment, and monitoring. As cancer rates increase, the demand for innovative oncology devices like imaging systems, radiation therapy machines, and surgical instruments grows. In addition, an aging population, which is more susceptible to cancer, further drives the need for effective oncology medical devices. Therefore, the growing prevalence and demographic shifts significantly impact the validation and verification of oncology devices.

Nephrology is projected to witness the fastest CAGR of 9.4% over the forecast period, which is attributed to the increasing prevalence of kidney diseases, particularly chronic kidney disease (CKD), which is driven by factors like diabetes, hypertension, and obesity, leading to higher demand for nephrology medical devices such as dialysis machines. In addition, the aging population is more susceptible to kidney issues, further intensifying the need for effective diagnostic and therapeutic devices. Moreover, technological advancements, including portable and home-based dialysis systems, are emerging as innovative treatment options. These advancements require thorough validation to ensure safety and efficacy. Therefore, rising disease prevalence and technological progress are reshaping the validation and verification of nephrology devices.

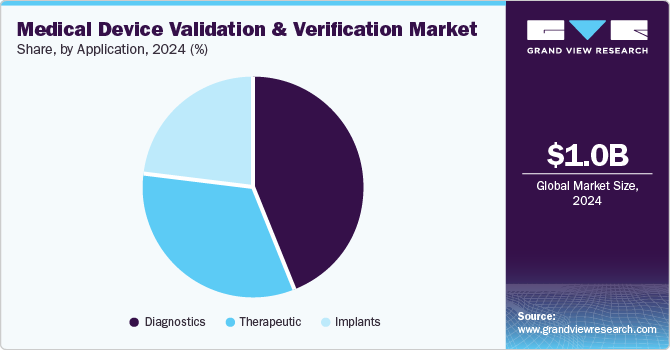

Application Insights

The diagnostics segment dominated the market with the largest revenue share of 44.0% in 2024, driven by increasing demand for early disease detection and a shift towards preventive healthcare, emphasizing early diagnosis for better treatment outcomes and lower costs. In addition, technological advancements, such as advanced imaging and rapid testing kits, enable earlier disease detection, requiring strong validation for accuracy. Moreover, the rising incidence of chronic diseases such as diabetes and cancer creates a heightened need for reliable diagnostic devices to monitor these conditions. Therefore, the complexity of diagnosing chronic diseases demands sophisticated testing methods, further emphasizing the importance of thorough validation and verification processes.

The therapeutic segment is projected to grow at a CAGR of 9.0% over the forecast period. It is fueled by the rising prevalence of chronic diseases like diabetes and cardiovascular conditions, demanding validated devices such as drug delivery systems and infusion pumps for effective management. In addition, Innovative therapies, including biologics and gene therapy, require sophisticated devices that must undergo thorough validation for safety and effectiveness. Moreover, the rise of wearable devices and remote monitoring systems enables continuous patient management, demanding validation for accuracy. Therefore, integrating AI and machine learning enhances treatment personalization, making validating these technologies essential.

Regional Insights

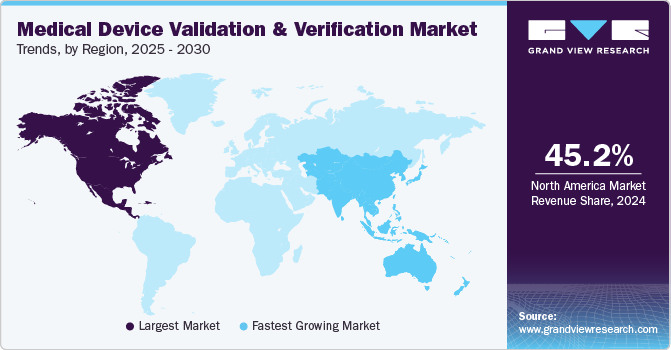

North America medical device validation & verification market dominated the global market with a revenue share of 45.2% in 2024, fueled by healthcare infrastructure, with leading healthcare systems like Mayo Clinic and Cleveland Clinic equipped with cutting-edge technology that supports innovative medical device development. In addition, prominent research institutions such as Johns Hopkins University and Stanford University facilitate collaboration between manufacturers and healthcare providers. This partnership promotes the creation of validated medical devices that meet safety and efficacy standards.

U.S. Medical Device Validation & Verification Market Trends

The U.S. medical device validation & verification market dominates North America. An advanced healthcare infrastructure, stringent regulatory standards, robust R&D investments, and a high prevalence of chronic diseases drive it. The recent regulation from the U.S. Food and Drug Administration (FDA) regarding medical devices is the Digital Health Innovation Action Plan, published in January 2021. This plan outlines the FDA's approach to regulating digital health technologies, including software as a medical device (SaMD). It emphasizes a streamlined regulatory pathway for certain low-risk digital health devices and encourages the use of real-world evidence in the validation and verification processes.

Europe Medical Device Validation & Verification Market Trends

Europe medical device validation & verification market held a substantial market share in 2024, driven by a combination of stringent regulatory standards, high demand for innovative medical technologies, and a significant aging population. According to the European Commission, the Medical Device Regulation (MDR), applicable since May 2021, and the In Vitro Diagnostic Regulation (IVDR), effective from May 2022, impose stringent requirements for the approval and monitoring of medical devices in Europe. These regulations aim to enhance the safety and efficacy of devices, driving manufacturers to invest significantly in thorough validation and verification processes. Therefore, this ensures that only high-quality products reach the market.

The medical device validation and verification market in Germany is expected to grow in the forecast period; as per the European Commission, a substantial number of Notified Bodies are accredited to conduct conformity assessments under the Medical Device Regulation (MDR), with over 25 Notified Bodies designated as of 2023. This robust infrastructure is crucial for evaluating medical devices against stringent safety and performance standards, facilitating compliance with EU regulations. Therefore, the presence of these organizations helps streamline the approval process, reducing time-to-market for manufacturers while ensuring that devices meet high-quality benchmarks. As a result, Germany maintains its position as a leader in the medical device sector within Europe.

Asia Pacific Medical Device Validation and Verification Market Trends

Asia Pacific medical device validation & verification market anticipates registering the fastest CAGR of 9.3% over the forecast period. This market is driven by substantial economic growth, leading to increased healthcare spending. In addition, the rise of remote monitoring technologies, essential for managing chronic diseases, has further emphasized the need for validated devices that ensure reliability and accuracy in home settings. Therefore, the rising expenditure fuels the demand for advanced medical devices requiring validation and verification.

China is increasingly aligning its regulatory standards with global norms, such as the International Organization for Standardization (ISO) and the Medical Device Regulation (MDR) in Europe, which enhances the credibility of validated devices in international markets. In addition, according to World Bank 2021, The expansion of the middle class in China, estimated to reach 1 billion by 2030, drives demand for high-quality healthcare services and medical devices, further enhancing the validation and verification market.

Key Medical Device Validation & Verification Company Insights

Some key companies operating in the market include SGS Société Générale de Surveillance SA, QuEST Global Services Pte. Ltd., Element Materials Technology, Intertek, and TÜV SÜD AG. Companies are implementing strategic initiatives, including mergers, acquisitions, and therapeutic area launches, to expand their market presence and address evolving healthcare demands through medical device validation and verification.

-

SGS Société Générale de Surveillance SA offers a range of services in the Medical Device Validation and Verification Market, including regulatory compliance testing, quality management system audits, and performance evaluations. Recently, The company launched an integrated digital platform designed to streamline the validation process for medical devices, enhancing efficiency and transparency. This platform supports manufacturers in meeting stringent regulatory requirements while ensuring product safety and efficacy.

-

QuEST Global Services Pte. Ltd. offers a range of engineering and digital transformation services tailored for Medical Device Validation and Verification, including product design, regulatory compliance, and testing solutions. Recently, It launched its "MedTech Accelerator" program, aimed at expediting the development and validation of medical devices through enhanced engineering support and regulatory expertise. This initiative helps manufacturers streamline their processes while ensuring compliance with industry standards. QuEST's comprehensive approach fosters innovation and accelerates time-to-market for medical devices.

Key Medical Device Validation & Verification Companies:

The following are the leading companies in the medical device validation & verification market. These companies collectively hold the largest market share and dictate industry trends.

- SGS Société Générale de Surveillance SA

- QuEST Global Services Pte. Ltd.

- Intertek.

- Element Materials Technology

- TÜV SÜD AG

- Eurofins Scientific SE

- Charles River.

- Sterling Medical Devices

- Toxikon Corporation.

- Steris Laboratories.

Recent Developments

-

In October 2024, SGS Société Générale de Surveillance SA announced the launch of the new CDISC Open Rules consultancy to assist pharmaceutical organizations in navigating compliance with the latest CDISC standards for clinical trial submissions. This service offers comprehensive support from initial consultation to ongoing evaluation, ensuring high-quality data and regulatory adherence.

Medical Device Validation & Verification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.13 billion

Revenue forecast in 2030

USD 1.71 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Therapeutic Area,application, implants, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

SGS Société Générale de Surveillance SA; QuEST Global Services Pte. Ltd.; Intertek; Element Materials Technology; TÜV SÜD AG; Eurofins Scientific SE; Charles River.; Sterling Medical Devices; Toxikon Corporation; Steris Laboratories.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Validation & Verification Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global medical device validation & verification market report based on therapeutic area, application, implants, technology, and region:

-

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular

-

Dermatology

-

Orthopedics

-

Nephrology

-

Respiratory

-

Neurology

-

Oncology

-

ENT

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostics

-

Therapeutic

-

Implants

-

-

Implants Outlook (Revenue, USD Billion, 2018 - 2030)

-

Active Implantable Medical Device

-

Medical Implants

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mechanical Testing

-

Biological

-

EMI/EMC

-

Electrical Safety Testing

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device validation and verification market size was estimated at USD 1.04 billion in 2023 and is expected to reach USD 1.13 billion in 2024.

b. The global medical device validation and verification market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 1.71 billion by 2030.

b. North America dominated the medical device validation and verification market with a share of 45.2% in 2024. This is attributable to recent technological advancements in medical devices and increasing complexity in product design.

b. Some of the players operating in the market are SGS SA; QuEST Global Services Pte. Ltd; Intertek; Element Materials Technology; TÜV SÜD AG; North American Science Associates, Inc. (NAMSA); Eurofins Scientific SE; Charles River; Sterling Medical Devices; Pacific Biolabs; Toxikon Corporation; and Steris Laboratories.

b. Key factors that are driving the market growth include increasing product complexity, increasing medical device recalls, and stringent regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.