- Home

- »

- Organic Chemicals

- »

-

Metallic Stearates Market Size, Share, Industry Report, 2030GVR Report cover

![Metallic Stearates Market Size, Share & Trends Report]()

Metallic Stearates Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Zinc Stearate, Calcium Stearate, Aluminum Stearate, Magnesium Stearate, Sodium Stearate), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-636-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metallic Stearates Market Summary

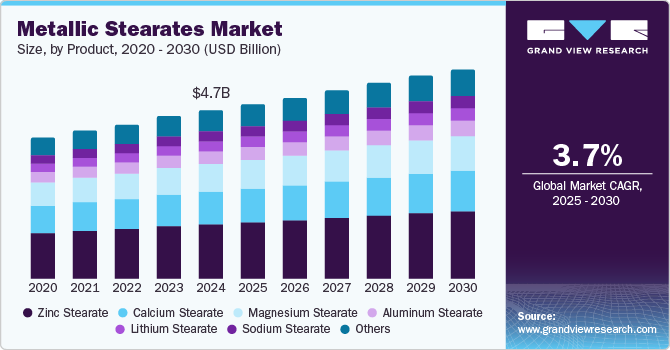

The global metallic stearates market size was estimated at USD 4.69 billion in 2024 and is projected to reach USD 5.85 billion by 2030, growing at a CAGR of 3.7% from 2025 to 2030. Market growth is fueled by widespread applications across diverse industries such as plastics, rubber, pharmaceuticals, cosmetics, and construction.

Key Market Trends & Insights

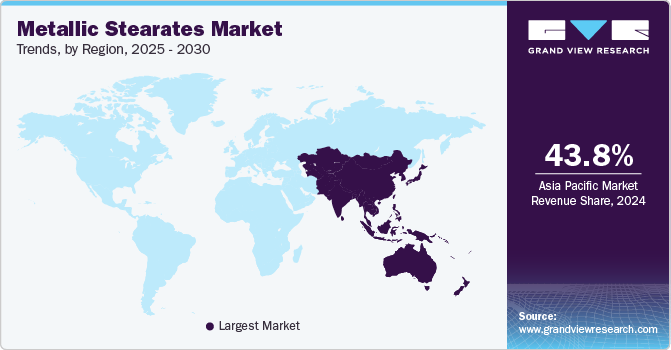

- The Asia Pacific metallic stearates market dominated the global market with a revenue share of 43.8% in 2024.

- The North America metallic stearates market is expected to register significant growth over the forecast period.

- By product, zinc stearate dominated the market and accounted for a share of 32.0% in 2024.

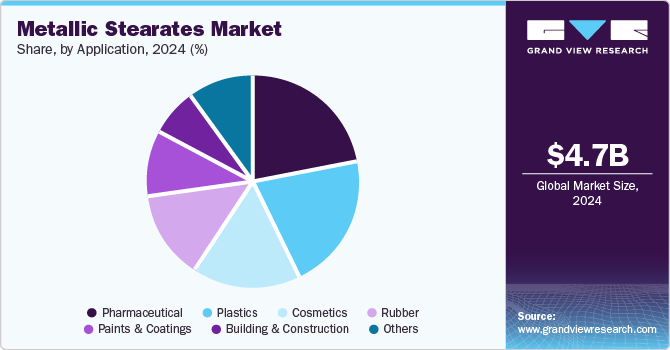

- By application, the pharmaceutical segment dominated the market and accounted for a share of 21.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.69 Billion

- 2030 Projected Market Size: USD 5.85 Billion

- CAGR (2025-2030): 3.7%

- Asia Pacific: Largest market in 2024

Their critical roles as lubricants, release agents, and stabilizers are essential in manufacturing processes, driving a consistent demand that underscores their importance within these sectors. This versatility positions metallic stearates as integral components in various formulations, thereby solidifying their market presence and leading to an anticipated increase in consumption.

The rising demand for plastic products necessitates the incorporation of metallic stearates to enhance surface texture and improve processing efficiency. Their ability to serve as processing aids allows manufacturers to optimize production yields and maintain product quality, contributing significantly to market expansion. As industries scale up production to meet consumer needs, metallic stearates will continue to play a pivotal role in supporting this upward trend.

The growing consumer preference for personal care and cosmetic products has escalated the need for thickening agents and lubricants—key functionalities provided by metallic stearates. Their application in various formulations, including creams and lotions, improves product performance meets the evolving consumer expectations for quality and efficacy. This trend underscores the expanding role of metallic stearates in responding to market demands.

Furthermore, rapid urbanization and infrastructure development in emerging economies, particularly in the Asia-Pacific region, are further driving demand for construction materials that utilize metallic stearates. Ongoing investments in infrastructure projects are anticipated to sustain this growth trajectory, as economies develop and expand. Coupled with technological advancements and innovations in manufacturing processes, the ongoing research into the properties of metallic stearates is likely to unlock new applications and enhance performance. This confluence of factors positions the metallic stearates market favorably for continued growth amid economic expansions in emerging markets such as China and India, where increased investment across key sectors amplifies demand potential.

Product Insights

Zinc stearate dominated the market and accounted for a share of 32.0% in 2024, owing to its versatility as a lubricant, release agent, and stabilizer across industries such as plastics, rubber, and pharmaceuticals. Zinc stearate enhances processing efficiency, improves product quality, and is favored for its non-toxic nature, contributing to its sustained demand in a safety-focused market.

Calcium stearate is expected to grow at the fastest CAGR of 4.1% over the forecast period, driven by its key roles as a lubricant and release agent in plastics and rubber manufacturing. As industries seek cost-efficient solutions to enhance productivity and performance, the demand for calcium stearate is expected to rise, making it an attractive option for manufacturers.

Application Insights

The pharmaceutical segment dominated the market and accounted for a share of 21.9% in 2024, fueled by the increasing use of metallic stearates as excipients in drug formulations, where they function as lubricants and flow agents during tablet production. The expanding global pharmaceutical industry and stringent regulatory standards further bolster the need for reliable excipients, ensuring this segment’s continued prominence.

The plastics segment is projected to grow at a significant rate over the forecast period, aided by escalating demand from end-use industries such as packaging, automotive, and construction. Metallic stearates are essential for improving the processing characteristics of plastics, serving as lubricants and anti-blocking agents. As urbanization and consumer demand for plastic products rise, the need for effective additives will drive robust growth in this segment.

Regional Insights

Asia Pacific metallic stearates market dominated the global market with a revenue share of 43.8% in 2024, fueled by rapid industrialization and urbanization, resulting in heightened demand across sectors such as plastics, rubber, and personal care. Key markets such as China and India are experiencing significant economic growth, driving investments in manufacturing and infrastructure, which subsequently enhances the need for metallic stearates.

China Metallic Stearates Market Trends

The metallic stearates market in China dominated the Asia Pacific metallic stearates market with the largest revenue share in 2024, aided by its flourishing manufacturing sector, particularly in plastics and cosmetics. The nation’s increasing emphasis on quality control and product safety is fueling the demand for high-quality metallic stearates. Rising consumer awareness in the country regarding personal care products is driving growth as companies seek effective additives for their formulations.

Europe Metallic Stearates Market Trends

Europe metallic stearates market held substantial market share in 2024 due to heightened consumer awareness surrounding sustainable and high-quality products, especially within cosmetics and pharmaceuticals. The region’s rigorous regulatory frameworks encourage manufacturers to innovate while ensuring safety and efficacy. The growing interest in eco-friendly packaging solutions further propels the demand for metallic stearates across various applications.

The metallic stearates market in Germany is expected to grow rapidly in the forecast period. As a leader in high-quality pharmaceutical and cosmetic manufacturing, the country exhibits a high demand for effective additives such as metallic stearates. Furthermore, Germany’s commitment to sustainability promotes the use of eco-friendly formulations, enhancing market growth.

North America Metallic Stearates Market Trends

North America metallic stearates market is expected to register significant growth over the forecast period. The presence of leading cosmetic brands necessitates high-quality metallic stearates in their formulations. Moreover, rising urbanization and infrastructure development are increasing demand across multiple applications, thereby significantly contributing to the overall market expansion.

The metallic stearates market in the U.S. dominated the North America metallic stearates market in 2024, supported by substantial investments in the pharmaceutical and cosmetic industries, which depend heavily on metallic stearates for product formulation. The concentration of leading manufacturers and advanced research facilities promotes innovation. Moreover, stringent regulatory standards enhance product quality, further stimulating demand among consumers and industries.

Key Metallic Stearates Company Insights

Some key companies operating in the market include Dover Chemical Corporation; Valtris Specialty Chemicals; Peter Greven GmbH & Co. KG; Baerlocher GmbH; among others. Companies are actively pursuing mergers, acquisitions, and product innovations to strengthen market presence, while strategic partnerships and R&D investments enhance product quality and versatility.

-

Dover Chemical Corporation specializes in manufacturing and distributing specialty chemicals, including a wide array of metallic stearates such as zinc, calcium, magnesium, and aluminum stearate. These high-quality products enhance processing efficiency and performance across numerous industries, including plastics and pharmaceuticals.

-

Peter Greven GmbH & Co. KG is a leading manufacturer of metallic stearates, offering high-quality products such as zinc, calcium, and magnesium stearate. The company prioritizes innovation and sustainability while serving industries such as plastics and pharmaceuticals.

Key Metallic Stearates Companies:

The following are the leading companies in the metallic stearates market. These companies collectively hold the largest market share and dictate industry trends.

- Dover Chemical Corporation

- Valtris Specialty Chemicals

- Peter Greven GmbH & Co. KG

- Baerlocher GmbH

- Faci S.p.A

- Norac Additives

- Sun Ace Kakoh (Pte.) Limited

- PMC Biogenix, Inc.

- James M. Brown Ltd.

- Nimbasia Stabilizers LLP

- Marathwada Chemicals

- Seoul Fine Chemical Ind. Co., Ltd.

- IRRH Specialty Chemicals India Limited

- Akrochem Corporation

Metallic Stearates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.87 billion

Revenue forecast in 2030

USD 5.85 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U;S;, Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, Japan, India, Australia, South Korea, Indonesia, Oceania, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Dover Chemical Corporation; Valtris Specialty Chemicals; Peter Greven GmbH & Co. KG; Baerlocher GmbH; Faci S.p.A; Norac Additives; Sun Ace Kakoh (Pte.) Limited; PMC Biogenix, Inc.; James M. Brown Ltd.; Nimbasia Stabilizers LLP; Marathwada Chemicals; Seoul Fine Chemical Ind. Co., Ltd.; IRRH Specialty Chemicals India Limited; Akrochem Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metallic Stearates Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metallic stearates market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Zinc Stearate

-

Calcium Stearate

-

Aluminum Stearate

-

Magnesium Stearate

-

Sodium Stearate

-

Lithium Stearate

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Rubber

-

Pharmaceutical

-

Cosmetics

-

Building & Construction

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Oceania

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.