- Home

- »

- Advanced Interior Materials

- »

-

Metal Recycling Equipment Market Size, Share Report, 2030GVR Report cover

![Metal Recycling Equipment Market Size, Share & Trends Report]()

Metal Recycling Equipment Market Size, Share & Trends Analysis Report By Equipment (Balers, Shredders, Granulators, Shears, Separators), By Region (Europe, MEA, APAC), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-598-0

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Metal Recycling Equipment Market Trend

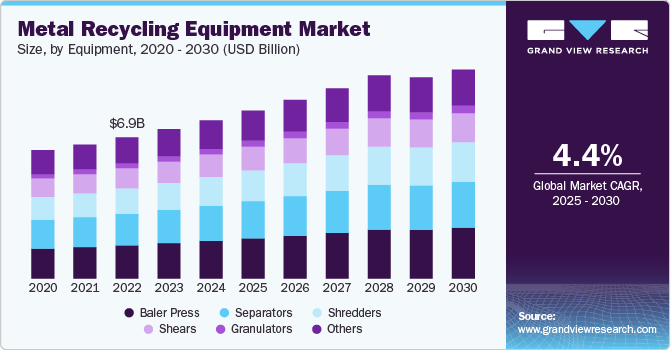

The global metal recycling equipment market size was estimated at USD 7,737.1 million in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. The market is experiencing significant growth driven by increasing awareness of environmental sustainability and the need for efficient waste management. As industries and municipalities strive to reduce their carbon footprints, demand for advanced recycling technologies, such as shredders, balers, and sorting systems, is on the rise. Innovations in automation and artificial intelligence are enhancing operational efficiency, enabling more precise material recovery.

Metals have great sustainability and recyclability, and they are employed in a variety of end-use sectors, thereby market is witnessing increased demand for recyclable metal, resulting the demand for metal recycling technology too. Growing government waste management activities, increased consumer awareness about recycling garbage, and expanding demand for recycled materials from different end-use sectors are likely to drive market demand.

Moreover, collecting and sorting recyclable items takes time and energy, and it is also costly. Few metals, particularly aluminum, erode with each reuse cycle, implying that the final product's quality may vary. The time-consuming and complex process of collecting and sorting metals for recycling is expected to hamper the growth of this industry.

Drivers, Opportunities & Restraints

The metal recycling equipment market is primarily driven by the increasing global emphasis on sustainability and resource conservation. As industries face growing pressure to reduce waste and enhance recycling rates, the demand for efficient metal recycling technologies, such as shredders and magnetic separators, continues to rise. Additionally, regulatory frameworks and government initiatives promoting recycling practices further propel market growth, as businesses seek to comply with environmental standards while capitalizing on the economic benefits of reclaiming valuable materials.

Despite its growth potential, the metal recycling equipment market faces several restraints, including high initial capital investment and operational costs. Smaller recycling facilities may struggle to afford advanced technologies, limiting their competitiveness. Furthermore, fluctuating metal prices can impact the profitability of recycling operations, leading to uncertainty in investment decisions. Additionally, the complexity of recycling processes and the need for skilled labor to operate sophisticated machinery pose challenges for market expansion.

The metal recycling equipment market presents numerous opportunities, particularly through technological advancements and the rise of automation. Innovations such as artificial intelligence and IoT integration can enhance sorting accuracy and operational efficiency, attracting investment from both public and private sectors. The growing trend toward circular economy practices creates additional demand for advanced recycling solutions, encouraging partnerships and collaborations among stakeholders. Furthermore, expanding electric vehicle (EV) production and renewable energy sectors drive the need for effective metal recycling, providing significant growth avenues for the market.

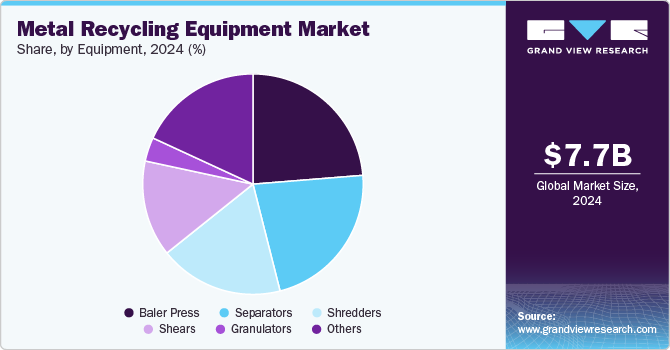

Equipment Insights

“The demand for the shredders equipment segment is expected to grow at a significant CAGR of 5.2% from 2025 to 2030 in terms of revenue.”

The baler press equipment segment led the market and accounted for 23.7% of the global revenue share in 2024. The demand for recycling metals is rapidly increasing from multiple end use industries due to increased environmental benefits, and recyclable metals are used as primary raw materials in various industries such as construction, automotive, aerospace, and electronics, which is likely to benefit the metal recycling equipment market.

The shredders equipment segment is likely to grow at a significant CAGR over the forecast period. Modern technology has shown to be successful in recognizing many types of metals, particularly ferrous metals. Metal scrap demand has prompted scrap yards to develop technologically advanced and complex shredding equipment, consequently supplementing market expansion.Industrial shredders used for recycling are high-volume, heavy-duty machines. These shredders are outfitted with a variety of cutting systems, including horizontal shaft, vertical shaft, single shaft, 2-shaft, 3-shaft, and 4-shaft cutting systems.

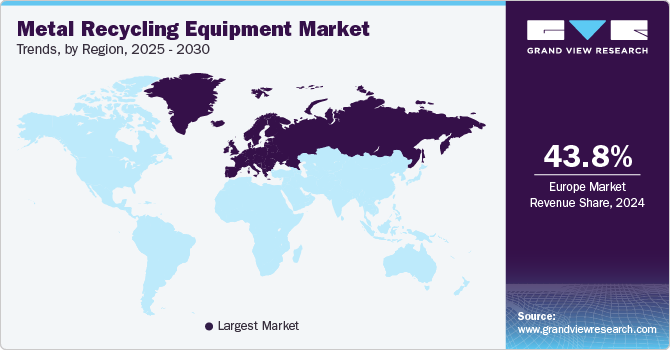

Regional Insights

“India to witness fastest market growth at 5.6% CAGR”

North America Metal Recycling Equipment Market Trends

North America region accounted for 17.7% of the global metal recycling equipment market share in 2024. In North America, the metal recycling equipment market is driven by increasing regulations on waste management and sustainability efforts. For instance, states like California have implemented stringent recycling mandates that incentivize businesses to upgrade their recycling technologies. The push for efficiency in waste processing, coupled with a rising focus on circular economy principles, is leading to heightened investment in advanced sorting and shredding equipment.

U.S. Metal Recycling Equipment Market Trends

The U.S. metal recycling equipment market is expected to grow at a CAGR of 3.4% from 2025 to 2030. The U.S. market is witnessing a surge in demand for metal recycling equipment due to the rapid growth of the construction and automotive sectors. For example, the increasing focus on infrastructure renewal projects, supported by federal funding initiatives, is generating a significant amount of scrap metal, prompting construction firms to invest in efficient recycling solutions. Additionally, innovations like automated shredders are gaining traction for their ability to streamline operations.

The Canada metal recycling equipment market is expected to grow at a CAGR of 3.1% from 2025 to 2030. In Canada, the metal recycling equipment market is significantly influenced by environmental policies that promote recycling and waste reduction. For instance, provinces like Quebec have set ambitious recycling targets, encouraging investments in advanced equipment such as hydraulic balers and metal detectors. The growing adoption of technologies that enhance material recovery is helping Canadian businesses improve profitability while meeting regulatory demands.

Mexico metal recycling equipment market is expected to grow at a CAGR of 3.8% from 2025 to 2030. Mexico's metal recycling equipment market is experiencing growth driven by industrial expansion and increasing awareness of sustainable practices. The automotive industry, in particular, is a major contributor, as companies seek efficient recycling solutions to manage scrap metal generated during production. For example, local manufacturers are increasingly investing in modern shredders and balers to optimize their recycling processes and comply with emerging environmental standards.

Europe Metal Recycling Equipment Market Trends

The Europe metal recycling equipment market held a share of 28.4% in 2024. The European market is shaped by stringent EU regulations aimed at promoting circular economy practices. Countries like Sweden and Denmark are leading in recycling initiatives, with municipalities investing in cutting-edge sorting and processing technologies to meet high recycling targets. For instance, advancements in automated sorting systems are being implemented to enhance recovery rates and improve operational efficiency across the region.

Germany's metal recycling equipment market held 18.1%share in the European market. Germany is at the forefront of the metal recycling equipment market in Europe, driven by its commitment to sustainability and resource efficiency. The country's robust manufacturing sector generates substantial metal waste, leading to significant investments in state-of-the-art recycling technologies. For example, German companies are adopting innovative shredding and separation systems that enhance the quality and quantity of recycled metals, aligning with national recycling goals.

Metal recycling equipment market in UK held 9.2% share in the Europe market. In the UK, the metal recycling equipment market is benefiting from increasing government initiatives aimed at reducing landfill waste and boosting recycling rates. The recent introduction of extended producer responsibility (EPR) regulations is prompting businesses to invest in efficient recycling solutions. For instance, UK firms are focusing on upgrading their sorting technologies to comply with new standards and improve their overall sustainability profiles.

Asia Pacific Metal Recycling Equipment Market Trends

The metal recycling equipment market in Asia Pacific accounted for a market share of 43.8% in 2024. The Asia Pacific market is experiencing rapid growth due to urbanization and industrialization. Countries like Japan and South Korea are investing heavily in advanced recycling technologies to handle the rising volume of electronic waste. For example, Japan has implemented innovative metal recovery systems that use automated sorting to reclaim valuable materials from discarded electronics, reflecting the region's commitment to sustainability.

China metal recycling equipment market held over 41.2% share in the Asia Pacific market. China remains a dominant player in the metal recycling equipment market, driven by its vast industrial base and demand for raw materials. The government's recent push for stricter recycling standards and environmental regulations is prompting investment in modern recycling technologies. For instance, Chinese companies are increasingly adopting advanced shredding and processing equipment to improve the efficiency of metal recovery from scrap sources, supporting the nation’s green development goals.

Metal recycling equipment market in the India is expected to grow at a CAGR of 16.9% from 2025 to 2030. Indian market is witnessing significant growth due to rapid urbanization and a booming construction sector. The government's initiatives to boost recycling rates, such as the Swachh Bharat Mission, are encouraging investments in efficient recycling technologies. For example, Indian firms are increasingly utilizing hydraulic balers and shredders to process scrap metal generated from construction activities, enhancing both efficiency and sustainability.

Middle East & Africa Metal Recycling Equipment Market Trends

The metal recycling equipment market in the Middle East and Africa is evolving, with increasing investments in recycling infrastructure driven by urban growth and resource scarcity. Countries like the UAE are implementing policies to enhance recycling rates, leading to a surge in demand for efficient metal recycling technologies. For instance, the UAE has seen significant investments in automated sorting systems to optimize the recycling of metals from construction and industrial activities, reflecting the region's commitment to sustainability.

Latin America Metal Recycling Equipment Market Trends

In Latin America, the metal recycling equipment market is expanding due to rising demand for sustainable practices amid economic growth. Countries like Brazil are focusing on improving recycling infrastructure to manage the growing volume of waste generated by urbanization. For instance, Brazilian municipalities are investing in modern sorting and baling equipment to enhance their metal recycling capabilities and comply with emerging environmental regulations.

Brazil metal recycling equipment market held 34.6% share in Latin America metal recycling equipment market. Brazil's market is driven by the country's rich natural resources and a growing emphasis on sustainability. The rise of the circular economy is prompting companies to invest in advanced technologies for processing scrap metal. For example, Brazilian manufacturers are increasingly adopting efficient shredders and sorting systems to recover valuable metals from industrial waste, supporting both economic and environmental objectives.

Key Metal Recycling Equipment Company Insights

Some of the key players operating in the metal recycling equipment market include Metso Outotec Corporation, Kiverco, General Kinematics Corporation.

-

Metso Outotec Corporation is a leading global provider of sustainable technologies, services, and solutions for the mining, aggregates, and recycling industries. Formed in 2020 through the merger of Metso and Outotec, the company focuses on developing innovative processes that enhance resource efficiency and minimize environmental impact. Metso Outotec offers a comprehensive range of equipment, including advanced recycling systems for metals, to help clients recover valuable materials from waste.

-

Kiverco is a prominent manufacturer of waste recycling and processing equipment, specializing in the design and production of tailored solutions for various sectors, including construction, demolition, and metal recycling. Based in Northern Ireland, Kiverco is known for its innovative modular systems that provide high efficiency and flexibility in waste separation and recovery processes. The company emphasizes sustainability and aims to help businesses achieve higher recycling rates while minimizing waste to landfill.

CP Manufacturing, Inc, and Advance Hydrau Tech Pvt Ltd. are some of the emerging players in the metal recycling equipment market.

-

CP Manufacturing, Inc. is a leading provider of recycling and waste management equipment based in the United States. Founded in 1972, the company specializes in designing and manufacturing innovative solutions for the recycling industry, including equipment for metal recycling, plastics, and municipal solid waste. CP Manufacturing is renowned for its advanced sorting technologies, including the patented CP 1000 series of systems that enhance material recovery and operational efficiency.

-

Advance Hydrau Tech Pvt Ltd is a prominent Indian company specializing in manufacturing hydraulic equipment for the recycling and waste management sectors. Established in 1981, the company has built a strong reputation for providing high-quality solutions, including balers, shredders, and hydraulic compactors. Advance Hydrau Tech is known for its innovative designs that enhance operational efficiency and reduce labor costs.

Key Metal Recycling Equipment Companies:

The following are the leading companies in the metal recycling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Kiverco

- General Kinematics Corporation

- MARATHON

- American Baler Company

- DANIELI CENTRO RECYCLING

- FOR REC S.P.A

- BHS Sonthofen GmbH

- Metso Outotec Corporation

- JMC Recycling Ltd

- LEFORT

- CP Manufacturing, Inc

- Advance Hydrau Tech Pvt Ltd.

- Eldan Recycling A/S

- MHM Recycling Equipment

- Ceco Equipment Ltd

View a comprehensive list of companies in the Metal Recycling Equipment Market

Recent Developments

-

In December 2022, ArcelorMittal has acquired Riwald Recycling, a cutting-edge ferrous scrap metal recycling operation located in the Netherlands. In 2021, Riwald processed over 330,000 tonnes of ferrous scrap metal, sourcing materials from a diverse array of suppliers, including industrial firms, OEMs, demolition contractors, traders, vehicle dismantlers, and regional and national governments. The company employs advanced technical equipment for material separation, ensuring high purity in the final products and maximizing recovery from various types of scrap and waste collected.

Metal Recycling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,210.6 million

Revenue forecast in 2030

USD 10.21 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, region

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Kiverco; General Kinematics Corporation; Marathon Equipment; American Baler Company; Danieli Centro Recycling; FOR REC S.P.A.; BHS Sonthofen GmbH; Metso Outotec Corporation; JMC Recycling Ltd.; LEFORT; CP Manufacturing, Inc.; JMC Recycling Ltd.; Eldan Recycling A/S; MHM Recycling Equipment; Advance Hydrau Tech Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Recycling Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal recycling equipment market based on equipment, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Baler Press

-

Shredders

-

Granulators

-

Shears

-

Separators

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global metal recycling equipment market size was estimated at USD 7,737.1 million in 2024 and is expected to reach USD 8,2016.6 million in 2025.

b. The global metal recycling equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 10.21 billion by 2030.

b. The baler press equipment segment led the market and accounted for 23.7% of the global revenue share in 2024. The demand for recycling metals is rapidly increasing from multiple end-use industries due to increased environmental benefits, and recyclable metals are used as primary raw materials in various industries such as construction, automotive, aerospace, and electronics, which is likely to benefit the metal recycling equipment market.

b. Some of the key players operating in the metal recycling equipment market include Kiverco; General Kinematics Corporation; Marathon Equipment; American Baler Company; Danieli Centro Recycling; FOR REC S.P.A.; BHS Sonthofen GmbH; Metso Outotec Corporation; JMC Recycling Ltd.; LEFORT; CP Manufacturing, Inc.; JMC Recycling Ltd.; Eldan Recycling A/S; MHM Recycling Equipment; Advance Hydrau Tech Pvt Ltd., among others.

b. The key factors that are driving the metal recycling equipment market include growing demand for recycled metal aerospace, automotive, construction industries coupled with, increasing generation of waste globally

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."