- Home

- »

- Specialty Polymers

- »

-

Medical Grade Ultra High Molecular Weight Polyethylene Monomer Market Report, 2030GVR Report cover

![Medical Grade Ultra High Molecular Weight Polyethylene Monomer Market Size, Share & Trends Report]()

Medical Grade Ultra High Molecular Weight Polyethylene Monomer Market Size, Share & Trends Analysis Report By Application (Knee Replacement, Hip Replacement), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-272-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Medical Grade UHMWPE Monomer Market Trends

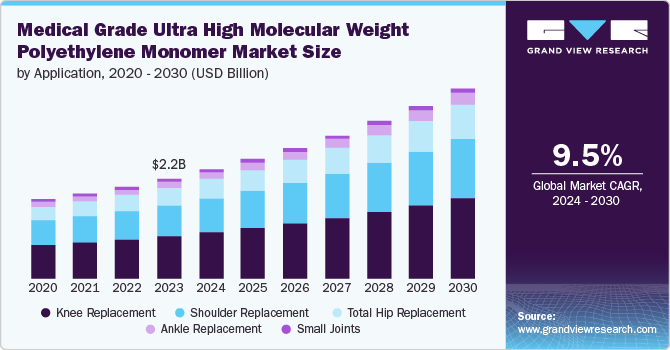

The global medical grade ultra high molecular weight polyethylene monomer market was valued at USD 2.21 billion in 2023 and is expected to grow at a CAGR of 9.5% from 2024 to 2030. This market surge can be attributed to the rising prevalence of chronic diseases and age-related conditions among the growing geriatric population. Elderly patients have increasingly preferred medical devices and implants, which often utilize UHMWPE monomers due to their high performance, biocompatibility, and wear resistance in advanced surgical techniques and minimally invasive procedures.

Furthermore, worldwide investments in healthcare infrastructure have led to the increased adoption of medical grade ultra high molecular weight polyethylene (UHMWPE) monomers. Healthcare providers have increasingly relied on these materials for orthopedic implants and prosthetics, particularly for high-stress anatomical regions such as knee, hip, and ankle. For instance, UHMWPE monomers are often used to make the acetabular cup, which replaces the hip socket. These materials offer several advantages including low friction coefficient, self-lubrication, high-impact strength, and wide service temperature range.

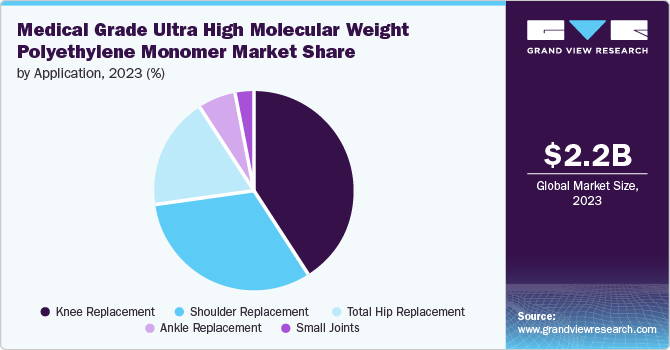

Application Insights

Knee replacements have accounted for the dominant share of 40.9% in 2023 owing to the increasing prevalence of osteoarthritis and other joint-related conditions. Patients have alarmingly preferred the UHMWPE monomer materials for their biocompatibility, wear resistance, ductility, long-term durability, and cost-to-performance ratio. These materials offer exceptional properties such as sound-dampening characteristics, electrical insulation, and chemical resistance which make it an ideal choice for knee implants, ensuring patient comfort and longevity. Additionally, ongoing research and development activities in the medical sector have increasingly focused on improving joint replacements including UHMWPE which significantly enhances knee prosthesis with metal caps for thighbone and shinbone.

Total hip replacement surgeries are expected to emerge at the fastest-growing CAGR during the forecast period owing to the escalating prevalence of osteoarthritis and rheumatoid arthritis. Healthcare providers have widely used UHMWPE monomer’s properties for wear resistance and biocompatibility, preventing diverse reactions or tissue rejection in implants. Furthermore, researchers have developed cross-linking methods to reduce the material’s wear particle generation by modifying the polymer’s molecular structure for prolonged durability. In addition, UHMWPE’s versatility allows manufacturers to create custom hip implants based on patient-specific requirements. Surgeons can choose implant sizes, shapes, and configurations that best match each patient’s anatomy, optimizing fit and function and driving considerable demand.

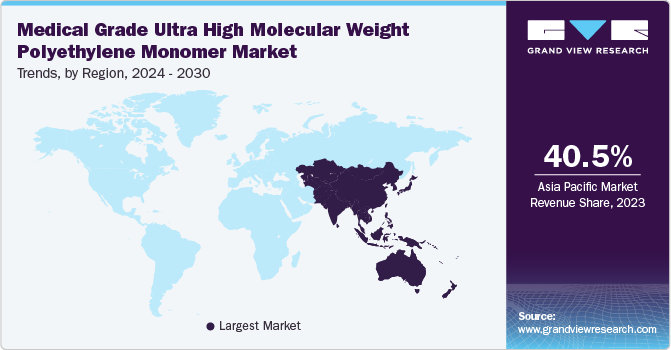

Regional Insights

The North America medical grade ultra high molecular weight polyethylene monomers market secured 26.0% of the market share in 2023 owing to the region’s growing investment in the healthcare infrastructure. The material’s chemical resistance, sound-dampening characteristics, and electrical insulation properties make it valuable in orthopedics. Its use resulted in reduced weight, lower maintenance, and improved patient outcomes.

U.S. Medical Grade Ultra High Molecular Weight Polyethylene Monomers Market Trends

The U.S. medical grade ultra high molecular weight polyethylene monomers market was driven by the rising research and development activities to enhance orthopedic devices, leading to increased spending on joint replacements. The market witnessed a considerable surge in the demand for UPMWPE-enhanced knee replacement as the material’s wear resistance ensures minimal abrasion during knee flexion and extension which helped patients experience improved mobility and reduced pain.

Asia Pacific Medical Grade Ultra High Molecular Weight Polyethylene Monomers Market Trends

The medical grade ultra high molecular weight polyethylene monomers market in Asia Pacific registered 40.5% as the dominant market share in 2023. This can be credited to the rising health awareness and increasing disposable income in developing economies such as India, China, Japan, and South Korea. Furthermore, the aging demographic in APAC led to a surge in joint replacement surgeries, fueling the market demand.

The medical grade ultra high molecular weight polyethylene monomers market in China was propelled by the rising number of hip and knee replacements with the demand for high-performance materials in medical applications. UHMWPE monomers stand out due to their load-bearing capabilities. Furthermore, the ongoing trend toward personalized medicine necessitates custom-built medical implants which has further boosted the adoption of the of the material.

Europe Medical Grade Ultra High Molecular Weight Polyethylene Monomers Market Trends

The medical grade ultra high molecular weight polyethylene monomers market in Europe held 24.3% of the market share in 2023 owing to the robust advancements in medical devices and surgical techniques. The materials’ sound-dampening characteristics, electric insulation, and chemical resistance have significantly contributed to their usage in orthopedic applications.

Key Medical Grade Ultra High Molecular Weight Polyethylene Monomers Company Insights

Some of the manufacturers operating in the market are undertaking research initiatives to introduce an improved version of medical-grade UHMWPE fibers that involve less wear issues and are safe to come in contact with the tissues.

-

Celanese Corporation is an integrated worldwide producer of value-added industrial chemicals. The company specializes in acetic acid production, contributing approximately 25% of global output. Celanese’s diverse portfolio includes acetyls, engineered materials, and polymer solutions for various industries, from aerospace to medical and pharmaceuticals.

-

DSM Biomedical is a global company in biomedical materials science, specializing in creating advanced drug delivery technologies. The company provides essential biomaterials for implantable medical devices. Their proprietary bioresorbable polymers serve as the foundation for formulating drug delivery systems tailored to specific applications. In addition, DSM Biomedical collaborates across therapeutic areas, including diabetes, orthopedics, and vascular health, to improve patient outcomes through innovative solutions.

Key Medical Grade Ultra High Molecular Weight Polyethylene Monomer Companies:

The following are the leading companies in the medical grade ultra high molecular weight polyethylene monomer market. These companies collectively hold the largest market share and dictate industry trends.

- Celanese Corporation

- DSM Biomedical

- Honeywell International Inc.

- Mitsui Chemicals India Pvt. Ltd.

- TEIJIN LIMITED

- LyondellBasell Industries Holdings B.V.

- Orthoplastics Ltd.

- Tianyi Biomedical Tech Pte. Ltd.

- Quadrant Engineering Plastic Products (Mitsubishi Chemical Advanced Materials)

- Asahi Kasei Corporation

Recent Development

-

In February 2023, Honeywell International Inc. extended their Spectra Medical Grade BIO fiber portfolio by introducing the Ultra Fine (UF) BIO fiber, which offers several advantages for minimally invasive design. These fibers are crafted from UHMWPE using the company’s patented gel spinning process.

Medical Grade Ultra High Molecular Weight Polyethylene Monomer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.41 billion

Revenue forecast in 2030

USD 4.16 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Celanese Corporation; DSM Biomedical; Honeywell International Inc.; Mitsui Chemicals India Chemicals Pvt. Ltd.; TEIJIN LIMITED; LyondellBasell Industries Holdings B.V.; Orthoplastics Ltd.; Tianyi Biomedical Tech Pte. Ltd.; Quadrant Engineering Plastic Products (Mitsubishi Chemical Advanced Materials); Asahi Kasei Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Grade Ultra High Molecular Weight Polyethylene Monomer Market Report Segmentation

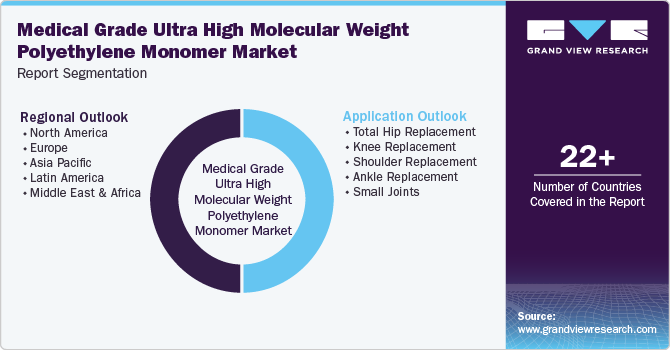

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical grade ultra high molecular weight polyethylene monomer market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Total hip replacement

-

Knee replacement

-

Shoulder replacement

-

Ankle replacement

-

Small joints

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."