- Home

- »

- Green Building Materials

- »

-

Medium Density Fiberboard Market, Industry Report, 2033GVR Report cover

![Medium Density Fiberboard Market Size, Share & Trends Report]()

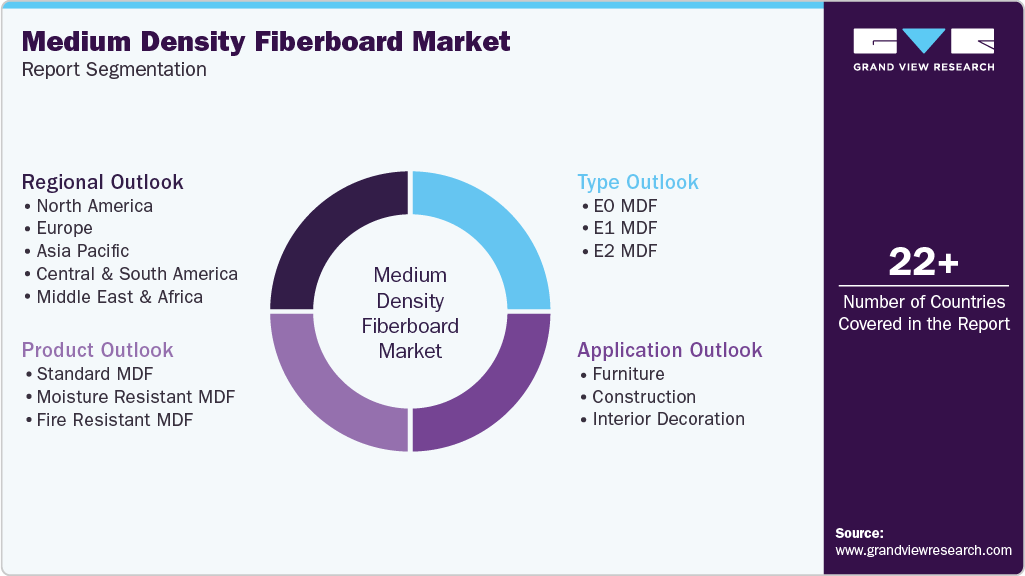

Medium Density Fiberboard Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Standard MDF, Moisture Resistant MDF), By Type, By Application (Furniture, Construction), By Region, And Segment Forecast

- Report ID: GVR-4-68038-661-5

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medium Density Fiberboard Market Summary

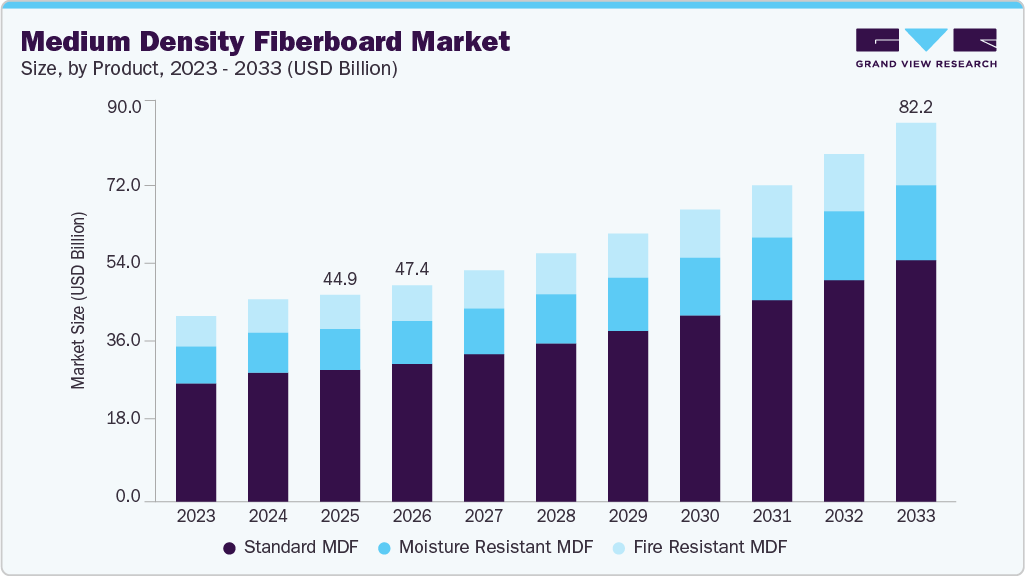

The global medium density fiberboard market size was valued at USD 44.96 billion in 2025 and is projected to reach USD 82.24 billion by 2033, growing at a CAGR of 8.2% from 2026 to 2033. This growth is attributed to the increasing demand for products in the construction, furniture, and interior decoration sectors.

Key Market Trends & Insights

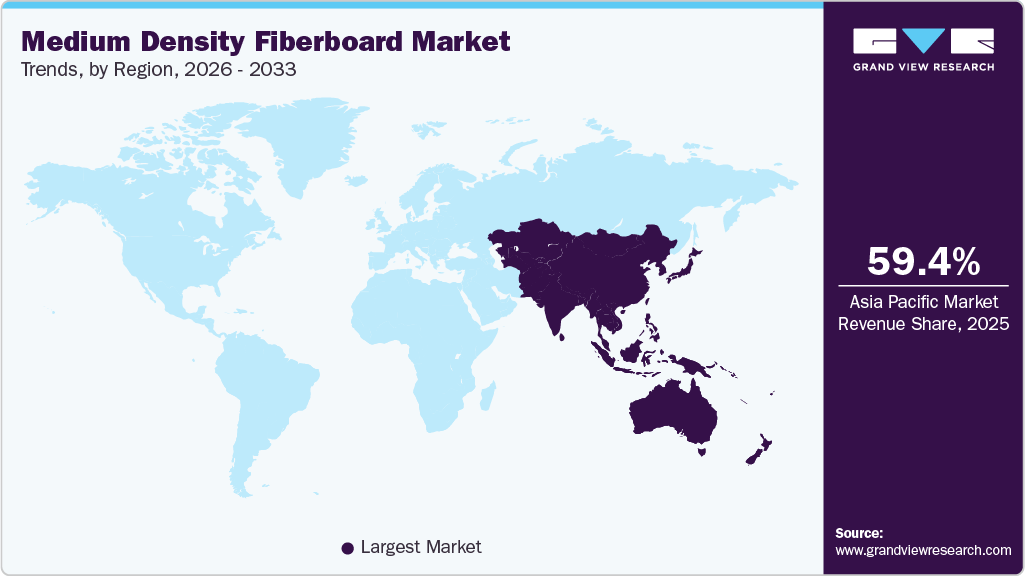

- Asia Pacific dominated the market and accounted for a revenue share of 59.4% in the global market in 2025.

- By product, the standard medium density fiberboard segment led the market and accounted for the largest revenue share of 66.0% in 2025.

- By type, the E1 medium density fiberboard segment led the market and accounted for the largest revenue share of 75.1% in 2025.

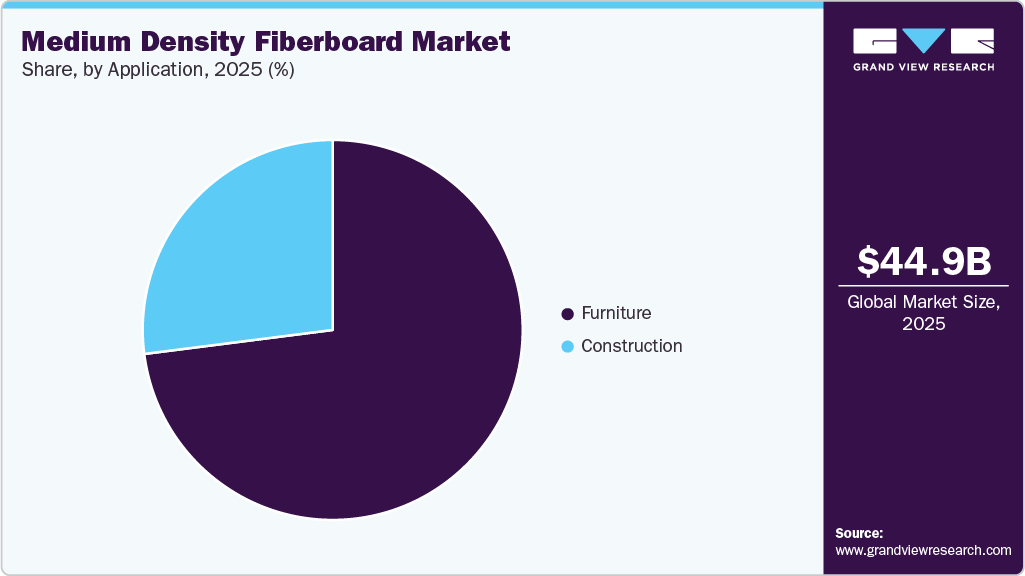

- By application, the furniture segment led the market and accounted for the largest revenue share of 59.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 44.96 Billion

- 2033 Projected Market Size: USD 82.24 Billion

- CAGR (2026-2033): 8.2%

- Asia Pacific: Largest market in 2025

Furthermore, the low product cost and the availability of several varieties of application-specific panels are factors that are likely to compel manufacturers to opt for these products in construction and furniture applications. The U.S. dominates the North American medium-density fiberboard (MDF) panel market, accounting for the highest revenue share in terms of consumption. This is attributed to the increased penetration of the product in the residential sector, coupled with the growing number of single-family homes. Moreover, major companies in the U.S. are increasingly opting for smart wood packaging products to meet strict guidelines laid by government bodies regarding the safe storage of food products over a long duration and to improve medical compliance rates.

The demand for the product is further anticipated to increase due to its superior qualities, including high strength, durability, and resistance to moisture and fire, supporting the growth of the fire-rated medium density fiberboard market. Additionally, technical innovations and improvements in the production process have resulted in the manufacturing of medium density fiberboard with superior durability and extended lifespan. Superior adhesion techniques with low-emission formaldehyde-based resins have spurred product innovations in the industry.

Medium density fiberboard panels are used in a variety of production processes in the construction sector, including siding, flooring, window, and door panels. In the aforementioned applications, these panels can replace conventional building materials, including cement, glass, plywood, and plastic. The demand for medium density fiberboard panels is, therefore, expected to increase throughout the course of the forecast period, along with the expansion of the building industry and the broader medium density fiberboard panel market.

The government's initiatives to increase residential development, along with population growth and rising urbanization, are projected to fuel demand for wooden furniture. The demand for furniture is expected to increase due to remodeling and renovation projects driven by improving living standards. The development of office spaces and corporate buildings in emerging nations has impacted the demand for wood furniture as a result of the expansion of the service sector.

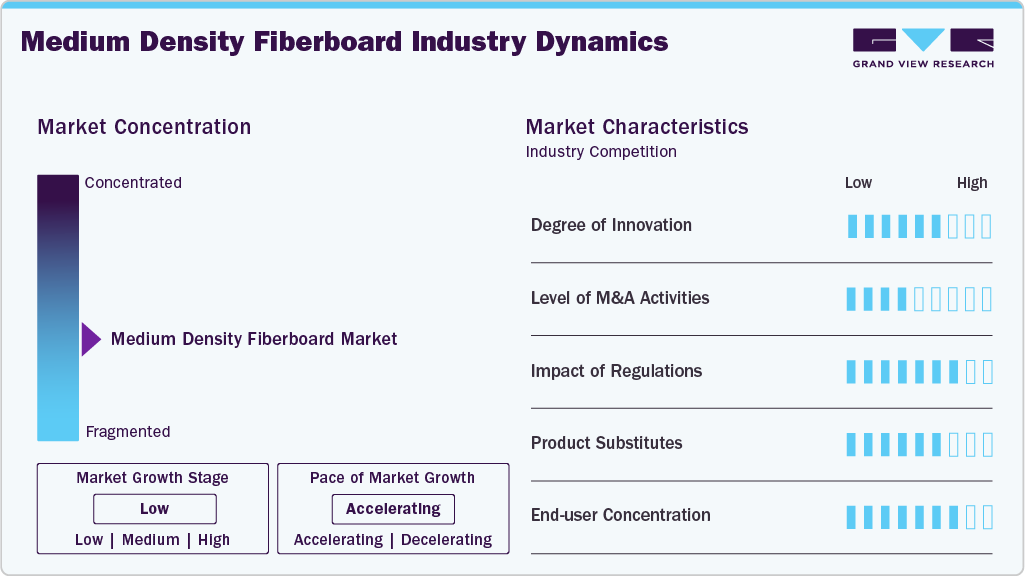

Market Concentration & Characteristics

The medium density fiberboard (MDF) market is moderately fragmented, with a mix of global players and regional manufacturers competing for market share. Leading companies focus on product innovation, capacity expansion, and expanding their distribution networks to strengthen their position, while smaller players often serve niche markets or meet local demands. Competitive intensity is shaped by price sensitivity, quality differentiation, and sustainability initiatives.

The MDF market is governed by strict environmental and safety regulations, including standards for formaldehyde emissions, sustainable sourcing, and workplace safety. Compliance with certifications such as FSC, CARB, and E1/E0 standards is crucial for both domestic and international sales. Regulatory frameworks influence production methods, raw material sourcing, and export potential.

Key substitutes for MDF include plywood, particleboard, and solid wood, which can impact pricing and demand dynamics. End users are primarily concentrated in furniture manufacturing, interior construction, and cabinetry sectors, making demand sensitive to trends in real estate, renovation, and home décor. Strong relationships with these end users often determine market success and customer retention.

Product Insights

Standard medium density fiberboard led the market and accounted for the largest revenue share of 66.0% in 2025. Standard medium density fiberboard has a range of applications in the construction and furniture industries. The rising demand for medium-density fiberboard (MDF) for use in furniture, flooring, and cabinet manufacturing is expected to drive market growth during the forecast period. Recovery of the construction industry in Europe, coupled with rapid growth in the residential and commercial building & construction sectors in Asia Pacific, is expected to impact the market in the coming years positively.

Moisture-resistant medium density fiberboard is engineered to resist elevated levels of moisture, humidity, and occasional wetting. These products exhibit similar physical characteristics & workability as standard medium density fiberboard. Moisture-resistant medium-density fiberboard is used in various applications, including sink bases, dishwasher enclosures, laboratories, and laundry areas, among others. These medium-density fiberboards are usually dyed green for identification purposes.

Fire-resistant medium-density fiberboard is expected to be the fastest-growing market, with a CAGR of 9.1% during the forecast period. These are manufactured by homogeneous incorporation of flame-retardant additives during the production process. The European Union has developed the “Euroclass” classification system to determine and standardize the fire resistance of these medium density fiberboard panels. This classification system comprises seven classifications, ranging from A1 to F, which determine the different levels of fire resistance of various types of wood-based panels. Most fire resistant MDF panels are manufactured with Class B and Class C fire resistance.

Type Insights

E1 medium density fiberboard led the market and accounted for the largest revenue share of 75.1% in 2025 and is also expected to be the fastest-growing market with a CAGR of 8.3% during the forecasted years. E1 MDF boards have gained widespread adoption globally due to regulatory support worldwide. E1 MDF boards are manufactured by using phenol-formaldehyde resin as a binding material. This type of MDF emits about 90% less formaldehyde than the E2 type MDF. Additionally, the manufacturers are using melamine and hexamine as formaldehyde scavengers to reduce the emission levels further.

EO medium density fiberboard is manufactured using polymeric methylene diphenyl diisocyanate (pMDI) resin. This particular type of MDF gives out zero levels of formaldehyde during the product lifecycle. Adoption of stringent formaldehyde emission norms in countries such as the U.S., Canada, Japan, Denmark, and Austria is proving to be the primary factor driving the global demand for the products.

E2 type of medium density fiberboard is manufactured using urea-formaldehyde as the primary binding material. Various scientific studies have indicated that the products made from E2 MDF continue to emit formaldehyde fumes for a prolonged period. As a result, the product is finding a lower adoption rate among developed countries across the world. However, the low cost associated with the products is driving the product demand in the countries within underdeveloped countries.

Application Insights

The furniture segment led the market, accounting for the largest revenue share of 59.7% in 2025 and is expected to be the fastest-growing segment with a CAGR of 8.1% during the forecasted years. Medium density fiberboard panels find a wide application scope in furniture, as they are lightweight, well-finished, and durable as compared to traditional wood. Unlike glass, these panels can be used to manufacture sturdy and durable interior decoration items, which is expected to have a positive impact on the market growth over the next ten years.

Rising demand for modular furniture for living rooms and bedrooms is expected to drive the demand for medium density fiberboard panels over the forecast period. Increasing product demand to manufacture residential and commercial furniture, ready-to-assemble (RTA) products, and small accent pieces is expected to boost the market growth over the forecast period.

Rising consumer demand for green products, driven by increasing environmental awareness, is likely to reduce the demand for plastic products in construction applications. As wood-based products are bio-derived and recyclable, they are expected to witness significant demand in construction applications over the forecast period.

Medium density fiberboards are widely gaining traction in interior decoration applications owing to the product’s durability and fine carving ability. The products are used widely for making decorative boards and large-scale walling applications. Product innovations by multinational companies in the market have introduced the enhanced quality of medium-density fiberboard that can resist water and fire to some extent. Moreover, the players are engaged in the production of veneered and pre-laminated medium density fiberboards in order to cater to the increasing interior decorative applications in residential and commercial spaces.

Regional Insights

The Asia Pacific region dominated the global medium density fiberboard market, accounting for a revenue share of 59.4% in 2025, and is projected to register the highest CAGR of 8.4% over the forecast period. Growth is supported by proactive government initiatives promoting the adoption of RFID sensors in wood packaging products, along with robust economic expansion across key countries such as China, India, and Japan, which is driving demand for MDF panels in furniture, construction, and interior applications. Furthermore, the growing consumer preference for sustainable and eco-friendly furniture is expected to drive market expansion further in the coming decade. Within the regional landscape, the Australian medium density fiberboard market is gaining traction due to rising residential construction, renovation activities, and growing adoption of engineered wood products that align with sustainability and low-emission standards.

China Medium Density Fiberboard Market Trends

China’s MDF market is driven by its massive furniture manufacturing industry, which serves both domestic and export markets. Rapid urbanization, coupled with government initiatives promoting affordable housing, has led to strong demand for cost-effective building materials like MDF. Furthermore, the integration of advanced manufacturing technologies and automation has enabled large-scale, efficient MDF production. Export-oriented growth, especially in furniture and interior products, also sustains China’s leadership in the global MDF market.

North America Medium Density Fiberboard Market Trends

The North America medium density fiberboard (MDF) market is witnessing steady growth driven by rising residential construction, increased furniture manufacturing, and strong demand from interior applications such as cabinetry, flooring, and wall panels. The region benefits from advancements in engineered wood technology, improved moisture-resistant and low-emission MDF grades, and a growing preference for cost-effective alternatives to solid wood. Sustainability trends, including the use of recycled wood fibers and compliance with stringent emission regulations, continue to shape product development across the U.S. and Canada. Within the regional landscape, the Mexico Medium Density Fiberboard market is emerging as a key growth contributor, supported by expanding furniture exports, nearshoring of manufacturing activities, and increasing investments in housing and commercial infrastructure, strengthening North America’s overall MDF value chain.

Europe Medium Density Fiberboard Market Trends

The MDF market in Europe is driven by the region’s strong furniture and interior design industry, which values cost-effective engineered wood solutions with uniform density and ease of machining. Growing demand for sustainable products and compliance with stringent EU environmental regulations, such as E1 and CARB standards, has also enhanced the adoption of eco-friendly MDF. The region’s push for circular economy practices and recycling of wood fibers provides further impetus to MDF production and trade.

The Germany MDF market is supported by its position as a leading furniture manufacturing hub in Europe, with global exports driving large-scale demand for engineered wood panels. The country’s emphasis on sustainable and certified materials, coupled with strict emission regulations, fuels the shift from solid wood to high-quality MDF boards. Increasing construction activity in both the residential and commercial sectors, supported by government renovation incentives, provides a steady demand for MDF usage.

Latin America Medium Density Fiberboard Market Trends

The MDF market in Latin America is driven by rapid urbanization and rising investments in housing and infrastructure projects. With a growing middle-class population, demand for affordable yet durable furniture and decorative interior solutions has accelerated, making MDF a preferred choice due to its cost-effectiveness and adaptability to laminates and finishes.

Middle East & Africa Medium Density Fiberboard Market Trends

The MDF market in the Middle East is primarily driven by rapid urbanization and rising construction activity in residential and commercial sectors. Governments across the region are investing heavily in infrastructure modernization, including housing projects, office complexes, and hospitality developments, creating a strong demand for engineered wood products. MDF is increasingly preferred over solid wood due to its cost-effectiveness, design versatility, and sustainability benefits.

Key Medium Density Fiberboard Company Insights

Some key players operating in the market include EGGER Group, Kronospan Limited, and Nordbord Inc.

-

Nordbord Inc. is a leading manufacturer of engineered wood products, including MDF, oriented strand board (OSB), and particleboard. With manufacturing facilities in Canada and the UK, Nordbord supplies MDF primarily under the CaberWood brand. Their MDF product portfolio includes general-purpose MDF, premium-grade MDF for demanding machining applications, moisture-resistant options, and industrial-grade MDF tailored to specific customer needs. Nordbord's products serve the furniture, construction, and interior finishing markets, emphasizing quality and sustainability.

-

EGGER Group is a producer of wood-based panel products with a comprehensive MDF portfolio. Their MDF offerings include standard panels, moisture-resistant and fire-retardant grades, as well as melamine-faced MDF boards designed for furniture, flooring, and interior applications. EGGER prioritizes innovation and environmental responsibility, providing low-emission MDF panels compliant with stringent health and safety standards.

CalPlant I, LLC, MEDITE SMARTPLY, Dongwha Malaysia Holdings Sdn. Bhd., and Dare Panel Group Co., Ltd are some of the emerging market participants in the medium density fiberboard market.

-

CalPlant I, LLC operates as a producer of engineered wood products, including MDF panels primarily aimed at the construction and furniture industries. Though specific MDF product lines are not extensively detailed publicly, CalPlant emphasizes sustainable manufacturing practices and high-quality products. Their MDF offerings typically target applications requiring strong, dense, and machinable fiberboard for interior architectural uses and cabinetry.

-

MEDITE SMARTPLY is a UK-based producer of engineered wood products with a strong focus on eco-friendly MDF solutions. Their product portfolio includes MEDITE MDF, which is certified sustainable and reputed for superior machining and finishing properties. MEDITE SMARTPLY also manufactures enhanced durability products such as MEDITE TRICOYA (modified MDF with extended moisture resistance) and MEDITE FR (fire-retardant MDF). The company supports the furniture, cabinetry, flooring, and construction industries through innovation, sustainability, and quality assurance.

Key Medium Density Fiberboard Companies:

The following are the leading companies in the medium density fiberboard market. These companies collectively hold the largest Market share and dictate industry trends.

- Dongwha Malaysia Holdings Sdn. Bhd.

- Kronospan Limited

- Dare Panel Group Co., Ltd.

- EGGER Group

- Norbord Inc.

- Kastamonu Entegre

- Georgia-Pacific

- ARAUCO

- West Fraser Timber Co. Ltd.

- Nag Hamady Fiber Board Co.

- Century Plyboards (India) Limited

- CalPlant I, LLC

- Soane Industria SGPS, S.A

- An Cuong Woodworking Materials

- Evergreen Fiberboard Berhad

Recent Developments

-

In February 2025, Greenpanel Industries, India's leading MDF manufacturer, has expanded its annual production capacity from 660,000 CBM to 891,000 CBM at its Srikalahasti facility in Andhra Pradesh. This enhancement includes the introduction of a thin MDF range (1.5 mm to 1.7 mm) to meet the growing demand for precision-engineered solutions. The new line employs advanced ContiPress Technology (Dieffenbacher CPS+) to ensure high-quality output. The expansion underscores Greenpanel's commitment to innovation and maintaining its leadership in the MDF industry.

-

In May 2025, Homanit, a German MDF manufacturer, has announced plans to establish its first U.S. manufacturing operation in Alcolu, South Carolina. The company will invest USD 250 million in the greenfield facility, which is expected to be operational by 2028. This expansion aims to strengthen Homanit's presence in the North American market and is anticipated to create approximately 300 new jobs in the region.

Medium Density Fiberboard Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 47.42 billion

Revenue forecast in 2033

USD 82.24 billion

Growth rate

CAGR of 8.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Volume in Thousand Cubic Meters, Revenue in USD Million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Russia; China; Japan; India; Brazil; Argentina; Saudi Arabia; UAE; Egypt

Key companies profiled

Dongwha Malaysia Holdings Sdn. Bhd.; Kronospan Limited; Dare Panel Group Co., Ltd.; EGGER Group; Norbord Inc.; Kastamonu Entegre; Georgia-Pacific; ARAUCO; West Fraser Timber Co. Ltd.; Nag Hamady Fiber Board Co.; Century Plyboards (India) Limited; CalPlant I, LLC; Soane Industria SGPS, S.A; An Cuong Woodworking Materials; Evergreen Fiberboard Berhad

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medium Density Fiberboard Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the medium density fiberboard market on the basis of product, type, application, and region:

-

Product Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million; 2021 - 2033)

-

Standard MDF

-

Moisture Resistant MDF

-

Fire Resistant MDF

-

-

Type Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million; 2021 - 2033)

-

E0 MDF

-

E1 MDF

-

E2 MDF

-

-

Application Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million; 2021 - 2033)

-

Furniture

-

Construction

-

Interior Decoration

-

-

Regional Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global medium density fiberboard (MDF) market size was estimated at USD 44.96 billion in 2025 and is expected to reach USD 47.42 billion in 2026.

b. The global medium density fiberboard (MDF) market is expected to grow at a compound annual growth rate of CAGR of 8.2% from 2026 to 2033 to reach USD 82.24 billion by 2033.

b. The standard MDFs accounted for the largest revenue share in 2024 due to the rising demand for these MDFs for use in furniture, floor, and cabinet manufacturing.

b. Some key players operating in the MDF market include Kronospan Limited; EGGER Group; Nordbord Inc.; Kastamonu Entegre; and ARAUCO.

b. The key factors that are driving the market growth is low product cost and the availability of several varieties of application-specific panels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.