- Home

- »

- Advanced Interior Materials

- »

-

Metal Casting Market Size & Share Analysis Report, 2030GVR Report cover

![Metal Casting Market Size, Share, & Trends Report]()

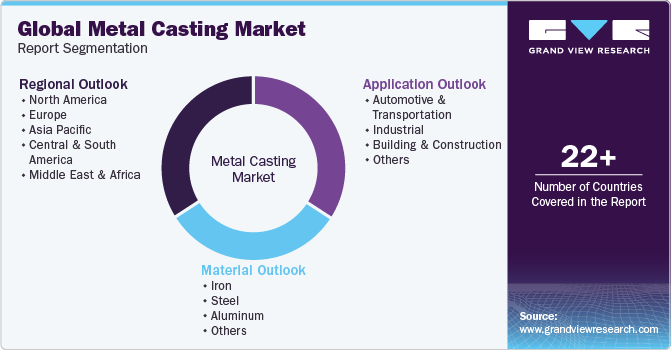

Metal Casting Market Size, Share, & Trends Analysis Report By Material (Iron, Steel, Aluminum, Others), By Application (Automotive & Transportation, Industrial, Building & Construction, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-298-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Metal Casting Market Size & Trends

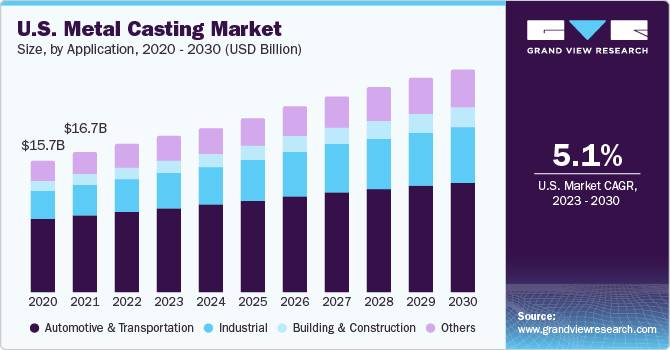

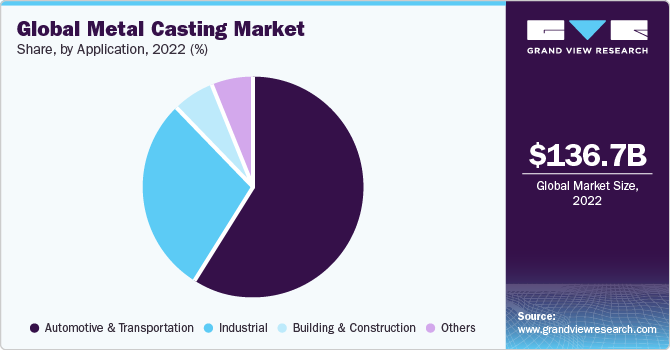

The global metal casting market size was valued at USD 136.71 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Increasing demand for casting from the automotive sector is anticipated to drive market growth over the forecast period. Metal casting is one of the popular manufacturing processes and involves pouring molten metal into a die or sand mold to get the desired shape. It helps produce complex and large-size parts for various industrial applications. Stringent regulations regarding pollution and energy efficiency requirements in vehicles are triggering the growth of the metal casting industry. Regulations have forced automakers to shift to lightweight vehicles to improve fuel efficiency.

Increasing use of casting on account lightweight properties and aesthetic appeal imparted by it is driving the demand for aluminum casting in the construction market. Finished products can be used in construction equipment & machinery, heavy vehicles, curtain walling, door handles, windows, and roofing. The ability to recycle aluminum products is becoming a crucial factor as building owners are increasingly moving toward deconstruction instead of demolishing old or out-of-use buildings. Extracting recyclable materials from buildings also reduces the environmental impact of construction activities.

Cast iron is an alloy containing metals such as silicon, carbon, manganese, sulfur, and phosphorus with wide application range. Increasing demand for pans, pots, utensils, engines, piping, and automotive are the growth factors for the cast iron market. Demand for grey iron metal is projected to increase over the years on account of its applications in housing, engine blocks, cylinder heads, and enclosures. Its properties, such as stiffness, high thermal conductivity, and wear resistance, make it useful in such applications.

The global market is anticipated to be driven over the forecast period by rising product demand from end-use industries, especially in the Asia Pacific. The use of aluminum and stainless-steel cast products in healthcare and telecom industries is likely to positively influence market growth. Increasing demand from Asia’s building & construction industry is one of the key growth drivers for the market. The building and construction sector in the Asia Pacific region is largely driven by the developing countries of the region including China, India, Malaysia, Indonesia, and others. For instance, in 2018, Malaysia’s residential and non-residential sectors observed growth of nearly 4.4% in real terms. Similarly, Indonesia’s building sector registered a healthy growth of around 7-8%. In 2018, total construction projects in the country, excluding the oil & gas sector, were worth USD 32.2 billion.

The construction sector growth in the aforementioned countries is largely attributed to the continuous support schemes offered by the government. For instance, to encourage first-time homebuyers, the Indonesian central bank scrapped the 15% minimum mortgage down payment scheme and relaxed its rule for loan disbursements. Owing to such government incentives, the Asia Pacific region is likely to witness stable growth in its building sector. Thereby, driving the demand for metal cast products over the forecast period.

Furthermore, the rising penetration of aluminum as an efficient, lightweight material in vehicle production is further boosting the market growth. Corporate Average Fuel Economy (CAFE) has doubled its target for average fuel efficiency from 2012 to 2025 owing to the increasing emission of greenhouse gases. Weight reduction in vehicles through the use of aluminum is set to play a crucial role in these conditions in order to meet the regulatory requirements.

Technological developments in the automotive field are propelling the demand for automotive products. China is the largest automobile market in the world in terms of both demand and supply. South Korea, Japan, and India are among the top 10 largest markets for automobiles, which has created a significant demand for aluminum in APAC. Growing demand for automobiles in the U.S. is also expected to drive aluminum casting demand over the forecast period. The average aluminum content in a lightweight vehicle rose by more than 4% from 2017 to 2018.

The metal casting industry requires large machine tools and other heavy equipment for production. The industry also has a huge space requirement. Owing to these reasons, it is known to be capital-intensive. Additionally, skilled labor is required to handle products during transportation, which increases the overall cost of metal cast products. Continuous technological advancements in manufacturing quality products also require a huge investmen in R&D. The requirement of skilled professionals for operating advanced machines is another limitation for the market, especially in developing and underdeveloped economies.

Material Insights

The aluminum segment accounted for the largest revenue share of 38.3% in 2022. The major portion of the demand in this segment is projected to come from emerging markets, especially from the automotive, construction, and oil & gas sectors. Finished casting products are likely to remain a key area for investors. As per the World Foundry Organization, the production volume of iron casting increased by 0.8% in 2017 compared to the previous year. It was 156.58 kilotons in 2017. The production of ductile iron and grey iron metal products observed a growth rate of 1.1% and 1.3%, respectively, in 2017 compared to 2016.

The aluminum segment is projected to grow at a CAGR of 8.7%, in terms of revenue, over the forecast period. The demand for lightweight metals including magnesium and aluminum is anticipated to create many opportunities for market vendors. Stricter emission regulations and increasing requirements for energy efficiency are projected to boost the production of lightweight materials in the market over the forecast period. These materials assist in reducing the consumption of fuel owing to the light weight of auto components.

Application Insights

The automotive segment held the largest revenue share of 59.5% in 2022. The global automotive production has been observing gradual yet encouraging growth in global automotive production over recent years. The global automotive production rose by 2.3% in 2017, according to data from the International Organization of Motor Vehicle Manufacturers. The incorporation of aluminum in order to achieve weight reduction will continue to hold significant importance for both automakers and market vendors.

The industrial segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. Industrial products such as decanters, metal valves and gaskets, flanges, air injection tubes, coal throw pipes, air injection tubes, collectors, radiation protection tubes, rollers, elbows, and bends are manufactured using iron & steel materials. The expansion of manufacturing industries in China and other emerging countries is anticipated to drive the growth of the industrial segment.

The building & construction industry is one of the leading consumers of different types of casting products. Increasing focus on infrastructure and investments is triggering the growth of the industry. Governments of different countries are investing in various infrastructure projects including transportation, water supply, telecommunications, and energy networks.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 55.4% in 2022. Asia Pacific is characterized by the presence of skilled labor at low cost, which makes it the most lucrative region for manufacturers to set up production facilities. A shift in the global production landscape toward emerging economies, especially China and India, is expected to positively influence market growth over the forecast period. The rapidly expanding automobile sector in the region is expected to further boost the market growth over the forecast period.

China is viewed as a highly cost-effective region for manufacturing activities owing to favorable government regulations. The market for metal casting in China has witnessed significant growth in recent years due to the economic benefits offered in the country. China has taken advantage of the availability of high-tech manufacturing facilities as well as a skilled workforce, which are essential for the manufacturing sector.

Europe metal casting market is anticipated to grow at a moderate pace with a CAGR of 4.8%, in terms of revenue, from 2023 to 2030. Europe has a presence of 4,500 metal casting firms, a major share of which are small businesses with less than 50 employees. In addition, the presence of a strong automotive sector in countries like Germany, Italy, and France is expected to lead to a massive demand for aluminum-based casting solutions over the forecast period.

Key Companies & Market Share Insights

The market for metal casting is fragmented in nature due to the presence of a large number of small & medium enterprises (SMEs) and an unorganized industry structure. Several leading players are focusing on improving their production capacities across countries and strengthen their presence. Players engaged in manufacturing metal casting are facing various challenges including underutilization of capacity, optimization of resources, high energy consumption, and compliance with stringent norms.

The growing use of aluminum in vehicles is anticipated to create many opportunities for market vendors; hence, well-established players are concentrating on the development of new alloys and materials.

Key Metal Casting Companies:

- POSCO

- Dynacast

- Arconic

- Ryobi Limited

- Endurance Technologies Limited

- Alcast Technologies

- UNI Abex

- MES, Inc.

- CALMET

- Hitachi, Ltd.

Recent Developments

-

In June 2020, Endurance Technologies Limited completed the acquisition of Grimeca Srl, an Italian auto parts manufacturer. In a filing made to the stock exchange, Endurance announced the attainment of a complete ownership stake of 100% in Grimeca for a sum of 2.25 million Euros, equivalent to approximately USD 2.45 million.

-

In November 2022, POSCO announced that two of its steel plants, located in Pohang and Gwangyang, have achieved certification for their commendable contributions towards fostering a sustainable future for the steel industry. This remarkable accomplishment underscores the plants' steadfast commitment and effective management in promoting environmental, social, and corporate governance (ESG) objectives.

-

Following a rigorous nine-month evaluation conducted by the Future Strategy Forum based in Memphis, Tennessee, the Pohang and Gwangyang plants were awarded the certification. Notably, these plants hold the distinction of being the first steel facilities in Asia to receive certification from ResponsibleSteel, a renowned non-profit organization acclaimed for its comprehensive ESG standards and certification program.

Metal Casting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 144.36 billion

Revenue forecast in 2030

USD 210.40 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Saudi Arabia; South Africa; UAE; Nigeria

Key companies profiled

POSCO; Dynacast; Arconic; Ryobi Limited; Endurance Technologies Limited; Alcast Technologies; UNI Abex; MES, Inc.; CALMET; Hitachi, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Casting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal casting market based on material, application, and region:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Iron

-

Steel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive & Transportation

-

Industrial

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue in USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the metal casting market include POSCO; Arconic; Alcast Technologies; Dynacast; Ryobi Ltd.; Endurance Technologies Limited; Uniabex; MES, Inc.; CALMET; and Hitachi Metals.

b. Key factors that are driving the market growth include increasing use of casting on account lightweight properties and aesthetic appeal in construction equipment & machinery, heavy vehicles, curtain walling, door handles, windows, and roofing.

b. The global metal casting market size was estimated at USD 136.71 billion in 2022 and is expected to reach USD 143.36 billion in 2023.

b. The global metal casting market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 210.40 billion by 2030

b. Iron castings dominated the metal casting market with a share of 35.1% in 2022. This is attributable to demand from emerging markets, especially from the automotive, construction, and oil & gas sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."