- Home

- »

- Advanced Interior Materials

- »

-

Metal Foam Market Size And Share, Industry Report, 2030GVR Report cover

![Metal Foam Market Size, Share & Trends Report]()

Metal Foam Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Aluminum, Nickel, Copper), By End-use (Automotive, Construction, Industrial), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-2-68038-201-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Foam Market Size & Trends

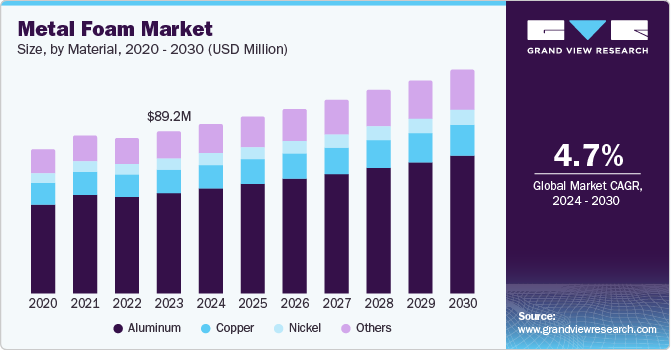

The global metal foam market size was valued at USD 89.2 million in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The increasing interest in metallic foams is due to their exceptional combination of lightweight and high strength, making them ideal for applications in the automotive, aeronautics, and building sectors. There is a growing demand for metallic foams across various sectors, including their use for thermal insulation. Technological advancements in manufacturing have resulted in reduced production costs and expanded application fields. Moreover, the growing environmental consciousness is compelling industries to adopt more sustainable materials, further contributing to market expansion.

The global metal foam market is experiencing growth due to the increasing focus on energy efficiency and enhanced performance in various sectors. Metal foams are seeing expanded use in crash energy management and sound deadening in automobiles, contributing to improved vehicle safety and passenger comfort. Additionally, to meet stringent fuel consumption regulations and reduce vehicle weight, manufacturers are increasingly turning to lightweight materials such as aluminum foams, which is a key factor driving industry expansion.

Significant investments in research and development (R&D) activities for metal foam are also propelling market growth. Researchers are constantly seeking new alloys and manufacturing methods to enhance the thermal conductivity and mechanical strength of metal foams, thereby expanding their application areas and improving their economic viability for widespread use. Ongoing R&D developments are crucial for meeting market demands and are expected to continue driving market expansion.

Material Insights

The aluminum segment dominated the market and accounted for a share of 62.0% in 2023. This dominance can be attributed to aluminum's lightweight nature, high strength, and cost-effectiveness, which make it a versatile choice for various applications. Its superior heat conduction and corrosion resistance have further expanded its usage, particularly in industries where performance and durability are crucial. Notably, advancements in aluminum foam manufacturing techniques have substantially lowered production costs, driving widespread adoption and reinforcing its leading position in the market.

The nickel segment is expected to register a CAGR of 4.4% during the forecast period due to the increasing demands from aerospace, automotive, and energy storage industries. The rising need for lightweight yet sturdy materials in these sectors has led to a surge in the use of nickel-based metal foams, renowned for their exceptional thermal and electrical conductivity. Furthermore, the segment's growth is also fueled by the growing adoption of nickel-based metal foams in new applications such as noise absorption and vibration damping.

End-use Insights

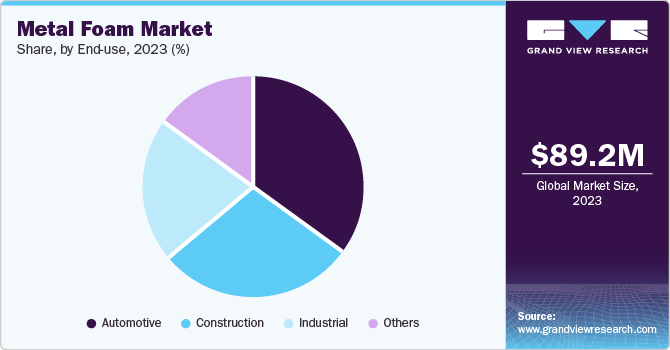

The automotive segment dominated the market in 2023 due to the growing demand for lightweight materials that can improve fuel efficiency and reduce emissions. Metal foams, with their high strength-to-weight ratios, corrosion resistance, and thermal insulation capabilities, are being widely used in engine components, exhaust systems, and battery trays, among other automotive applications. The increasing shift towards electric vehicles has further fueled the demand for metal foams, particularly in the fabrication of battery casings and other structural components for electric cars.

The construction segment is projected to grow at a CAGR of 5.5% over the forecast period. This growth is driven by the increasing need for materials offering efficient energy use and thermal insulation properties provided by metal foams. These materials also enhance the overall performance of structures by reducing noise and adding a lightweight advantage. Furthermore, with the tightening of regulations and standards for green buildings, there is a growing likelihood of an upsurge in the use of metal foams and other innovative materials, thus contributing to the growth of the construction sector.

Regional Insights

Asia Pacific metal foam dominated the market with revenue share of 39.08% in 2023 primarily fueled by rapid industrialization and urbanization in countries within this region. The surging demand for metal foams across various sectors, particularly automotive and construction, has been a major driving factor. The presence of prominent metal foam manufacturers in the region, coupled with supportive government initiatives and research investments, has significantly contributed to the region's dominance in the global market.

Europe Metal Foam Market Trends

Europe's metal foam market grew high in 2023 owing to the region's emphasis on technological innovation and high-performance materials across various industries. The automotive and aerospace sectors, in particular, have witnessed a surge in metal foam adoption due to stringent efficiency and safety regulations necessitated by environmental concerns. Europe's commitment to sustainability has also fueled demand for metal foams in the construction sector, further accelerating market expansion within the region.

North America Metal Foam Market Trends

The North American metal foam market is anticipated to witness significant growth. This can be attributed to the escalating demand for advanced materials within the region's aerospace, defense, and automotive sectors. Metal foams' unique properties, such as superior thermal insulation and lightweight characteristics, make them ideal for applications in aerospace and defense components, contributing to improved performance and fuel efficiency. Moreover, the expanding electric vehicle market is fueling demand for metal foam-based battery enclosures and structural components, offering advantages in terms of weight reduction and safety. The presence of prominent metal foam manufacturers and research institutions in the U.S. and Canada is expected to foster innovation and the development of novel applications, further strengthening market expansion.

Key Metal Foam Company Insights

Some key companies in the global metal foam market include Mott, Erg Aerospace Corporation, Bauer Cases, Spectra-Mat, Inc, CYMAT Technologies Ltd., and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Mott offers advanced filtration and separation technologies. It specializes in precision filters, metal foams, and custom-engineered parts aimed at maximizing performance and efficiency for the aerospace, automotive, and pharmaceutical industries.

-

CYMAT Technologies Ltd. specializes in developing and producing aluminum-based metal foam solutions. It caters to industries such as automotive, aerospace, and construction.

Key Metal Foam Companies:

The following are the leading companies in the metal foam market. These companies collectively hold the largest market share and dictate industry trends.

- Liaoning Rontec Advanced Material Technology Co. Ltd.

- Mayser GmbH & Co. KG (Germany)

- Mott

- Erg Aerospace Corporation

- Bauer Cases

- Spectra-Mat, Inc

- CYMAT Technologies Ltd.

- Shanxi Putai Aluminum Foam Manufacturing Co., Ltd.

- Cnem Corporation

- Ultramet

Recent Developments

-

In August 2024, Apheros, a tech startup developing advanced cooling solutions for data centers, secured USD 1.85 million in funding led by Founderful. The investment will support the company's growth as it addresses the critical challenges facing the data center industry, including rising energy costs, infrastructure constraints, and sustainability concerns. Apheros' proprietary metal foam technology promises to significantly improve the efficiency of data center cooling systems, a crucial requirement given the escalating power consumption per rack.

-

In July 2024, ERG showcased innovative lightweight structures, impact protection solutions, and heat exchangers at the Small Satellite Conference. These products, developed using Duocel foam material, offer exceptional lightweight, rigidity, and customization capabilities, making them ideal for demanding space missions.

Metal Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 93.0 million

Revenue forecast in 2030

USD 122.8 million

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Italy, Spain, Germany, France China, Japan, India, Argentina, Brazil, Saudi Arabia

Key companies profiled

Liaoning Rontec Advanced Material Technology Co. Ltd., Mayser GmbH & Co. KG (Germany), Mott, Erg Aerospace Corporation, Bauer Cases, Spectra-Mat, Inc, CYMAT Technologies Ltd., Shanxi Putai Aluminum Foam Manufacturing Co., Ltd., Cnem Corporation, Ultramet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Foam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Metal Foam market report based on material, end-use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Nickel

-

Copper

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Spain

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.