- Home

- »

- Next Generation Technologies

- »

-

Merchant Banking Services Market Size, Share Report, 2030GVR Report cover

![Merchant Banking Services Market Size, Share & Trends Report]()

Merchant Banking Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Services (Portfolio Management, Business Restructuring), By Service Provider, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Merchant Banking Services Market Summary

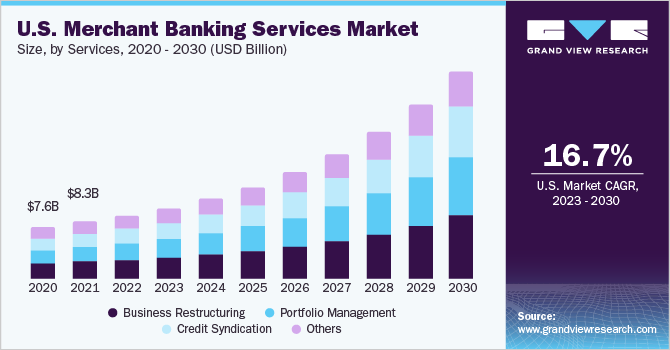

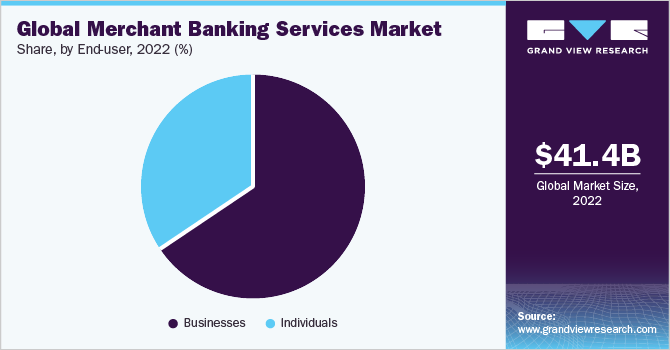

The global merchant banking services market size was estimated at USD 41.44 billion in 2022 and is projected to reach USD 143.94 billion by 2030, growing at a CAGR of 17.4% from 2023 to 2030. A merchant bank can be a banking and non-banking firm that offers several services such as fundraising, loan services, and financial advising to its customers, including High-Net-Worth Individuals (HNWI), small & medium enterprises, and startups.

Key Market Trends & Insights

- North America dominated the merchant banking services market in 2022 and accounted for more than 28.0% of revenue share.

- Asia Pacific is expected to emerge as the fastest-growing region over the forecast period.

- Based on services, the business restructuring segment dominated the market in 2022.

- Based on service provider, the banks segment dominated the market in 2022, accounting for more than a 56.0% revenue share.

- Based on end user, the business segment dominated the market in 2022 and accounted for a global revenue share of more than 65.0%.

Market Size & Forecast

- 2022 Market Size: USD 41.44 Billion

- 2030 Projected Market Size: USD 143.94 Billion

- CAGR (2023-2030): 17.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The merchant banking services growth can be attributed to increasing globalization. For instance, the expansion in international trade and commerce has driven the demand for specialized financial services to facilitate transactions and manage risks associated with cross-border trade.

Merchant banking service providers offer advice on mergers & acquisitions, restructuring, and project financing. The growth in merger and acquisition deals worldwide has allowed the market players to boost their sales and revenues. For instance, according to IMAA analysis, the number of M&A deals reached 25,170 in 2021 from 18,422 deals in 2020. Moreover, the growth in demand for merchant banking and financial services across the globe is expected to drive the market’s growth.

The growing technological advancements across various industries, including the banking and finance industries, are anticipated to drive the merchant banking services market growth over the forecast period. Leveraging technologies such as digital platforms to promote and provide merchant banking services enables market players to reach a broader range of clients and provide them with real-time information and analytics. Furthermore, increasing launches of merchant banking services over digital platforms are also expected to drive the market’s growth. For instance, in April 2023, Greengage, a UK-based digital merchant banking company, announced the launch of e-money accounts services. The company also facilitated GBP and EUR payments and cards targeting SMEs, digital assets firms, and HNWs.

Merchant banks assist companies in being listed on stock exchanges, also known as Initial Public Offering (IPO). IPO management responsibilities include conducting due diligence, appointing intermediaries, filing requisite documents, advertising, calculating issue size, and redressal of investor grievances. The recent surge in IPO participation is a direct factor contributing to the growth of merchant banking services. For instance, in August 2021, OYO Hotels and Homes, a SoftBank-backed hospitality company, announced that the company had hired a minimum of 3 merchant banks, including JPMorgan Chase & Co., Kotak Mahindra Capital Company, and Citigroup Inc, to raise USD 1.2 billion by launching its initial public offering (IPO).

The primary challenge of merchant banking services is their high costs, making them more expensive than traditional banking services. Merchant banking services are not available to the public since they serve only wealthy individuals, known as HNIs, who meet minimum asset size requirements. Additionally, merchant banking services are not guaranteed success and still have associated risks. Moreover, in terms of business clients, merchant banks do not help raise funds for startups but those businesses with good fundamentals that need help scaling.

COVID-19 Impact Analysis

The asset management industry encountered significant challenges during the COVID-19 pandemic. The uncertainties of the pandemic drove the prices of all asset classes, including stocks, bonds, and commodities, to low levels. The pandemic also resulted in innovations and exposed investors to new trading and investing methods using algorithms and robo-advisors, creating direct competition. Moreover, temporarily shrank risk appetites also meant rising participation in passive investing through Exchange Traded Funds (ETFs). As global economies recover, investors' risk appetite is expected to normalize, creating an opportunity for the resumption of merchant banking services.

Services Insights

The business restructuring segment dominated the market in 2022, accounting for a revenue share of more than 29.0%. Business restructuring involves significantly changing a company's operations, structure, or financing to improve its operational efficiency and financial position. The growth of the segment can be attributed to the rising need for business restructuring to improve their operations, reduce costs, and increase efficiency, making them more competitive in the market. For instance, in December 2019, JPMorgan Chase & Co. announced that it had reorganized its wealth management businesses. This business restructuring aimed to better compete with its rivals, including Morgan Stanley, among others.

The credit syndication segment is anticipated to register significant growth over the forecast period. Credit syndication consolidates debt with a single lending source, a financial institution, or a consortium. The growing use of merchant banks for credit syndication can be attributed to their ability to reduce the cost of debt and improve balance sheets. Moreover, with the rise in competition and the need for capital to fund business expansions and other strategies, companies are increasingly attracted toward credit syndication to secure financing.

Service Provider Insights

The banks segment dominated the market in 2022, accounting for more than a 56.0% revenue share. The dominance of the banks segment is primarily due to the large scale of operations. Investors banks, due to the trust factor embedded with big names and their ability to deploy funds and resources, often optimally undertake such operations to maximize return on investments. Furthermore, banks are subject to stringent regulations with less room for oversight. Additionally, the banks have started to offer a wide range of financial services, including loans, credit facilities, and investment advice, which are critical to the growth and success of businesses.

The non-banking institutions segment is anticipated to register significant growth over the forecast period. Non-banking institutions segment includes private companies, investment firms, or even proprietary ownerships. The most common non-banking institutions apart from investment firms include hedge funds and insurance companies. The main point of difference is that non-banking entities help in arranging for capital but are not fully licensed to be classified as banks and hence are not permitted to accept deposits.

End-user Insights

The business segment dominated the market in 2022 and accounted for a global revenue share of more than 65.0%. Business clients leveraging merchant banking services include pension funds, government institutions, global corporates, and charity organizations. Business clients are responsible for managing significant assets and resort to merchant banking service providers for active portfolio management to minimize risk and generate a return on equity. Moreover, merchant banking consulting and advisory services may also assist businesses in assessing the cost and benefits of projects to determine the payback period.

The individual segment is expected to register significant growth over the forecast period. Merchant banks mainly assist HNIs with portfolio management services. The primary responsibilities include buying and selling underlying securities in their portfolios while adapting to market conditions (market timing). The segment's growth can be attributed to the building and execution of investment strategies to meet specific investment objectives.

Regional Insights

North America dominated the merchant banking services market in 2022 and accounted for more than 28.0% of revenue share. The presence of prominent merchant banking service providers such as the U.S. Capital Advisors LLC; Bank of America Corporation; and JPMorgan Chase & Co across the region is anticipated to fuel the market’s growth. Furthermore, local companies seek to enter new markets, as illustrated by real estate development company Panatonni, which forayed into the Indian market in July 2022. Additionally, a developed capital market and business environment are further expected the boost the merchant banking services industry.

Asia Pacific is expected to emerge as the fastest-growing region over the forecast period. The growth can be attributed to favorable demographics, rising income levels, and growing regional businesses. Moreover, the global Foreign Direct Investment (FDI) Annual Report reported a rise in foreign direct investments in greenfield projects in the region by 17% in 2021. Prominent merchant banking service providers such as JPMorgan Chase & Co. have expanded offerings in the Asia Pacific region, recognizing the potential opportunity.

Key Companies & Market Share Insights

The merchant banking services market is characterized as a fragmented market. Prominent market players are investing in research & development, expansion initiatives, strategic partnerships & joint ventures, and mergers & acquisitions to gain a competitive edge. The strategic initiatives also represent an effort to introduce new products and services and expand across geographies. For instance, in April 2023, Edgar Matthews & Co. LLC was launched as a new investment and merchant banking firm headquartered in the U.S. The company focuses on offering customized investment banking services to middle-market companies.

Though the market is dominated by the largest players, it is a competitive market with high growth potential. Vendors offering merchant banking services cater to specific institutional and high-end retail clients. The key market players are also involved in launching additional services to diversify offerings. For instance, in December 2022, FSDH Merchant Bank initiated the provision of custodial services for the safekeeping of assets. Some prominent players in the global merchant banking services market include:

-

U.S. Capital Advisors LLC

-

JPMorgan Chase & Co.

-

Bank of America Corporation

-

DBS Bank Ltd.

-

NIBL Ace Capital Limited

-

Bryant Park Capital

-

Morgan Stanley

-

HSBC Bank USA, N.A.

-

Royal Bank of Canada Website

-

BERENBERG

-

LAZARD

Merchant Banking Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 46.82 billion

Revenue forecast in 2030

USD 143.94 billion

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Services, service provider, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; Singapore; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

U.S. Capital Advisors LLC; JP Morgan Chase & Co; Bank Of America Corporation; DBS Bank Ltd; NIBL Ace Capital Limited; Bryant Park Capital; Morgan Stanley; HSBC Bank USA N.A.;

Royal Bank Of Canada Website; BERENBERG; Lazard

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

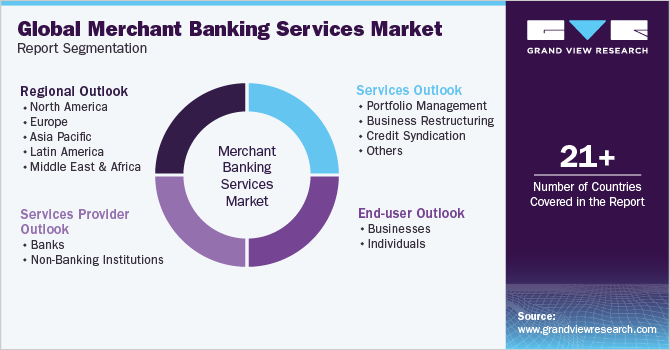

Global Merchant Banking Services Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels providing an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global merchant banking services market report based on services, service provider, end-user, and region:

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Portfolio Management

-

Business Restructuring

-

Credit Syndication

-

Others

-

-

Services Provider Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banks

-

Non-Banking Institutions

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Businesses

-

Individuals

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the merchant banking services market with a share of 28.5% in 2022. This is attributable to the presence of global companies, such as the U.S. Capital Advisors LLC, JP Morgan Chase & Co, and Bank Of America Corporation in the region, with operations worldwide.

b. Some key players operating in the merchant banking services market include the U.S. Capital Advisors LLC, JP Morgan Chase & Co, Bank Of America Corporation, DBS Bank Ltd, NIBL Ace Capital Limited, Bryant Park Capital, Morgan Stanley, HSBC Bank USA N.A., Royal Bank Of Canada Website, BERENBERG, and Lazard.

b. Key factors that are driving the market growth include growing global participation in capital markets, rising merger and acquisitions deals, and rise in global trade and financing.

b. The global merchant banking services market size was estimated at USD 41.44 billion in 2022 and is expected to reach USD 46.82 billion in 2023.

b. The global merchant banking services market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 143.94 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.