- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Casting Market Size, Share, Industry Report, 2030GVR Report cover

![Aluminum Casting Market Size, Share & Trends Report]()

Aluminum Casting Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Die Casting, Permanent Mold Casting), By End Use (Transportation, Industrial, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-008-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Casting Market Summary

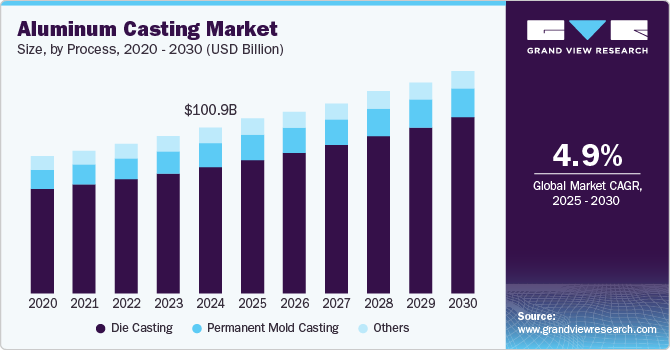

The global aluminum casting market size was estimated at USD 100.94 billion in 2024 and is projected to reach USD 135.20 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. Increasing use of aluminum in automobiles, owing to its characteristics, such as high strength and lightweight features that are likely to drive the market.

Key Market Trends & Insights

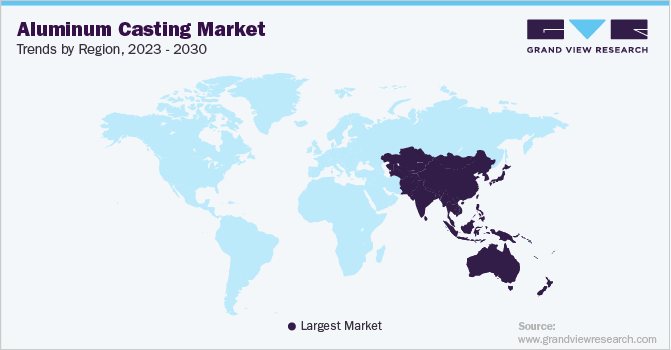

- Asia Pacific aluminum casting market with the largest revenue share of over 51.6% in 2024.

- North America aluminum casting market is expected to witness lucrative growth over the coming years.

- In terms of price trend, over recent years, prices have experienced volatility due to supply chain disruptions and energy cost spikes, especially impacting smelting and casting operations which are energy-intensive.

- Based on end use, the building and construction segment is anticipated to exhibit a CAGR of 3.7% in terms of volume from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 100.94 Billion

- 2030 Projected Market Size: USD 135.20 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Nearly 30-40% of aluminum is being used per lightweight vehicle every year and is likely to reach 70% over the coming years owing to stringent regulations on reducing fuel emissions across the globe. According to the Federal Reserve Bank of St. Louis, the global sales of lightweight vehicles reached 15.502 million units in 2023. Thus, increasing demand for lightweight vehicles due to soaring environmental pollution, rising disposable incomes, and changing lifestyles of consumers is anticipated to boost the demand for aluminum casting.

Drivers, Opportunities & Restraints

The defense industry is expected to be a key driver for the aluminum casting market due to the increasing demand for lightweight, durable, and high-performance materials in military applications. Aluminum castings are likely to see growing adoption in the production of defense components such as aircraft parts, armored vehicles, and naval vessels, where strength and weight reduction are critical. The anticipated rise in defense budgets globally, coupled with the need for advanced, cost-efficient materials, is expected to boost the demand for aluminum castings.

However, challenges such as the elevated costs of aluminum casting equipment and significant investments required for technological innovations in the casting process are anticipated to restrict market growth. Additionally, stringent environmental regulations set by organizations such as the European Environment Agency and U.S. Environmental Protection Agency (EPA) aimed at controlling harmful emissions during casting operations, are expected to pose barriers to market expansion in the near future.

Price Trend Analysis

The price trend of aluminum is influenced by several key factors, including global demand fluctuations, raw material costs, and technological advancements in casting processes. Over recent years, prices have experienced volatility due to supply chain disruptions and energy cost spikes, especially impacting smelting and casting operations which are energy-intensive. Rising demand from sectors like automotive, aerospace, and construction, particularly as these industries seek lighter, fuel-efficient materials, has also exerted upward pressure on prices.

Process Insights

Pressure die casting involves injecting molten aluminum into a steel mold at high pressure, a process anticipated to produce complex shapes with high dimensional accuracy. This method is likely to offer rapid cycle times, making it ideal for large-scale production, especially in the automotive and electronics industries.

Permanent mold casting uses reusable metal molds where molten aluminum is poured by gravity or low pressure, anticipated to yield parts with a dense structure and high mechanical strength. This method is often selected for producing medium volumes of robust components, such as wheels and engine blocks, due to the durability of the final castings.

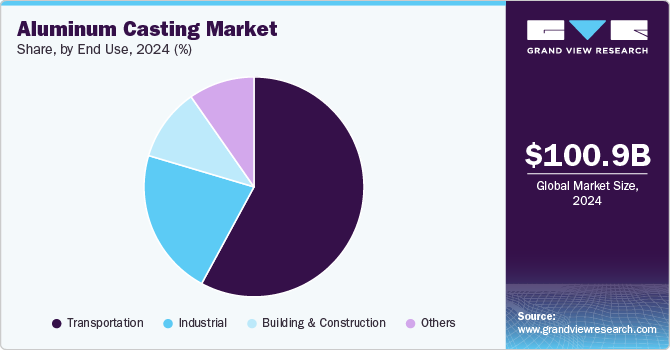

End Use Insights

The growth of the segment is attributed to the increasing demand for lightweight vehicles and aircraft globally. Sports vehicle is among the most lucrative segments in the lightweight vehicle sector. The popularity of sporting events, rallies, and races in North America and Europe continue to drive the demand for sports vehicles, thereby boosting the demand for aluminum casting.

The growth in the transportation segment is also supported by increasing demand for aircraft as aluminum cast products are used in manufacturing jet or aircraft engines. A study published by Airbus in 2024 stated that the demand for new aircraft is estimated to reach nearly 42,000 over the next 20 years. Rising demand for new aircraft is likely to propel the need for new jet engines, thereby positively influencing the market growth.

In the industrial segment, construction equipment is likely to observe strong growth in the years to come owing to rigorous infrastructure development across the globe. Asia Pacific has observed a surge of Chinese construction equipment manufacturers such as XCMG and Sany in this segment over the past decade, which is likely to result in steady demand for aluminum casting products.

The building and construction segment is anticipated to exhibit a CAGR of 3.7% in terms of volume from 2025 to 2030 owing to the increasing use of aluminum casting products in houses. Aluminum casting can be employed in various applications such as roofing, door handles, windows, and curtain walling. The rising replacement of iron and steel due to changing consumer preferences and the benefits of aluminum, such as lightweight and aesthetic appeal, are anticipated to drive the market over the coming years.

Regional Insights

Asia Pacific Aluminum Casting Market Trends

Asia Pacific aluminum casting market is expected to grow on account of owing to the rapidly expanding manufacturing sector in China and India. Automakers are shifting or expanding their production facilities in these countries owing to the low labor cost and government policy support, such as 100% FDI allowed under automatic route for auto components. As reported by, Automotive Component Manufacturers Association of India (ACMA) around USD 2.5 to 3 billion of investment is expected to observe in Indian auto component manufacturing industry.

China aluminum casting market is anticipated to grow steadily, driven by strong demand from the automotive and electronics sectors, alongside government initiatives supporting lightweight materials.

North America Aluminum Casting Market Trends

North America aluminum casting market is expected to witness lucrative growth over the coming years. In North America, demand for lightweight vehicles is anticipated to grow at a healthy rate over the coming years on account of the North American Free Trade Agreement (NAFTA). It was announced with an intention to achieve the objective of 54.5 mpg fuel efficiency in two phases by 2025. This is forcing automotive players to achieve a 25% reduction in the weight of the car body, which, in turn, is likely to boost the demand for aluminum casting over the coming years.

Europe Aluminum Casting Market Trends

Europe emerged as the second-largest regional market in 2024 owing to its established automotive sector, supported by stringent regulations on reducing CO2 emissions. Euro 6c with real driving emissions (RDE) and Euro 6b emission standards along with World Harmonized Light Vehicle Testing Procedure (WLTP) is likely to boost the demand for lightweight materials such as aluminum in the region, which, in turn, is anticipated to augment market growth over the coming years.

France aluminum casting market is expected to benefit from advancements in aerospace and defense technologies, alongside increasing focus on sustainability in manufacturing. Government support for green technologies is also anticipated to boost market growth.

Latin America Aluminum Casting Market Trends

Aluminum casting market in Brazil is likely to expand, fueled by rising industrialization and the development of local automotive and construction sectors. Investment in infrastructure and domestic manufacturing capabilities is expected to support this trend.

Key Aluminum Casting Company Insights

Some of the key players operating in the market include Dynacast, and RDW Wolf, GmbH

-

Dynacast is one of the leading company in precision die casting, specializing in producing complex metal components for industries such as automotive, consumer electronics, and healthcare. The company supplies high-quality, and small-to-medium-sized metal parts to these industries.

-

Ryobi Limited is Japan-based manufacturer of aluminum casting, power tools, and printing equipment. The company focuses on automotive sector and has capabilities to support rising demand for lightweight vehicle components.

Key Aluminum Casting Companies:

The following are the leading companies in the aluminum casting market. These companies collectively hold the largest market share and dictate industry trends.

- Walbro

- Alcoa Corporation

- Consolidated Metco, Inc.

- BUVO Castings

- RDW Wolf, GmbH

- Georg Fischer Ltd.

- Dynacast

- Ryobi Limited

- GIBBS

- Martinrea Honsel Germany GmbH

Recent Developments

-

In August 2024, Wisconsin Aluminum Foundry announced acquisition of ATEK Metal Technologies. This acquisition is expected to assist the company to expand its capabilities in medical, agriculture, transportation, and motorsports among others.

-

In July 2024, The Department of Defense, U.S. announced order of USD 23 million to Constellium Muscle Shoals LLC. This is expected to increase the aluminum casting capacity and support U.S. security commitments in the world. This will help the Constellium to add the 300 million pounds of annual capacity.

Aluminum Casting Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 106.68 billion

Revenue forecast in 2030

USD 135.20 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Process, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; China; India; Japan; South Korea; Brazil; South Africa; Russia

Key companies profiled

Walbro; Alcoa Corporation; Consolidated Metco Inc.; BUVO Castings; RDW Wolf, GmbH; Georg Fischer Ltd.; Dynacast; GIBBS; Ryobi Limited; Martinrea Honsel Germany GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Casting Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum casting market report based on process, end use, and region.

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Die Casting

-

Pressure Die Casting

-

Others

-

-

Permanent Mold Casting

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Industrial

-

Building & Construction

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aluminum casting market size was estimated at USD 100.94 billion in 2024 and is expected to reach USD 106.68 billion in 2025.

b. The global aluminum casting market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 135.20 billion by 2030.

b. The die casting segment dominated the aluminum casting market with a share of over 76.0% in 2024. This is attributable to the rising demand for aluminum casting products in the automotive sector. Die casting is used to manufacture various auto parts such as engines, cylinders, gears, and flywheels, which are used in high-end vehicles to mass-produce vehicles

b. Some of the key vendors of the global aluminum casting market are Walbro, Alcoa Corporation, Consolidated Metco, Inc., BUVO Castings, RDW Wolf, GmbH, Georg Fischer Ltd., Dynacast, GIBBS, and Ryobi Limited, among others

b. Increasing usage of aluminum casting products in the automotive industry, rise in the building & construction sector along with growing investment in the EV industry are the major factor attributed to the growth of the aluminum casting market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.