- Home

- »

- Clothing, Footwear & Accessories

- »

-

Men’s Wear Market Size, Share And Trends Report, 2030GVR Report cover

![Men’s Wear Market Size, Share & Trends Report]()

Men’s Wear Market Size, Share & Trends Analysis Report By Apparel (Top Wear, Bottom Wear, Innerwear), By Category (Mass, Premium, Luxury), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-422-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Men’s Wear Market Size & Trends

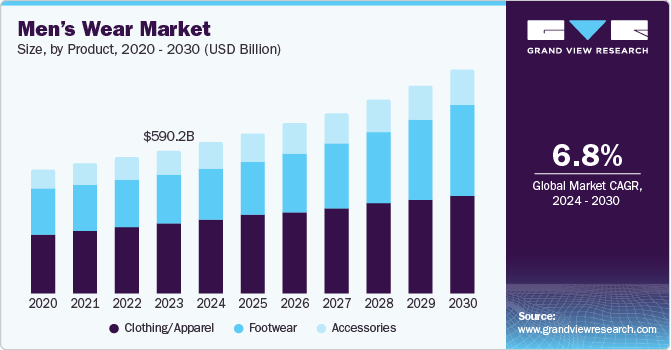

The global men’s wear market size was estimated at USD 537.31 billion in 2023 and is expected to grow at a CAGR of 4.4% from 2024 to 2030. The market demand and preference for men’s wear are rising due to several significant factors that reflect broader societal and economic changes. One of the primary reasons is the evolving norms around fashion. Traditionally, men's fashion was considered less dynamic compared to women's, but this perception has shifted dramatically. Modern fashion norms encourage men to express their personal style and experiment with different trends, which has led to increased interest in fashionable and high-quality clothing. Men are now more engaged with their wardrobe choices, driven by a desire to reflect their individuality and stay current with fashion trends.

Social media and pop culture have also played a crucial role in shaping this shift. Platforms like Instagram and TikTok, along with the influence of celebrities and fashion icons, have amplified the visibility of diverse and premium fashion styles. Men are inspired by these influences to invest in their appearance, seeking to emulate the sophisticated looks of public figures and showcase their own style. This influence has made high-end and designer clothing more desirable, driving up the willingness to spend on luxury items.

Economic factors also contribute to this trend. As disposable incomes rise, particularly in economically stable regions, men are increasingly able to afford premium and luxury items. Higher financial stability allows consumers to invest in quality clothing that offers both style and durability. This willingness to spend reflects a broader trend where men view fashion as a worthwhile investment in their personal and professional image.

Additionally, the focus on personal branding and professional image has intensified. In a competitive job market and social environment, appearance is increasingly linked to career success and personal status. Investing in high-quality, stylish clothing helps men project a polished and professional image, which can be advantageous in both career and social settings. This emphasis on image and the desire to stand out contribute to the growing preference for premium men’s wear.

Moreover, there is a growing need for occasion-specific and versatile clothing among men. Consumers are increasingly looking for formal wear, ethnic wear, and sportswear that cater to specific events. At the same time, there is a preference for versatile and comfortable all-season wear that can be worn for various occasions, reflecting a shift in lifestyle and fashion choices.

Apparel Insights

Top wear accounted for a revenue share of 55.2% in 2023. There has been a significant shift toward casual and athleisure styles in men's fashion, especially in the last decade. With more men working from home or opting for relaxed dress codes even in professional settings, there is a growing demand for comfortable yet stylish top wear such as T-shirts, hoodies, sweatshirts, and polos. These versatile pieces cater to both casual and semi-formal occasions, making them a popular choice for modern consumers who value comfort and adaptability in their wardrobes. Advances in textile technology and design have made top wear more appealing to men. Brands are investing in innovative fabrics that offer better comfort, moisture-wicking properties, and durability, catering to active lifestyles.

Innerwear is expected to grow at a CAGR of 5.2% from 2024 to 2030. Men are becoming more aware of the importance of comfort and fit in their innerwear choices. With increasing awareness of how crucial a good fit and comfortable material is to daily comfort, men are investing more in high-quality innerwear that offers better support, breathability, and a snug fit. This shift is driven by both personal comfort preferences and a desire for innerwear that accommodates active and varied lifestyles. There have been significant advancements in fabric technology used in men's innerwear, such as moisture-wicking materials, antimicrobial fabrics, and breathable microfibers. These innovations enhance comfort, hygiene, and durability, making modern innerwear more appealing to consumers.

Distribution Channel Insights

Sales through offline stores accounted for a revenue share of 79.3% in 2023. Shopping in physical stores allows consumers to immediately obtain their purchases. This instant gratification is appealing to those who prefer to try on clothing and take it home right away, rather than waiting for shipping or dealing with potential delivery delays. The ability to physically handle and inspect items before purchasing also enhances satisfaction. Consumers can try on clothing to assess fit, comfort, and style, which helps in making more informed purchase decisions. Additionally, in-store shopping allows customers to feel the quality of fabrics and see the true colors and details of garments, leading to greater confidence in their choices.

The online segment is expected to grow at a CAGR of 4.9% from 2024 to 2030. Online stores offer a broader selection of men's wear compared to physical retail outlets. Consumers can easily explore various brands, styles, sizes, and price ranges in one place, allowing for a more comprehensive shopping experience. This variety makes it easier for shoppers to find specific items or compare different options, which can enhance satisfaction and meet diverse fashion needs. It also provides access to customer reviews and ratings, which can significantly influence purchasing decisions. Reviews offer insights into the quality, fit, and comfort of men's wear, helping consumers make more informed choices.

Category Insights

The mass segment accounted for a revenue share of 68.2% in 2023. Mass-category men's wear offers a more affordable option for consumers, allowing them to purchase clothing without straining their budgets. With economic uncertainties and a growing emphasis on cost-effective shopping, many men are opting for mass-market brands that provide good quality at reasonable prices. This affordability makes mass-category men's wear accessible to a broad consumer base, from students to working professionals, driving up demand. Additionally, mass category men's wear is widely available across various retail channels, including department stores, supermarkets, and online platforms. This accessibility ensures that consumers can easily find and purchase these products, regardless of location.

The luxury segment is expected to grow at a CAGR of 5.1% from 2024 to 2030. Luxury men's wear is often associated with superior craftsmanship, high-quality materials, and exclusive designs that are not available in mass-market fashion. Consumers are increasingly seeking out luxury brands for their reputation for durability, comfort, and timeless style. This emphasis on quality and exclusivity appeals to consumers who view their clothing as an investment and a means of expressing personal status and sophistication. As global economies grow and disposable incomes increase, particularly in emerging markets, more consumers have the financial means to invest in luxury fashion.

Regional Insights

North America men’s wear market accounted for a market share of 37.8% in 2023 and is expected to grow at a CAGR of 4.7% during the forecast period from 2024 to 2030. There is a rising trend among North American men toward fashion and personal style. As societal attitudes toward men's fashion evolve, more men are investing in stylish and trendy clothing. This shift is driven by an increasing emphasis on individual expression and the desire to keep up with evolving fashion trends. Men’s wear brands are responding to this demand with diverse and fashionable collections that cater to various tastes and preferences.

U.S. Men’s Wear Market Trends

The men’s wear market in the U.S. is facing intense competition and innovation. The growth of both physical and online retail channels has made men's wear more accessible to consumers. The expansion of e-commerce platforms, coupled with the presence of major retail chains and specialty stores, has increased the availability of diverse men's wear options. This expanded reach allows consumers to easily shop for a wide range of styles and brands, contributing to the overall growth in demand.

Europe Men’s Wear Market Trends

The men’s wear market in Europe is expected to grow at a CAGR of 4.6% during the forecast period. Europe has a rich tradition of fashion and style, with iconic fashion capitals like Paris, Milan, and London setting global trends. The continent's deep-rooted fashion culture influences consumer preferences and drives demand for high-quality, stylish men's wear. European men are increasingly inclined to invest in fashion-forward clothing that reflects the region’s renowned style standards and heritage.

Asia Pacific Men’s Wear Market Trends

The men’s wear market in Asia Pacific is expected to grow at a CAGR of 5.3% during the forecast period from 2024 to 2030. Economic stability and rising disposable incomes across Asia Pacific have led to increased consumer spending on fashion. With more financial resources available, Asian consumers are willing to invest in both premium and luxury men’s wear. Higher purchasing power enables them to buy quality clothing, including designer pieces and sophisticated styles. Media and pop culture greatly influence men's fashion trends and consumer preferences. The rise of celebrities and fashion influencers on social media has sparked increased interest in stylish clothing, encouraging men to explore and purchase new styles, which has led to a growing demand for men's wear.

Key Men’s Wear Company Insights

The men’s wear market is characterized by dynamic competitive dynamics shaped by a combination of factors, including apparel innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality apparel.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Men’s Wear Companies:

The following are the leading companies in the men’s wear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- H&M Hennes & Mauritz AB

- ZARA (Industria de Diseño Textil, S.A.)

- UNIQLO Co., Ltd.

- Levi Strauss & Co.

- Ralph Lauren Corporation

- PVH Corp. (includes Calvin Klein and Tommy Hilfiger)

- HUGO BOSS AG

- Under Armour, Inc.

Recent Developments

-

In March 2023, Muzo launched a new summer collection of luxury men’s wear shirts in India, featuring a range of stylish and comfortable options designed for the warm season. The collection includes a variety of fabrics, colors, and patterns, emphasizing breathability and elegance. Muzo aims to cater to the modern man who values both style and comfort in his wardrobe. The new shirts are crafted from high-quality materials, ensuring durability and a premium feel.

Men’s Wear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 559.21 billion

Revenue forecast in 2030

USD 725.15 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Apparel, category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

Nike, Inc., Adidas AG, H&M Hennes & Mauritz AB, ZARA (Industria de Diseño Textil, S.A.), UNIQLO Co., Ltd., Levi Strauss & Co., Ralph Lauren Corporation, PVH Corp. (includes Calvin Klein and Tommy Hilfiger), HUGO BOSS AG, Under Armour, Inc

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Men’s Wear Market Report Segmentation

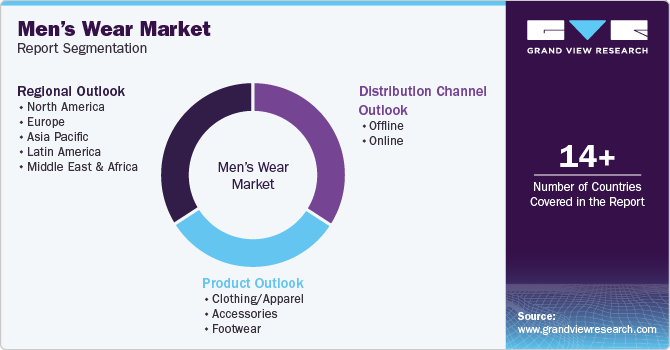

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global men’s wear market report based on apparel, category, distribution channel, and region:

-

Apparel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Top wear

-

Bottom wear

-

Innerwear

-

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

Luxury

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Clothing Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."