- Home

- »

- Organic Chemicals

- »

-

Mexico Water Treatment Chemicals Market Size Report, 2030GVR Report cover

![Mexico Water Treatment Chemicals Market Size, Share & Trends Report]()

Mexico Water Treatment Chemicals Market Size, Share & Trends Analysis Report By Product, By Application By End-use, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-024-4

- Number of Report Pages: 131

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

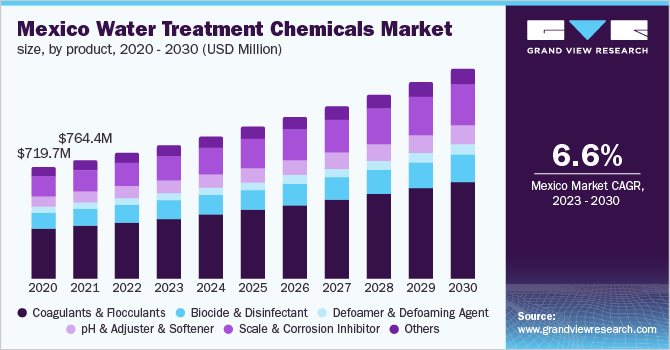

The Mexico water treatment chemicals market size was valued at USD 812.36 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. This is attributed to the growing oil & gas industry, as Mexico is one of the largest oil producers in the world. According to the International Trade Administration, Mexico ranked twelfth in crude oil production, sixteenth in the refined capacity of oil, and twenty-first in crude oil reserves in 2021 globally. Additionally, in 2021, the earnings from the oil & gas industry of Mexico accounted for a share of approximately 16% of the total revenues recorded by the government of the country, as a result boosting the demand.

Major environmental issues being faced by Mexico are scarce freshwater resources in northern parts of the country, poor water quality in extreme southern and central regions, and pollution of rivers caused by industrial effluents & raw sewage in urban areas. Untreated effluents from industries are directly discharged into the environment causing pollution in downstream water sources and posing threat to the health of consumers of water from these sources, thus boosting the demand for water treatment chemicals in the country.

However, sustainable water treatment or scale-free systems are becoming the choice of the leading companies operating in various industries in Mexico. The chemical-free water treatment systems are preferred in the country as they are environment-friendly, consume less energy, and have low-maintenance requirements. The market players in Mexico are adopting these systems to reduce their operating costs. Thus, the adoption of chemical-free systems in the country is anticipated to hamper the growth of water treatment chemicals in Mexico over the forecast period.

Mexico was the worst-hit country by COVID-19 in North America in 2020. According to the Federal Reserve Bank of Dallas, the economy of Mexico fell by 4.5% in 2020 as the pandemic led to the shutting down of factories, lowering of industrial production, declining oil prices, and lowering of the income of the masses. Additionally, the output of service-related activities such as transportation and trade dropped by 5.2% in the country and the productivity of goods and service-offering industries such as construction, manufacturing, and chemicals fell by 0.5% in Mexico. This affected the demand for water treatment chemicals in the country.

Product Insights

Mexico was the largest consumer of coagulants & flocculants in North America with a revenue share of over 44.9% in 2022. This is attributed to the increasing industrial development in the region. Flocculation and Coagulation are used to eliminate suspended solid materials by destabilizing the suspended solid particles in water solutions. Wastewater solids, effluent wastewater, mining wastewater, and municipal water are some of the key applications for the product.

The scale & corrosion inhibitor segment is anticipated to witness the fastest CAGR of 7.3% over the forecast period. Corrosion inhibitors are formulated and designed to avoid metal loss, which can hamper operational efficiency by creating critical system errors/failures in heat exchangers and process cooling equipment. However, due to corrosion, there is a loss of efficiency as corrosion precipitates in heat transfer machines and isolates the metals. Some of the commonly used scale & corrosion inhibitors include phosphates, polyphosphate, copolymers, and acrylate polymers.

End-use Insights

The municipal end-use segment dominated with a revenue share of over 41.6% in 2022. This is attributed to the Growing water scarcity in Mexico which pushed major players to focus on reusing and recycling the water. According to Borgen, a non-profit organization, in 2020, over 50% of the population of Mexico faced water scarcity thus, creating the need for water treatment chemicals.

Oil & gas is another major end-use segment. It is expected to witness the fastest CAGR of 6.7% over the forecast period. According to the International Trade Administration (ITA), in 2021, the Mexican petroleum industry was the 12th largest producer of crude oil in the world. The country had the 17th largest oil reserves in the world and was the 4th largest oil producer in America with a production capacity of 1.99 million barrels per day. Thus, the expansion of the oil & gas industry in Mexico has led to a high amount of effluent discharge in water bodies, thus, creating the need for water treatment chemicals in the country.

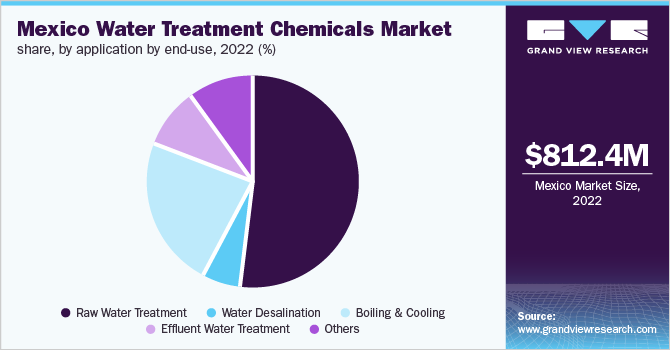

Application By End-use Insights

The Raw water treatment segment dominated with a revenue share of over 52.2% in 2022. This is attributed to its increasing usage in municipal, oil & gas, and power industry with municipal accounting for a major revenue share of over 41.6% in 2022. Raw water treatment is mainly used in industrial settings for cooling, product formulation, rinsing, and human consumption. It is used for the pre-treatment of sourced water to improve process performance and production efficiency for a particular application. It is focused on protecting industrial equipment from corrosion, scaling, fouling, or any other form of damage.

The effluent water treatment segment is anticipated to witness the fastest CAGR of 7.8% over the forecast period. This is attributed to its increasing usage in end-use industries such as oil & gas, municipal, and mining industries. Effluent water treatment is a process of treating industrial wastewater for its safe disposal or reusability in the environment. Industrial wastewater contains a large number of impurities and thus, requires a special treatment process. The treatment depends on the type of effluent present. Several chemicals used in this treatment include dewatering aids, organic coagulants, flocculants, filtration aids, and deoiling polyelectrolytes (DOPE).

Key Companies & Market Share Insights

The water treatment chemicals market in Mexico is fragmented. Manufacturers are focusing on both backward and forward integration i.e. in-house raw material production facilities, distribution, and application of the product. Thus, this presence of companies across various stages of the value chain has resulted in improving the profit margins of the companies by reducing distribution costs and giving better control over the pricing of products. Some prominent players in the Mexico water treatment chemicals market include:

-

IDE Water Technologies

-

Baker Hughes Company

-

BASF SE

-

Buckman

-

Cortec Corporation

-

Ecolab Inc

-

Kemira

-

Nouryon

-

SNF Group

-

Solenis LLC

-

Solvay

-

Dow

-

Veolia

-

Apollo Chemicals

Mexico Water Treatment Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 864.2 million

Revenue forecast in 2030

USD 1,357.09 million

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application by end-use, end-use

Country scope

Mexico

Key companies profiled

IDE Water Technologies; Baker Hughes Company; BASF SE; Buckman; Cortec Corporation; Ecolab Inc.; Kemira; Nouryon; SNF Group; Solenis LLC; Solvay; Dow; Veolia; Apollo Chemicals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Water Treatment Chemicals Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico water treatment chemicals market report based on product, application by end-use, and end-use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coagulants & Flocculants

-

Biocide & Disinfectant

-

Defoamer & Defoaming Agent

-

pH & Adjuster & Softener

-

Scale & Corrosion Inhibitor

-

Others

-

-

Application By End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Raw Water Treatment

-

Power

-

Oil & Gas

-

Upstream

-

Well Development

-

Hydraulic Equipment

-

Others

-

-

Midstream

-

Tank Cleaning

-

Others

-

-

Downstream

-

Refineries

-

Others

-

-

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Construction

-

Others

-

-

Water Desalination

-

Power

-

Oil & Gas

-

Upstream

-

Well Development

-

Hydraulic Equipment

-

Others

-

-

Midstream

-

Tank Cleaning

-

Others

-

-

Downstream

-

Refineries

-

Others

-

-

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Construction

-

Others

-

-

Boiling and Cooling

-

Power

-

Oil & Gas

-

Upstream

-

Well Development

-

Hydraulic Equipment

-

Others

-

-

Midstream

-

Tank Cleaning

-

Others

-

-

Downstream

-

Refineries

-

Others

-

-

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Construction

-

Others

-

-

Effluent Water Treatment

-

Power

-

Oil & Gas

-

Upstream

-

Well Development

-

Hydraulic Equipment

-

Others

-

-

Midstream

-

Tank Cleaning

-

Others

-

-

Downstream

-

Refineries

-

Others

-

-

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Construction

-

Others

-

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Power

-

Oil & Gas

-

Upstream

-

Well Development

-

Hydraulic Equipment

-

Others

-

-

Midstream

-

Tank Cleaning

-

Others

-

-

Downstream

-

Refineries

-

Others

-

-

-

Chemical Manufacturing

-

Mining & Mineral Processing

-

Municipal

-

Food & Beverage

-

Pulp & Paper

-

Construction

-

Others

-

Frequently Asked Questions About This Report

b. The Mexico water treatment chemicals market size was estimated at USD 812.36 million in 2022 and is expected to reach USD 864.2 million in 2023.

b. The Mexico water treatment chemicals market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 1,357.09 million by 2030.

b. Coagulants & flocculants dominated the Mexico water treatment chemicals market with a share of 44.9% in 2022. This is attributable to their ability to remove around 90% of the suspended solid particles from the wastewater.

b. Some key players operating in the Mexico water treatment chemicals market include IDE Water Technologies, Baker Hughes Company, BASF SE, Buckman, Ecolab Inc., Solvay, Dow, and others

b. Key factors that are driving the market growth include scarce and polluted freshwater resources in northern parts of the country, poor water quality in extreme southern and central regions of the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."