- Home

- »

- Pharmaceuticals

- »

-

Medical Foods Market Size & Share, Industry Report, 2030GVR Report cover

![Medical Foods Market Size, Share & Trends Report]()

Medical Foods Market Size, Share & Trends Analysis Report By Route of Administration, By Product (Powder, Pills, Liquid), By Application, By Sales Channel, By Module, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-419-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Medical Foods Market Size & Trends

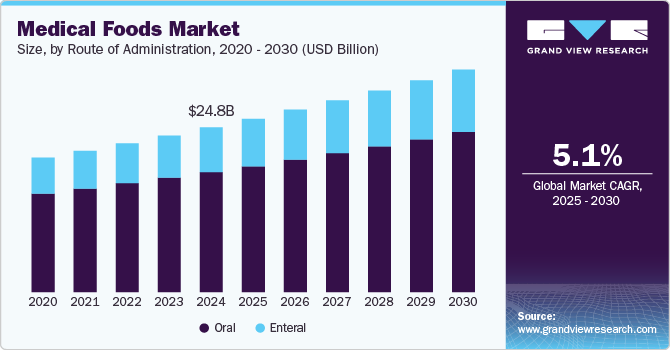

The global medical foods market size was estimated at USD 24.80 billion in 2024 and is projected to grow at a CAGR of 5.13% from 2025 to 2030. The market growth is driven by the rising prevalence of chronic diseases like Alzheimer's, ADHD, osteoporosis, osteoarthritis, and central nervous system disorders. Noncommunicable diseases, causing 74% of annual deaths (41 million), prompt global action. The UN's 2030 Agenda aims to reduce noncommunicable disease-related deaths by one-third between ages 30 and 70. Amino acid-based enteral nutrition is applied for conditions like sleep disorders, depression, osteoporosis, fibromyalgia, and PTSD. It's tailored for patients with impaired digestive capacity or specific nutrient needs.

The rise in consuming disease-specific formulas is set to boost the market, driven by the increasing incidence of targeted diseases and advancements in drug development. Clinical nutrition is increasingly used for personalized treatment, especially in diseases like cancer and cystic fibrosis, where special nutrition is vital to prevent drug interactions. For example, in cystic fibrosis cases, unique digestive enzyme capsules are administered, varying among individuals. Notable companies like Nestlé specialize in personalized clinical nutrition products, offering solutions like Deplin for depression and Metanx for diabetes.

Growing product launches and constant innovations by manufacturers are key factors expected to drive product demand. The need for new food to address inherited metabolic disorders and manage incurable conditions is on the rise. For instance, In July 2022, Danone, as stated in the press release, launched the first-ever dairy and plants blend baby formula in response to parents’ demand for vegetarian & flexitarian options for their babies. The consumption of plant-based products is experiencing significant growth, with over one-third (37%) of EU consumers opting for a vegan, vegetarian, or flexitarian diet.

In addition, almost 70% (69%) of parents now prefer their children to consume more plant-based foods. Industry experts provide insights into the significance of this product launch:

“At Danone, we recognize many parents want to introduce plant-based, vegetarian, and flexitarian options into their baby’s diet, while still meeting their baby’s specific nutritional requirements. Our new Dairy & Plants Blend baby formula has been developed with these needs top of mind.”

-Manuela Borella, Vice President, Global Plant Based Strategy & Business Acceleration, Nutricia's parent company Danone

In October 2020, Nestle Health Science introduced a protein-based ready-to-drink nutritional food in China for special medical purposes, featuring galactomannan to improve gastrointestinal intolerance.

Market Concentration & Characteristics

Market growth is at a high level, and the pace is accelerating. The medical foods industry, driven by a surge in chronic diseases, exhibits significant innovation. Key players are engaging in industry consolidation through acquisitions, mergers, and partnerships to expand product reach. For example, ByHeart's acquisition of the Allerton facility from DairiConcepts (a DFA subsidiary) in January 2023 tripled supply capacity and fortified formula production in the U.S. The additional domestic infant formula manufacturing facility, along with ByHeart's existing facilities, positions the company to achieve its annual goal of feeding 500,000 babies.

Industry Expert Insights

"Infant formula is one of the most value added dairy products in the world. We at Dairy Farmers of America are committed to producing high-quality milk and dairy ingredients in a sustainable way while building relationships that leverage the value of dairy nutrition for infant formula.

We look forward to continuing to work with ByHeart, which we believe has the potential to unlock significant opportunity for our 11,500 family farmers across the country.”

- Martin Bates, President, Dairy Farmers of America (DFA) Ingredient Solutions

The medical foods industry is subject to increasing regulatory scrutiny. According to the Federal Food, Drug, and Cosmetic Act, for a product to be classified as medical food, it must be labeled for dietary management of a specific disease condition with discrete nutritional requirements and must be intended for oral or tube feeding. In addition, the product must be intended for use under specific medical supervision.

The threat of substitute product is expected to be low in the medical foods industry over the forecast period. Medical food is a partial or complimentary meal replacement, and these products effectively enhance chronic disease management.

Growing geriatric population along with the increasing number of chronic diseases would offer growth opportunities for the market over the forecast period. Medical foods products are highly adopted by the geriatric population who are dealing with chronic conditions for proper intake of nourishment and, thus, fueling market growth.

Route of Administration Insights

Based on route of administration, the oral segment led the market with the largest revenue share of 72.86% in 2024. Increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for orally administered medical foods. Furthermore, the increased preference for oral products in the form of prethickened products, powders, and pills is anticipated to fuel the segment. For instance, in January 2023, Nutricia launched its Fortimel PlantBased Energy, a plant-based oral nutritional supplement designed to address the nutritional requirements of individuals facing malnutrition or those at risk due to illness. This addition to the Fortimel portfolio leverages Nutricia's parent company, Danone's proficiency in plant nutrition. It further extends the range of Fortimel products, which are clinically proven medical nutrition solutions specifically developed to cater to the daily needs of patients.

The enteral segment is expected to witness at the fastest CAGR over the forecast years. The growing prevalence of cardiovascular and chronic diseases resulting from several metabolic disorders leads to difficulty in oral food consumption and increases the preference for medical food feeding through enteral mode. Moreover, the growing focus of the manufacturers to develop technologically advanced enteral feeding devices is positively impacting the segment growth.

Product Insights

The powder segment led the market with the largest revenue share of 35.53% in 2024. Medical foods are most widely available in powder form, which can be administered through the oral route or enteral route by mixing milk or water, as advised by the physician. Medical foods in the powdered formula are suitable for patients of all age groups, especially in the oral route. Owing to a high preference for powdered formulations due to ease of consumption, manufacturers are developing product categories in line with consumer preferences. For instance, in January 2022, Danone launched Souvenaid, a powder version of a medical nutrition drink to support memory function in the early stages of Alzheimer's disease.

The liquid segment is anticipated to grow at the fastest CAGR during the forecast period owing to the rising adoption of liquid formulations in the pediatric and geriatric population, where the intake of solid formulations is limited or impossible and in case of clinically diagnosed dysphagia or when oral physiology is limited. In addition, the ease of administration of liquid-based medical foods and the commercial viability of these products will drive the segment. Increasing functional gastrointestinal disorders and the recommendation of doctors to intake liquid formulated medical food who suffer from these illnesses before or after surgeries support the segment growth. Moreover, the increasing benefits of taking liquid formulated food to maintain sufficient hydration and electrolyte balance favor the segment growth.

Application Insights

Based on application, the cancer segment led the market with the largest revenue share of 12.11% in 2024. According to the Pan America Health Organization, North America saw approximately 4 million new cancer diagnoses in 2020, resulting in 1.4 million deaths. Notably, 57% of new cases and 47% of related deaths affected individuals aged 69 or younger. Globally, 2020 recorded an estimated 20 million new cancer cases and 10 million deaths. Projections indicate a 60% increase in the cancer burden over the next two decades, reaching approximately 30 million new cases by 2040, with significant rises in low- and middle-income countries. These statistics underscore the increasing for comprehensive strategies to address the growing cancer burden and support affected populations worldwide.

The cachexia segment is expected to grow at the fastest CAGR during the forecast period. It is a complex metabolic syndrome characterized by severe weight loss and muscle wasting, often accompanied by chronic illnesses such as cancer, HIV/AIDS, and certain metabolic disorders. Medical foods made to address the nutritional needs of individuals suffering from cachexia have become increasingly crucial in mitigating the adverse effects of this condition. The rising prevalence of chronic diseases and the growing geriatric population, where cachexia frequently presents as a challenging comorbidity, is driving the market growth.

Module Insights

Based on module, the protein modules segment led the market with the largest revenue share of 12.72% in 2024. Protein modules are used in severe infections, trauma, burns, malnutrition, post-surgery recovery, and critically ill patients. The increasing prevalence of chronic diseases, such as cancer, chronic kidney disease, and malnutrition, which require specialized nutritional interventions likely drive the segment growth. Patients undergoing treatments like chemotherapy or dialysis often suffer from muscle wasting and protein deficiencies, boosting demand for protein-enriched medical foods. In addition, the aging population, particularly in developed countries, further contributes to the need for protein modules to combat age-related muscle loss (sarcopenia).

The hypoallergic module segment is expected to grow at a significant CAGR over the forecast period. The growth is driven by the increasing prevalence of food allergies and intolerances, especially among infants and individuals with chronic health conditions. Hypoallergenic medical foods cater to patients with specific dietary needs, such as those unable to tolerate proteins found in common foods like cow's milk or soy. These products are formulated to minimize allergenic responses and are crucial for managing conditions like severe food allergies, eosinophilic esophagitis, and gastrointestinal disorders. The rising awareness of food-related health issues and advancements in hypoallergenic formulations, such as amino acid-based or extensively hydrolyzed proteins, have significantly boosted demand.

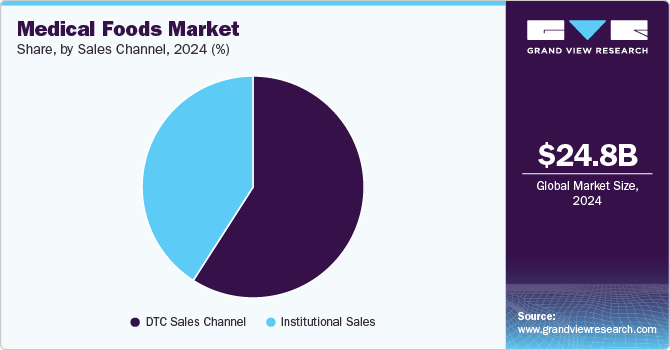

Sales Channel Insights

Based on sales channel, the DTC segment led the market with the largest revenue share of 59.07% in 2024. DTC sales in the medical foods sector allow companies to bypass traditional retail channels and establish a direct relationship with end users. This model has gained traction due to its ability to provide personalized customer experiences and foster brand loyalty. By leveraging online platforms, companies can offer detailed product information, educational resources, and tailored recommendations based on individual health conditions. Moreover, the COVID-19 pandemic accelerated the shift toward online shopping; many consumers turned to DTC channels for essential medical foods when traditional retail options were limited.

The institutional sales segment is expected to expand at a significant CAGR over the forecast period. Institutions that purchase medical foods include hospitals, long-term care centers, hospices, clinics, and disability facilities. The decision to purchase medical foods is influenced by doctors. Since the consumption of medical foods is recommended under medical supervision, the revenue generated through institutional sales is the highest. Furthermore, the growing number of private and public healthcare institutions and the increasing chronic disease patient population across the globe are propelling the segment. According to the data published by the American Hospital Association in 2024, 6,120 hospitals in the U.S. provided healthcare services to 33,679,935 patients. In addition, the collaboration between manufacturers and healthcare institutions has led to improved product visibility and accessibility within clinical settings.

Regional Insights

North America dominated the medical foods market with the largest revenue share of 29.90% in 2024. Market growth can be attributed to the increasing geriatric population, which is more susceptible to chronic diseases, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. According to the United Health Foundation, in 2022, about 17.3% of the population in the U.S. was aged 65 and above. Furthermore, around 56 million elderly people are expected to depend on medical foods to fulfill their nutritional needs in the U.S. by 2030. Moreover, the growing number of premature infants in critical care is a major factor driving market growth. For instance, in 2022, CDC reported that approximately 10% of infants born in the U.S. were affected by preterm birth. In addition, the preterm birth rate decreased by 1% in 2022, after a 4% increase from 2020 to 2021. These aforementioned factors are anticipated to fuel market growth over the forecast period.

U.S. Medical Foods Market Trends

The medical foods market in the U.S. accounted for the largest revenue share in North America in 2024. The increasing prevalence of head & neck cancer across the U.S. is driving the adoption of medical foods. For instance, the American Cancer Society, in 2023, reported that approximately 54,540 new cases and 11,580 fatalities were attributed to oral cavity or oropharyngeal cancer in the U.S. Moreover, the growing incidence of various chronic diseases, such as neurological diseases, is anticipated to improve the adoption of medical foods during the forecast period. According to the Alzheimer’s Association’s 2022 Report in the U.S., around 6.5 million individuals lived with Alzheimer’s disease in 2022.

Europe Medical Foods Market Trends

The medical foods market in Europe is expected to grow at a significant CAGR over the forecast period. Europe has a large elderly population, which is at a high risk of various diseases, such as cardiovascular, respiratory, and other chronic diseases. For instance, as per a 2022 publication by the European Parliament, Chronic Kidney Disease (CKD) imposes a substantial burden on society and individuals. According to the article, CKD affects around 100 million people, with projections indicating that it is expected to become the fifth leading cause of global mortality by 2040 in the region.

The UK medical foods market is driven by a large geriatric population and the consequent rise in malnutrition in this region. According to the Office for National Statistics, in 2021, around 11 million people aged 65 and above were at risk of malnutrition in the UK. In addition, about one-third of the elderly people admitted to hospitals are at risk of malnutrition. Moreover, the growing adoption of HEN due to the rising awareness is contributing to market growth in the UK. According to Cambridge University, in 2020, it was estimated that over 23,000 adults receive community-based, long-term home enteral tube feeding in the UK. In addition, several surveys are being conducted in the UK on enteral feeding formulas, which are anticipated to boost the adoption of formulas in the country.

The medical foods market in Germany held a significant share in Europe in 2024. The increasing prevalence of cancer and the growing need for radiotherapy procedures are some of the key factors boosting the demand for medical foods in Germany. According to ESTRO-HERO (Health Economics in Radiation Oncology), the proportion of new cancer cases requiring radiotherapy is expected to increase by 15.2% from 2012 to 2025, while it is expected to increase by 16% in other European countries. In addition, the rising geriatric population in the country is projected to drive the market during the forecast period

Asia Pacific Medical Foods Market Trends

The medical foods market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing rate of cancer and diabetic patients, along with several government initiatives in the healthcare segment. In addition, the local presence of key players and untapped opportunities provided by the region are among the major factors propelling regional market growth.

The China medical foods market accounted with the largest revenue share in the Asia Pacific in 2024. A UN report indicates that the elderly population in China is projected to double from 10% in 2017 to 20% by 2037. This growing geriatric demographic, along with higher per capita healthcare spending and the growing prevalence of esophageal cancer, is anticipated to be key market driver.

The medical foods market in India is expected to grow at a significant CAGR over the forecast period. An increase in malnutrition and diabetes is expected to drive the market over the forecast period. According to the India Diabetes (INDIAB) study published by the Indian Council of Medical Research (ICMR) in 2023, around 1.2 million people have diabetes. In addition, according to the Poshan Tracker, around 671,922 children in the country suffer from malnutrition

Key Medical Foods Company Insights

Some of the key players operating in the market include Danone, Nestlé, Fresenius Kabi AG, and Abbott. Furthermore, Key innovators in the market are utilizing strategies like new product launches to enhance their market presence. For instance:

- Lanfam LLC

In March 2022, the company launched a new medical food Proleeva for chronic pain relief conditions such as inflammatory disorders, including fibromyalgia, osteoporosis, diabetic neuropathy, and rheumatoid arthritis. The company also offers customized solutions for specific conditions, which help the company recognize as an innovator in the market)

- SFI Health

In December 2021, the company introduced two new medical foods, EQUAZEN PRO and Ther-Biotic PRO IBS Relief, for treating irritable bowel syndrome (IBS) and supporting dietary nutrition. These innovations have contributed to the company's market position as key innovators.)

Notable Product-Level Data for Key Companies at the Application Level:

Companies

Top Notable Products/Brands

Available Product Form

Application

Market Presence

Danone

Aptamil

Powder/Liquid

Constipation Relief

High

Nutrison

Liquid/Semi-elemental

Malabsorption

High to Medium

Alzheimer's

Cancer

Cerebral Plasy

Diabetes

Dysphagia

Gastrointestinal Disease

Wound Care

Parkinson's Disease

Multiple Food Allergy

Eosinophilic Esophagatis

Short Bowel Sydrome

Malabsorption

Abbott

Ensure

Powder

Diabetes

High

Glucerna

Shakes/Bars/Powder

Diabetes

High

Similac

Powder/Liquid

Nutritional Deficiency

High to Medium

Key Medical Foods Companies:

The following are the leading companies in the medical foods market. These companies collectively hold the largest market share and dictate industry trends.

- Danone

- Nestlé

- Abbott

- Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Mead Johnson & Company, LLC

Recent Developments

-

In November 2023, Danone launched its first medical nutrition product, Fortimel, for adults in China, categorized under foods for special medical purposes. This launch is a crucial component of Danone's strategy in China, aimed at utilizing its scientific expertise across all life stages and promoting growth of the adult medical nutrition segment.

-

In September 2023, Danone announced a €50 million (USD 53.78 million) line expansion of its production facility at Opole, Poland, to meet the increasing demand for medical nutrition worldwide. This move aims to enhance its position in the adult medical nutrition market, with the growing rate of chronic diseases and aging population. The expansion is anticipated to enable Danone to serve patients across the globe, as many people are expected to require medical nutrition at some point in their lives due to diseases such as cancer and stroke, which can result in malnutrition.

-

In March 2023, Danone acquired ProMedica, a Poland-based company that specializes in providing care services for patients in their homes. This acquisition is part of Danone's lucrative specialized nutrition market expansion strategy, to strengthen its presence in Poland.

- In February 2023, Neslte and EraCal Therapeutics entered into a research collaboration to identify novel nutraceuticals relevant to controlling food intake.

Medical Foods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.08 billion

Revenue forecast in 2030

USD 33.49 billion

Growth rate

CAGR of 5.13% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Route of administration, product, application, module, sales channel, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Danone; Nestlé; Abbott; Targeted Medical Pharma Inc. (Physician Therapeutics LLC; a division of the company); Primus Pharmaceuticals Inc.; Fresenius Kabi AG; Mead Johnson & Company, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Foods Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical foods market report based on route of administration, product, application, module, sales channel, and region:

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Minimal Hepatic Encephalopathy

-

Chemotherapy Induced Diarrhoea

-

Pathogen Related Infections

-

Diabetic Neuropathy

-

ADHD

-

Depression

-

Alzheimer's Disease

-

Nutritional Deficiency

-

Orphan Diseases

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

Phenylketonuria

-

MSUD

-

Homocystinuria

-

Others

-

-

Wound Healing

-

Chronic Diarrhea

-

Constipation Relief

-

Protein Booster

-

Dysphagia

-

Pain Management

-

Parkinson's Disease

-

Epilepsy

-

Other Cancer related treatments

-

Severe Protein Allergy

-

Cancer

-

Cachexia

-

Other

-

-

Module Outlook (Revenue, USD Million, 2018 - 2030)

-

Amino Acid Module

-

Protein Module

-

Vitamin & Mineral Modules

-

Fatty Acid based Modules

-

Carbohydrate Modules

-

Fiber Modules

-

Ketogenic Modules

-

Peptide based Modules

-

Hypoallergic Modules

-

Others (Electrolyte Module, etc.)

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

DTC Sales Channel

-

Online Sales

-

Retail Sales

-

-

Institutional Sales

-

Hospitals

-

Others (Long-term Care Facilities, etc.)

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some of the key market players include Danone, Nestlé, Abbott, Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company), Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company, LLC

b. The global medical foods market size was valued at USD 24.80 billion in 2024 and is expected to reach USD 26.08 billion in 2025.

b. The global medical foods market is anticipated to reach USD 33.49 billion by 2030 and is anticipated to expand at a CAGR of 5.13% from 2025 to 2030.

b. The oral route of administration segment dominated the medical foods market with a share of 72.86% in 2024. This is attributed to the increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for orally administered medical foods.

b. North America dominated the global medical foods market with a revenue share of 29.90% in 2024. Growth in the market can be attributed to the increasing geriatric population, which is more susceptible to chronic diseases, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. Moreover, the growing number of premature infants in critical care is a major factor driving market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."