- Home

- »

- Medical Devices

- »

-

Micro-pumps Market Size & Share, Industry Report, 2030GVR Report cover

![Micro-pumps Market Size, Share & Trends Report]()

Micro-pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mechanical, Non-mechanical), By Application (Drug Delivery, In-vitro Diagnostics, Medical Devices), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-949-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2020 - 2030

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro-pumps Market Size & Trends

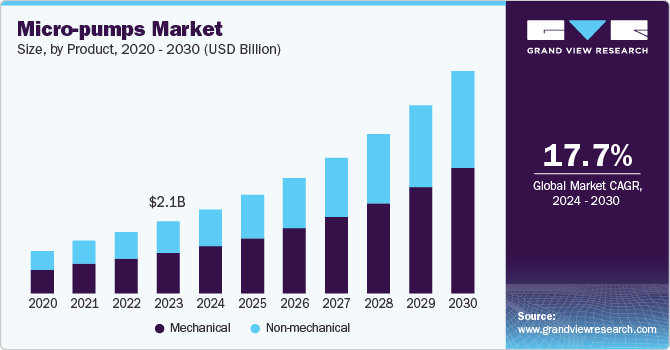

The global micro-pumps market size is valued at USD 2.1 billion in 2023 and is expected to grow at a CAGR of 17.7% from 2024 to 2030. The expansion of the biotechnology and pharmaceutical sectors is driving the demand for micro-pumps due to their critical role in various applications. In laboratory research, micro-pumps facilitate precise fluid handling and delivery, essential for conducting accurate and reproducible experiments. During drug development, these pumps are integral in automated high throughput screening systems, enabling the efficient testing of numerous compounds. In production processes, micro-pumps ensure the accurate and consistent dosing of active pharmaceutical ingredients, enhancing the quality and efficacy of the final products.

The economic development in emerging markets, combined with rising healthcare expenditure and enhanced healthcare infrastructure, is providing growth opportunities for the micro-pumps market as emerging economies experience robust economic growth, they are investing heavily in upgrading their healthcare systems to meet the increasing demand for quality medical services. This includes the adoption of advanced medical technologies, such as micro-pumps, which are essential for modern diagnostic devices, drug delivery systems, and laboratory research tools. Increased healthcare funding is also fostering the establishment of new healthcare facilities and research institutions, further driving the demand for micro-pumps.

The demand for micro-pumps increased due to COVID-19 in 2020 as the pumps were used in emergency care devices like ventilators, nebulizers, etc. There was a rapid increase in the number of patients admitted to the hospitals due to critical health conditions, especially during the second wave of the COVID-19 pandemic. In March 2020, The Lee Company partnered with GM and Ventec life systems to mass-produce, critically needed ventilators to fight the COVID-19 pandemic. The companies together delivered 30,000 V+ Pro ventilators. The increasing number of patients required more tests and other emergency care services. Hence, the increased demand for such devices and test kits during the COVID-19 pandemic indirectly led to the growth of the market.

Product Insights

Mechanical micropumps segment held the highest revenue market share of 56.1% in 2023. Mechanical micropumps provides a cost-effective solution compared to other types of micropumps which increases the demand. Simpler designs and manufacturing processes increases the affordability. This cost advantage makes mechanical micropumps particularly attractive in industries such as automotive, where mass production and cost efficiency are paramount, as well as in healthcare settings seeking economical solutions for fluid handling and delivery systems.

Non-mechanical micropumps segment is expected to grow at fastest CAGR over forecasted period. The increasing demand for smaller, more compact devices across various industries, including medical and consumer electronics, is driving the adoption of non-mechanical micropumps. These pumps can be integrated into tiny spaces, facilitating the development of miniaturized products without compromising functionality.

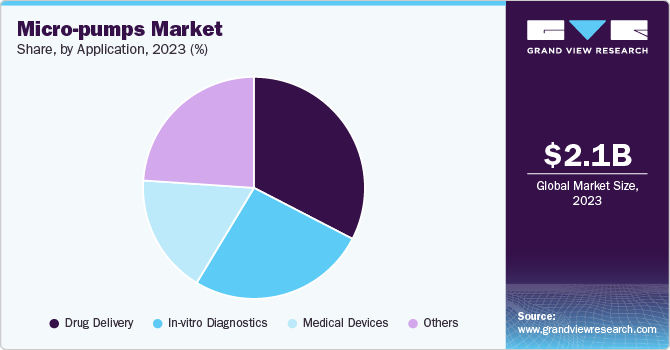

Application Insights

Drug Delivery segment held the highest revenue market share in 2023, accounting for around 32.6% of the market share. Continuous technological advancements in micro-pump design, including miniaturization, wireless connectivity, and integration with smart devices, are enhancing their functionality and demand in drug delivery applications. In December 2021, AstraZeneca unveiled its next generation of drug delivery technologies, which include advanced nanoparticle formulations, which enhance the precision and efficiency of drug delivery by targeting specific cells and tissues, increasing the therapeutic efficacy and reducing potential side effects.

AstraZeneca has developed innovative sustained-release mechanisms that ensure a consistent and controlled release of medication over an extended period, improving patient compliance and convenience. These technologies also integrate smart device connectivity, allowing for real-time monitoring and adjustments to treatment regimens based on patient-specific data.

In-vitro diagnostics segment is expected to grow at fastest CAGR. There is a growing demand for rapid and accurate diagnostic testing at the point of care, which requires miniaturized and efficient fluid handling systems like micropumps. These pumps enable precise control and delivery of small sample volumes, crucial for portable diagnostic devices used in clinics and remote settings, driving the growth of segment.

End-use Insights

Biotechnology & pharmaceutical companies segment held the highest market revenue share in forecasted period. Biotechnology and pharmaceutical companies intensively invest in research and development to advance micro-pump technologies, driven by the need to enhance reliability, efficiency, and compatibility with a wide array of drugs. These efforts are crucial in expanding the application scope of micro-pumps across drug development stages, from initial formulation to clinical trials and manufacturing processes. Improved reliability ensures consistent performance in delivering precise doses of medications, critical for both acute therapies and chronic disease management, driving the growth of segment.

Hospitals & Diagnostic centers segment is expected to grow at fastest CAGR over forecasted period. Increased healthcare spending, particularly in developing economies, is leading to the expansion and modernization of hospitals and diagnostic centers, hence driving the demand for advanced medical devices and equipment incorporating micro-pumps.

Regional Insights

North America micro-pumps market held the largest market revenue share of 49.8% in 2023. High healthcare expenditure in North America is driving investments towards advanced diagnostic technologies and infrastructure within cancer diagnostic centers. The substantial financial resources available enable healthcare providers and institutions to adopt and integrate cutting-edge diagnostic modalities, such as genetic testing, molecular imaging, and AI-driven analytics, into clinical practice. This timely adoption of new technologies enhances the accuracy, efficiency, and scope of diagnostic capabilities for diseases like ovarian cancer. The financial capability supports the development of facilities equipped with specialized equipment and skilled healthcare professionals, thereby improving patient access to comprehensive diagnostic services. These investments contribute to the expansion of the market for Micro-Pumps in North America.

In the U.S., national health expenditures (NHE ) accounted for 17.3% of GDP in 2022 and increased by 4.1% to reach USD 4.5 trillion, or USD 13,493 per person. Medicare spending accounted for 21 percent of the entire NHE, or USD 944.3 billion, an increase of 5.9%. Spending on Medicaid increased significantly as well, by 9.6% to USD 805.7 billion, or 18% of the overall NHE. Spending on private health insurance increased to USD 1,289.8 billion, or 29% of the total NHE. Spending that comes from personal funds increased by 6.6% to USD 471.4 billion, or 11% of the entire NHE. These numbers demonstrate the significant financial investment made in healthcare in the United States, which is fueled by rising costs for private insurance, Medicare, Medicaid, and out-of-pocket expenses.

U.S. Micro-pumps Market Trends

Supportive government policies and substantial funding for healthcare research and development in the U.S., exemplified by initiatives such as the 21st Century Cures Act and increased funding for the National Institutes of Health (NIH), play a crucial role in promoting the adoption of advanced medical technologies like Micro-Pumps. The 21st Century Cures Act aims to accelerate the discovery, development, and delivery of new treatments and cures. It includes provisions that streamline the regulatory approval process for medical devices, fostering innovation and facilitating quicker market entry for technologies such as Micro-Pumps. Increased funding for the NIH supports groundbreaking research in medical sciences, including microfluidics and precision medicine, which are integral to the development of next-generation micro-pump technologies. This financial support enables researchers and healthcare providers to explore new applications and enhance the performance of micro-pumps in areas such as drug delivery systems, point-of-care diagnostics, and personalized medicine, driving the micro-pumps market.

Europe Micro-Pumps Market Trends

Europe's well-established pharmaceutical and biotechnology industry is a significant driver of the Micro-Pumps market due to its extensive use of these devices in research, drug development, and manufacturing processes. In research laboratories, Micro-Pumps are essential for precise fluid handling and the accurate delivery of reagents and samples, which are critical for conducting high-quality experiments in genomics, proteomics, and cell biology. During drug development, Micro-Pumps facilitate automated high-throughput screening, allowing for the efficient testing of large numbers of compounds and the identification of promising drug candidates.

In manufacturing processes, micro-pumps ensure the consistent and precise dosing of active pharmaceutical ingredients, which is crucial for maintaining the quality and efficacy of pharmaceutical products. The high demand for reliable and accurate fluid handling solutions in these sectors underscores the importance of micro-pumps in achieving precision and efficiency in pharmaceutical and biotechnological operations. As these industries continue to expand and innovate, the demand for advanced micro-pump technologies is expected to grow, further boosting the market in Europe.

Asia Pacific Micro-pumps Market Trends

The demand for point-of-care testing and portable diagnostic devices is significantly increasing in the Asia Pacific region, driven by the urgent need for rapid and accurate diagnostic results, especially in remote and underserved areas. Point-of-care testing allows for immediate decision-making in patient care by providing swift diagnostic results, which is crucial for managing diseases and improving patient outcomes. Portable diagnostic devices, which are compact and user-friendly, are becoming more prevalent due to their convenience and efficiency. Micro-pumps are essential components of these devices, as they facilitate precise fluid manipulation, crucial for accurate diagnostic tests. By enabling controlled movement and handling of small fluid volumes, micro-pumps ensure the reliability and precision of diagnostic assays, leading to better detection and monitoring of various health conditions, hence driving the growth of micro-pumps in region.

Key Micro-pumps Company Insights

Some key companies in micro-pumps market include Bartels Mikrotechnik GmbHF., TOPS INDUSTRY & TECHNOLOGY CO., LTD.

-

Bartels Mikrotechnik focuses on providing high-precision micro-pumps that cater to a wide range of applications in medical technology, biotechnology, and industrial processes. Their product offerings include the mp6 series of piezoelectric diaphragm micro-pumps, known for their compact design, reliability, and versatility. These Micro-Pumps are designed to handle various fluids with high precision, making them ideal for applications such as drug delivery, lab-on-a-chip systems, inkjet printing, and environmental monitoring.

-

TOPS INDUSTRY & TECHNOLOGY CO., LTD. manufacturer of high-quality micro-pumps and related fluidic systems. The company offers a comprehensive range of Micro-Pumps designed for various applications, including medical devices, environmental monitoring, industrial automation, and laboratory research. Their product portfolio includes piezoelectric Micro-Pumps, diaphragm Micro-Pumps, and peristaltic Micro-Pumps, each engineered to deliver precise and reliable fluid control. TOPS INDUSTRY & TECHNOLOGY CO., LTD. emphasizes cutting-edge technology and rigorous quality standards, ensuring their micro-pumps provide exceptional performance and durability.

Key Micro-pumps Companies:

The following are the leading companies in the micro-pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Bartels Mikrotechnik GmbH

- Bürkert Fluid Control Systems

- TOPS INDUSTRY & TECHNOLOGY CO., LTD.

- The Lee Company

- Xiamen AJK Technology Co., Ltd.

- Xavitech

- ALLDOO Micropump

- Dolomite Microfluidics (Backtrace Holdings Ltd.)

- Arcmed Group (Halma)

Recent Developments

-

In September 2023, CEME Group announced a new strategic partnership with Micropump, a renowned company in micro-pump technology. This collaboration is set to leverage the strengths and expertise of both companies to innovate and expand their product offerings in the fluid control market. By combining CEME Group's extensive experience in fluid control systems with Micropump's advanced micro-pump technology, the partnership aims to deliver highly efficient and reliable solutions for a wide range of applications, including medical devices, industrial automation, and laboratory equipment.

-

In September 2022, The Lee Company announced its acquisition of TTP Ventus, a micro-pump manufacturer. This acquisition aims to enhance The Lee Company's product portfolio and expand its capabilities in the precision fluid control market. The acquisition aligns with The Lee Company's commitment to providing cutting-edge solutions and strengthening its position as a leader in fluid control systems. By integrating TTP Ventus' expertise and advanced micro-pump offerings, The Lee Company is poised to deliver enhanced performance and broaden its market reach, catering to the evolving needs of its global clientele.

Micro-pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.6 billion

Revenue forecast in 2030

USD 6.8 billion

Growth Rate

CAGR of 17.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2030

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, applications, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, India, China, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bartels Mikrotechnik GmbH; Bürkert Fluid Control Systems; TOPS INDUSTRY & TECHNOLOGY CO., LTD.; The Lee Company; Xiamen AJK Technology Co., Ltd.; Xavitech; ALLDOO Micropump; Dolomite Microfluidics (Backtrace Holdings Ltd.); Arcmed Group (Halma)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

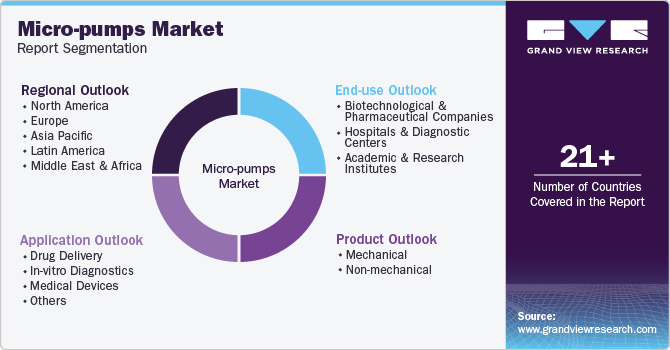

Global Micro-pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro-pumps market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Mechanical

-

Piezoelectric Micro-pump

-

Peristaltic Pump

-

Others

-

-

Non-mechanical

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Drug Delivery

-

In-vitro Diagnostics

-

Medical Devices

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2030)

-

Biotechnological & Pharmaceutical Companies

-

Hospitals & Diagnostic Centers

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Italy

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.