- Home

- »

- Healthcare IT

- »

-

Mental Health Screening Market Size & Share Report, 2030GVR Report cover

![Mental Health Screening Market Size, Share & Trends Report]()

Mental Health Screening Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Cognitive, Behavioral), By Demography, By Solution Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Mental Health Screening Market Trends

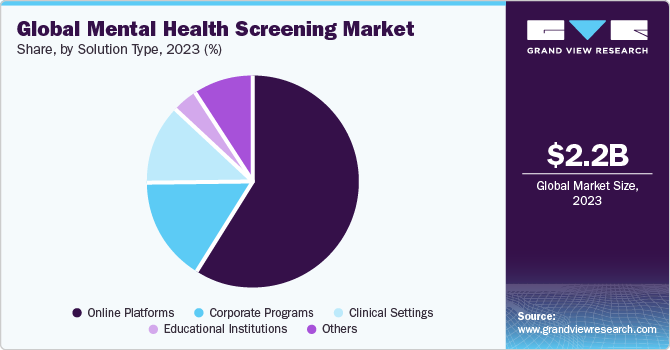

The global mental health screening market size was estimated at USD 2.16 billion in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. The market growth can be attributed to the rising prevalence of mental disorders, increasing government initiatives & policies, adoption of AI-based screening tools and advanced mental health screening tools. Moreover, the increasing integration of mobile platforms and the rise of social media are further fostering market growth.

The global prevalence of mental disorders, such as depression, anxiety, and substance abuse, is increasing, thereby driving the demand for early detection and intervention. In June 2022, the World Health Organization (WHO) released a report on the prevalence of mental disorders. The report highlighted that approximately 970 million individuals, or roughly 1 in 8 people globally, were living with a mental disorder in 2019. Mental disorders contribute approximately 13% of the global burden of disease, making it one of the leading causes of disability worldwide. Furthermore, according to a Forbes released report on Mental Health and Stats, anxiety disorders rose 25% in 2023, increasing the number of affected people from 298 million to 374 million.

Moreover, innovative digital health technologies have expanded the market's reach, providing accessible and convenient options for remote screening, innovative referrals, and mobile health apps. For instance, in August 2022, Brave Health announced an innovative referral partnership with MedArrive, the company engaged in providing a mobile-integrated care management platform. This strategic partnership aims to streamline the process of connecting individuals in need of mental health assistance to Brave Health's specialized behavioral health professionals. This real-time referral system ensures that the concerned member can access appropriate care within a short timeframe, enhancing the overall efficiency and accessibility of mental health services for Medicaid beneficiaries. Such an initiative will supplement the market for mental health screening.

Governments and healthcare systems are implementing policies and initiatives to promote AI-based mental health screening and early intervention. They are providing funding and resources for screening programs. For instance, in March 2022, Woebot Health announced a USD 9.5 million strategic investment from Leaps by Bayer, the impact investment arm of Bayer AG. This funding is aimed at accelerating the advancement of Woebot Health's AI-driven behavioral health platform and products. This investment in Woebot Health marks Leaps from Bayer's initial investments in mental health. In addition, the rise of such telehealth services has created a need for remote mental health screening tools that can be seamlessly integrated into virtual care delivery models.

The development of digital screening tools, online platforms, and mobile applications has made mental health screening more convenient and accessible, particularly for remote or underserved populations. Several manufacturers are involved in the production and introduction of mobile apps that offer mental health screening tools, along with resources for meditation, mindfulness, and cognitive-behavioral therapy. For instance, Flow, an app by Flow Neuroscience aiding in depression management, experienced a 247% rise in sales of its home-based brain stimulation headset during the pandemic. This device is used in conjunction with the Flow app for depression treatment. Furthermore, according to Med-Tech Innovation's reports, during the COVID-19 pandemic, approximately 30% of Flow app and headset users successfully overcame depression. Such instances demonstrate increasing adoption, contributing to the market's growth.

Furthermore, utilizing AI for customized and predictive analytics in mental health screening offers substantial prospects for market progression. Establishing collaborations with educational and corporate sectors to integrate mental health screenings in schools and workplaces is anticipated to present profitable avenues for market expansion.

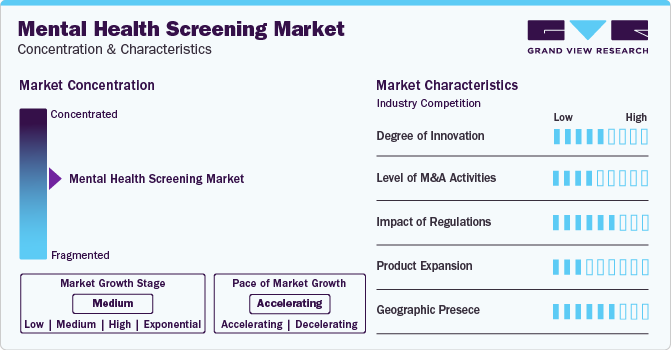

Market Concentration & Characteristics

Growing innovations & advancements are improving access, accuracy, and personalization, ultimately contributing to better mental health outcomes and earlier intervention. For instance, in November 2023, the National Institute for Health and Care Excellence (NICE) highlighted a recent innovation for the treatment of depression. This innovative approach combines the use of the Flow transcranial direct current stimulation (tDCS) headset with a behavioral therapy app. The headset is connected to a guided app and allows for remote monitoring by clinicians through a portal.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for mental health screening products and services. For instance, in January 2022, Headspace health, a digital mental health services provider, acquired Sayana, an AI-centered mental health and wellness company. This takeover enables Headspace Health to incorporate Sayana's AI technology into its platform, thereby enhancing patient care with more tailored and efficient support.

The impact of regulation on mental health screening is estimated to be moderate, as many regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), require clinical validation and evidence of efficacy for mental health apps and screening tools that make clinical claims or provide treatment recommendations. This process can be time-consuming and costly, potentially hindering the rapid development and deployment of new technologies. Furthermore, mental health apps and screening tools must comply with these regulations to protect user privacy and prevent unauthorized access to sensitive health data.

Product expansion in the market consists of manufacturers expanding their portfolio range for better service offerings and to grow their global customers. By leveraging cutting-edge technologies, data-driven approaches, and collaborative efforts, product expansion is transforming the market for mental health screening.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in August 2023, Headspace, a company that provides digital mental health services, joined forces with Castell, a value-based care subsidiary of Intermountain Healthcare. The partnership was formed to expand the availability of virtual mental health services. Such initiatives will accelerate the demand for mental health screening tools.

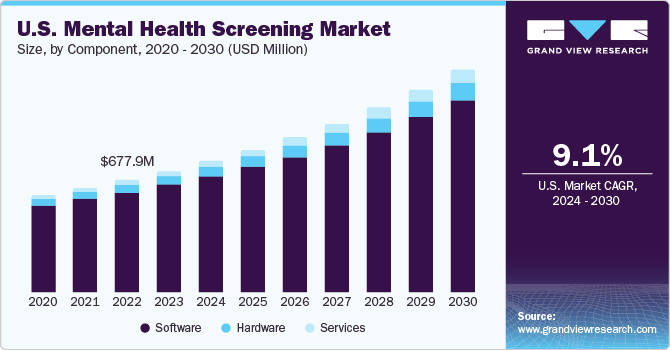

Component Insights

The software segment held the largest revenue share of 88.2% in 2023. The software segment consists of AI-based screening tools, self-screening mhealth apps, remote mental health, platforms & virtual care solutions and telehealth. These tools can provide personalized screening recommendations, thereby fostering segment growth. Furthermore, the proliferation of smartphones and the increasing focus on mental health awareness have driven the adoption of software services and platforms such as self-screening mHealth apps and remote mental health platforms. For instance, in April 2024, Fortis Healthcare launched an AI-powered application to assist individuals with mental health issues. The app includes a self-assessment tool that utilizes AI to provide personalized assessments to users.

The services segment is anticipated to witness the fastest CAGR over the forecast period. The growth is attributable to healthcare providers, mental health clinics, and specialized screening centers offering professional mental health screening and assessment services. These services employ trained professionals who administer standardized screening tools, interpret results, and provide recommendations for further evaluation or treatment. Furthermore, the partnerships between healthcare providers and technology companies are also driving the segment growth. For instance, the American Psychological Association (APA) and the National Board for Certified Counsellors (NBCC) have expanded their training and certification programs for mental health professionals in administering and interpreting screening tools. In addition, the National Alliance on Mental Illness (NAMI) has partnered with various manufacturers through its partnership program to provide online therapy and counseling services to its members.

Solution Type Insights

The online platforms segment held the largest revenue share of 59.0% in 2023. The availability of user-friendly and customized assessment tools plays a significant role in market growth. Online platforms employ a mix of screening techniques to offer individuals comprehensive, convenient, and tailored evaluations of their mental health status and requirements. Consequently, the efforts from the government in various regions to foster mental health awareness facilitate early intervention and ensure access to support services for those seeking assistance in maintaining their emotional well-being. For instance, in January 2024, the Department of Health Care Services (DHCS), California state, unveiled the Behavioral Health Virtual Services Platform, which consists of two complementary applications focused on behavioral health services for families with children, adolescents, and young adults aged 0-25 years. Such availability of nationwide online platforms and portals is driving market growth.

The corporate programs segment is anticipated to witness the fastest CAGR over the forecast period. Companies are recognizing the impact of mental health on employee productivity, absenteeism, and overall organizational performance. As a result, they are implementing mental health screening programs as part of their wellness initiatives to identify and support employees struggling with mental health issues. Companies are partnering with mental health service providers, such as Employee Assistance Programs (EAPs), to offer mental health screening, counseling, and other support services to their employees.

Demography Insights

Adults (Age 19-64) demography held the largest market share with 41.5% in 2023. This is due to the rising prevalence of mental illness amongst the age group over the years. For instance, in February 2024, according to a health article published by Forbes, mental illness is most prevalent among young adults aged between 26 and 49 years (29.4%) and adults aged 50 and over (13.9%) in the U.S. Anxiety disorders were found to be the most common mental illness among adults, with a prevalence rate of 19.1% in 2020. Depressive disorders came in second at 7.8%, followed by bipolar disorder at 2.8%. In addition, among adults with serious mental illness (SMI), which includes conditions like schizophrenia, bipolar disorder, and major depression, the usage of mental health services was higher; it is approximately 1 in 25 U.S. adults.

Children & Adolescents (Age 0-18 Years) demography is anticipated to witness the fastest CAGR over the forecast period. According to CDC data, over 20% of youth aged 13-18 have experienced debilitating mental illness. Furthermore, the government raising concern and awareness through various programs is also driving market growth. For instance, the American Academy of Pediatrics (AAP) recommends universal mental health screening for all children and adolescents during routine well-child visits. Screening tools commonly used for children and adolescents include the Pediatric Symptom Checklist (PSC), the Patient Health Questionnaire for Adolescents (PHQ-A), and the Strengths and Difficulties Questionnaire (SDQ).

Application Insights

Physiological disorders dominated the application segment in 2023, with the largest revenue share of 45.2%. This is attributable to the high prevalence of physiological disorders such as anxiety, depression, bipolar disorder, eating disorders, andpost-traumatic stress disorder (PTSD). According to the World Health Organization (WHO), globally, more than 264 million people of all ages suffer from depression. Approximately 3.5% of U.S. adults experience PTSD annually, while 8% of adolescents aged 13-18 have a lifetime prevalence of this condition. It is projected that roughly 1 in 11 individuals may receive a PTSD diagnosis throughout their lives. Thus, a number of companies are leveraging smartphone data and wearable devices to monitor mental health indicators and detect potential physiological disorders, which is driving the market growth.

Cognitive disorders are anticipated to witness the fastest CAGR over the forecast period. The growing geriatric population, increased incidence of neurodegenerative diseases, heightened awareness, and enhanced access to screening tools contribute to the market growth. For instance, as per the GVR Internal Database, in 2023, there were 1.7 million cases of Alzheimer's disease in Germany. Cognitive disorders can significantly impact a person's ability to perform daily activities and maintain independence. These disorders tend to affect older adults the most, but younger individuals may also experience them due to factors such as traumatic brain injury, genetic predispositions, or neurological conditions.

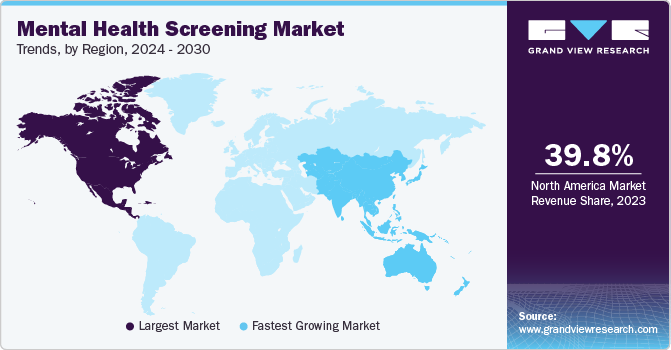

Regional Insights

North America mental health screening market accounted for the largest global revenue share of over 39.8%. The growth is attributed to the favorable government initiatives coupled with the growing patient population. Moreover, growing societal awareness and acceptance of mental health issues have spurred an increased demand for mental health screening services.

U.S. Mental Health Screening Market Trends

The mental health screening market in the U.S. held the largest share of 85.19% in 2023 in the North American region. The prevalence of mental disorders in the country is quite high. Therefore, mental health screening is being integrated into primary care settings like physician offices and community health centers. This approach aims to reduce the stigma around mental health and promote early intervention. The rise in severe psychotic disorders, bipolar disorders, severe anxiety, and eating disorders that significantly impair functioning is also raising concern. As per the NAMI report, in 2021, about 6% of U.S. adults experienced a serious mental health condition. In addition, Mental Health America (MHA) highlights that 19.1 million American adults aged 18 to 54 have an anxiety disorder, and about 2.3 million are affected by bipolar disorders. Such factors drive the need for the integration of mental screening into a large population set, thus driving market growth.

The Canada mental health screening market is anticipated to register the fastest CAGR in North America over the forecast period. The rising geriatric population is driving the need for mental health screening in Canada. The efforts to raise awareness about mental health and reduce stigma have contributed to a greater willingness to seek mental health screening and support services in Canada. The Canadian government has implemented various initiatives and allocated funding to support mental health screening and services. For instance, the Wellness Together Canada program provides free online resources and screening tools for mental health and substance use issues. Such a factor is responsible for the growth of the mental health screening industry in Canada.

Europe Mental Health Screening Market Trends

The mental health screening market in Europe is anticipated to register a significant CAGR during the forecast period. This is attributed to an aging population in Europe. There is an increased focus on screening for cognitive impairments and dementia, driving demand for specialized screening tools and services. Increasing government initiatives for mental health disorders are anticipated to aid in market growth. For instance, in June 2023, the European Commission allocated USD 1.2 billion towards mental health initiatives across the 27-member European Union. Some of the initiatives include creating a European Code for Mental Health, launching an initiative on European depression and suicide prevention, and investigating the impact of social media and mental health campaigns in the workplace.

Germany mental health screening market is anticipated to register a considerable CAGR during the forecast period. The government has implemented several initiatives to promote mental health screening and improve access to mental health services, such as the National Strategy for Depression and the E-Health Act. In addition, the government recognizes the importance of early identification and intervention for mental health concerns in the population, thus funding various studies across the country. For instance, in January 2024, the Federal Ministry of Education and Research funds the COMO study, coordinated by Karlsruhe Institute of Technology (KIT); the study focuses on the physical and mental health of children and adolescents in Germany. The funding was valued at USD 1.92 million.

The mental health screening market in the UK is anticipated to register the fastest CAGR in Europe during the forecast period due to the increased prevalence of anxiety. In 2022, as per the ChampionhealthUK statistics, more than 8 million people will experience anxiety disorder in the UK. Furthermore, increasing smartphone usage and enhanced internet coverage are directly influencing the acceptance of mental health solutions. According to Kepios statistics, in 2023, approximately 83% of UK adults owned smartphones, while 66.11 million were existing internet users in the UK, representing nearly 98% of the total population. Consequently, the rising adoption of smartphones and internet access has significantly boosted market growth during the forecast period.

Asia Pacific Mental Health Screening Market Trends

The Asia Pacific mental health screening market is anticipated to be the fastest-growing globally owing to the rapidly developing healthcare infrastructure in major countries in the region with increasing mental health awareness. Moreover, rising prevalence of mental disorders and government initiatives to improve mental health services is anticipated to supplement market growth.

China mental health screening market is expected to witness significant CAGR over the forecast period. Increasing awareness about mental health, the rising prevalence of mental disorders, and government initiatives are fostering market growth. Some of the other key factors driving this growth include the expansion of the healthcare industry, advancements in technology, and the rising demand for early intervention and prevention in mental health care. Furthermore, the growing adoption of mHealth apps in China, where platforms such as WeChat are offering telemedicine and nursing care to the population, is boosting market growth.

The mental health screening market in India is anticipated to witness a significant CAGR over the forecast period owing to the growing prevalence of mental health disorders. Moreover, the Indian government promoted mental health care by implementing various initiatives such as the “National Tele Mental Health Programme” in the annual financial budget of 2022 - 23.

Latin America Mental Health Screening Market Trends

The mental health screening market in Latin America is anticipated to witness a significant CAGR over the forecast period. The high disease burden, coupled with rising government initiatives aimed at creating awareness and providing effective approaches to managing mental health issues, is driving market growth.

Middle East and Africa Mental Health Screening Market Trends

The mental health screening market in the Middle East and Africa is anticipated to witness a significant CAGR over the forecast period. This growth is driven by technological advancements, increasing focus on remote monitoring, and the rise of social media. In addition, the region witnesses a high prevalence of mental disorders, thereby fostering market growth.

The UAE mental health screening market is anticipated to grow significantly over the forecast period. Macroeconomic factors, including a high per capita income and government investment in healthcare infrastructure and services, are underlying factors driving the market's growth in the UAE. The government's active investment in healthcare, including mental health, has created opportunities for the market's growth.

Key Mental Health Screening Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Mental Health Screening Companies:

The following are the leading companies in the mental health screening market. These companies collectively hold the largest market share and dictate industry trends.

- Sondermind

- Riverside Community Care

- Proem Behavioral Health

- Headspace Inc.

- Quartet

- Clarigent Corporation

- Ellipsis Health, Inc.

- Adaptive Testing Technologies

- Aiberry

- Kintsugi Mindful Wellness, Inc

- Thymia Limited

- Canary Speech, Inc.

- Modern Life, Inc.

- Sonde Health, Inc.

- FuturesThrive

- Fitbit

- Apple Inc

- Cognitive Health Solutions

Recent Developments

-

In November 2023, SonderMind, a mental wellness company based in the US, announced its acquisition of Total Brain to expand its services. The acquisition aims to provide personalized mental health services to individuals, improve care methods for therapists, equip enterprises with population mental health tools, and offer comprehensive solutions to health plans.

-

In October 2023, Ellipsis Health Inc. and Augmedix collaborated to introduce AI-generated vocal biomarker technology for automated mental health screenings during patient visits. The technology helps to identify and monitor mental health conditions.

-

In January 2023, Metta Media, an Indian startup, announced the launch of the country’s first MyndStories platform for guidance and insights on mental health.

Mental Health Screening Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.35 billion

Revenue forecast in 2030

USD 4.17 billion

Growth Rate

CAGR of 10.1 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, demography, application, solution type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sondermind; Riverside Community Care; Proem Behavioral Health; Headspace Inc.; Quartet; Clarigent Corporation; Ellipsis Health, Inc.; Adaptive Testing Technologies; Aiberry; Kintsugi Mindful Wellness, Inc; Thymia Limited; Canary Speech, Inc.; Modern Life, Inc.; Sonde Health, Inc.; Apple; Cognitive Health Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mental Health Screening Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the mental health screening market report based on component, demography, application, solution type, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

AI-Based Screening Tools

-

Self-screening mHealth Apps

-

Remote Mental Health Platforms & Virtual Care Solutions

-

Telehealth

-

-

Services

-

-

Demography Outlook (Revenue, USD Million, 2018 - 2030)

-

Seniors (Age 65 and above)

-

Adults (Age 19-64)

-

Children & Adolescents (Age 0-18 Years)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cognitive Disorders

-

Alzheimer’s Disease

-

Cognitive Impairment

-

Dementia

-

Other Cognitive Disorders

-

-

Behavioral Disorders

-

Sleep Disorder

-

Social Withdrawal

-

Dissociative Disorder

-

Hyperactivity

-

Self-Harm

-

Aggression

-

Other Behavioral Disorders

-

-

Physiological Disorders

-

Bipolar Disorder

-

Eating Disorder

-

Substance Abuse

-

Depression

-

Anxiety

-

Post-Traumatic Stress Disorder (PTSD)

-

Other Physiological Disorders

-

-

Psychiatric Disorders

-

Psychotic Disorder

-

Dissociative Disorder

-

Obsessive Compulsive Disorder

-

Schizophrenia

-

Dissociative Disorder

-

Attention Deficit Hyperactivity Disorder (ADHD)

-

Other Psychiatric Disorders

-

-

-

Solution Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Platforms

-

Corporate Programs

-

Clinical Settings

-

Educational Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mental health screening market size was estimated at USD 2.16 billion in 2023 and is expected to reach USD 2.35 billion in 2024.

b. The global mental health screening market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 4.17 billion by 2030.

b. North America dominated the mental health screening market with a share of 39.8% in 2023. This is attributable to the favorable government initiatives coupled with the growing patient population. Moreover, growing societal awareness and acceptance of mental health issues have spurred an increased demand for mental health screening services.

b. Some key players operating in the mental health screening market include Sondermind, Riverside Community Care, Proem Behavioral Health, Headspace Inc., Quartet, Clarigent Corporation, Ellipsis Health, Inc., Adaptive Testing Technologies, Aiberry, Kintsugi Mindful Wellness, Inc,Thymia Limited, Canary Speech, Inc., Modern Life, Inc., Sonde Health, Inc., Apple, Cognitive Health Solutions

b. Key factors that are driving the market growth include the rising prevalence of mental disorders, increasing government initiatives & policies, adoption of AI based screening tools and the adoption of advanced mental health screening tools.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."