- Home

- »

- Medical Devices

- »

-

Medical Specialty Bags Market Size And Share Report, 2030GVR Report cover

![Medical Specialty Bags Market Size, Share & Trends Report]()

Medical Specialty Bags Market Size, Share & Trends Analysis Report By Product (Ostomy Collection Bags, Urinary Collection Bags, Blood Bags, Bile Collection Bags, Sterile Packaging Bags), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-172-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Specialty Bags Market Size & Trends

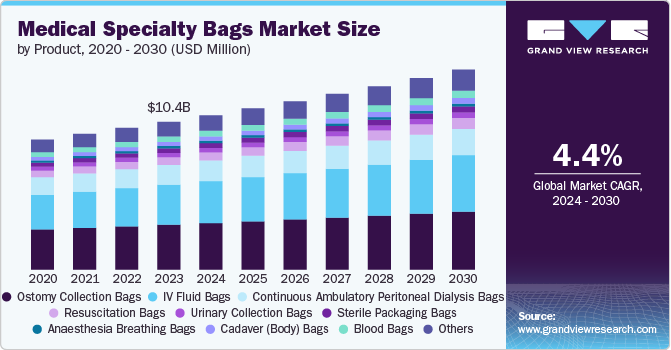

The global medical specialty bags market size was estimated at USD 10.40 billion in 2023 and is expected to grow at a CAGR of 4.4% from 2023 to 2030. This growth is mainly due to the increase in the elderly population and the rising prevalence of acute diseases such as urinary bladder cancer and other urinary bladder-related disorders. According to the American Cancer Society, bladder cancer is predominantly found in older individuals, with around 90.0% of cases occurring in people over the age of 55. The average age at diagnosis is 73. Men have a higher lifetime risk of developing bladder cancer, with about a 1 in 28 chance, while women have a lower risk at about 1 in 89.

Medical specialty bags are used to store and deliver various fluids, drugs, and nutrients to patients while maintaining a sterile and hazard-free environment around the infected site. Blood storage, bile collection, gastrointestinal feeding, and sterile packaging are some of the key applications of medical bags. Medical bags can be used to control bowel incontinence and bile leakage. According to the World Health Organization (WHO), 120 million units of blood are donated annually globally, and these blood storage and transfusion activities require blood bags. Rubber, latex, and plastic are used to make blood, urinary, ostomy, intravenous (IV), and enteral bags with different capacities and shapes.

The increasing focus on infection control and prevention is also propelling the growth of medical specialty bags market. Healthcare facilities are increasingly adopting single-use disposable bags to minimize the risk of cross-contamination and healthcare-associated infections. The emphasis on maintaining sterile environments in hospitals and clinics is driving the demand for high-quality, hygienic medical bags that comply with stringent regulatory standards.

Continuous improvements in bag design, materials, and manufacturing processes are driving the medical specialty bags market. Manufacturers are integrating real-time monitoring systems, RFID tracking, and other emerging technologies to enhance the durability, sterility, and convenience of these bags. These technological advancements make medical specialty bags more attractive to healthcare providers and patients, further fueling market growth. For Instance, in June 2022, Gufic Biosciences has introduced a novel drug delivery system known as dual-chamber bags. These bags are constructed from polypropylene (free of DEHP) and feature peelable aluminum foil. They enable the safekeeping of unstable medications that can be reconstituted right before being administered to patients.

Market Concentration & Characteristics

Degree of innovation: The degree of innovation in the medical specialty bags market is moderate. Market players in the industry are focusing on continuous advancements in materials, design, and technology to meet the evolving needs of healthcare professionals and patients. For instance, in April 2024, STERIS, a prominent provider of infection prevention products and services, introduced Verafit Sterilisation Bags and Covers. These innovative products improve sterilization by incorporating a patent-pending viewing window.

Level of M&A Activities: The level of merger and acquisition activity in the medical specialty bags market is moderate with market players engaging in various transactions to drive growth and innovation within the industry. For Instance, in March 2023, Vonco Products, a manufacturer specializing in plastic products and packaging, acquired Genesis Plastics Welding, which focuses on manufacturing thermoplastics. The acquisition expands Vonco's product offerings to include bioprocessing, cell separation and culture, cryogenic storage, blood bags, and its existing specialty medical devices, fluid bags, and flexible packaging capabilities.

Impact of Regulation: The medical specialty bags market is highly regulated, with stringent guidelines and standards set by government agencies and healthcare organizations across different regions. For instance, in U.S., the Food and Drug Administration (FDA) oversees the regulation and approval of medical specialty bags, ensuring they meet safety and efficacy requirements. Similarly, in Europe, the medical devices industry is regulated by the European Union's Medical Device Regulation (MDR), which sets strict guidelines for designing, manufacturing, and labeling medical specialty bags. Manufacturers in the medical specialty bags market must adhere to various quality and safety standards, such as ISO 13485 for medical device quality management systems, to gain regulatory approvals and access different markets.

Product Substitute: There are a few potential substitutes for medical specialty bags, depending on their specific use and medical application. Some facilities use integrated transfusion systems that eliminate the need for traditional bags for specific medical applications, such as blood transfusions. These systems prioritize blood product compatibility. For urinary drainage, intermittent catheterization methods or smaller, more mobile leg bags can sometimes replace traditional bags. However, any substitute must comply with healthcare regulations and ensure patient safety and treatment efficacy.

Regional Expansion: North America and Europe lead the medical specialty bags market due to the rising prevalence of chronic diseases, aging population, and technological advancements in the region. The Asia-Pacific region is witnessing rapid growth in this market, driven by the expansion of healthcare infrastructure, rising healthcare expenditure, and increasing prevalence of chronic diseases. The medical specialty bags market in Latin America, particularly in Brazil, is also experiencing growth, driven by government initiatives to improve healthcare access and support the domestic medical devices industry.

Product Insights

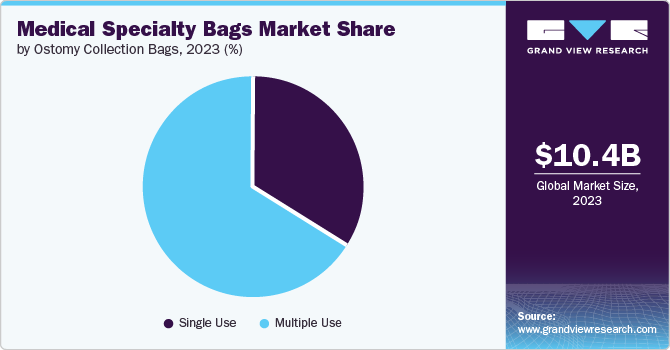

The ostomy collection bags segment held the largest share of 30.38% in 2023. This can be attributed to the increasing prevalence of gastrointestinal diseases, such as Crohn’s disease and ulcerative colitis, which often necessitate ostomy surgeries. The rising geriatric population globally is also contributing to the growth of this segment, as older individuals are more prone to conditions that may require ostomy procedures. Additionally, advancements in ostomy bag technology, including improved materials for better comfort and odor control, are driving market growth. For Instance, in January 2024, the ORIENTMED Ostomy bag, created by Ostomate Innovations, represents a significant advancement in ostomy care technology. This innovative product is designed to enhance the quality of life for individuals with ostomies by offering a more comfortable and discreet experience.

The bile collection bags segment is projected to grow at a significant rate over the forecast period. This rapid growth can be attributed to the rising prevalence of gallbladder disorders and the increasing adoption of minimally invasive surgical procedures that require bile collection bags. For instance, according to the American College of Gastroenterology, gallstones affect approximately 10-15% of the adult population in the U.S. The growing geriatric population, sedentary lifestyles, and obesity are major risk factors contributing to the surge in gallbladder diseases globally. Furthermore, technological advancements in bile collection bags, such as improved leak-proof mechanisms and antimicrobial properties, are driving their adoption in healthcare settings. The increasing focus on patient comfort and the need for efficient bile management during and after gallbladder surgeries also fuels the demand for advanced bile collection bags.Regional Insights

The North America medical specialty bags market accounted for a 27.85% share in 2023. North America has a strong and well-established healthcare infrastructure and a better technology adoption rate, contributing to market growth. Pharmaceutical players in this region are continuously investing in developing medical specialty bags. The Centers for Medicare and Medicaid Services (CMS) have reported that the National Health Expenditure (NHE) rose by 4.1% in 2022, reaching a total of USD 4.5 trillion, which represents 17.3% of the Gross Domestic Product (GDP).

U.S. Medical Specialty Bags Market Trends

The medical specialty bags market in the U.S. is expected to grow rapidly from 2024 to 2030. This market is characterized by a highly competitive landscape, with leading global players vying for market share. Manufacturers are increasingly emphasizing product innovation, leveraging advanced materials and smart technologies to enhance the functionality and safety of their offerings. Major players in the U.S. market invest in developing automated and robotic manufacturing facilities to produce intravenous (IV) fluid bags. For Instance, in August 2022, Assure Infusions Inc. is set to construct a 60,000-square-foot state-of-the-art robotics facility in Bartow, creating 100 job opportunities. The company’s investment in this project amounts to USD 20.0 million, and the plant will be situated on a 10-acre plot along Century Boulevard in Bartow.

Europe Medical Specialty Bags Market Trends

Europe medical specialty bags market dominated with the largest revenue share in 2023. The market is experiencing significant investments from the key players to expand their regional manufacturing operations. For Instance, in February 2023, Hollister Incorporated, a leading global healthcare company, is significantly expanding its manufacturing operations in Kaunas, Lithuania. The company is investing USD 25.0 million over the next four years to increase production capacity at its Kaunas Free Economic Zone facility. This expansion allows Hollister to meet the growing demand for its ostomy, continence care, and critical care products across Europe.

The medical specialty bags market in the UK is expected to grow rapidly from 2024 to 2030. The market is shaped by the country's universal healthcare system, the National Health Service (NHS), which plays a pivotal role in driving the adoption of specialized medical bags. The NHS's commitment to improving patient outcomes and reducing healthcare-associated infections has led to a heightened focus on using high-quality, sterile, and leak-proof specialty bags. Manufacturers are responding to this demand by investing in research and development to create innovative products that meet the stringent requirements of the UK healthcare system. Additionally, the growing emphasis on home-based care and the increasing prevalence of chronic diseases in the UK further contribute to the market's growth.

Germany medical specialty bags market is projected to expand from 2024 to 2030. As a part of the European Union, Germany is involved in efforts to harmonize regulatory standards across the region for medical devices, including specialty bags. Implementing regulations such as the EU Medical Device Regulation (MDR) aims to streamline the approval and certification processes, enabling manufacturers to access the broader European market more efficiently.

Asia Pacific Medical Specialty Bags Market Trends

The medical specialty market in Asia Pacific is growing at the fastest CAGR from 2024 to 2030. The increasing focus on investing in the healthcare sector to support the large population and its rapid growth and facilitate the speedy development of the region are the key growth contributors. For instance, in India, the estimated expenditure of the Department of Health and Family Welfare is USD 10.42 billion for the year 2023-2024, an increase of 13.0% from 2022-2023.

China medical specialty bags market is witnessing robust growth driven by the country's expanding healthcare sector and the government's initiatives to improve healthcare access and quality. Manufacturers in China are leveraging the country's strong research and development capabilities to create innovative specialty bags with advanced features and materials. This trend is driven by the Chinese government's emphasis on enhancing patient outcomes and promoting the use of cutting-edge medical technologies.

The growth of the medical specialty bags market in India is projected to increase due to the country's ongoing efforts to strengthen its healthcare system and improve access to quality medical care. The government's initiatives to expand health insurance coverage and promote domestic manufacturing of medical devices have played a significant role in driving the demand for specialty bags.

Latin America Medical Specialty Bags Market Trends

Latin America medical specialty bag market is expected to grow over the forecast period. The region's expanding healthcare infrastructure and the increasing prevalence of chronic diseases drive the market. Governments in Brazil and Argentina are implementing initiatives to improve healthcare access and support the domestic medical devices industry, contributing to the market's growth. Additionally, the rising awareness among healthcare providers and patients about the importance of infection control and sterile medical environments has increased the demand for specialized bags with advanced safety features.

The medical specialty bags market in Brazil is growing due to the increasing awareness among the Brazilian population about the importance of hygiene and health. This trend is fueling the demand for medical specialty bags, particularly those with advanced safety features that help prevent the transmission of diseases. Brazil's aging population is more prone to illnesses such as cardiovascular disease and urinary tract infections, among others. As the elderly population grows, so does the preference for medical specialty bags tailored to their specific needs, further driving market growth.

MEA Medical Specialty Bags Market Trends

The MEA medical specialty bags market in the region is shaped by a focus on quality, safety, and sustainability standards, as well as initiatives to promote domestic manufacturing and improve healthcare access. Manufacturers must navigate this evolving regulatory landscape to capitalize on the growing demand for specialized medical bags in the region.

The medical specialty bags market in UAE shows opportunities. The UAE medical specialty bags market is shaped by the country's commitment to enhancing its healthcare system and promoting the use of advanced medical technologies. The government's initiatives to attract foreign investment and support the domestic manufacturing of medical devices have created a favorable environment for the growth of the specialty bags market.

Key market players are implementing various strategic initiatives such as launching new products, obtaining approvals, engaging in strategic acquisitions, and fostering innovations to sustain and broaden their global presence. These players are also introducing advanced technological solutions to enhance the reliability and efficiency of their offerings.

Key Medical Specialty Bags Companies:

The following are the leading companies in the medical specialty bags market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Baxter

- C.R. Bard Inc. ( BD)

- Coloplast A/S

- Convatec Inc.

- Fresenius Medical Care AG

- Hollister Incorporated

- SB-KAWASUMI LABORATORIES, INC.

- Macopharma

- Pall Corporation

- Terumo Corporation

- Westfield Medical Ltd.

Recent Developments

-

In February 2024, Xheme, a company specializing in innovative medical technologies, has recently collaborated with the Vitalant Research Institute to develop a new type of non-toxic, PVC-free blood bag technology. This collaboration represents a significant advancement in blood storage and transfusion, as it addresses concerns about the potential health risks associated with traditional PVC-based blood bags.

-

In January 2022, Vonco Products LLC, a prominent contract manufacturer specializing in medical devices, fluid bags, biohazard transport products, infection protection gear, and clean room services, acquired Flex-Pak Packaging Products, Inc. This strategic move is expected to enhance Vonco’s capabilities and offerings in the packaging sector while expanding its market reach and customer base.

Medical Specialty Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.86 billion

Revenue forecast in 2030

USD 14.06 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia UAE; Kuwait

Key companies profiled

B. Braun SE; Baxter; C.R. Bard Inc (BD).; Coloplast A/S; Convatec Inc.; Fresenius Medical Care AG; Hollister Incorporated; SB-KAWASUMI LABORATORIES, INC.; Macopharma; Pall Corporation; Terumo Corporation; Westfield Medical Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Specialty Bags Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical specialty bags market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ostomy Collection Bags

-

By Application

-

Single Use

-

Multiple Use

-

-

Intravenous (IV) Fluid bags

-

By End-Use

-

PVC

-

Non-PVC

-

-

-

-

Continuous Ambulatory Peritoneal Dialysis (CAPD) Bags

-

By Application

-

Disposable

-

Reusable

-

-

-

Resuscitation Bags

-

Urinary Collection Bags

-

Sterile Packaging Bags

-

Anesthesia Breathing Bags

-

Cadaver (Body) Bags

-

Blood Bags

-

Enema Bags

-

Enteral Feeding Bags

-

Bile Collection Bags

-

Ice Bags

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical specialty bags market size was estimated at USD 10.40 billion in 2023 and is expected to reach USD 10.86 billion in 2024.

b. The global medical specialty bags market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 14.06 billion by 2030.

b. North America dominated the medical specialty bags market with a share of 45.9% in 2023. This is attributable to rapid growth in consciousness among people and progress in emerging economies due to technological trends.

b. Some key players operating in the medical specialty bags market include Terumo Corporation Hollister Incorporated, Coloplast A/S, B Braun Medical, Pall Corporation, C.R. Bard Inc., Kawasumi Laboratories Inc, Terumo Corporation, Baxter International Inc., Westfield Medical Ltd., Maco Pharma, Convatec Inc., and Fresenius Medical Care AG & Co

b. Key factors that are driving the market growth include growing need for customer focused products/services, improving patient awareness and growing geriatric population

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."