- Home

- »

- Beauty & Personal Care

- »

-

Medical Disinfectant Wipes Market Size Report, 2028GVR Report cover

![Medical Disinfectant Wipes Market Size, Share & Trends Report]()

Medical Disinfectant Wipes Market Size, Share & Trends Analysis Report By Type (Germicidal Disposable Wipes, Surface Disinfectant Wipes), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-587-3

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The global medical disinfectant wipes market size was valued at USD 4.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2021 to 2028. The increasing use of these products to avoid disease is a prominent factor strengthening the growth of the market. Hospital-acquired Infection (HAI) is an infection that thrives in a medical environment, such as one contracted by a patient while on a hospital visit, is one of the major factors contributing to the increase in demand for medical disinfectant wipes, globally.

The COVID-19 outbreak has accelerated the product demand, particularly in countries such as the U.S., India, Brazil, Russia, and the U.K., which are some of the most adversely affected ones. The pandemic has called for increased use of these products worldwide in public facilities, transportation, hospitals, nursing homes, and even common households to mitigate the virus burden. As per The American Cleaning Institute (ACI), a U.S.-based trade association for the cleaning products industry, manufacturers around the globe have been working around the clock to meet the surge in product demand.

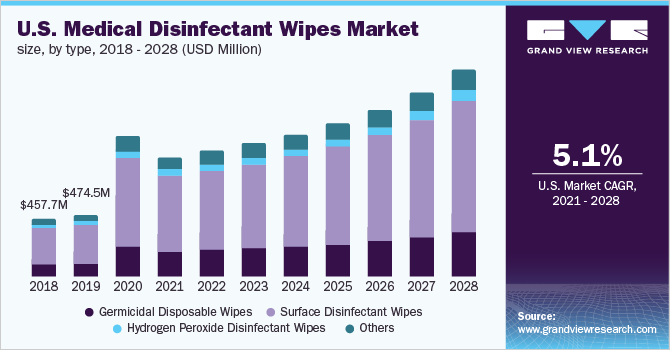

Several companies have been investing in the U.S. medical disinfectant wipes market because of a huge surge in product demand during the COVID-19 pandemic. For instance, Reckitt Benckiser’s Lysol brand witnessed a spiked demand of over 50% due to the pandemic. Apart from hospitals and other medical facilities, commercial spaces, educational institutions, and offices have been using the product to prevent the spread of coronavirus. In December 2019, when the coronavirus outbreak was first reported and people were infected with the SARS-CoV-2 virus, there was a spike in the demand for these products as the SARS-CoV-2 virus is primarily airborne and people could get infected by contacting contaminated surfaces.

The growth of the market for medical disinfectant wipes can be attributed to growing awareness about health and hygiene among consumers, which has spurred the demand for a wide range of cleaning and disinfectant products. People across the globe have been increasingly spending on such products in recent years, resulting in a supply shortage worldwide.

New product launches and huge investments by several international players in the U.S. are likely to boost the demand for hydrogen peroxide wipes. For instance, in July 2021, LSI, a disinfectant wipe solutions provider, launched unique disinfectant wipes with several innovative attributes. It launched NUGEN EHP Disinfectant Wipes, which is based on hydrogen peroxide, an active listed under the EPA’s Safer Choice program.

Type Insights

The surface disinfectant wipes segment dominated the market for medical disinfectant wipes and held the largest revenue share of 59.5% in 2020. The segment is expected to maintain its dominance over the forecast period. The growing availability of virucidal, bactericidal, and fungicidal surface disinfectant wipes is also boosting product adoption. For instance, in March 2021, EarthSafe Chemical Alternatives introduced “EvaClean Disposable Surface Disinfection Wipes” to eliminate emerging pathogens like the COVID-19 virus

However, the hydrogen peroxide disinfectant wipes segment is projected to register the fastest CAGR of 6.5% from 2021 to 2028. According to CDC, hydrogen peroxide is effective in eliminating microorganisms including yeasts, fungi, bacteria, viruses, and mold spores, which makes it an essential hygiene product. Thus, the growth of this segment is supported by continuous product innovations and launches by key market players.

Application Insights

The hospital segment dominated the market for medical disinfectant wipes and held the largest revenue share of 54.2% in 2020 and is expected to maintain dominance over the forecast period. The rapid expansion of hospitals and healthcare settings around the globe will positively impact the demand for medical disinfectant wipes. As per The Clorox Company, more than 5,000 hospitals in the U.S. rely on Clorox healthcare disinfectant products to eliminate infectious environment.

However, the dental clinic segment is projected to register the fastest CAGR of 6.3% from 2021 to 2028. Several dental clinics use a variety of disinfectant wipe brands, and every brand contains different chemical disinfectant formulas that help eliminate germs and bacteria.

Distribution Channel Insights

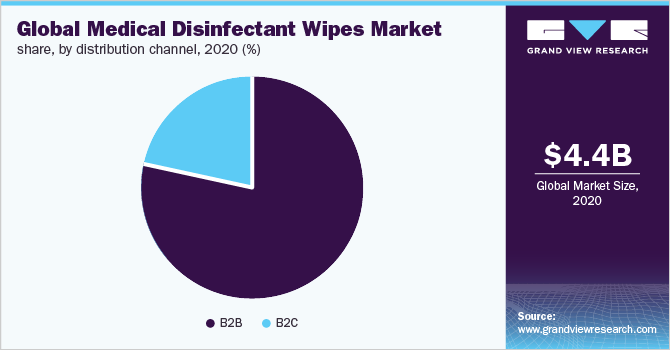

The B2B segment dominated the market for medical disinfectant wipes and accounted for the largest revenue share of over 76.7% in 2020. The outbreak of COVID-19 has significantly increased product sales through this channel. The global demand for these products exceeded production and product manufacturers boosted their manufacturing and distribution to deliver these products in bulk quantities to medical industries, hospitals, dialysis centers, medical institutions, and healthcare centers.

The B2C distribution channel is projected to register a faster CAGR of 6.4% from 2021 to 2028. The B2C segment is witnessing a steady rise owing to the growing penetration of major offline and online stores. Companies operating in the market for medical disinfectant wipes, resort to a combination of offline and online distribution models.

Regional Insights

North America dominated the market for medical disinfectant wipes and held the largest revenue share of 34.5% in 2020 and is expected to maintain dominance over the forecast period. The increase in the number of hospital-acquired infections (HAIs), rising percentage of the geriatric population, and continuous improvements in healthcare infrastructure across the region is the primary factor driving this market’s growth.

Asia Pacific is projected to register the fastest CAGR of 6.5% from 2021 to 2028 in the market for medical disinfectant wipes. Countries like China and Japan witnessed a surge in new infections, which led to an increase in the adoption of sanitation measures to curb the spread of infections arising from hospitals. This is expected to support the demand for medical disinfectant wipes in the Asia Pacific.

In Central & South America, the market is projected to register a CAGR of 6.0% from 2021 to 2028 in the market for medical disinfectant wipes. In Central America, Costa Rica has the best-quality healthcare and both the public and private sectors have been attracting investments from across the globe. Such factors would further contribute to the regional growth of the market.

Key Companies & Market Share Insights

The market for medical disinfectant wipes is characterized by the presence of some large multinational companies with a strong presence across the globe. While key market players such as The Clorox Company, and Kimberly-Clark Corporation enjoy a global presence and high product consumption based on a brand name, the market is highly fragmented owing to the presence of a large number of regional and domestic players occupying a significant market share.

Companies have been strategically implementing various expansion strategies such as mergers and acquisitions, production enhancement, strengthening of online presence, and new product launches to gain a competitive advantage. For instance, in February 2021, The Clorox Company, a leading global manufacturer and marketer of consumer goods, announced its plans to invest in doubling the manufacturing of disinfecting wipes. Because of the increased demand for disinfectant wipes in the aftermath of the COVID-19 outbreak, the company intends to invest in an Atlanta manufacturing site. Some of the prominent players in the medical disinfectant wipes market include:

-

3M

-

The Clorox Company

-

Reckitt Benckiser Group plc.

-

Kimberly-Clark Corporation

-

PDI

-

Metrex Research

-

Maxil

-

Micro-Scientific

-

Sunshine Global LLC

-

Crosstex Sanitex

Medical Disinfectant Wipes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.7 billion

Revenue forecast in 2028

USD 6.9 billion

Growth Rate

CAGR of 5.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; Brazil

Key companies profiled

3M; The Clorox Company; Reckitt Benckiser Group plc; Kimberly-Clark Corporation; PDI; Metrex Research; Maxill; Micro-Scientific; Sunshine Global LLC; Crosstex Sanitex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global medical disinfectant wipes market report on the basis of type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Germicidal Disposable Wipes

-

Surface Disinfectant Wipes

-

Hydrogen Peroxide Disinfectant Wipes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospital

-

Dental Clinic

-

Nursing Home

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

B2B

-

B2C

-

Hypermarkets/Supermarkets

-

Pharmacies/Drug Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global medical disinfectant wipes market size was estimated at USD 4.4 billion in 2020 and is expected to reach USD 3.7 billion in 2021

b. The global medical disinfectant wipes market is expected to grow at a compound annual growth rate of 5.8% from 2021 to 2028 to reach USD 6.9 billion by 2028

b. North America dominated the medical disinfectant wipes market with a share of 34.4% in 2020. The increase in the number of hospital-acquired infections (HAIs), rising percentage of the geriatric population, and continuous improvements in healthcare infrastructure across the region is the primary factor driving this market’s growth.

b. Some key players operating in the medical disinfectant wipes market include 3M; The Clorox Company; Reckitt Benckiser Group plc; Kimberly-Clark Corporation; PDI; Metrex Research; and Crosstex Sanitex

b. The rising global awareness regarding sanitation and personal hygiene and the increasing cross-contamination problems are expected to drive the demand for medical disinfectant wipes over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."