- Home

- »

- Next Generation Technologies

- »

-

Micro Lending Market Size, Share, Industry Trend Report, 2030GVR Report cover

![Micro Lending Market Size, Share & Trends Report]()

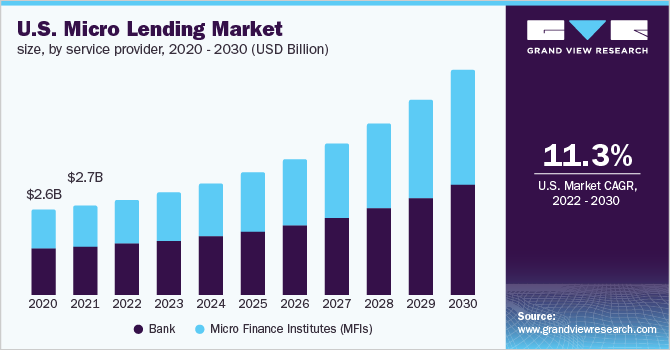

Micro Lending Market (2022 - 2030) Size, Share & Trends Analysis Report By Service Provider (Banks, Micro Finance Institutes (MFIs)), By End-user (Solo Entrepreneurs & Individuals, Micro, Small & Medium Enterprises), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Lending Market Summary

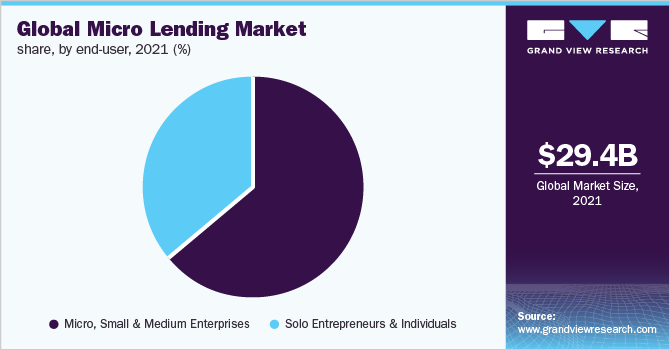

The global micro lending market size was valued at USD 29.39 billion in 2021 and is expected to expand at a CAGR of 13.4% from 2022 to 2030. The growth of the industry can be attributed to the growing adoption of microfinancing.

Key Market Trends & Insights

- Asia Pacific accounted for over 26.0% of the global revenue share.

- By service provider, the banks segment dominated the micro lending market in 2021 and accounted for more than 54.0% in 2021.

- By end user, the micro, small & medium enterprises segment accounted for more than 65.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 29.39 Billion

- 2030 Projected Market Size: USD 86.82 Billion

- CAGR (2022-2030): 13.4%

- Asia Pacific: Largest market in 2021

For instance, according to the 2019 report of Microfinance Barometer, almost 140 million borrowers are micro-financed by microfinance institutions worldwide with an estimation of total loan portfolio of USD 124 billion.

The lucrative benefits of micro lending to both borrowers and investors are anticipated to drive the growth of the market over the forecast period. The benefits to the micro lending borrowers include little to no collateral for the loan along with secured micro financing. In addition, borrowers which do not qualify for traditional loans are also benefitted with micro lending as it offers quick & secure financing options to all such borrowers. Moreover, the micro lending investors are also benefited as they gain the ability for passive investment through investing via digital platforms and collect high interest compared to other fixed-income securities.

Loans within USD 50,000 can be considered microloans. Thus, the companies requiring such small loans demand for micro lending platforms. The increasing number of small businesses across the globe is one of the major factors creating demand for micro lending services. For instance, in 2022, according to the U.S. Small Business Administration (SBA), nearly 33.2 million small businesses are present in the U.S., which consists of 99.9% of U.S. businesses. Moreover, the individuals requiring micro-loans demand peer-to-peer financing which is also anticipated to drive the growth of the industry over the forecast period.

Moreover, the increasing investments by venture capital firms into the micro lending providers are also expected to drive the growth of the micro lending market over the forecast period. For instance, in November 2019, BlueVine Inc., a financing solutions provider to SMEs, announced that it had raised USD 102.5 million through a Series F round of equity financing. The round was led by ION Crossover Partners with all other existing investors, including Menlo Ventures, Lightspeed Venture Partners, SVB Capital, 83North, and Nationwide. The funds were used to create an end-to-end banking platform that included a business checking account that was easily connected with Bluevine's technology-enabled range of online financing products.

Furthermore, though the micro lending market is on the surge, some of the challenges might restrain the growth of the market. The challenges in micro lending, such as the short time for repayment provided by microlenders and high interest on small amounts, are expected to hinder the market's growth over the forecast period. Moreover, factors such as the inability of micro lending investors to recover losses owing to the defaulter borrowers also restrain the growth. Nevertheless, the adoption of advanced technology such as artificial intelligence having the capability of identifying the creditworthiness of customers is anticipated to reduce the rate of defaulter borrowers in the near future.

COVID-19 Impact Analysis

The COVID-19 pandemic adversely impacted the industry. The shutdown of small and medium businesses in the early COVID-19 pandemic impacted the micro lending service providers. However, various government bodies in collaboration with microlenders started providing micro-loans to small businesses. The main agenda behind this initiative was to help businesses sustain the pandemic. The COVID-19 outbreak also increased the investments in the companies operating in micro lending services.

For instance, in July 2020, Kiva, a non-profit microfinance company, announced the partnership under Women’s Global Development and Prosperity (W-GDP) led by the White House initiative with USAID to enhance women’s economic empowerment by enabling financing for women entrepreneurs and business owners. Kiva received USD 2.5 million at USAID from W-GDP Fund to develop a gender-focused impact fund aimed at generating critical capital for women entrepreneurs.

Service Provider Insights

The banks segment dominated the micro lending market in 2021 and accounted for more than 54.0% of the global revenue. The growth is attributable to the growing partnerships of banks with other micro lending service providers to support several small businesses and other business owners. For instance, in March 2022, The Asian Development Bank (ADB) and HSBC India entered into an agreement aimed at establishing USD 100 million partial guarantee program. This program was developed to support over 400,000 micro-borrowers mostly microenterprises run by women in India.

The Micro Finance Institutes (MFIs) segment is anticipated to witness the fastest growth over the forecast period. The segment includes peer-to-peer lenders, and credit unions, among others that offer micro lending services to provide financial support for small and individual business owners. The growing demand for peer-to-peer lending worldwide is expected to drive the segment’s growth. Moreover, the increasing investment in P2P platforms is another major factor driving the growth of the segment. For instance, according to Swaper, Europe has more than 90 P2P lending platforms with total funding of more than USD 15.7 billion, and USD 419.9 million funded just in January 2021.

End-user Insights

The micro, small & medium enterprises segment accounted for more than 65.0% of the global revenue. The segment's growth is attributable to the growing initiatives taken by the government and other organizations to offer support to small & medium enterprises. For instance, in April 2019, LendingClub Corporation, a financial services company, announced its partnership with Opportunity Fund, a non-profit small business lender; and Funding Circle, the U.S.-based leading small business loan platform. This partnership was aimed at increasing small business owners’ access to affordable, transparent, and responsible credits.

The solo entrepreneurs & individuals segment registered significant growth over the forecast period. The numerous initiatives launched by non-profit organizations for women and social entrepreneurs are fueling the growth of the segment. For instance, in October 2021, Halcyon announced that it is piloting a microloan program specifically created for supporting social entrepreneurs looking at enforcing capital in their impacted businesses. The Halcyon Microloan Fund, by the Kimsey Foundation, aimed at offering total loans of USD 100,000 to Halcyon ventures requiring an alternative to traditional funding vehicles for early-stage businesses across Washington.

Regional Insights

Asia Pacific accounted for over 26.0% of the global revenue share. The regional growth is attributed to the growing number of start-ups across the region. For instance, according to Startup India Hub, India ranks 3rd as the largest startup ecosystem worldwide which is estimated to witness a consistent Year-on-Year annual growth of 12% to 15%. The total number of startups across India stood at around 65,861 in March 2022. Such a growing number of startups create demand for micro lending, thereby fueling the regional growth. Moreover, several government initiatives and policies implemented in the countries such as Japan and Australia to provide ease in getting small loans to SMEs and entrepreneurs are driving regional growth.

Latin America is expected to expand at a significant CAGR in the forecast period. The growth can be attributed to the increasing number of micro lending platform providers across the region. Furthermore, in 2020, through The United Nations Environment Programme (UNEP) farmers in Latin America have leveraged microfinancing to fight climate change. In addition, the market players in Latin America are also expanding their micro lending solutions to help customers during the pandemic. For instance, in March 2022, Mibanco utilized FICO Platform’s Decisions Capability to enhance its lending capacity and adjust according to changing market conditions during the pandemic.

Key Companies & Market Share Insights

Many predominant players identify the industry as a fragmented marketplace. As part of their efforts to increase their offerings, they opt for various strategies, such as particular product launches aimed at supporting SMEs and entrepreneurs. For instance, in August 2022, Telkom Business, a subsidiary of Telkom introduced Telkom Lend. With this new launch, the company enabled small businesses to apply online for funding and get a reply within 24 hours.

Key participants are also involved in mergers and acquisitions to expand their capabilities and collaborations to accelerate the company's growth and expansion. For instance, in November 2020, NerdWallet, a financial guidance company, announced the acquisition of Fundera Inc. With this acquisition, NerdWallet announced that Fundera Inc. would operate as a subsidiary. The acquisition was aimed at assisting NerdWallet to expand into the small and medium-business market with both actual and content financing. Some prominent players in the global micro lending market include:

-

Funding Circle

-

American Express

-

OnDeck

-

Accion Microfinance Bank Limited

-

Biz2Credit Inc

-

Fundbox

-

LendingClub Bank

-

Lendio

-

Zopa Bank Limited

-

LiftFund

Micro Lending Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 31.85 billion

Revenue forecast in 2030

USD 86.82 billion

Growth rate

CAGR of 13.4% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service provider, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Italy; France; Spain; China; Japan; India; Indonesia; Australia; Brazil; Mexico

Key companies profiled

Funding Circle; American Express; OnDeck; Accion Microfinance Bank Limited; Biz2Credit Inc.; Fundbox; LendingClub Bank; Lendio; Zopa Bank Limited; LiftFund

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro Lending Market Segmentation

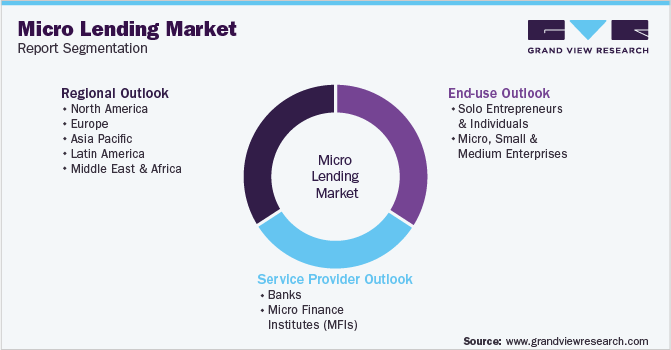

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global micro lendingmarket report based on service provider, end-user, and region:

-

Service Provider Outlook (Revenue, USD Million, 2017 - 2030)

-

Banks

-

Micro Finance Institutes (MFIs)

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Solo Entrepreneurs & Individuals

-

Micro, Small & Medium Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global micro lending market size was estimated at USD 29.39 billion in 2021 and is expected to reach USD 31.85 billion in 2022.

b. The global micro lending market is expected to grow at a compound annual growth rate of 13.4% from 2022 to 2030 to reach USD 86.82 billion by 2030.

b. The Asia Pacific dominated the micro lending market with a share of 26.57% in 2021. The regional market's growth is attributed to the growing number of start-ups across the region

b. Some key players operating in the micro lending market include Funding Circle, American Express, OnDeck, Accion Microfinance Bank Limited, Biz2Credit Inc, Fundbox, LendingClub Bank, Lendio, Zopa Bank Limited, LiftFund.

b. Key factors that are driving the market growth include increasing adoption of micro lending in emerging countries for improving lifestyle and growing shift from traditional lending to micro lending

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.