- Home

- »

- Conventional Energy

- »

-

Mexico Oil And Gas Market Size, Share & Growth Report 2030GVR Report cover

![Mexico Oil And Gas Market Size, Share & Trends Report]()

Mexico Oil And Gas Market Size, Share & Trends Analysis Report By Operations (Upstream, Midstream, Downstream), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-050-2

- Number of Report Pages: 77

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Report Overview

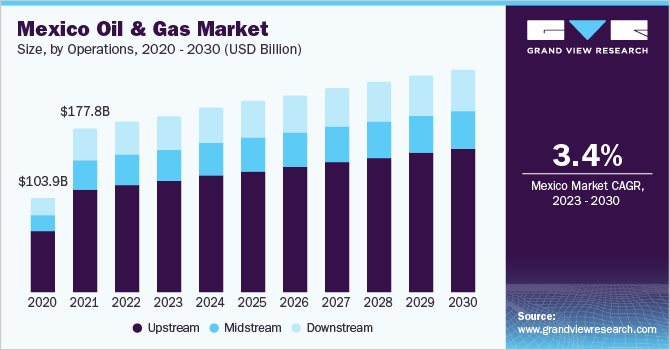

The Mexico oil and gas market size was valued at USD 185.46 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. Mexico's demand for oil & gas is anticipated to increase as a result of government subsidies and the liberalization of fuel prices. Additionally, it is anticipated that cooperation between Mexico and European nations for natural gas trading and the natural gas shortage experienced by European nations due to the conflict in Russia and Ukraine will further influence the oil and gas market’s growth.

Mexico emerged as a potential market for oil and gas in North America in 2022. North America also holds significant reserves of crude oil and natural gas beneath the waters of the Gulf of Mexico and the tight rocks of Alberta, Colorado, Texas, and Central California. Since 2005, an increase in natural gas and crude oil production is being witnessed due to the introduction of horizontal drilling and hydraulic fracturing techniques deployed by oil and gas companies in North America.

The upstream, midstream, and downstream stages make up the value chain for the oil and gas market in Mexico. Exploration, development, production, and decommissioning activities are all part of the upstream stage. Geological surveys, acquisition of land rights, and production activities like on- and offshore drilling are all part of the exploration process. Numerous techniques are used to conduct geological surveys such as seismic imaging for offshore exploration and soil testing for onshore exploration.

One of the commodities that are most frequently traded and consumed around the world is crude oil. The tight rocks of Alberta, Colorado, Texas, and Central California, as well as the waters of the Gulf of Mexico, contain sizeable reserves of crude oil and natural gas.

The COVID-19 pandemic has resulted in hindering the market growth of Mexico’s oil & gas industry owing to factors such as disruption in the supply chain. In March 2020, Mexico saw a sharp decline in oil prices on the market. Due to the economic consequences of the pandemic, there was a sharp decline in oil consumption that caused an oversupply and, as a result, insufficient global storage capacity. On April 20, 2020, the cost of crude oil exported from Mexico fell to a record low of minus USD 2.37 per barrel.

Operations Insights

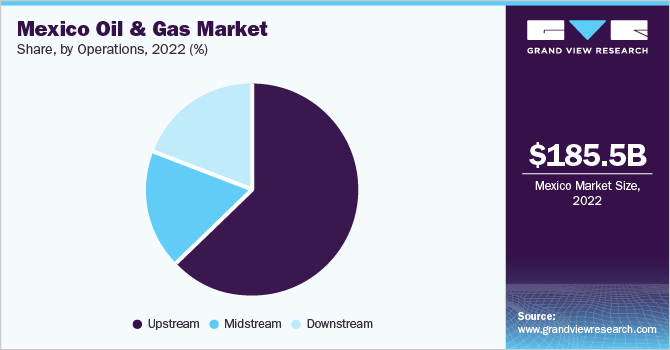

In terms of revenue, upstream led the operations segment with a market share of 62.75% in 2022. The upstream segment held a sizable portion of the market, and it is anticipated that it will continue to dominate during the forecast period. Oil discovery, extraction, and production are all part of the upstream sector. The midstream sector in the country constitutes 69 natural gas processing facilities throughout 11 natural gas processing centers. The majority of the nation's natural gas distribution system, which transports processed natural gas to consumption areas, is run by PEMEX.

The downstream sector is made up of oil refineries, distributors, petrochemical plants, and retail stores. As of the end of 2021, Mexico's six refineries, all run by PEMEX, had a combined refining capacity of 1.6 million b/d. An estimated 38% average refinery utilization rate was recorded in Mexico in 2021. Additionally, PEMEX owns 50% of Texas's 340,000 b/d Deer Park refinery.

Key Companies & Market Share Insights

The market is highly competitive and consolidated due to the presence of a large number of market players. The dominant trend in the operations of these oil & gas companies includes vertical integration which defends against market power and reduces competition. Russia Ukraine war, favorable government regulations, and strong R&D are among the significant factors governing the competitiveness of the Mexican oil & gas industry.

In August 2022, BP p.l.c. announced to consider divesting its oil assets in Mexico and shifting its focus toward renewable energy in Mexico. This business strategy is driven by the growing renewable energy sector in the country and the challenging political environment in Mexico toward the oil & gas sector. Some prominent players in the Mexico oil and gas market includes:

-

BP p.l.c.

-

Chevron Corporation

-

Citla Energy

-

Exxon Mobil Corporation

-

Marathon Petroleum Corporation

-

Petroleos Mexicanos (Pemex)

-

SAIPEM SpA

-

Sempra

-

Shell International B.V.

-

TotalEnergies

Mexico Oil And Gas Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 193.06 billion

Revenue forecast in 2030

USD 243.50 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operations

Regional Scope

Mexico

Key companies profiled

BP p.l.c.; Chevron Corporation; Exxon Mobil Corporation; Shell International B.V.; Citla Energy; Marathon Petroleum Corporation; TotalEnergies; SAIPEM SpA; Petroleos Mexicanos (Pemex); SICIM S.p.A.; TC Energy Corporation; Harbour Energy; Sempra

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Oil And Gas Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico oil and gas market report based on operations:

-

Operations Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upstream

-

Onshore

-

Offshore

-

-

Midstream

-

Downstream

-

Refining

-

-

Frequently Asked Questions About This Report

b. The Mexico oil and gas market size was estimated at USD 185.46 billion in 2022 and is expected to reach USD 193.06 billion in 2023.

b. The Mexico oil and gas market is expected to witness a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 243.50 billion by 2030.

b. The Upstream was the largest operation segment accounting for 62.75% of the total revenue in 2022 owing to large production in the country

b. Some of the major Mexico oil and gas market players include BP p.l.c, Chevron Corporation, Exxon Mobil Corporation, Shel international B.V.

b. Key factors driving the growth of the Mexico Oil & Gas market include increasing government support to develop public oil and gas company and policies by government promoting fossil fuel consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."