- Home

- »

- Healthcare IT

- »

-

Medical Specimen Tracking System Market Size Report 2030GVR Report cover

![Medical Specimen Tracking System Market Size, Share & Trends Report]()

Medical Specimen Tracking System Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Software, Hardware), By Technology (RFID, Barcode), By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-904-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

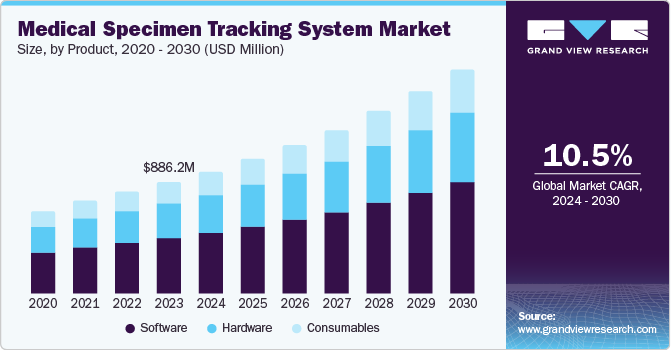

The global medical specimen tracking system market size was valued at USD 886.2 million in 2023 and is estimated to grow at a CAGR of 10.5% from 2024 to 2030. Favorable government regulations coupled with the rising adoption of specimen tracking systems for reducing errors in patient diagnosis are key drivers for this market. As per the Leica BioSystems, around 98,000 people die every year in U.S. hospitals & clinics owing to misdiagnosis. According to the World Health Organization, nearly one in every ten patients experiences harm during healthcare, and more than 3 million individuals face fatal consequences due to unsafe care every year. Furthermore, untapped opportunities in various emerging countries are anticipated to provide opportunities for market players to invest.

Furthermore, medical specimen tracking is increasing worldwide to reduce the disease's misdiagnosis and avoid false treatments. In addition, laboratories are constantly facing challenges due to the changing nature of required healthcare, sudden outbreaks, increasing cases of traumas, discovery of unknown diseases, and more. This has increased the product demand, thereby positively influencing the market growth during the pandemic. Various medical errors are often caused due to errors in sampling, mislabeling, and similar mistakes that can lead to misdiagnosis and, in turn, incorrect treatments.

Also, 2 out of every 1,000 medical reports do not reach the correct patient and 1 out of every 1,000 such cases are affected due to mislabeling. Such medical errors result in the growing demand for medical specimen tracking systems, thereby fueling the market growth. The arrival of specimens on time is very important because delays can lead to a variety of challenges, which jeopardizes customer satisfaction. Not using these systems might result in the delivery of specimens to the wrong lab. Using these systems results in speeding up the productivity of labs. Furthermore, benefits, such as reduction in missing or losing specimens, cost-effectiveness, reduction in turnaround time leading to increased revenue, and improved quality of care, are also some of the factors boosting the market growth.

Product Insights

The software segment accounted for the largest revenue share of 50.6% in 2023, owing to the increased need for automating the specimen tracking solutions process. Based on software, the market has been divided into software, hardware, and consumables. A growing focus on enhancing anatomic laboratories' efficiency and increasing the pathology laboratories' workload for specimen testing is expected to boost the software segment growth in future years. The consumables segment is anticipated to witness the fastest CAGR over the projected period.

Consumables include RFID tags, barcode labs, specimen containers, slides, blocks, transport bags, and tissue cassettes. The growing technological advancements related to RFID and barcodes are expected to fuel the segment's growth. The hardware segment is also estimated to grow significantly over the forecast period owing to the rising demand for products such as printers, labeling systems, RFID readers, barcode scanners, and mobile computing systems.

Type Insights

Based on type, the global market is segmented into patient testing and clinical trial tissue specimens. The patient testing segment held the largest revenue share of the global industry in 2023. This growth is attributed to the increased product usage for patient testing purposes to avoid misdiagnosis of the specimen. Use of medical specimen tracking systems enables facilities and laboratories to track samples and maintain integrity throughout the diagnostic processes. This plays vital role in reducing misdiagnosis and further complications such as false treatments and harm to patients during care.

The clinical trial tissue specimen segment is estimated to experience the fastest CAGR during the forecast period. Growth of this segment is primarily influenced by factors such as increased clinical trials and stringent product approval processes in multiple regions. The increasing awareness levels regarding the importance of bringing ideally tested products to the market are also anticipated to help augment the segment growth over the forecast period. The tissue specimen plays vital role in monitoring the response to the invented or practiced treatments.

Technology Insights

The barcode technology segment dominated the global market in 2023. This growth is attributed to the technological advancements in the use of barcodes and increased adoption in specimen labeling. Ease of use and convenience aspect offered by this technology has resulted in enhancements in its adoption. In addition, barcodes are less expensive as compared to RFID tags, which further increases the demand, leading to rapid growth in the market.

The RFID technology segment is anticipated to experience the fastest CAGR during 2024 to 2030. Radio-frequency identification tags allow real-time data management, which leads to the prevention of theft and loss. In addition, the rising concerns regarding patient safety, coupled with the growing research activities for developing advanced RFID tags for specimen tracking, are expected to boost the growth of this segment. Some of the commonly used RFID tags in medical specimen tracking systems are short reading distance RFID, long reading distance RFID, and medium reading distance RFID tags.

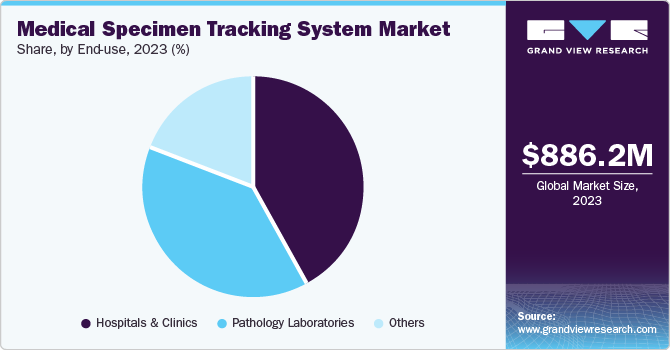

End-use Insights

Based on the end-use, the hospitals & clinics segment held the largest revenue share of the global industry in 2023. The key factor contributing to this segment's growth is the higher volume of patients visiting hospitals and clinics for multiple reasons including routine checkups, particular diagnostic tests, treatments related to chronic diseases, surgeries, and operations. In addition, the growing adoption of technologically advanced products in hospitals and clinics is expected to boost the segment's growth.

The pathology laboratories segment is anticipated to experience the fastest CAGR from 2024 to 2030. An increase in the adoption of specimen tracking systems in pathology laboratories worldwide to reduce the associated costs, enhance productivity, eliminate human errors, and avoid misdiagnosis has resulted in the unprecedented growth of this segment. In addition, the rising automation activities in pathology laboratories are expected to boost the development of this segment in the approaching years.

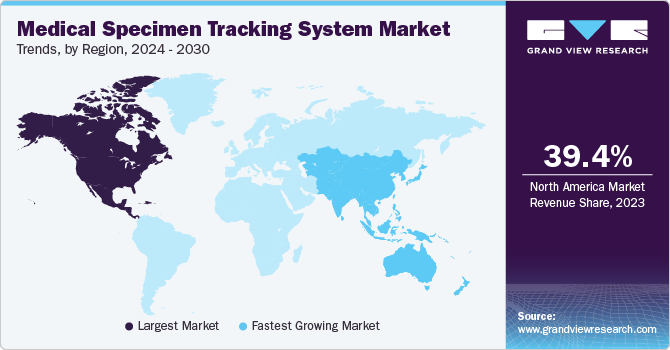

Regional Insights

North America medical specimen tracking system market dominated and accounted for a revenue share of 39.4% in 2023. The key factors contributing to this dominance are well-established healthcare providers in the region, the increasing prevalence of chronic diseases leading to a greater need for diagnosis services, and the availability of associated technologies in the industry. North America has been one of the early adopters of multiple healthcare technologies in recent years. Increasing innovations backed by enhanced research and development activities and advancements integrated with automated systems such as blockchain technologies and RFID codes have improved the efficiency and accuracy of specimen tracking. In addition, rising partnerships and collaboration between companies and healthcare providers are driving the region's growth.

U.S. Medical Specimen Tracking System Market Trends

The U.S. medical specimen tracking system market dominated the regional industry in 2023. Advanced healthcare technologies, a large consumer base, and robust end-use industry demand drive the region's dominance. Robust healthcare infrastructure and enhanced expenditure on healthcare is expected to drive growth for this industry in approaching years. Moreover, rising cases of several chronic diseases in the region create demand for advanced, accurate, and practical solutions such as specimen tracking systems. According to CA: A Cancer Journal for Clinicians, a flagship journal of the American Cancer Society, the U.S. is expected to record 2,001,140 cases of cancer and nearly 611,720 deaths associated with cancer in 2024. Furthermore, substantial investments in healthcare technologies and early adoption of advanced technologies facilitate the integration of specimen-tracking systems.

Europe Medical Specimen Tracking System Market Trends

Europe medical specimen tracking system market held a significant share in 2023. Increasing demand for technologically advanced healthcare infrastructure and growing prevalence of multiple chronic diseases has influenced this market in the region. A rise in awareness regarding significance of timely diagnosis and impact caused by misdiagnosis or errors during care has resulted in the growing adoption of the medical specimen tracking systems market in Europe.

The Germany medical specimen tracking system market is expected to experience a significant growth during forecast period. This market is mainly driven by the unceasing testing activities associated with multiple health intricacies, growing investments in the healthcare infrastructure by organizations and governments and enhanced technology updates leading to improved productivity. Availability of modern treatments, increasing number of healthcare facilities, and large enterprises embracing the technology enhancements are expected to generate greater growth for this industry in approaching years.

Asia Pacific Medical Specimen Tracking System Market Trends

The Asia Pacific medical specimen tracking system market is anticipated to experience the fastest CAGR of 12.6% during the forecast period. Improvements in infrastructural capabilities of healthcare industry in the region, growing demand for the testing and diagnosis, increasing prevalence of diseases such as cancer and diabetes, large number of trauma-related injuring leading to emergency diagnosis and blood samplings in critical cases are some of the key growth driving factors for this industry. Continuous stress on the systems utilized in the pathology laboratories due to large population and unceasing need has resulted in growing adoption systems such as medical specimen tracking.

The China medical specimen tracking systems market held significant revenue share in 2023. This market is primarily driven by the aspects such as presence of large geriatric population, increasing need for the diagnosis solutions, enhanced infrastructural capabilities of healthcare industry, growing investments by the international organizations to deliver errorless care and government support to embrace technological improvements to reduce misdiagnosis.

Key Medical Specimen Tracking System Company Insights

Some of the key companies in the medical specimen tracking system marketinclude Vision ID, RMS Omega Technologies, GAO RFID Inc., Cryoport Systems, LLC, and others. To address the competition in the market, the key industry participants are undertaking strategies such as focus on research and development activities, innovation backed new product launches, collaborations, partnerships, and effective distribution to enhance the market penetration.

-

Cryoport Systems, LLC, provides a comprehensive platform that ensures critical biological materials' safe and timely delivery. The company’s core services include supply chain management, consulting support, and temperature-controlled logistics.

Key Medical Specimen Tracking System Companies:

The following are the leading companies in the the medical specimen tracking system market. These companies collectively hold the largest market share and dictate industry trends.

- RMS Omega

- Peak Technologies (Vision ID)

- GAO Group

- TrakCel

- Kuehne + Nagel (Quick International Courier)

- Cryoport Systems, LLC

- LabConnect

- Taylor Data Systems

- BioIT Solutions

- BROOKS AUTOMATION

Recent Developments

-

In May 2023, Roche presented navify Sample Tracking which enables labs to track test samples of patients before reaching the lab premises.

Medical Specimen Tracking System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 973.01 million

Revenue forecast in 2030

USD 1,771.24 million

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018- 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, type, end-use, region

Regional scope

North America, Europe, APAC, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

RMS Omega; Peak Technologies (Vision ID); GAO Group; TrakCel; Kuehne + Nagel (Quick International Courier); Cryoport Systems, LLC; LabConnect; Taylor Data Systems; BioIT Solutions; BROOKS AUTOMATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Specimen Tracking System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical specimen tracking system market report based on product, technology, type, end-use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Consumables

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

Barcode

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patient Testing

-

Clinical Trial Tissue Specimen

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Pathology Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.