Market Size & Trends

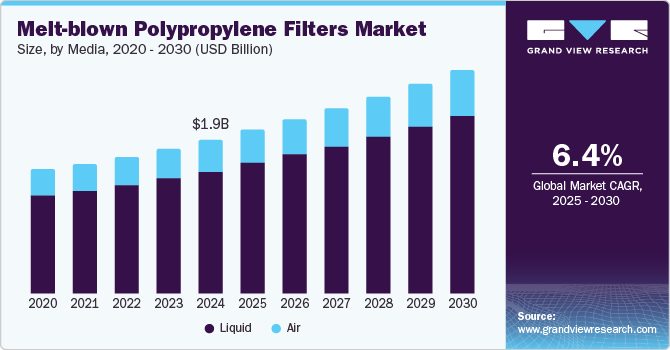

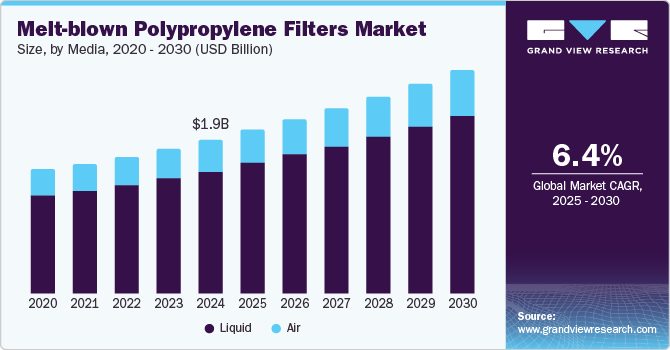

The global melt-blown polypropylene filters market was valued at USD 1.97 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. This growth is fueled by an escalating demand for high-quality water and air resulting from heightened health and safety regulations. This is particularly relevant in the water and wastewater treatment sectors, where these filters are extensively used to remove impurities and contaminants.

In addition, expanding industries such as pharmaceuticals, food and beverage, and electronics has further fueled the demand for high-efficiency filtration solutions. Moreover, stringent environmental regulations and the aftermath of the pandemic, which underscored the importance of air filtration, have led to increased adoption of these filters in various applications.

The melt-blown polypropylene filter market is significantly shaped by stringent environmental regulations and policies to ensure product purity and safety. For instance, the Clean Water Act in the U.S. mandates the removal of contaminants from wastewater before it is discharged into natural water bodies, driving the demand for high-quality filtration solutions. Similarly, the European Union's Water Framework Directive requires member states to achieve good qualitative and quantitative status of all water bodies, further boosting the market.

Media Insights

The liquid segment accounted for the largest share of 79.4% in 2024 due to the extensive use of these filters in water and wastewater treatment processes, where they play a crucial role in removing impurities, contaminants, and particulates to ensure the safety and quality of drinking water. The demand for clean water, driven by increasing health and safety standards, has significantly contributed to the growth of this segment. Moreover, the food and beverage industry's need for high-quality filtration to maintain product integrity and safety has further strengthened the liquid segment's market share.

The air segment is expected to grow at a CAGR of 12.3% from 2025 to 2030, due to the rising concerns about air pollution and the increasing prevalence of airborne diseases. The need for clean indoor air, especially in healthcare settings, residential spaces, and industrial environments, has driven the demand for efficient air filtration solutions. Technological advancements, such as the development of nanofiber-based filters, have enhanced the performance and efficiency of these filters, making them more attractive to consumers and industries alike. The aftermath of the COVID-19 pandemic has also underscored the importance of air filtration, further propelling the growth of the air segment.

Application Insights

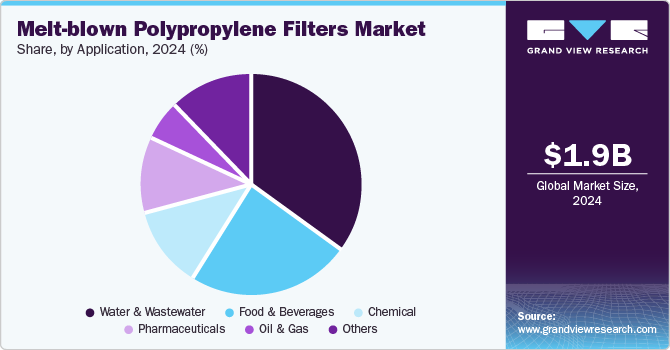

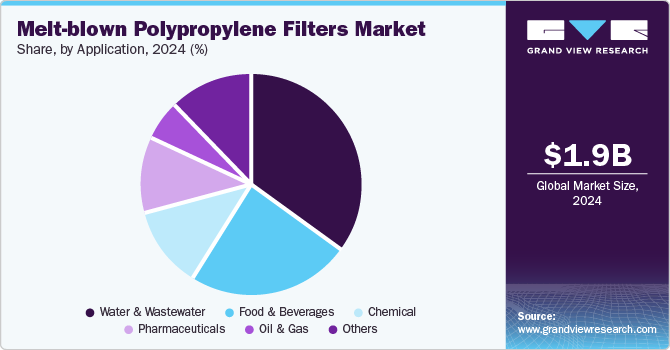

The water & wastewater segment dominated the global melt-blown polypropylene filters market in 2024. This dominance stems from the critical need for effective filtration solutions to ensure the availability of clean, safe water for both consumption and industrial use. In an era where water scarcity and pollution are pressing global issues, the demand for efficient filtration systems has skyrocketed. Melt-blown polypropylene filters are prized for their ability to remove fine particulates and contaminants, making them essential in water treatment facilities worldwide. Moreover, stringent environmental regulations and the increasing focus on sustainability have further driven the adoption of these filters in wastewater treatment processes.

The oil and gas segment is projected to grow at the fastest CAGR of 6.4% over the forecast period. The oil and gas industry is characterized by its complex operations and the need for robust filtration solutions to ensure the purity and efficiency of its processes. Melt-blown polypropylene filters are increasingly being utilized to filtrate hydraulic fluids, fuels, and lubricants, which are critical for the smooth functioning of machinery and equipment. The segment's growth is also fueled by the ongoing advancements in extraction and production technologies, which necessitate high-performance filtration systems to handle the challenging and variable conditions inherent in the oil and gas industry. As the demand for energy continues to rise, the oil and gas segment's reliance on these advanced filtration solutions is set to propel its market share significantly.

Regional Insights

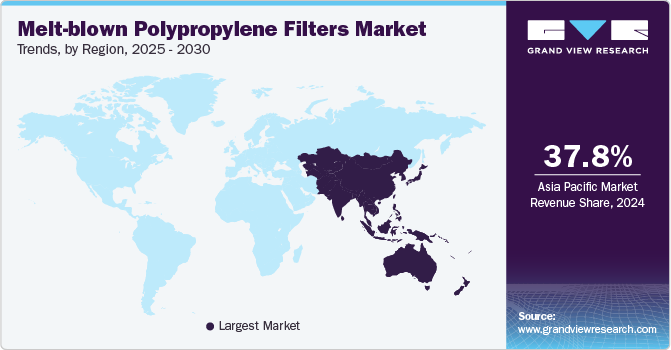

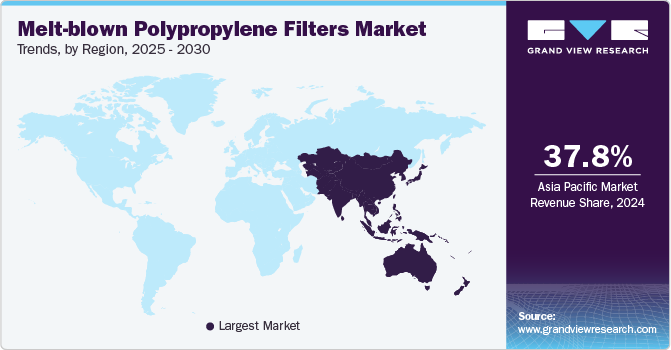

North America accounted for 26.4% revenue share of the global melt-blown polypropylene filters market in 2024. The region is experiencing a growing demand for high-efficiency filtration solutions across various sectors, including healthcare, automotive, and industrial applications. Regulatory requirements for air and water quality also drive market growth, as businesses seek to comply with stringent standards.

U.S. Melt-blown Polypropylene Filters Market Trends

The U.S. dominated the North American melt-blown polypropylene filter market in 2024, reflecting robust advancements in manufacturing technology and increasing investments in filter production. The healthcare sector, in particular, has been a key driver, spurred by heightened awareness of air quality and contamination risks. Innovations in filter design and materials are expected to propel market expansion further, catering to diverse applications and enhancing overall efficiency.

Europe Melt-blown Polypropylene Filters Market Trends

The melt-blown polypropylene filter market in Europe is anticipated to grow steadily throughout the forecast period. A rising emphasis on sustainable filtration solutions and stringent environmental regulations supports this growth. The region's focus on improving air and water quality and developing advanced filtration technologies positions it for a gradual yet consistent market expansion.

Asia Pacific Melt-blown Polypropylene Filters Market Trends

The Asia Pacific dominated the global melt-blown polypropylene filters market in 2024. Rapid industrialization, urbanization, and growing environmental concerns have driven significant demand for efficient filtration systems. The region's expanding manufacturing capabilities and rising health consciousness among consumers are fostering a robust market landscape. Investments in infrastructure and technological advancements are expected to sustain this momentum, making the Asia Pacific a pivotal market for melt-blown polypropylene filters in the coming years.

Key Melt-Blown Polypropylene Filters Company Insights

Some of the key companies in the melt-blown polypropylene filters market include Lenntech B.V., Borealis AG, Parker Hannifin Corporation, Suez, United Filters International (UFI), Brother Filtration, and others.

-

Lenntech B.V. is a key player in the melt-blown polypropylene filters market, renowned for its innovative water treatment solutions. The company delivers high-quality filtration products tailored for various applications, including industrial processes and municipal water systems.

-

Suez offers a broad range of melt-blown polypropylene filters for various applications, including water treatment, air filtration, and process industries. Their filters feature gradient density structures that provide low-pressure drop and high dirt-holding capacity.

Key Melt-blown Polypropylene Filters Companies:

The following are the leading companies in the melt-blown polypropylene filters market. These companies collectively hold the largest market share and dictate industry trends.

- Lenntech B.V.

- Borealis AG

- Parker Hannifin Corporation

- Suez

- United Filters International (UFI)

- Brother Filtration

- Trinity Filtration Technologies Pvt. Ltd.

- Clack Corporation

- 3M

- Pall Corporation

- Eaton

Recent Developments

-

In June 2021, Medicom Group Inc. established Meltech Innovation Canada Inc. to produce and innovate melt-blown polypropylene filters, a key component of surgical, pediatric, and N95 masks. This expansion marks a significant step toward domestic production of this critical material in Canada.

Melt-blown Polypropylene Filters Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 2.09 billion

|

|

Revenue forecast in 2030

|

USD 2.85 billion

|

|

Growth rate

|

CAGR of 6.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion/million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Media, application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Germany, UK, China, Japan, India, Brazil,

|

|

Key companies profiled

|

Lenntech B.V., Borealis AG, Parker Hannifin Corporation, Suez, United Filters International (UFI), Brother Filtration, Trinity Filtration Technologies Pvt. Ltd., Clack Corporation, 3M, Pall Corporation, Eaton

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Melt-Blown Polypropylene Filters Market Report Segmentation

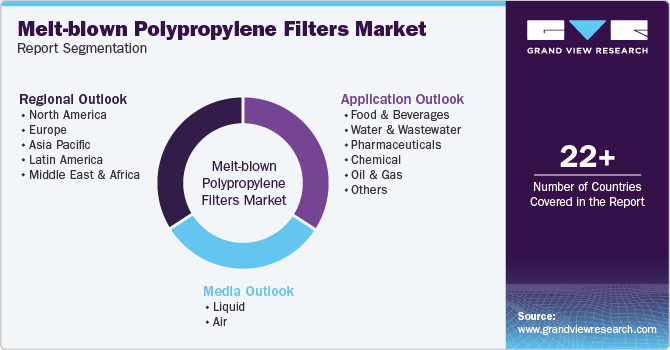

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global melt-blown polypropylene filters market report based on media, application, and region.

-

Media Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Water & Wastewater

-

Pharmaceuticals

-

Chemical

-

Oil and Gas

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)