- Home

- »

- Pharmaceuticals

- »

-

Medical Foods For Orphan Diseases Market Size Report, 2030GVR Report cover

![Medical Foods For Orphan Diseases Market Size, Share & Trends Report]()

Medical Foods For Orphan Diseases Market Size, Share & Trends Analysis Report By Route Of Administration, By Product, By Application (Tyrosinemia, MSUD, Homocystinuria), By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-993-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global medical foods for orphan diseases market size was valued at USD 1.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Increasing prevalence of rare diseases, healthcare expenditure, early screening, and awareness about rare diseases are some key factors driving the growth. According to the data of the European Organization of Rare Diseases (EURORDIS), in 2020, approximately 300 million patients suffered from the known list of rare diseases. The study further stated that currently, orphan diseases affect 3.5%-5.9% of the global population. About 80% of the rare diseases are caused due to genetic disorders. They are either inherited or are caused by mutation.

Various rare diseases require special medical nutrition for preventing serious disabilities and enabling normal growth in children and adults. For instance, food protein-induced enterocolitis syndrome, maple syrup urine disease, and short bowel syndrome are some of the common orphan diseases that have special nutritional requirements for their treatment. For example, infants and children dealing with FPIES are often fed with hypoallergenic formulas that are free from soy, grains, dairy, and other potential allergens. These factors remain key to market growth.

The main factors predicted to drive the product demand are increasing product launches by key global manufacturers and continuous product advancements. There is also an increasing need for the creation of novel food for specific medical uses in order to manage and treat new genetic metabolic illnesses. Furthermore, with the rising demand for medical foods for orphan diseases, many startups also remain keen on entry in the global landscape.

Growing government initiatives to spread knowledge about rare diseases, early screening of newborn babies and financial support to patients are expected to fuel the market growth during the forecast period. CDC’s Newborn Screening and Molecular Biology branch manages the Newborn Screening Quality Assurance Program (NSQAP) to improve and maintain the quality and precision of newborn screening results.

Throughout the world NSMBB has the only laboratory which is dedicated to certifying the accuracy of newborn screening tests in more than 80 countries. In March 2021, Indian government launched its national policy for rare diseases, according to which government will pay about USD 60,000 to the patient’s suffering from any category of rare diseases. Such initiatives remain noteworthy drivers of market growth.

Furthermore, COVID-19 had a positive impact on the market growth, contrary to general trends. In 2020, thanks to the growing awareness of nutrition, consumer demand for clinical foods surpassed that in year 2019. Consumers increasingly opted for nutritional support and dietetic care. Furthermore, medical foods played a major role in the rehabilitation process for COVID-19 patients. Key players like Abbott and Nestle are planning to play a pivotal role in health initiatives to expand their footprint in the industry.

Medical foods are expensive and may or may not be covered under health insurance. Many insurance plan do not cover medical foods as FDA doesn’t include them in the drug category. This may hamper the market growth. Insurance coverage of medical foods for special dietary usage is inconsistent and can widely vary depending on patient’s plan type, diagnosis, and also region.

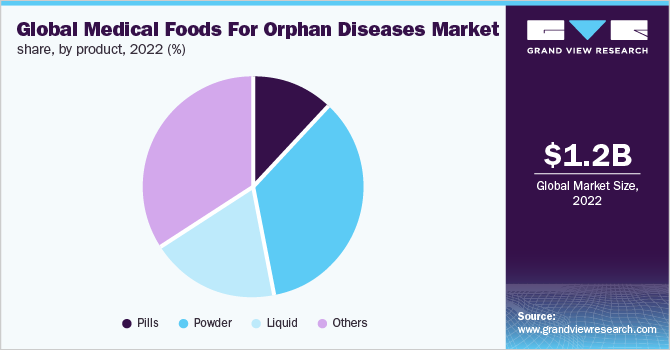

Product Insights

The powder segment accounted for the largest revenue share of over 35.4% in 2022. The growth of the segment can be attributed to commercial availability of large variety of medical foods in the powdered form. This form remains easy to consume and thus, is highly preferred by the pediatric and geriatric patients suffering from different orphan diseases, thereby fueling the segment growth. Physicians regularly advise powdered formulations as it can be easily administered through enteral and oral routes by patients of all ages.

However, the liquid segment is expected to grow at the fastest CAGR over the forecast period of 2023-2030. The growth is attributed to the rising adoption rate of liquid formulations by pediatric and geriatric consumers, as the intake of solid formulations is often unfeasible. Furthermore, the easy commercial availability of liquid formulations and the growing preference of liquid medical foods promise robust growth during the forecast period. Doctors prescribe liquid-formulated medical food for patients who have gastrointestinal disorders. Moreover, the increasing advantages of taking liquid-formulated food for maintaining sufficient hydration and electrolyte balance promise a further boost to the segment’s growth.

Application Insights

The other segment accounted for the largest revenue share of over 36.5% in 2022. Conditions like maple syrup urine disease, and short bowel syndrome require special nutritional support. Hence, enabling patients to control such rare conditions remains a key driver of growth. The high commercial availability of medical foods remains an important factor as well.

Furthermore, the growing penetration rate of such rare diseases along with growing awareness about orphan diseases are 2 major key factors that fuel the market growth. Key players remain highly invested in the development of disease-specific medical foods, which is expected to drive growth during the forecast period.

FPIES condition is expected to showcase the fastest CAGR-driven growth over the forecast period of 2023-2030. This condition makes patient allergic to one or many kinds of food products. Such patients require a special diet in order to meet their nutrition needs. Increasing initiatives for early screening of this condition and rising knowledge about this condition fuel market growth. Rising launches of hypoallergenic products and easy commercial availability of such products in various formulation further boosts the segment’s growth.

Sales Channel Insights

The institutional sales channel accounted for the largest revenue share of 41.2% in 2022. It consists of home care settings, hospitals, and disability facilities. The rising percentage of patient visits to hospitals and other settings remains this segment's primary driver of growth. Furthermore, the diagnosis and treatment of new orphan disorders also propel the growth of the segment.

Medical foods are often prescribed by doctors for the management of particular diseases. In addition, a large percentage of consumers opt for a special consultation with doctors for managing orphan diseases which positively impacts the segment's growth. Rising healthcare expenditure, and expanding healthcare infrastructure the across the globe are likely to aid this growth further.

The online sales segment is anticipated to expand at the fastest CAGR over the forecast period. With the convenience of shopping via online channels, a growing number of consumers continue to flock to e-commerce. Medical foods are mostly taken under medical supervision, but they are also meant for long-term nutrition control, which also remains a major factor behind the upsurge in e-commerce sales. Thus, with the penetration of e-commerce, consumers are switching from traditional ways of purchasing to online purchases of medical foods. This is expected to create new avenues for growth.

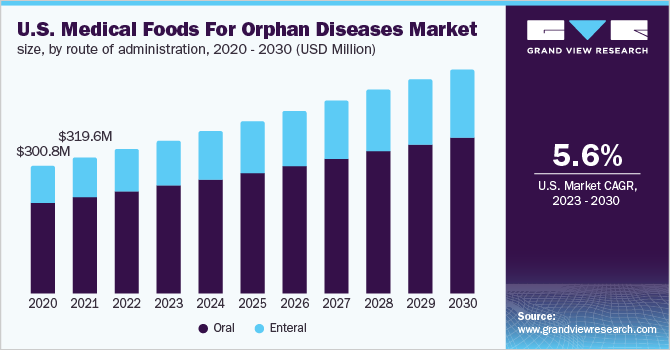

Route Of Administration Insights

The oral segment dominated the market with a revenue share of over 69.5% in 2022. Commonly, medical foods for orphan diseases are administered through the oral route which is one of the key reasons propelling the growth. Furthermore, the growing manufacturing of oral products in the form of pre-thickened products, powder, and pills, is further anticipated to fuel the segment’s growth. For instance, Relief announced the U.S. launch of PKU Golike in October 2022. It is a medical food product for the dietary management of phenylketonuria (PKU).

However, the enteral route of the administration segment is expected to showcase the fastest growth over the forecast years. The manufacturers remain keen on the development of technologically advanced enteral feeding devices. This is expected to aid the segment’s growth during the forecast period. In addition, the development and launch of disease-specific nutritional products remain a core concern for key players. The rapid adoption of condition-specific and immune-modulating formulas for the management of a wide variety of rare diseases continues to fuel the segment’s growth.

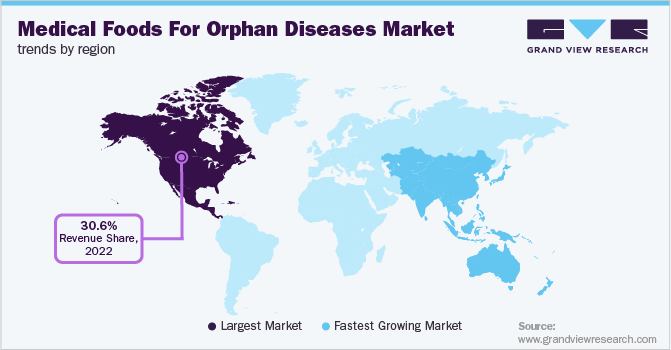

Regional Insights

In 2022, North America held the largest revenue share of 30.6%. The presence of international companies such as Abbott Laboratories and Mead Johnson & Company and their high revenue generation remains the key driver of growth. Additionally, strategic developments by key players in the form of mergers, acquisitions, and product launches also remain prominent drivers of growth. Rising prevalence of chronic conditions, and increasing adoption of medical food products by healthcare professionals and patients also continue to boost the market growth.

Asia Pacific is anticipated to be the fastest-growing regional market over the forecast period owing to the increasing penetration rate of rare conditions, along with several government initiatives in the healthcare segment. Furthermore, the highly populated nature of the region, and growing awareness among patients about medical foods are anticipated to drive the growth. The growing presence of global players in several countries in the region and several key untapped opportunities promise major growth during the forecast period.

Key Companies & Market Share Insight

Growing investments in R&D, collaborations, mergers & acquisitions, new product launches, and geographic expansions are the key competitive strategies adopted by global players. For instance, In January 2020, Nestle along with Allergan agreed to acquire Zenpep to expand their medical nutrition business segment. Zenpep is a U.S. company that provided medication to patient with digestive issues. Similarly, another key play, Danon opened a new science research center for advanced nutrition diets in Shanghai(China). In July 2020, this will help the company create evidence-based nutritional solutions tailor-made to Chinese consumers' tastes, traditions, and health needs. Such strategic initiatives are expected to fuel market growth during the forecast period. Some prominent players in the global medical foods for orphan diseases market include:

-

Nestle

-

Danone

-

Abbott

-

Mead Johnson & Company, LLC

-

Relief Therapeutics

-

Solace Nutrition

-

Ajinomoto Cambrooke, Inc.

Medical Foods For Orphan Diseases Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.3 billion

Revenue forecast in 2030

USD 1.9 billion

Growth Rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Product, route of administration, application, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Russia; China; Japan; India; South Korea; Singapore; Australia; New Zealand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Abbott; Nestle; Danone; Mead Johnson & Company, LLC; Relief Therapeutics; Solace Nutrition; Ajinomoto Cambrooke, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Foods For Orphan Diseases Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global medical foods for orphan diseases market report based on the route of administration, product, sales channel, application, and region:

-

Route of Administration Outlook (Revenue, USD Million, 2016 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Pills

-

Powder

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2030)

-

Phenylketonuria

-

Tyrosinemia

-

Eosinophilic esophagitis

-

FPIES

-

MSUD

-

Homocystinuria

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2016 - 2030)

-

Online Sales

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

Saudi Arabia

-

Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical foods for orphan diseases market size was valued at USD 1.2 billion in 2022 and is expected to reach USD 1.3 billion in 2023

b. The global medical food for orphan diseases market is projected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 1.9 billion by 2030.

b. The oral segment held the largest revenue share of over 69.5% in 2022 due to growing manufacturing of oral products in the form of pre-thickened products, powder, and pills.

b. Some key players operating in the medical food for orphan diseases market include Abbott, Nestle, Danone, Mead Johnson & Company, LLC, Relief Therapeutics, Solace Nutrition, Ajinomoto Cambrooke, Inc.

b. The increasing prevalence rate of rare diseases, healthcare expenditure, early screening, and awareness about rare diseases are some of the key factors that drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."