- Home

- »

- Medical Devices

- »

-

Medical Devices Cuffs Market Size, Industry Report, 2030GVR Report cover

![Medical Devices Cuffs Market Size, Share & Trends Report]()

Medical Devices Cuffs Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Blood Pressure Cuffs, Cuffed Endotracheal Tube, Tracheostomy Tube), By End-use (Hospitals, Clinics, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-211-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Devices Cuffs Market Size & Trends

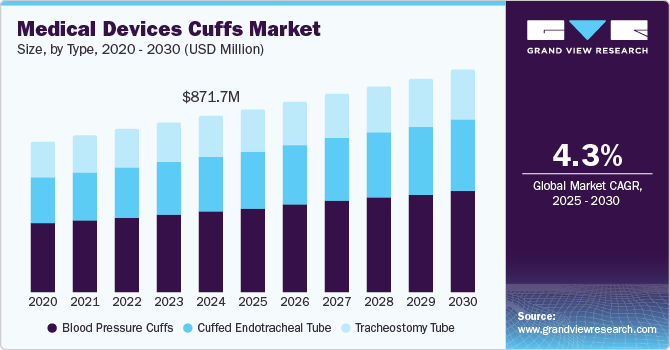

The global medical devices cuffs market size was estimated at USD 871.68 million in 2024 and is projected to grow at a CAGR of 4.25% from 2025 to 2030. This can be attributed to the rising prevalence of obesity, hypertension, and cardiovascular diseases, increasing demand for non-invasive blood pressure monitoring, and the growing geriatric population. According to World Obesity Atlas 2024, by 2035, more than half of the world's population is projected to be above a healthy weight, with the majority living in middle-income countries where obesity is under-addressed. In 2020, over 65% of adults living with obesity were from low- and middle-income countries, a figure expected to increase to 7 in 10 adults by 2030. Moreover, growing awareness about regular blood pressure monitoring and increasing healthcare infrastructure investments in emerging economies contribute to market growth.

The growth of the market is driven by the increasing prevalence of cardiovascular diseases and hypertension, which necessitate regular blood pressure monitoring. According to the WHO, hypertension or high blood pressure affects 1.28 billion adults worldwide and is a major cause of premature death. Similarly, according to the CDC, a life is lost to cardiovascular disease every 33 seconds in the U.S. Moreover, the country witnessed 702,880 heart disease mortalities in 2022, which is around one in every five deaths in the country. Medical device cuffs, including reusable and disposable blood pressure cuffs, play a crucial role in accurate diagnosis and patient monitoring in hospitals, clinics, and home healthcare settings. The rise in geriatric populations, who are more susceptible to chronic conditions requiring continuous blood pressure monitoring, has further contributed to market growth.

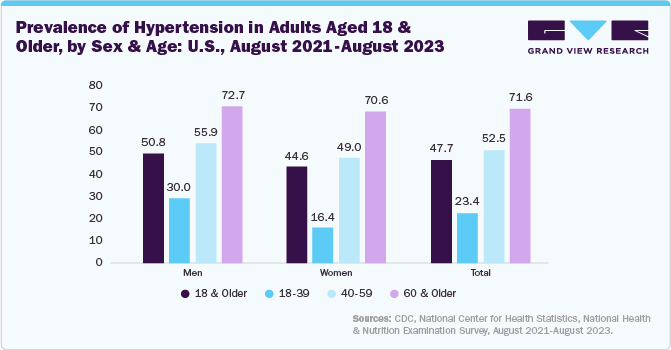

Moreover, several countries are witnessing significant increases in the prevalence of hypertension. For instance, hypertension prevalence in the U.S. increases with age. Among adults aged 18–39, 23.4% were affected, rising to 52.5% in those aged 40–59 and reaching 71.6% in individuals 60 and older. Both males and females exhibited this age-related increase. However, hypertension was more common in men than women in the younger (30.0% vs 16.4% for ages 18–39) and middle-aged groups (55.9% vs 49.0% for ages 40–59), while no significant sex difference was observed in those aged 60 and above.

The below figure shows the prevalence of hypertension in the U.S., segmented by age and sex, revealing a significant increase with age, particularly in men. This data directly impacts the medical device cuffs industry by showing a growing demand for blood pressure monitoring devices. As hypertension rises, mainly amongst older demographics, the need for accurate and reliable cuffs for both clinical and home use escalates.

Furthermore, government initiatives and healthcare programs significantly drive the growth of the mobile device cuffs industry by promoting preventive healthcare and enhancing access to medical technologies. For instance, in September 2024, Providence Health Plan and the American Heart Association announced collaboration on "Embracing Community Care," a cardiovascular health initiative in Oregon and Washington. They are establishing self-measured blood pressure programs in underserved communities to provide education and resources to combat high blood pressure. Such initiatives, coupled with the rise in public awareness of health issues, are expected to drive the demand for these products, thereby fueling market growth.

The rising number of adults with overweight and obesity significantly drives the medical devices cuffs industry, as these conditions are closely linked to hypertension, cardiovascular diseases, and metabolic disorders. Obesity increases the risk of high blood pressure, making regular blood pressure monitoring essential for both preventive care and disease management. As the global population living with obesity is projected to rise from 65% in 2020 to 70% by 2030 in low- and middle-income countries, the demand for blood pressure monitoring devices is expected to surge. In addition, with overweight and obese individuals often requiring larger or customized cuffs for accurate readings, manufacturers are increasingly developing multi-cuff devices and adjustable designs to cater to a wider patient demographic.

The table below presents the projected number of adults with overweight condition and obesity across different income groups from 2020 to 2035, along with the corresponding prevalence rates of high BMI.

Income Group

Year

Overweight Adults (Millions)

Adults with Obesity (Millions)

Prevalence of Overweight and Obesity (%)

Low-Income

2020

45.33

27.56

25%

2025

57.76

41.23

29%

2030

72.56

60.33

33%

2035

89.34

85.69

37%

Lower-Middle Income

2020

409.58

193.29

32%

2025

479.29

254.82

36%

2030

553.95

336.35

40%

2035

628.55

440.47

45%

Upper-Middle Income

2020

617.28

315.01

46%

2025

669.3

392.2

51%

2030

713.32

485.15

56%

2035

745.12

594.51

61%

High-Income

2020

314.39

271.9

61%

2025

316.07

312.85

64%

2030

312.89

356.67

67%

2035

304.59

401.27

70%

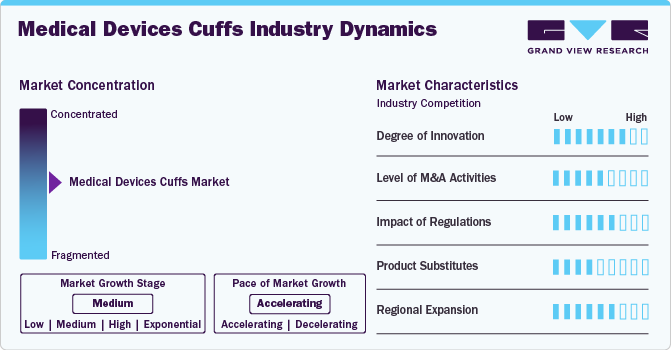

Market Concentration & Characteristics

Growth momentum is a qualitative concept that describes the current rate or speed of growth at a particular point in time, often reflecting recent trends in growth. It is more focused on assessing the pace of growth in the near term.

The medical device cuffs market is witnessing continuous innovation driven by the demand for enhanced accuracy, patient comfort, and integration with digital health platforms. Manufacturers are developing cuffs with advanced materials that provide better flexibility and durability while ensuring precise pressure measurement. As competition intensifies, players investing in R&D for next-generation cuffs with improved usability and integration with electronic health records (EHRs) are expected to gain a competitive edge.

Regulatory approvals play a crucial role in the commercialization and adoption of medical device cuffs, as these products must comply with stringent safety and efficacy standards. The approval process varies across major markets such as the U.S., Europe, and Asia-Pacific, with agencies like the FDA (U.S.), EMA (Europe), and PMDA (Japan) enforcing stringent guidelines. Companies need to conduct extensive clinical trials and provide detailed documentation on device performance, biocompatibility, and risk assessment to gain approvals. Regulatory pathways such as 510(k) clearance, CE Mark certification, and ISO 13485 compliance are essential for market entry. However, regulatory hurdles can lead to delays in product launches and increased compliance costs.Regulatory frameworks significantly impact the growth, pricing, and accessibility of medical device cuffs. Stringent regulations related to patient safety, data security, and manufacturing quality control can increase production costs and time-to-market for new products.

Product expansion is a key strategy in the medical device cuffs industry, driven by increasing demand for specialized cuff solutions. Companies are diversifying their product portfolios by introducing advanced cuffs to address the increasing demand. Moreover, integration with digital health platforms, telemedicine, and home monitoring solutions is leading to the launch of smart cuffs with remote connectivity.

Established players are focusing on entering emerging markets such as India, China, Brazil, and Southeast Asia, where healthcare infrastructure is improving and demand for affordable diagnostic solutions is rising. Government initiatives promoting universal healthcare coverage and increased investment in telehealth and remote monitoring are creating new opportunities for cuff manufacturers. However, challenges such as pricing pressures, import regulations, and reimbursement policies vary across regions and impact expansion strategies.

Type Insights

The blood pressure cuffs segment captured the largest revenue share of over 45.6% in 2024. This growth is driven by the increasing demand for accurate and efficient blood pressure monitoring across various healthcare settings. The shift from manual to automated cuffs has significantly contributed to this growth, as hospitals and clinics prioritize digital sphygmomanometers for consistent readings. Furthermore, the development of size-adjustable and pediatric-specific blood pressure cuffs has expanded the segment’s reach, ensuring effective monitoring across diverse patient populations and clinical requirements. Moreover, government initiatives promoting hypertension awareness and management have encouraged widespread screening programs, further driving the growth of the blood pressure cuffs segment in the market.

The cuffed endotracheal tube segment is expected to witness the fastest CAGR over the forecast period. This growth is driven by their critical role in airway management, particularly in surgical procedures, emergency care, and intensive care settings. Cuffed endotracheal tubes help prevent aspiration, ensure effective ventilation, and reduce the risk of ventilator-associated pneumonia (VAP). Moreover, increasing R&D initiatives for development of advanced products Is further expected to fuel the segment growth. For instance, in November 2023, the University of Nottingham secured USD 1.39 million from the Medical Research Council to trial iTraXS, the first smart endotracheal tube with optical fiber sensors. It monitors cuff pressure and tracheal blood flow to prevent ventilator-associated pneumonia (VAP) and tracheal injuries. Traditional cuffs can be either underinflated, risking aspiration, or overinflated, causing tissue damage. iTraXS ensures optimal cuff pressure, reducing these complications.

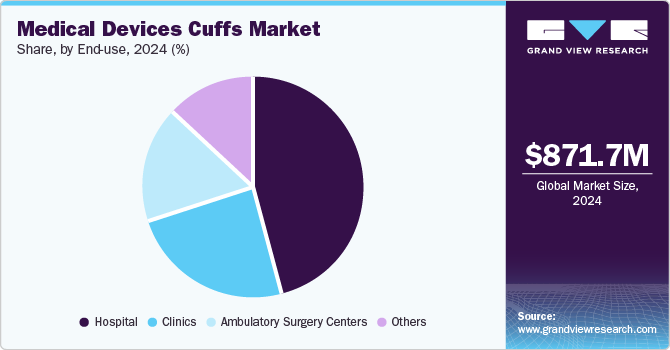

End-use Insights

The hospitals segment captured the largest revenue share in 2024 due to their high patient footfall and extensive use of monitoring and therapeutic devices. These facilities manage a wide range of acute and chronic conditions, requiring continuous blood pressure monitoring, respiratory support, and intravenous therapies, which rely on specialized cuffs. Intensive care units (ICUs) and operating rooms frequently use non-invasive blood pressure cuffs and compression cuffs for surgical patients. Hospitals also handle a significant number of high-risk patients, such as those in cardiology, neurology, and post-surgical recovery, where precise monitoring through reliable cuffs is essential for patient safety and treatment efficacy.

The ambulatory surgical centers segment is anticipated to witness a significant CAGR over the forecast period due to their increasing adoption of non-invasive monitoring and post-operative care solutions. ASCs prioritize cost efficiency and shorter patient stays, which has driven demand for high-quality blood pressure cuffs, and compression cuffs to enhance patient safety during and after procedures. With the rise in outpatient surgical procedures such as orthopedic, cardiovascular, and cosmetic surgeries, ASCs require durable and reusable cuffs that ensure accurate monitoring while reducing infection risks. The increasing number of ASCs, fueled by rising patient preference for outpatient procedures and regulatory support, further contributes to the segment growth.

“Most people take for granted the blood pressure. They assume that the machine is very smart and it’s just going to give you the right value, but there’s a lot that depends on the operator doing things properly. Make sure that there are enough cuffs around that are working and in proper order and that someone is paying attention and checking that equipment regularly. Many of the children that I get referred to for hypertension often don’t have their blood pressure measured with a cuff that is appropriately sized for them.”- Associate professor of pediatrics at Johns Hopkins University.

Regional Insights

North America medical devices cuffs market dominated globally in 2024 with the largest revenue share of 35.93%. North America’s market is driven by advanced technological innovations and evolving healthcare demands. Leading hospitals, specialized clinics, and emergency facilities across the U.S. and Canada have significantly relied on these devices for accurate patient monitoring and critical care management. Enhanced R&D initiatives, combined with stringent regulatory standards, have increased continuous improvements in product design and functionality. A growing emphasis on preventive healthcare and remote monitoring solutions has further driven adoption in both urban and rural settings.

U.S. Medical Devices Cuffs Market Trends

The medical device cuffs industry in the U.S. held the largest share in North America in 2024, driven by the increasing prevalence of chronic diseases and the ongoing evolution of healthcare technologies. Moreover, due to the high prevalence of hypertension and a significant number of populations suffering from respiratory disorders, the demand for reliable cuff-based diagnostic and monitoring systems has increased. According to the CDC, in 2022, there were 43,293 deaths from hypertension and related kidney disease. This rising prevalence of diseases significantly drives the market growth in the country.

Europe Medical Devices Cuffs Market Trends

Europe medical device cuffs market is driven by the increasing prevalence of chronic diseases and significant healthcare innovations. In Europe, where a large percentage of the adult population is affected by hypertension and respiratory disorders, demand for advanced diagnostic and monitoring systems has significantly increased. Health policies emphasizing preventive care and early intervention have further boosted the adoption of these devices in hospitals and outpatient facilities in the region. According to WHO data from May 2024, cardiovascular diseases are the major cause of disability and premature death in the European Region, causing over 42.5% of all deaths annually, which is 10,000 deaths every day.

The UK medical device cuffs market is witnessing significant growth. The National Health Service’s centralized system has prioritized cost-efficient, reliable monitoring solutions, prompting manufacturers to innovate specialized devices and increase their adoption in the country’s healthcare facilities. Moreover, the rising incidence of chronic illnesses among the aging population, coupled with targeted government investments in long-term care, has increased the demand for these products.

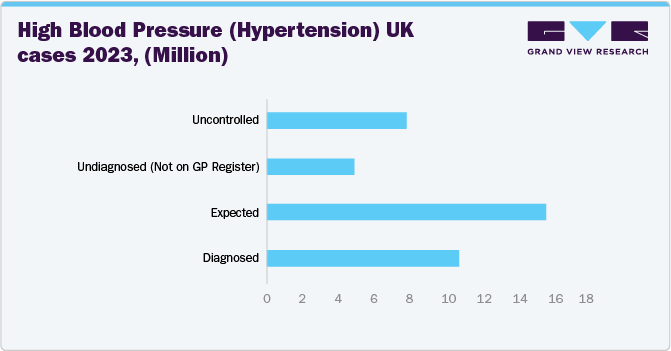

British Heart Foundation (BHF) data published in January 2025, in the UK, approximately 30% of adults (around 16 million people) are estimated to have high blood pressure, with up to half of them not receiving effective treatment in 2023. Out of these, 11 million people have been officially diagnosed by their General Practitioner (GP), suggesting that around 5 million adults could remain undiagnosed. In addition, nearly 8 million people are believed to be living with undiagnosed or uncontrolled high blood pressure, further elevating their risk of cardiovascular disease.

The data highlights a significant gap between the diagnosed and expected number of patients, indicating that up to 5 million individuals remain undiagnosed and not registered under GP care.

The medical device cuffs market in Germany is experiencing significant growth. Germany faces a significant burden of chronic conditions such as hypertension and cardiovascular diseases. The increasing number of patients requiring regular blood pressure monitoring has led to an increased demand for accurate and reliable medical device cuffs.

Asia Pacific Medical Devices Cuffs Market Trends

The Asia Pacific medical device cuffs industry is driven by increasing urbanization and rising disposable incomes of the middle class in emerging economies such as China, India, and Thailand, which have increased investments in modern healthcare infrastructure and technology. Governments in these countries are prioritizing digital health initiatives and telemedicine, encouraging a shift towards advanced patient-centric monitoring solutions. In addition, the region faces a high prevalence of chronic conditions such as hypertension and respiratory conditions, further fueling the market growth.

Japan’s medical device cuffs market is growing due to the country’s aging population, which has led to increased demand for continuous monitoring and early intervention for conditions such as hypertension and respiratory disorders. According to a press release by the Ministry of Internal Affairs and Communications in September 2024, the number of elderly people in Japan increased by 20,000 compared to September 2023, reaching a record high of 36.25 million and accounting for 29.3% of the total population, the highest proportion ever recorded.

The medical device cuffs market in China is driven by the combination of government-led healthcare reforms and significant demographic shifts. Government programs, such as the “Healthy China 2030” initiative, have driven significant investments in modernizing healthcare infrastructure, while policies to enhance insurance coverage and promote telemedicine are enhancing patient access to advanced diagnostic tools. An aging population and a rising prevalence of chronic conditions such as hypertension and respiratory disorders have further increased demand for reliable monitoring systems across urban centers and rural areas, thereby fueling market growth in the country. The rising obesity rates in China significantly impact the medical device cuffs market, particularly blood pressure cuffs. Obesity is a significant risk factor for hypertension and cardiovascular diseases, necessitating regular blood pressure monitoring. This increased need for monitoring devices directly boosts the demand for blood pressure cuffs. According to the China Obesity Conference (COC2023), over 50% of adults in China are either overweight or obese, with obesity rates increasing at a faster pace than the overweight population. This growing epidemic poses serious health risks, including higher incidences of cardiovascular diseases, diabetes, and other metabolic disorders.

“The number of patients in China undergoing weight loss and metabolic surgery reached the first 10,000 in three years from 2018 to 2021, and the second 10,000 took only one year from 2021 to 2022. We also hope to provide some common help and support for obese patients who need medical weight loss but have poor economic abilities through cooperation with public welfare charity."- Deputy dean of Beijing Friendship Hospital

Latin America Medical Devices Cuffs Market Trends

The Latin America medical device cuffs industry is driven by the high prevalence of chronic conditions such as hypertension and respiratory disorders. Governments in the region are increasingly prioritizing healthcare reforms, including the expansion of universal health coverage and the implementation of telehealth services, which significantly increase the adoption of advanced monitoring technologies.

MEA Medical Devices Cuffs Market Trends

The medical device cuffs industry in MEA is driven by the growing government investments in healthcare infrastructure, which has led to the modernization and expansion of hospital networks and health facilities. As a result, there is an increasing demand for advanced diagnostic and patient monitoring technology, including reliable cuff products. In Africa, the prevalence of chronic conditions such as hypertension, along with limited access to healthcare in rural areas, has increased demand for affordable, effective monitoring solutions.

Saudi Arabia medical device cuffs market is witnessing significant growth driven by the government’s strategic investment in modernizing healthcare infrastructure, including hospitals and primary care centers. As the prevalence of chronic conditions such as hypertension and respiratory disorders increases, there is an increasing emphasis on early detection and continuous patient monitoring. As per NIH, acute lower respiratory tract infection is a major health problem that affects more than 15% of the total population of Saudi Arabia each year. This high prevalence is expected to drive market growth over the forecast period.

Key Medical Devices Cuffs Company Insights

Key players in the medical devices cuffs industry are adopting strategies such as geographic expansion, strategic partnerships, and technological innovation to enhance their market presence. Geographic expansion allows companies to tap into emerging markets with growing healthcare needs, increasing their reach and customer base. Strategic partnerships with healthcare providers and technology firms enable the development of advanced solutions and the integration of new technologies. In addition, ongoing technological innovation focuses on improving device functionality, image quality, and user experience, ensuring that companies remain competitive and responsive to evolving market demands. These strategies collectively drive market growth and strengthen the position of leading players in the medical devices cuffs industry.

Key Medical Devices Cuffs Companies:

The following are the leading companies in the medical devices cuffs market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Smith’s Medical (Smiths Group plc)

- Teleflex Incorporated

- ConvaTec Inc.

- Cook Medical (Cook Group Incorporated)

- Troge Medical GmbH

- Fuji Systems Corporation

- Well Lead Medical Co., Ltd.

- TRACOE medical GmbH

- Pulmodyne, Inc.

Recent Developments

-

In February 2025, AD Medical launched enhanced home blood pressure monitors timed for Heart Month. The new devices combine precision innovation and seamless connectivity for accurate heart health tracking. Featuring an updated, user friendly cuff, they deliver reliable measurements and user-friendly performance.

-

In November 2024, the FDA De Novo authorization was granted to OMRON Healthcare for its new AI-powered blood pressure monitors with AFib detection. It represents a significant advancement in the medical device cuffs industry, particularly in remote patient monitoring and chronic care management.

-

In July 2024, Smart Meter, the leading supplier of Cellular Remote Patient Monitoring (RPM) solutions, has launched its innovative cellular-connected multi-cuff blood pressure monitor, specifically designed to revolutionize RPM and Chronic Care Management (CCM).

-

In April 2024, Garmin launched the Index BPM, a blood pressure cuff available outside the US. It measures systolic and diastolic readings and syncs via Wi‑Fi to Garmin Connect for tracking trends and reports. Featuring an all‑in‑one upper arm design, it supports 16 users, runs on four AAA batteries.

Medical Devices Cuffs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 947.6 million

Revenue forecast in 2030

USD 1217.6 million

Growth Rate

CAGR of 4.25% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Smith’s Medical (Smiths Group plc); Teleflex Incorporated; ConvaTec Inc.; Cook Medical (Cook Group Incorporated); Troge Medical GmbH; Fuji Systems Corporation; Well Lead Medical Co., Ltd.; TRACOE medical GmbH; Pulmodyne, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Devices Cuffs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical devices cuffs market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Pressure Cuffs

-

Cuffed Endotracheal Tube

-

Tracheostomy Tube

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics

-

Ambulatory Surgery Centers

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical devices cuffs market size was estimated at USD 871.68 million in 2024 and is expected to reach USD 947.6 million in 2025.

b. The global medical devices cuffs market is expected to grow at a compound annual growth rate of 4.25% from 2025 to 2030 to reach USD 1,217.63 million 2030.

b. North America dominated the medical devices cuffs market with a share of 35.93% in 2024. This is attributable to favorable reimbursement policies, the introduction of technologically advanced products, and the presence of several key players.

b. Some key players operating in the medical devices cuffs market include Medtronic, Smiths Medical, Teleflex Incorporated, ConvaTec Inc., Cook Medical, TROGE MEDICAL GmbH, Fuji Systems, Well Lead Medical Co. Ltd., TRACOE medical GmbH, and Pulmodyne, Inc.

b. Key factors driving the medical devices cuffs market growth include the rising prevalence of the chronic disease, growing geriatric population, increasing incidence of respiratory diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.