- Home

- »

- Medical Devices

- »

-

Medical Fiber Optics Market Size, Share & Growth Report 2030GVR Report cover

![Medical Fiber Optics Market Size, Share & Trends Report]()

Medical Fiber Optics Market (2023 - 2030) Size, Share & Trends Analysis Report By Fiber Type (Multimode, Plastic), By Product Type (Fiber Optics Cables), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-770-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Fiber Optics Market Summary

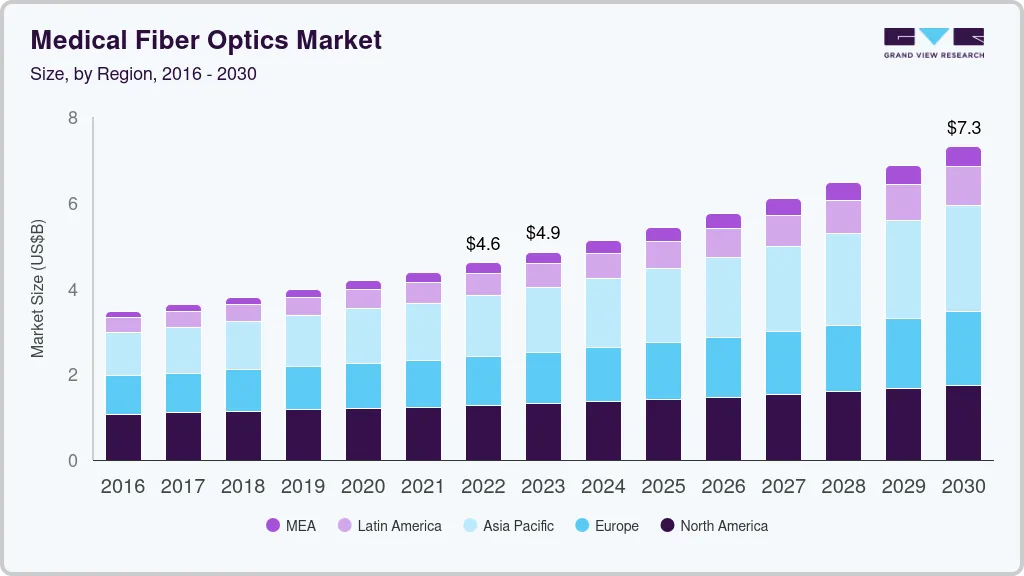

The global medical fiber optics market size was valued at USD 4.6 billion in 2022 and is projected to reach USD 7.3 billion by 2030, expanding at a CAGR of 6.0% from 2023 to 2030. The growing prevalence of chronic conditions such as cancer, technological advancements in medical devices, awareness regarding minimally invasive surgeries, and rapidly advancing healthcare infrastructure are some of the key factors which are projected to drive the market growth during the forecast period.

Key Market Trends & Insights

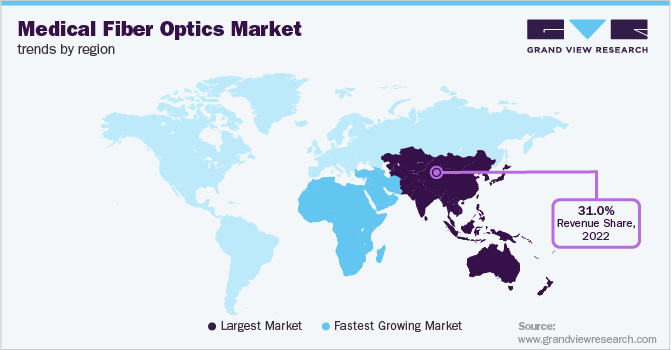

- Asia Pacific dominated the market in 2022 with a share of 31%.

- By fiber type, the multimode optical fiber segment held the largest share of 44.3% in 2022.

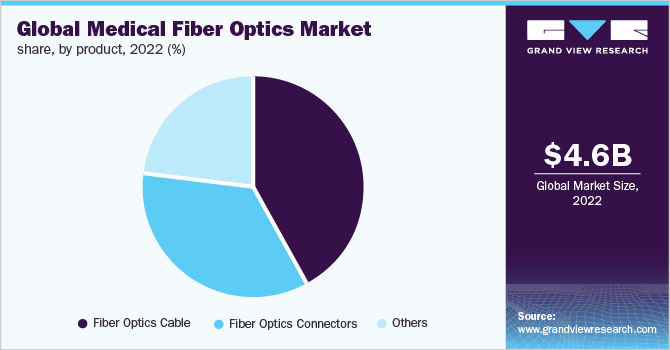

- By product type, the fiber optics cables segment held the largest share of 42. 2% in 2022.

- By application, the illumination segment accounted for the largest share of 29.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.6 Billion

- 2030 Projected Market Size: USD 7.3 Billion

- CAGR (2023-2030): 6.0%

- Asia Pacific: Largest market in 2022

- Middle East and Africa: Fastest growing market

Besides, the COVID-19 pandemic had a slight negative impact on the growth of the market. Factors such as the cancellation of non-essential surgical procedures like dentistry, and cosmetology negatively impacted the growth of the medical fiber optics market. However, the use of optic fibers-based biosensors for the detection of COVID-19 had a positive impact on the market growth.

Moreover, the adoption of lasers in dentistry and cosmetology due to better and promising patient outcomes is expected to boost the market growth. Lasers are used in cosmetology for permanent hair removal and tattoo removal, and both procedures are increasing at a considerable rate. For instance, according to an article by Astanza, 23% of the population with tattoos later experience regret. Moreover, medical applications of laser technology include eye correction surgeries, tumor removal, kidney stone removal, and varicose vein treatment. The use of lasers prevents bleeding and promotes faster healing, which is expected to drive their adoption. For instance, the use of lasers in LASIK eye surgeries improves the precision of the procedure.

The rising number of minimally invasive surgeries performed globally is projected to drive the demand for sensors, miniaturized optical cameras, and optic fibers, thereby driving the growth of the medical fiber optics market. Minimally invasive surgeries offer advantages such as faster recovery, smaller incisions, and shorter hospital stays, which are expected to drive their adoption. The surgeries are performed for multiple conditions such as abdominal issues, hip and knee replacements, and certain types of cancers. Endoscopic surgery is the most common type of minimally invasive surgery in the U.S., with more than 20 million endoscopy surgeries being performed every year according to an article by the National Institute of Diabetes, Digestive and Kidney Diseases.

Despite several advantages, the adoption of some medical fiber optics is limited in developing and underdeveloped nations due to the high costs of the fibers. Moreover, the high cost of raw materials and high transportation costs further add up to their manufacturing costs thereby, increasing the final product price. The high maintenance costs of medical devices further add up to the cost of devices. In addition, the shortage of healthcare professionals is expected to negatively impact the growth of the market as skilled professionals are required for handling the devices.

Fiber Type Insights

The multimode optical fiber segment held the largest share of 44.3% in 2022 and is expected to reveal a CAGR of 6.3% during the forecast period due to the wide applications of fibers in surgical lightning and illumination solutions. Moreover, these fibers are easy to manufacture and are more economical. These are used to transmit light waves and signals over a short distance and are often used to transmit signals from the light source to the locations.

The plastic optical fiber segment is anticipated to witness lucrative growth at a CAGR of 7.0% during the forecast period due to high flexibility, elastic limit, and resistance. Moreover, these are sterilizable, biocompatible, and non-invasive due to their small size which increases their adoption in medical applications. Moreover, fibers can also be customized according to their diameter. Further, technological advancements in material processing, electronics, and data transmission are expected to further contribute to the demand for fibers.

Product Type Insights

Based on product type, the fiber optics cables segment held the largest share of 42. 2% in 2022. Wide applications of the cables in the field of laparoscopy, gynecology, arthroscopy, and urology contributed to the growth of the segment. Moreover, the cables help to transmit illumination from the light source to the surgical instrument. The cables can be autoclaved and sterilized, while also acting as a sensor transmitting signals to monitoring devices.

The segment is anticipated to grow at a CAGR of 6.4% during the forecast period. The cables use electronic pulses to transmit data in the form of light pulses down the cable which is faster than the copper cables that use electronic pulses for data transmission. Moreover, the cables are flexible, thinner, and generally require low maintenance. These factors are anticipated to drive the adoption of fiber optics cable. The application of these cables in medical devices such as endoscopes and optical coherence tomography is expected to contribute to their rising demand.

Application Insights

The illumination segment accounted for the largest share of 29.8% in 2022 and is anticipated to exhibit a CAGR of 5.6% in the forecast period due to the increasing adoption of fiber optics as a source of illumination in endoscopies and as a lighting solution for surgical procedures. Moreover, the growing application of fiber optics in high-power lights in healthcare therapies such as phototherapy, and light therapy is expected to boost the segment growth in the forecast period. Moreover, the use of light therapy in tattoo removal and hair removal is expected to further contribute to the segment’s growth.

The biomedical sensing segment accounted for the largest share of 12.6% in 2022 and is anticipated to reveal the fastest CAGR of 7.1% during the forecast period owing to the use of the sensors in wearables and other medical devices. Moreover, the sensors are used for measuring body temperature, muscle displacement, and blood pressure. Further, the sensors are used for quantifying and identifying biomolecules such as antigens, enzymes, antibodies, and others. The use of biomedical sensors for photoacoustic imaging and optical coherence tomography is anticipated to drive the segment’s growth during the forecast period.

Regional Insights

Asia Pacific dominated the market in 2022 with a share of 31% and is expected to grow at a CAGR of 7.2% during the forecast period. Supporting government initiatives, and improving healthcare infrastructure and the standard of living of the population in the region are some of the factors driving the growth of the market. Moreover, increasing medical tourism in countries such as South Korea, Thailand, and Singapore is expected to drive the growth of fiber optics in the region. Furthermore, the key players are planning to invest in developing countries such as China and India which is expected to boost market growth.

Middle East and Africa is anticipated to witness the fastest CAGR of 8% in the forecast period owing to factors such as growing preference for cosmetic laser surgeries, and increasing awareness about minimally invasive surgeries. The increasing prevalence of cancer and the growing geriatric population base in the region is expected to further drive the market. For instance, according to Knoema, the number of people above the age of 65 in Saudi Arabia was 3.7% of the total population in 2021. Moreover, the growing demand for early disease diagnosis is expected to positively impact the market growth during the forecast period.

Key Companies & Market Share Insights

The key players in the market have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the end users which is anticipated to boost the market growth during the forecast period.

-

In April 2022, Smiths Interconnect introduced HyperGrip disposable connectors to expand its product portfolio. It is a cost-effective solution for single-use medical devices, and it is suitable for applications with a disposable connector as well as a cycle receptacle

Some of the key players operating in the global medical fiber optics market include:

-

Integra Lifesciences Corporation

-

Fiberoptics Technology Incorporated (FtI)

-

AFL

-

Coherent, Inc.

-

Timbercon, Inc.

-

Gulf Fiberoptics

-

LEONI

-

Newport Corporation

-

SCHOTTAmphenol Corporation

-

LEMO

-

Hirose Electric Co. Ltd.

-

Fischer Connectors SA

-

ODU GmbH & Co. KG

-

Smiths Interconnect

-

Molex, LLC

Medical Fiber Optics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.9 billion

Revenue forecast in 2030

USD 7.3 billion

Growth Rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; Japan; India; South Korea; Australia; Singapore; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Integra Lifesciences Corporation; Fiberoptics Technology Incorporated (Fti); AFL; Coherent, Inc.; Timbercon, Inc.; Gulf Fiberoptics; LEONI, Newport Corporation; SCHOTT; Amphenol Corporation; LEMO, Hirose Electric Co. Ltd.; Fischer Connectors SA; ODU GmbH & Co. KG; Smiths Interconnect; Molex, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Fiber Optics Market Segmentation

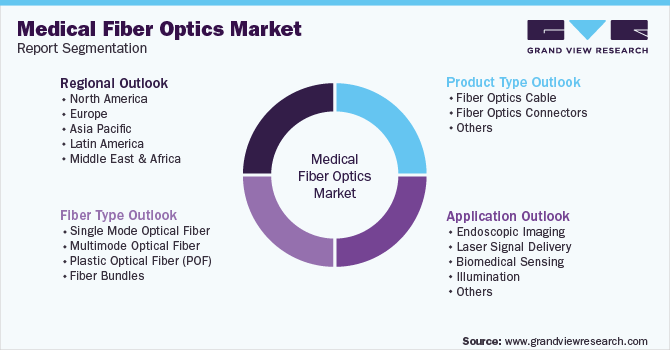

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global medical fiber optics market report based on fiber type, product type, application, and region:

-

Fiber Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Single Mode Optical Fiber

-

Multimode Optical Fiber

-

Plastic Optical Fiber (POF)

-

Fiber Bundles

-

-

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Fiber Optics Cable

-

Fiber Optics Connectors

-

Standard Fiber Optics Connectors

-

Lucent Connectors (LC)

-

Multi-Fiber Push On Connectors

-

Other

-

-

Custom Fiber Optics Connectors

-

Circular with Optics

-

Hybrid Circular with Fiber and Electrical

-

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Endoscopic Imaging

-

Laser Signal Delivery

-

Biomedical Sensing

-

Illumination

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain `

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical fiber optics market size was estimated at USD 4.6 billion in 2021 and is expected to reach USD 4.9 billion in 2022.

b. The global medical fiber optics market is expected to grow at a compound annual growth rate of 6.0% from 2022 to 2030 to reach USD 7.3 billion by 2030.

b. Asia Pacific dominated the medical fiber optics market with a share of 30.7% in 2021. This is attributable to the improving standard of living among citizens, growing imports of high-quality medical devices, and increasing medical tourism in countries such as Thailand, Singapore, and South Korea

b. Some key players operating in the medical fiber optics market include Integra LifeSciences Holdings Corporation; Molex; SCHOTT; Newport Corporation; Coherent, Inc.; and Timbercon, Inc.

b. Key factors driving the medical fiber optics market growth include an increase in the number of endoscopic procedures for early detection of cancer & other chronic diseases and the rising adoption of technologically advanced products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.