- Home

- »

- Advanced Interior Materials

- »

-

Membrane Separation Technology Market Size Report, 2030GVR Report cover

![Membrane Separation Technology Market Size, Share & Trends Report]()

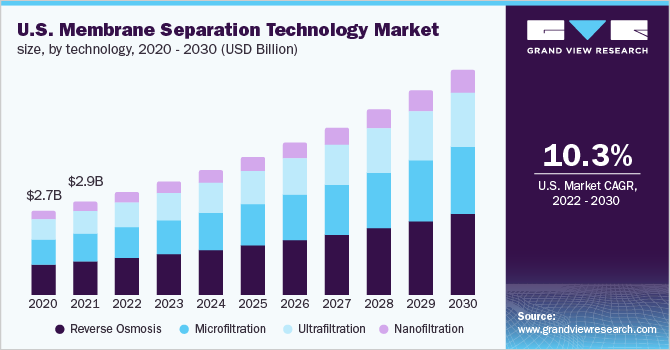

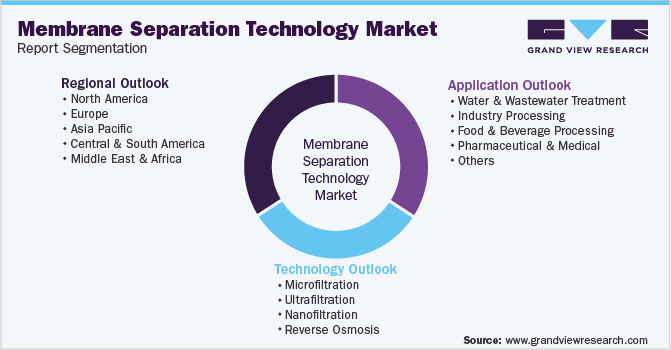

Membrane Separation Technology Market Size, Share & Trends Analysis Report By Technology (Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-503-8

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

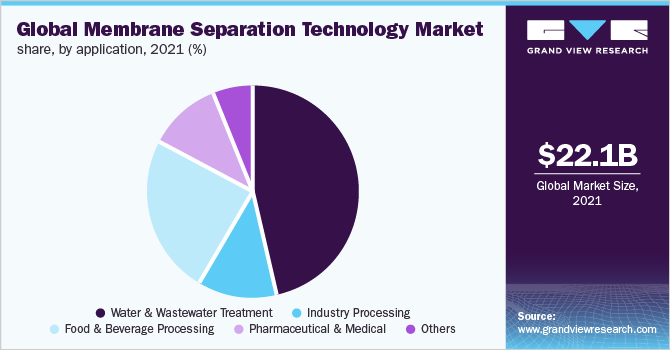

The global membrane separation technology market size was estimated at USD 22.08 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 12.2% over the forecast period. This growth is attributed to the growing environmental restriction on untreated wastewater discharge. Additionally, the rising adoption of membrane separation technology in the dairy processing and beverages industry is expected to have a positive impact on membrane separation technology growth over the forecast period.

The COVID-19 outburst across the globe severely impacted the trade relations of major players. Supply of raw materials and finished goods related to membrane separation technology has been hampered owing to restrictions on trade and manufacturing in some economies. However, gradual resumption of industrial activities and trade operations to smoothen economic conditions, several economies are offering ease in trade operations, thus, positively impacting the market.

The U.S. Food and Drug Administration (FDA) has suggested the implementation of RO pre-filtration in the food & beverage industry to reduce the possibility of biofilm formation. Membranes used in the reverse osmosis (RO) pre-filtration process increase the surface area of filtration, thereby, improving the overall efficiency of the separation process. Hence, the implementation of the RO pre-filtration process coupled with the food & beverage industry is anticipated to promote market growth.

The membrane separation technology is expected to witness a higher rate of adoption in the food & beverages processing industry. Growing demand for reverse osmosis and ultrafiltration separation technologies for removing contaminants from water, milk, and wine, is expected to have a positive impact on the market. Furthermore, government regulations pertaining to food safety and pollution control are expected to propel the growth of the market over the forecast period.

The global increase in population is exerting considerable stress on the existing water resources across the world. Furthermore, the continuous exploitation of surface and underground resources is reducing the per capita availability of water. Globally, there has been a growing focus on recycling and reusing municipal and industrial wastewater thereby driving the demand for membrane separation technology.

The increase in per capita income is proving to be the primary factor driving the demand for various alcoholic beverages such as wine and beer. Countries such as India, China, and Vietnam are witnessing a continuous increase in consumption volume for beer and wine. Furthermore, an increase in per capita income also has a positive impact on consumption levels of dairy products. Thus, the growth of the alcoholic beverages and dairy processing industry is expected to generate significant demand for membrane separation technology over the forecast period.

Technology Insights

Reverse osmosis led the market and accounted for the largest revenue share of 42.0% in 2021. Reverse osmosis emerged as the largest technology segment, in terms of revenue, owing to its widespread utilization in residential and industrial applications. Furthermore, the growing adoption of reverse osmosis as an alternative to the thermal desalination process is expected to boost segment growth.

Microfiltration is a low-pressure separation process. It uses membrane separation technology with open-pore structures and pore sizes ranging from 0.1 microns to 1 micron. The key application areas of microfiltration technology include municipal water treatment plants and pre-treatment desalination plants. Microfiltration separation technology is also used in combination with other membrane technologies such as reverse osmosis, nanofiltration, and ultrafiltration for pre-treating liquids.

Ultrafiltration membrane has the ability to filter particles that are 5,000 times smaller than the width of human hair. This membrane has a recovery rate of about 90-95%. As a result, it is widely used to treat wastewater for reuse purposes. Furthermore, the use of ultrafiltration as an alternative to reverse osmosis technology in household water purification systems has the potential to generate considerable water savings owing to its superior recovery rate.

Nanofiltration is a liquid membrane separation technology placed between reverse osmosis and ultrafiltration. The pore structure of these membranes is relatively large compared to the RO membrane. As a result, these membranes are unable to filter salts. Nanofiltration membranes have a pore size of approximately 1-5 nm and a molecular weight cut-off between 150 and 500 Dalton.

Application Insights

The water & wastewater treatment segment led the membrane separation technology and accounted for the largest revenue share of 46.1% in 2021. Various governments and several regulatory agencies have issued multiple regulations and mandates concerning water treatment and disposal to safeguard the environment. Strict enforcement of these regulations is prompting industries to adopt environment-friendly wastewater treatment processes, thereby, favorably influencing the global demand for membrane separation technologies.

The increasing industrialization in emerging economies such as China, India, Vietnam, and Brazil is expected to drive the demand for membrane separation technology. Rising technological innovations coupled with increasing R&D initiatives are anticipated to have a positive impact on product demand in the industrial processing segment. The emergence of new applications such as the solvent recovery process is expected to augment the market growth.

The increasing disposable income in regions such as North America is expected to promote the growth of the food & beverage industry. Membrane filtration processes are used in the food & beverage industry to eliminate contaminants from water, milk, wine, and others. Government regulations related to food safety and pollution control are expected to propel the growth of the membrane filtration technology market in this application segment over the forecast period.

The growing investment in the development of healthcare facilities, rising per capita income, improvement in diagnostic technology and increasing prevalence & treatment of chronic diseases are some of the factors propelling the growth of the pharmaceutical industry. Furthermore, the rapid growth of the geriatric population in developed countries such as the U.S., Germany, and Japan is expected to generate significant demand for pharmaceutical products over the forecast period.

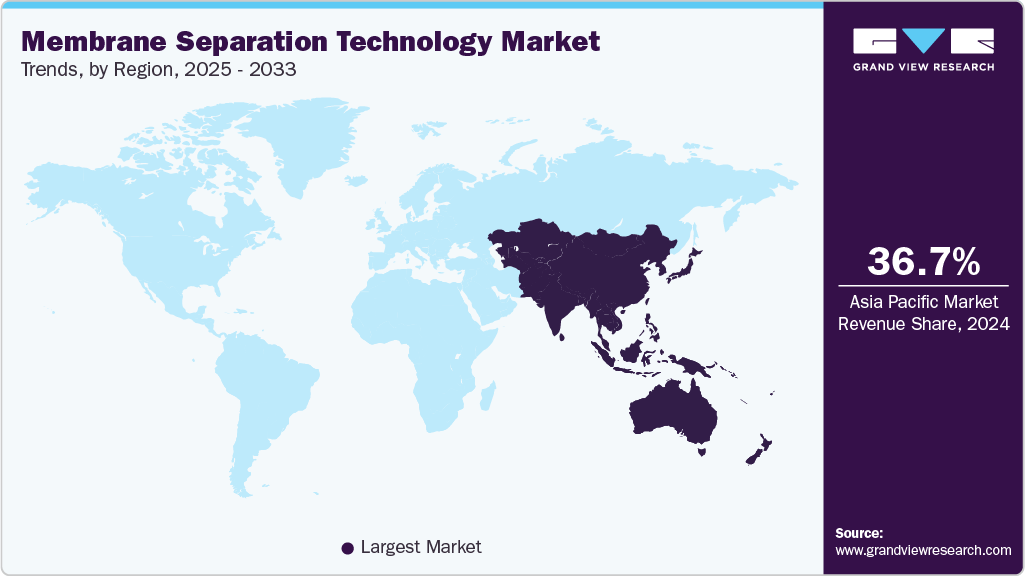

Regional Insights

Asia Pacific region dominated the market and accounted for a revenue share of 35.0% in the global membrane separation technology industry in 2021. The Asia Pacific market is projected to grow significantly over the forecast period. The market growth is expected to bolster on account of rapid industrialization and rising environmental concerns in the emerging economies of the region. Furthermore, increasing government initiatives to develop water and wastewater treatment plants in India and China are expected to have a positive impact on market growth over the forecast period.

The North America market is anticipated to experience rapid growth on account of the rapid adoption of the technology for its utilization in application industries. The demand for ultrafiltration in North America is expected to witness growth at a rate of 10.8% over the forecast period owing to stringent norms and industrial laws governing water filtration performance & standards established by the EPA.

The German Federal Wastewater Charges Act imposes charges on entities that discharge wastewater into water bodies. The objective of this act is to minimize the release of contaminants into the environment, thereby, limiting environmental degradation. The imposition of a fine by the government on industries causing pollution is anticipated to promote wastewater treatment, in turn, propelling the market growth over the forecast period.

Central & South America is expected to grow as a destination for mining investments and oil & gas exploration, which can be attributed to relatively low production costs in the region and a conducive regulatory environment for industrial growth. Mining activities result in the discharge of toxic wastewater into the environment, which results in environmental degradation. National governments along with the environmental protection bodies in the region are expected to impose stringent regulations on mining industries to limit the contamination of water bodies and freshwater streams, thereby, driving the demand for membrane separation technology.

Key Companies & Market Share Insights

The global membrane separation technology market is characterized by the presence of a large number of players, with established players leading the market trends. The majority of these companies focus on forward integration by providing their products directly to end-users across different industry verticals. Some of these companies also use an established distribution and sales network to connect with their customers across regions easily.

Increasing investments and continuous R&D in membrane separation technology have led to the introduction of membrane separation products with enhanced durability and higher flow rates. Moreover, manufacturers are developing industry application membrane separation technology to address the specific requirements of the end-use industries. For instance, manufacturers have launched membrane products adhering to food contact regulations formulated by the USFDA and the European Union.Some prominent players in the global membrane separation technology market include:

-

SUEZ

-

Merck KGaA

-

Toray Industries Inc.

-

Pentair plc

-

Hydranautics

-

AXEON Water Technologies

-

GEA Group Aktiengesellschaft

-

Hyflux Ltd.

-

Koch Membrane Systems, Inc.

-

Corning Incorporated

-

HUBER SE

-

Pall Corporation

-

3M Company

-

Asahi Kasei Corporation

-

DuPont de Nemours, Inc.

Membrane Separation Technology Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 24.65 billion

Revenue forecast in 2030

USD 62.45 billion

Growth rate

CAGR of 12.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Russia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

SUEZ; Merck KGaA; Toray Industries Inc.; Pentair plc; Hydranautics; AXEON Water Technologies; GEA Group Aktiengesellschaft; Hyflux Ltd.; Koch Membrane Systems, Inc.; Corning Incorporated; HUBER SE; Pall Corporation; 3M Company; Asahi Kasei Corporation; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Membrane Separation Technology Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2017 to 2030. For this study, Grand View Research has segmented the membrane separation technology market based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Microfiltration

-

Ultrafiltration

-

Nanofiltration

-

Reverse Osmosis

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Water & Wastewater Treatment

-

Industry Processing

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane separation technology market size was estimated at USD 22.08 billion in 2021 and is expected to reach USD 24.65 billion in 2022.

b. The global membrane separation technology market is expected to grow at a compound annual growth rate of 12.2% from 2021 to 2030 to reach USD 62.45 billion by 2030.

b. Reverse osmosis emerged as the largest technology segment with a market share of 42% in 2021. This is attributed its widespread utilization in residential and industrial applications.

b. Some of the key players operating in the membrane separation technology market include Merck KGgA, Toray Industries, Inc., Pentair plc, Hydranautics, AXEON Water Technologies, GEA Group Aktiengesellschaft, Hyflux Ltd., Koch Membrane Systems, Inc., Corning Incorporated, HUBER SE, Pall Corporation, 3M Company, SUEZ and Asahi Kasei Corporation.

b. The key factors that are driving the membrane separation technology market include growing environmental restrictions on untreated wastewater discharge and rising adoption of membrane separation technology in the dairy processing and beverages industry

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."