- Home

- »

- Medical Devices

- »

-

Medical Supply Delivery Service Market Size Report, 2030GVR Report cover

![Medical Supply Delivery Service Market Size, Share & Trends Report]()

Medical Supply Delivery Service Market Size, Share & Trends Analysis Report By Application (Medical Supplies, Lab Specimens & Reports), By Mode Of Service (Courier Delivery), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-980-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

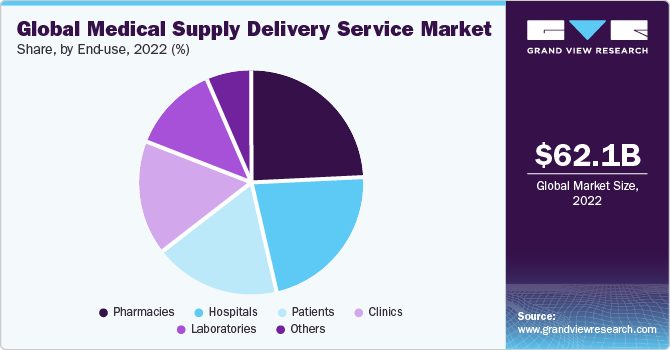

The global medical supply delivery service market size was valued at USD 62.1 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. An increase in the volume of surgical procedures and the surging adoption of medical courier services for delivering medical supplies to healthcare facilities on time is expected to fuel market growth. The growing need to ensure quick and secure transportation of samples and specimens for testing, declining cost of logistics, and increasing focus on improving the healthcare system are driving the demand for medical supply delivery services. In addition, a continued increase in the incidence of road accidents that lead to blood loss and the immediate requirement for blood is boosting the market growth.

The expansion of healthcare logistics and rising demand for faster and cost-effective delivery of samples and specimens for testing or diagnostic purposes bolsters market growth. Introducing drone delivery services supports healthcare facilities to transport medical items at unparalleled speed and predictability, leading to higher operational savings and improved patient care. In addition, introducing small indoor drones that can deliver medicine to a patient's bedside directly from the pharmacy while eliminating human interaction for more rapid and less error-prone administration of medications, further drives the market.

The COVID-19 pandemic has further driven market growth, as the situation demands on-time delivery of essential medical supplies and a smooth flow of specialty drugs that need handling with care. Furthermore, the growing geriatric population, increasing incidence of hypertension and diabetes, and rising surgical procedures for organ transplants are likely to drive revenue over the forecast period further. According to data published by the Health Resources and Services Administration (HRSA) in 2019, in the U.S., a total of 39,718 organ transplant surgeries were performed, which include 23,401 kidney transplants, 8,896 liver transplants, 3,552 heart transplants, and 2,714 lung transplants.

The growing demand for blood and blood components across various surgical procedures, such as hematology procedures, cardiovascular surgical interventions, general medicine, and bone marrow surgery procedures, is a significant factor anticipated to boost service demand over the forecast period. Furthermore, the rising adoption of medical drones creates numerous opportunities to improve healthcare services, majorly in remote and underserved environments, by reducing turnaround times for lab testing, enabling just-in-time medical supply delivery, and reducing routine prescription care costs.

Furthermore, mergers & acquisitions, partnerships, and collaborative agreements are some of the crucial initiatives undertaken by major market players that are expected to propel the growth of the overall market. In January 2021, TFI International, a Canada-based logistics and transport company, announced its acquisition plans of UPS Freight for USD 800 million. The acquisition was completed in April 2021, with TFI being able to strengthen its North American truckload network through this acquisition and enhance its overall business.

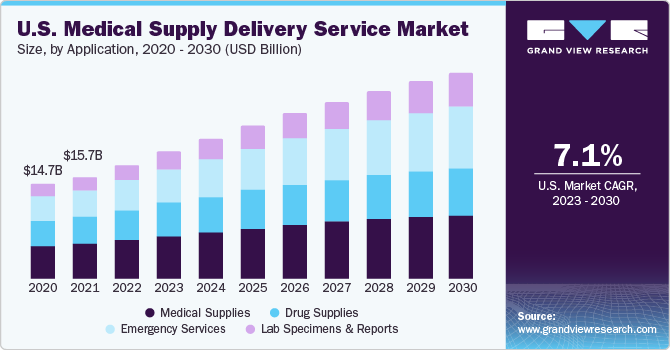

Application Insights

The medical supplies segment held the largest revenue share in 2022. The increasing number of surgical procedures, coupled with benefits offered by medical device delivery services for faster, cost-effective, and contactless delivery of products, is expected to drive the adoption of medical supply delivery services. There has been an increase in the number of organ transplant procedures due to factors such as rising alcohol consumption, unhealthy eating habits, increasing prevalence of chronic diseases, and a rapid increase in the success rate of organ transplants over recent years, which has served to drive market expansion.

In February 2022, Medtronic launched the NuVent Eustachian tube dilation balloon to treat chronic and obstructive Eustachian Tube Dysfunction. In another instance, in April 2022, the FDA approved Boston Scientific Corp. for its EMBOLD Fibered Detachable Coil that helps to obstruct the blood flowing in the peripheral vasculature. Such developments are likely to boost demand in the medical supply services market in the coming years.

The market is segmented based on application into medical supplies, drug supplies, emergency services, and lab specimens & reports. The lab specimens & reports application segment is anticipated to register the fastest growth rate during the forecast period. The COVID-19 pandemic increased the demand for these services as providers sought to reduce the chances of contamination by ensuring contactless and on-time delivery of specimens.

There has also been a growing need to improve patient care by increasing the accessibility of these services in rural areas, where the scope for road transportation is limited. In addition, the expansion of healthcare logistics, real-time tracking offered by companies, and the growing demand for faster and cost-effective delivery of samples and specimens are boosting segment growth.

Mode Of Service Insights

Based on the service mode, the market is segmented into courier and drone deliveries. In 2022, courier delivery accounted for the larger market share due to various national and multinational courier companies providing real-time tracking and a cost-effective way to transport medical supplies to hospitals and medical laboratories. For instance, TVS SCS Rico’s same-day medical courier services provide urgent deliveries around the clock through experienced couriers, ensuring compliance with standard operating procedures while delivering products to end-users. Companies offer effective delivery of samples using trained couriers and route optimization.

On the other hand, the drone delivery segment is anticipated to register the fastest growth rate during the forecast period. The growing public acceptance of medical drones in developing economies is anticipated to drive their demand, propelling market growth. Evolving drone regulations are supporting the adoption of drones for increasing efficiency, improving the direct-to-patient supply chain, and boosting cold chain solutions.

In June 2023, Siemens Healthineers (Middle East, Africa) collaborated with Wingcopter GmbH, a German drone service provider, to release an integrated drone delivery service for medical supplies in Africa. In April 2023, Riverside Health System announced its collaboration with DroneUp and the Virginia Institute for Spaceflight & Autonomy to deliver hypertension medicines to patients in an emergency. In September 2019, the government in Maharashtra, India, partnered with Zipline to use the logistics network of autonomous delivery drones to enhance critical care and emergency medicine deliveries in the state.

End-use Insights

In 2022, pharmacies accounted for the largest revenue share of 24.4% in the market, due to the increasing benefits offered by these services to fulfill unmet needs of consumers by doorstep delivery of medical supplies that help them avoid long pharmacy lines, as well as the COVID-19 pandemic and human interaction. Increasing investments, collaborations, partnerships, mergers & acquisitions, and government initiatives are boosting the adoption of these services.

In April 2020, Uber announced its partnership with Medlife to support the last-mile delivery of prescription and other over-the-counter medicines in the Indian cities of Kolkata, Jaipur, Hyderabad, Lucknow, and Pune, during the COVID-19 pandemic. In May 2023, National Health Services (NHS) announced the imminent launch of its first national service in England by the end of 2023, post negotiations between the Social Care (DH) and the Pharmaceutical Services Negotiating Committee (PSNC), and the Department of Health. In addition, NHSE announced its desire to "build on the success" of existing pharmacy services to "increase convenience for the public."

With regard to end-use, the market is segmented into hospitals, clinics, laboratories, pharmacies, and patients, among other end-users. The patients’ segment is anticipated to register the fastest CAGR of 9.6% during the forecast period, owing to the adoption of medical delivery services enabling vulnerable patients to receive medicines at their doorstep to avoid interaction with COVID-19 patients.

The pandemic boosted the demand for courier and mail-order-based drug deliveries, as people avoided in-person trips to the pharmacy. For instance, in March 2021, Uber announced its partnership with ScriptDrop for prescription delivery services for patients in 37 states in the U.S. In August 2020, NimbleRx announced its partnership with Uber Health to offer safe and contactless prescription delivery from pharmacies in Seattle and Dallas, with plans to expand to other parts of the U.S. in succeeding months.

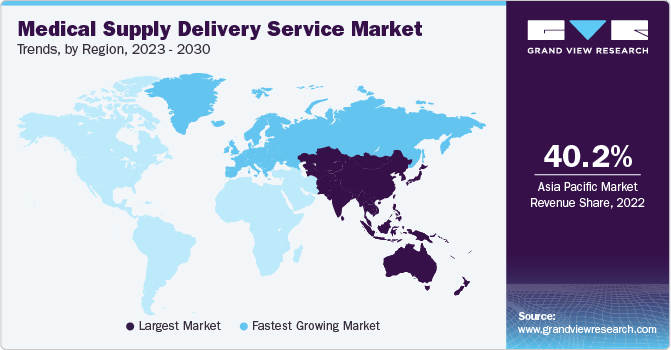

Regional Insights

Asia Pacific accounted for the largest share of over 40.2% in 2022, due to factors such as improving healthcare infrastructure, growing geriatric population, rising prevalence of chronic diseases, technological advancements, improving medical tourism industry, infrastructure investments, higher labor costs amid workforce shortages, evolving care models, and the expansion of healthcare systems in developing economies. Moreover, the adoption & implementation of aerial drone technology is increasing in developing economies, creating new markets in countries such as China and India, through partnerships with several private operators, governments, and humanitarian organizations.

On the other hand, the European market is expected to expand at the fastest CAGR of 8.4% during the forecast period. Increasing healthcare expenditures, the adoption of advanced technologies, and the presence of global players in the region are propelling market growth. In addition, meteoric growth in the e-commerce space has created a surge in the number of parcel delivery and logistics service providers in the region.

Moreover, companies are devising entry strategies and mergers & acquisitions to cater to the European healthcare logistics and delivery services market. In April 2019, Marken, a business unit of UPS, expanded its logistics footprint in Italy by acquiring HRTL. Additionally, Marken expanded its European presence by acquiring Austria-based HETO and Hungary-based Der Kurier. Such developments are anticipated to drive the market in the forthcoming years.

Key Companies & Market Share Insights

Companies are focusing on expanding their geographical reach and introducing newer, innovative solutions through various strategies, including partnerships, product launches, and collaborations, to support end-users in faster delivery of medical supplies, deliver value-based care, and maintain a competitive edge in the market. For instance, in June 2023, Unimed, a provider of pharmaceutical and medical services, declared its merger with Marine Pharma (Singapore), a medical supplier. This merger aims to offer pharmaceutical and medical services and solutions to the marine industry.

In another example, in April 2023, PharmaLex Group announced its merger with Cpharm to expand its pharmacovigilance services. In February 2023, Garuda Aerospace (Chennai) collaborated with Narayana Health to facilitate the transportation of biomedical supplies with its product “Sanjeevani” drones. The drone service will be helpful in the delivery of critical and emergency medical supplies, such as reports & samples, in case of heavy traffic and other obstacles.

Another instance of notable industry development came in February 2021, when DHL Express and SmartLynx Malta partnered to focus on DHL’s European air fleet expansion plans by including two new Airbus A321-200 cargo planes belonging to SmartLynx Malta. This partnership is expected to streamline DHL’s CO2 emission reduction goals.

Key Medical Supply Delivery Service Companies:

- DHL International GmbH

- United Parcel Service of America, Inc.

- Agility

- ModivCare Solutions, LLC

- FedEx

- CEVA Logistics

- Wings Logistics

- International SOS

- Matternet

- Zipline

- Flirtey

- Swoop Aero

Medical Supply Delivery Service Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 69.6 billion

Revenue forecast in 2030

USD 115.4 billion

Growth Rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, mode of service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DHL International GmbH; United Parcel Service of America, Inc.; Agility; ModivCare Solutions, LLC; FedEx; CEVA Logistics; Wings Logistics; International SOS; Matternet; Zipline; Flirtey; Swoop Aero

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

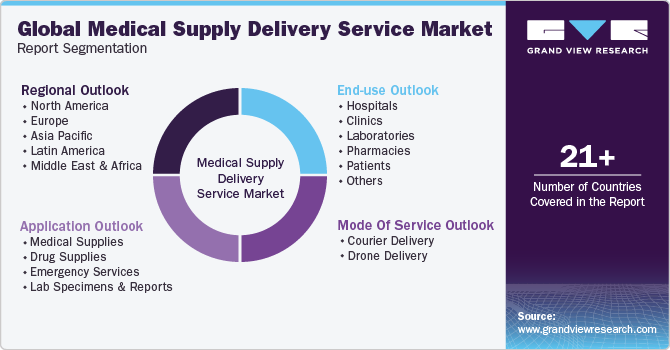

Global Medical Supply Delivery Service Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global medical supply delivery service market report based on application, mode of service, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Supplies

-

Drug supplies

-

Emergency Services

-

Lab Specimens & Reports

-

-

Mode Of Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Courier Delivery

-

Drone Delivery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Laboratories

-

Pharmacies

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical supply delivery service market size was estimated at USD 62.1 billion in 2022 and is expected to reach USD 69.6 billion in 2023.

b. The global medical supply delivery service market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 115.4 billion by 2030.

b. North America dominated the medical supply delivery service market with a share of around 35% in 2022. This is attributable to the rise in the adoption of new technologies coupled with an increasing focus on providing cost-competitive supplies throughout the regions.

b. Some key players operating in the medical supply delivery service market include DHL; UPS; Agility; LogistiCare Solutions, LLC; FedEx Corporation; CEVA Logistics; wingslogistics, International SOS; Matternet; Zipline; Flirtey; and Swoop Aero.

b. Key factors driving the medical supply delivery service market growth include the growing need for quick transportation and delivery of drugs & medical supplies at the time of emergencies and increasing focus on improving the healthcare system and reducing supply chain costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."