- Home

- »

- Electronic Devices

- »

-

Metrology Services Market Size, Share, Industry Report 2030GVR Report cover

![Metrology Services Market Size, Share & Trends Report]()

Metrology Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (CMM, ODS), By Application (Automotive, Aerospace, Industrial, Power Generation), By Region, And Segment Forecasts

- Report ID: 978-1-68038-211-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metrology Services Market Summary

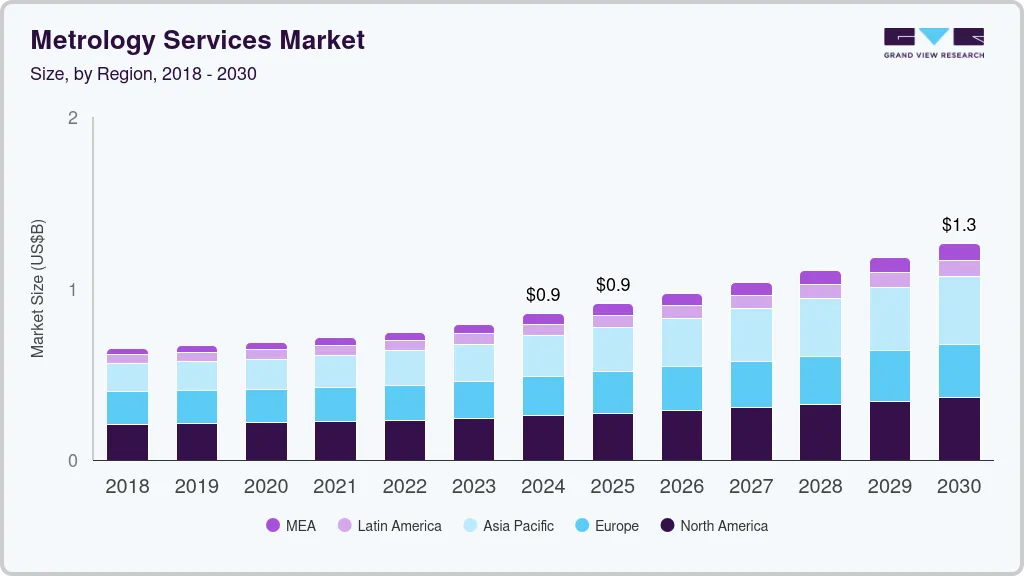

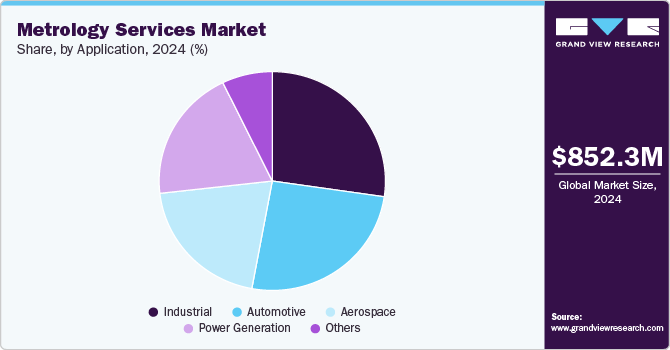

The global metrology services market size was estimated at USD 852.3 million in 2024 and is projected to reach USD 1,259.8 million by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The market growth is fueled by the rise of additive manufacturing.

Key Market Trends & Insights

- North America dominated the metrology services market with the largest revenue share of 30% in 2024.

- The metrology services market in the U.S. accounted for the largest market revenue share in North America in 2024.

- In terms of product, The optical digital systems (ODS) segment led the market with the largest revenue share of 61% in 2024.

- In terms of application, The industrial segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- 2024 Market Size: USD 852.3 Million

- 2030 Projected Market Size: USD 1,259.8 Million

- CAGR (2025 - 2030): 6.7%

- North America: Largest market in 2024

As 3D printing becomes more prevalent in precision-driven sectors like aerospace, automotive, and healthcare, the need for advanced, non-destructive measurement techniques is increasing. Traditional inspection tools often fall short in handling the complex geometries of 3D-printed components. This is driving the adoption of high-resolution optical scanning and CT-based metrology solutions, enabling real-time quality control and ensuring compliance in high-performance applications.Gantry CMMs are increasingly being adopted in heavy industries due to their robust architecture and unmatched capability to measure large and heavy components, making them essential in sectors like aerospace and shipbuilding. These systems excel in handling oversized parts that surpass the capacity of standard CMMs, ensuring precise measurements for critical applications where structural integrity and dimensional accuracy are vital. In the metrology services industry, continuous innovations in sensor technology and advanced measurement software are enhancing both the precision and throughput of Gantry CMMs, enabling faster and more accurate inspections. This trend is driving the demand for these systems in large-scale manufacturing environments where efficient and reliable inspection processes are needed. As a result, Gantry CMMs are becoming a cornerstone of quality control in industries that require high-performance metrology services for complex, large-scale components.

Bridge CMMs are gaining significant traction in automotive production lines due to their high accuracy, compact footprint, and cost-effectiveness. These systems are well-suited for inspecting engine parts, chassis elements, and gear components, making them a critical tool in the automotive industry's push for precision and high throughput. In the metrology services industry, bridge CMMs are enhancing quality control processes through seamless integration with CAD platforms and automated data reporting tools, which streamline inspection workflows. Their adaptability to automated production systems has made them indispensable in improving operational efficiency on manufacturing floors. As automotive OEMs demand higher throughput and consistent quality, the demand for bridge CMMs in the metrology services industry is expected to continue growing rapidly.

Articulated arm CMMs are becoming increasingly popular due to their portability, ease of use, and versatility across various workspaces, especially in industries like aerospace and defense. These systems offer both manual and automated inspection capabilities, making them ideal for complex geometries and hard-to-reach areas, particularly in maintenance, repair, and overhaul (MRO) applications. In the metrology services industry, their minimal setup requirements and user-friendly interfaces are driving adoption, particularly in decentralized quality control environments where flexibility and mobility are essential. Their ability to deliver precise measurements in diverse operational settings, including large-scale manufacturing and field inspections, is expanding their market presence. The growing demand for flexible, mobile metrology solutions is positioning articulated arm CMMs as a key driver in the metrology services industry.

Horizontal arm CMMs are increasingly being used for inspecting large, flat sheet metal parts, particularly within the automotive and railway industries, where high precision is essential. Their open-structure design allows easy access to large components, such as vehicle bodies and assemblies, making them crucial for body-in-white (BIW) inspections in automotive manufacturing. In the metrology services industry, advances in multi-sensor integration and improved measurement precision are elevating the value of horizontal arm CMMs in large-scale quality assurance applications. These systems are critical for manufacturers seeking high-throughput solutions for inspecting expansive surfaces, where accuracy is paramount. As the demand for high-performance inspection tools grows, horizontal arm CMMs are becoming more integral to the metrology services industry, enhancing operational value in quality control processes across various manufacturing sectors.

Product Insights

The optical digital systems (ODS) segment led the market with the largest revenue share of 61% in 2024. The rise in industries requiring highly accurate measurement tools is propelling the demand for optical digital systems (ODS). These systems, designed to provide non-contact, high-precision measurements, are crucial in sectors such as automotive, aerospace, and electronics. Their ability to enhance product quality while reducing production costs makes them a preferred choice for manufacturers. As technology advances, the demand for more sophisticated metrology services that support complex production environments continues to grow. The increasing need for quality control in automated manufacturing systems further strengthens the role of ODS in metrology services.

The coordinate measuring machine (CMM) segment is expected to witness at the fastest CAGR of over 7% from 2025 to 2030. The growing adoption of automation in manufacturing processes is one of the primary drivers for the CMM segment in the metrology services industry. Manufacturers are increasingly seeking automated CMM systems to improve productivity, reduce human error, and enhance consistency in quality control. These systems offer high precision in inspecting complex components, which is crucial for industries like automotive, aerospace, and electronics. Automation helps in achieving faster measurement cycles, leading to reduced production times and increased throughput. As manufacturing facilities become more automated, the demand for advanced CMM solutions is set to rise sharply.

Application Insights

The industrial segment accounted for the largest market revenue share in 2024. The integration of metrology services with smart manufacturing solutions is a major trend in the industrial sector. The increasing use of IoT-enabled machines, sensors, and real-time data analytics within factories allows for continuous monitoring of product quality during production. Metrology services are becoming more integrated with these smart manufacturing systems to provide on-the-spot, precise measurements that can be immediately analyzed and acted upon. This seamless integration between metrology services and smart manufacturing technologies ensures that quality control is embedded within the production process, reducing errors and minimizing costly rework.

The aerospace segment is expected to witness at the fastest CAGR from 2025 to 2030. The aerospace industry is increasingly adopting 3D measurement technologies to inspect and analyze complex parts and assemblies. Traditional 2D inspection methods are often insufficient for assessing intricate geometries found in aerospace components, such as curved surfaces, complex structural designs, and delicate engine parts. 3D measurement technologies, such as laser scanning and optical digital systems (ODS), provide more detailed and accurate assessments by capturing three-dimensional data. This technology enables manufacturers to inspect the complete geometry of an object, providing greater insight into design and manufacturing tolerances. The ability to create digital models of physical parts is enhancing the quality control process, leading to more reliable and efficient aircraft production.

Regional Insights

North America dominated the metrology services market with the largest revenue share of 30% in 2024, owing to the significant shift toward automation and smart manufacturing technologies in the metrology services industry. Manufacturers are increasingly adopting AI-driven measurement systems and integrating them with the Internet of Things (IoT) to optimize production efficiency and product quality. The demand for precision measurement solutions is growing across industries such as automotive, aerospace, and electronics, as businesses seek to improve operational excellence and maintain competitive advantage.

U.S. Metrology Services Market Trends

The metrology services market in the U.S. accounted for the largest market revenue share in North America in 2024.In the U.S., there is a growing emphasis on the adoption of advanced metrology services in sectors like aerospace, automotive, and defense. The country’s robust manufacturing base and technological innovations are pushing the demand for precision measurement tools such as 3D scanners, laser trackers, and coordinate measuring machines (CMMs). In addition, the increasing integration of Industry 4.0 technologies with metrology services is helping U.S. manufacturers achieve higher levels of accuracy and operational efficiency.

Europe Metrology Services Market Trends

The metrology services market in Europe is driven by the rapid advancements in digital manufacturing and the increasing importance of sustainability in production. The European Union’s regulatory framework, which places a strong emphasis on environmental standards and product quality, is prompting industries to adopt precision metrology tools for compliance. Industries such as automotive, aerospace, and energy are leveraging cutting-edge metrology solutions to ensure product quality and adhere to stringent environmental regulations.

The UK metrology services market is witnessing a strong push towards the digitalization of manufacturing processes, with metrology services playing a key role in ensuring precision and efficiency. The UK's automotive and aerospace sectors are leading adopters of optical measurement technologies, such as 3D scanning and CMMs, to meet the growing demand for high-quality and complex components. Furthermore, the ongoing focus on quality control in manufacturing processes is driving the adoption of metrology solutions for faster and more accurate inspections.

The metrology services market in Germany is known for its strong engineering and manufacturing sectors; metrology services are evolving with an increasing focus on the integration of artificial intelligence (AI) and machine learning into measurement processes. German industries, particularly automotive, machinery, and precision engineering, are adopting highly automated metrology systems to improve product quality and production efficiency. The demand for advanced metrology tools is also being fueled by Germany’s commitment to Industry 4.0 and digital manufacturing technologies.

Asia Pacific Metrology Services Market Trends

The metrology services market in Asia Pacific is expected to grow at the fastest CAGR of 8% from 2025 to 2030, due to the region's heavy investments in advanced manufacturing technologies and industrial automation. Countries like China and India are leading the way in adopting precision measurement solutions to boost production capabilities and meet international quality standards. The growing focus on the development of smart factories and the digitalization of manufacturing processes is further driving the need for accurate and reliable metrology services across the region.

The India metrology services market are in increasing demand for metrology services driven by the growing manufacturing sector, especially in industries such as automotive, aerospace, and electronics. The shift toward digital manufacturing and smart factories is prompting Indian manufacturers to adopt advanced metrology tools to boost product quality and lower production costs. Moreover, the government’s “Make in India” initiative is driving investments in high-precision measurement technologies, helping local industries enhance their global competitiveness.

The metrology services market in China is experiencing rapid growth due to the country’s position as a global manufacturing hub. The increasing complexity of manufacturing processes, particularly in electronics, automotive, and heavy machinery, is driving demand for advanced metrology solutions such as 3D measurement systems and optical digital sensors. In addition, China’s focus on technological innovation and automation is pushing the adoption of smart manufacturing solutions, which require high-precision metrology tools to ensure quality control throughout the production cycle.

Key Metrology Services Company Insights

Some of the key players operating in the market include Hexagon AB and Renishaw plc.

-

Hexagon AB offers a comprehensive range of solutions including coordinate measuring machines (CMMs), optical and laser measurement tools, and integrated systems for industrial automation. The company specializes in delivering advanced metrology solutions across various industries, such as automotive, aerospace, and electronics. Hexagon's cutting-edge technologies, such as AI-powered inspection systems and smart manufacturing solutions, set it apart as a key innovator in the industry.

-

Renishaw plc specializes in metrology services and precision measurement technologies, including CMM probes, laser measurement systems, and additive manufacturing solutions. With a strong emphasis on innovation, Renishaw offers specialized solutions for industries like aerospace, automotive, and medical devices. The company is also a leader in providing measurement systems that integrate seamlessly with digital and smart manufacturing technologies.

Nikon Metrology Inc. and Optical Metrology Services Ltd are some of the emerging participants in the metrology services industry.

-

Nikon Metrology Inc. is an emerging player in the metrology market, focusing on 3D measurement solutions, digital imaging, and non-contact inspection systems. The company specializes in creating high-accuracy tools for industries such as automotive, aerospace, and electronics. Nikon's cutting-edge optical measurement technology is helping to transform quality control processes in manufacturing environments.

-

Optical Metrology Services Ltd specializes in providing high-precision optical measurement services, particularly for industries requiring detailed analysis of complex geometries. The company offers advanced laser scanning and photogrammetry technologies that help with 3D scanning, reverse engineering, and rapid prototyping. With its focus on optical and non-contact metrology solutions, Optical Metrology Services Ltd is becoming an emerging player in the high-precision measurement market.

Key Metrology Services Companies:

The following are the leading companies in the metrology services market. These companies collectively hold the largest market share and dictate industry trends.

- Hexagon AB

- Carl Zeiss AG

- Renishaw plc

- Nikon Metrology Inc.

- Quality Vision International Inc.

- Optical Metrology Services Ltd

- Intertek Group plc

- Dimensional Metrology Services

- Verus Precision Ltd

- Metalock Engineering Group

- Metrology Services, Inc.

- Rice Lake Weighing Systems.

Recent Developments

-

In May 2025, ZEISS introduced the Smartzoom 100, an advanced digital microscope designed to enhance optical inspections and failure analysis in industrial environments. This product combines high-resolution imaging with a user-friendly interface, making it ideal for quality assurance processes across industries. The Smartzoom 100 simplifies workflows while delivering precise results, contributing to increased operational efficiency. With its cutting-edge technology, ZEISS sets new standards in industrial microscopy, offering a more reliable solution for inspections and quality control.

-

In September 2024, Hexagon launched the Leica Absolute Tracker ATS800, a system combining laser tracking and non-contact measurement technologies. It enables high-precision inspections of large components from a safe distance, reducing inspection times from hours to minutes. With capabilities like direct scanning and reflector tracking, it allows real-time monitoring of complex features without proximity to the parts. Ideal for industries such as aerospace, automotive, and wind energy, the ATS800 enhances productivity, ensuring accurate measurements while minimizing safety risks and operational disruptions.

Metrology Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 909.7 million

Revenue forecast in 2030

USD 1,259.8 million

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Hexagon AB; Carl Zeiss AG; Renishaw plc; Nikon Metrology Inc.; Quality Vision International Inc.; Optical Metrology Services Ltd; Intertek Group plc; Dimensional Metrology Services; Verus Precision Ltd; Metalock Engineering Group; Metrology Services, Inc.; Rice Lake Weighing Systems.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metrology Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metrology services market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CMM

-

Gantry Machines

-

Bridge Machines

-

Articulated Arm Machines

-

Horizontal Arm Machines

-

-

ODS

-

3D Laser Scanners

-

White Light Scanners

-

Laser Trackers

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Industrial

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metrology services market size was estimated at USD 852.3 million in 2024 and is expected to reach USD 909.7 million in 2025.

b. The global metrology services market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 1,259.8 million by 2030.

b. North America dominated the metrology services market with a share of over 30% in 2024. owing to the demand for fast, accurate, and detailed data collection, the North America metrology services market is increasingly adopting 3D scanning and laser measurement systems for applications such as quality control, reverse engineering, and prototyping in the automotive and aerospace sectors.

b. Some key players operating in the metrology services market include owing to the significant shift toward automation and smart manufacturing technologies in the metrology services market. Manufacturers are increasingly adopting AI-driven measurement systems and integrating them with the Internet of Things (IoT) to optimize production efficiency and product quality. Hexagon AB, Carl Zeiss AG, Renishaw plc, Nikon Metrology Inc., Quality Vision International Inc., Optical Metrology Services Ltd, Intertek Group plc, Dimensional Metrology Services, Verus Precision Ltd, Metalock Engineering Group, Metrology Services, Inc., Rice Lake Weighing Systems.

b. Key factors that are driving the market growth include increasing demand for precision engineering and quality control in manufacturing, rising adoption of 3D metrology solutions across the automotive and aerospace sectors, and growing implementation of automated inspection systems for faster production cycles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.