- Home

- »

- Automotive & Transportation

- »

-

Micro-mobility Charging Infrastructure Market Report, 2030GVR Report cover

![Micro-mobility Charging Infrastructure Market Size, Share & Trends Report]()

Micro-mobility Charging Infrastructure Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By Charger Type, By Power Source, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-279-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

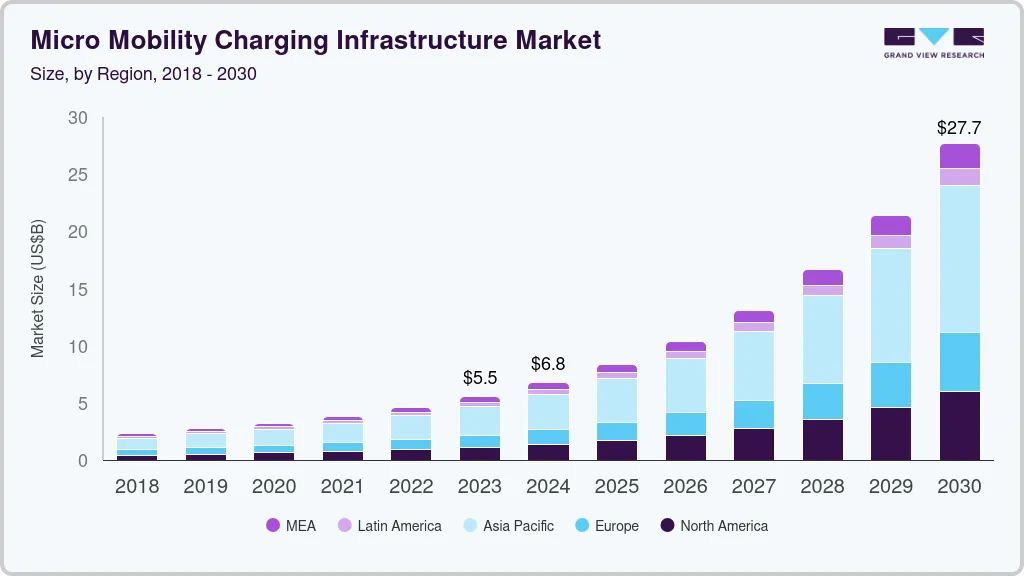

The global micro-mobility charging infrastructure market size was valued at USD 5,538.8 million in 2023 and is anticipated to grow at a CAGR of 25.8% from 2024 to 2030. Increasing adoption of micro-mobility vehicles such as e-scooters and e-bikes to help reduce pollution and congestion, especially in crowded cities, is a major factor driving the market growth. Micro-mobility is a better alternative to public transportation for countries worldwide, focusing on solving the transportation bottlenecks and rising concerns about emissions from vehicles running on gasoline or diesel. Moreover, government subsidies and tax incentives aimed at encouraging the adoption of micro-mobility vehicles are further expected to create more growth opportunities for the market.

Rising applications of micro-mobility vehicles in the transportation and commercial sectors present the need for a strong network of micro-mobility charging stations. In response to the rising demand, micro-mobility vehicle manufacturers are also focusing on offering charging networks across the globe. For instance, in November 2020, TIER, a German e-scooter startup, raised USD 250 million in a Series C funding round from SoftBank Vision Fund 2 to expand its presence in European cities. Such developments bode well for the growth of the micro-mobility charging infrastructure market over the forecast period.

Leading players across the globe are offering innovative services to expand their presence in the increasingly competitive market. For instance, in December 2020, Ola Electric Mobility Pvt Ltd announced the launch of its electric charging stations, known as the Ola Hypercharger Network, for its range of e-scooters worldwide. The company has planned to develop 5,000 charging points across 100 cities in India to provide seamless charging for its e-scooters.

The demand for wireless charging stations for e-scooters and e-bikes has increased significantly in recent years. Several players are developing innovative products to enhance operational functionality and reduce the charging time of chargers. For instance, in May 2021, LG Electronics launched wireless charging stations in Bucheon, Seoul, in partnership with Olulo, Inc.’s Kicking, a local e-scooter sharing service provider, to provide a better experience for e-scooter users.

The rapidly growing demand for shared mobility solutions will drive market growth over the forecast period. Increasing traffic congestion, fuel costs, and rapidly shrinking parking spaces in emerging and developed countries have increased the demand for shared mobility solutions. Moreover, citizens prefer using shared mobility solutions as they are cheaper than other modes of transportation and eliminate the issues related to parking spaces. However, the high costs of setting up micro-mobility vehicle charging infrastructure could hamper the market's growth prospects to a certain extent.

The COVID-19 pandemic had an adverse impact on the market. The pandemic decimated demand for public transport as businesses closed and people stayed home. It impacted the profitability of players in the market. Moreover, as micro-mobility vehicle manufacturing facilities remained closed, a severe impact was also observed on the demand for micro-mobility charging infrastructure. Multiple industries faced significant challenges due to the shortage of raw materials.

Vehicle Type Insights

The e-scooters segment accounted for the largest revenue share of 60.3% in 2022 and is expected to expand at the fastest CAGR of 26.4% over the forecast period. The increasing adoption of e-scooters for shared mobility transportation and first and last-mile transportation has increased the demand for micro-mobility charging stations for e-scooters. Micro-mobility charging stations in the market are adaptable to any model of e-scooter design, providing greater flexibility to the user. The demand for e-scooters is rapidly increasing as these scooters are easy to park and recharge. E-scooter charging platforms help to reduce traffic congestion and improve air quality by lowering e-scooter recovery operations.

The e-bike segment is anticipated to witness significant growth over the forecast period. Increasing deployment of e-bike charging stations in tourist and public areas is expected to fuel the segment growth over the forecast period. The demand for charging stations capable of charging multiple e-bikes is high. Also, these e-bike charging stations can be easily and quickly mounted free-standing or on a wall.

Charger Type Insights

The wired segment accounted for the largest revenue share of around 53.2% in 2022. The high demand for wired charging stations can be attributed to their convenience. Several market players, including bike-energy and Swiftmile, Inc., have developed flexible wired charging stations to use in any weather conditions. These wired charging stations are compatible with all e-scooters and e-bikes, providing greater charging flexibility. These factors are expected to contribute to the growth of the wired segment.

The wireless segment is estimated to register the fastest CAGR of 26.5% over the forecast period. The segment growth can be attributed to the increasing usage of autonomous vehicles in logistics by prominent retail Multinational Corporations (MNCs) and public transport agencies. Wireless charging systems are more convenient for e-scooters and e-bikes than wired charging stations. Moreover, companies are also developing intelligent dock systems called wireless charging systems that work indoors and outdoors. Wireless charging stations can also help avoid plug-in glitches regularly faced in wired charging stations.

Power Source Insights

The battery-powered segment held the largest revenue share of 55.1% in 2022. The demand for battery-powered charging stations is increasing due to the rising adoption of battery-swapping technology for e-scooters. At battery swapping stations, users can easily swap an uncharged battery with a charged one and continue their rides. Many companies have started installing battery-swapping stations in public places. For instance, in January 2021, Zypp, an electric vehicle startup, announced its plans to set up 5,000 battery-swapping stations in 100 cities across India.

The solar-powered segment is expected to expand at the fastest CAGR of 26.8% over the forecast period. Benefits such as reduced operating and maintenance costs compared to battery-powered systems drive the demand for solar-powered charging infrastructure. Moreover, solar-powered charging stations are generally used by people to charge their e-scooters within a shorter period to travel short distances.

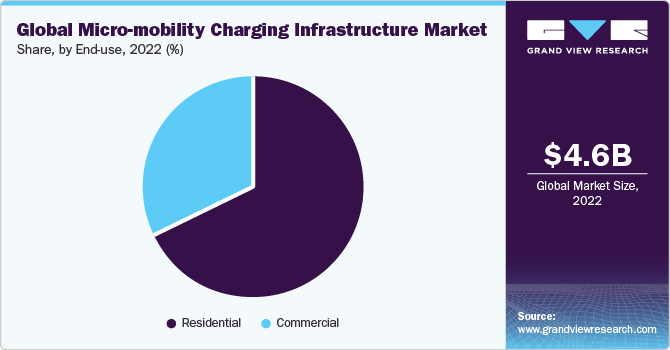

End-use Insights

The residential segment held the largest revenue share of 68.5% in 2022 and is expected to expand at the fastest CAGR over the forecast period. Factors such as an increase in urbanization and growing traffic congestion encourage customers to shift to micro-mobility vehicles. Users prefer stations that allow the overnight charging of micro-mobility vehicles in homes and residential complexes. In addition, people are becoming more inclined to use e-scooters and e-bikes for transportation at shorter distances. The market features a diverse range of products catering to various transportation requirements. These factors are anticipated to contribute to the segment growth over the forecast period.

The commercial segment is anticipated to register significant growth over the forecast period. The segment includes micro-mobility charging infrastructure installed in various malls and business complexes to provide hassle-free services to visitors. Furthermore, many companies have developed charging stations in hotels, businesses, and other tourist places to allow visitors and employees to charge their e-scooters and e-bikes quickly. For instance, bike-energy, a company dealing with charging stations, provides charging stations to hotels, businesses, and tourist places. These stations also feature proper parking spaces for e-scooters, thereby preventing vehicle congestion.

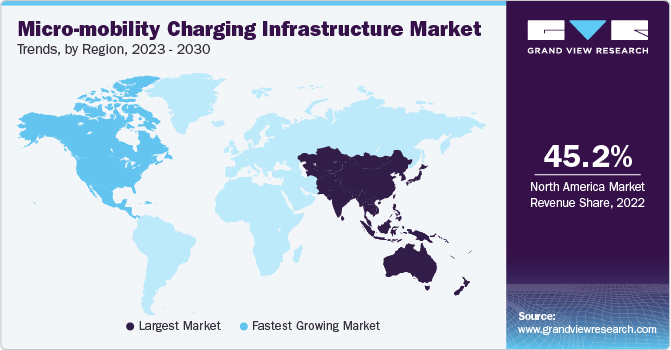

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 45.2% in 2022. The promising growth of the Asia Pacific regional market can be attributed to the smart city projects and initiatives undertaken by the governments of several countries in the region. For instance, in June 2021, the Government of India, under its smart city project, announced an increase in subsidies for purchasing e-bikes and e-scooters under its scheme called Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) II.

North America is expected to expand at the fastest CAGR of 27.3% during the forecast period. The regional market growth can be attributed to the rising awareness of adopting eco-friendly transportation options. Moreover, the region's geographical features and urban planning are conducive to using micro-mobility charging infrastructure. In addition, the presence of many prominent players in the region are further expected to drive the demand in the regional market.

Key Companies & Market Share Insights

Market players focus on business strategies such as new product launches to increase their customer base and strengthen their product portfolio. For instance, in June 2022, Statiq, an electric vehicle charging network startup, partnered with Hala Mobility to improve the mobility network for EV users. The partnership aims to enhance the convenience and accessibility of charging infrastructure for Hala's electric vehicle users, ensuring they have reliable access to charging facilities across various locations.

Key Micro-mobility Charging Infrastructure Companies:

- Ather Energy

- bike-energy

- Bikeep

- Flower Turbines

- Get Charged, Inc.

- Giulio Barbieri SRL

- Ground Control Systems

- Magment

- Perch Mobility

- Robert Bosch GmbH

- Solum

- SWIFTMILE

- The Mobility House GmbH

Recent Developments

-

In January 2022, Soltsol AG collaborated with Swiftmile, a light electric vehicle charging company. The collaboration seeks to cater to customers seeking cost-effective solutions for establishing and managing e-mobility charging hubs on public and private properties. Moreover, the partnership aims to deploy 150 LEV charging hubs throughout Germany.

-

In May 2021, LG Electronics Inc. launched wireless charging solutions for electric scooters. In addition, the company established a wireless charging station in partnership with electric scooter-sharing services provider Kickgoing at Bucheon for electric scooter users in the area.

-

In April 2021, HeroMotoCorp and Gogoro Inc. partnered to accelerate India's electric mobility shift. The partnership aimed to launch a battery-swapping venture to bring Gogoro's platform to the country and collaborate to develop Hero brand automobiles powered by Gogoro Network to the market.

Micro-mobility Charging Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6,764.0 million

Revenue forecast in 2030

USD 27,664.7 million

Growth rate

CAGR of 25.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, charger type, power source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Ather Energy.; bike-energy; Bikeep; Flower Turbines.; Get Charged, Inc.; Giulio Barbieri SRL; Ground Control Systems.; Magment; Perch Mobility; Robert Bosch GmbH; Solum; SWIFTMILE; The Mobility House GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro-mobility Charging Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global micro-mobility charging infrastructuremarket report based on vehicle type, charger type, power source, end-use, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

E-scooters

-

E-bikes

-

E-unicycles

-

E-skateboards

-

-

Charger Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Wired

-

Wireless

-

-

Power Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Solar Powered

-

Battery Powered

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global micro-mobility charging infrastructure market size was estimated at USD 4.58 billion in 2022 and is expected to reach USD 5.54 billion in 2023.

b. The global micro-mobility charging infrastructure market is expected to grow at a compound annual growth rate of 25.9% from 2023 to 2030 to reach USD 27.70 billion by 2030.

b. The e-scooters segment led the micro-mobility charging infrastructure market and accounted for more than 60.0% share of the global revenue in 2022.

b. Some key players operating in the micro-mobility charging infrastructure market include Ather Energy; bike-energy; Bikeep; Flower Turbines; Get Charged, Inc.; Giulio Barbieri SRL; Ground Control Systems; Magment GmbH; Perch Mobility; Robert Bosch GmbH; Solum PV; SWIFTMILE; and The Mobility House GmbH.

b. Key factors that are driving the micro-mobility charging infrastructure market growth include increasing investments in the micro-mobility mode of transportation and the rapidly growing demand for shared mobility solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.