- Home

- »

- Next Generation Technologies

- »

-

Microinsurance Market Size, Share & Growth Report, 2030GVR Report cover

![Microinsurance Market Size, Share & Trends Report]()

Microinsurance Market (2023 - 2030) Size, Share & Trends Analysis Report By Model Type (Partner Agent Model, Full-Service Model), By Product Type, By End-use (Business, Personal), By Provider, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-062-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microinsurance Market Size & Trends

The global microinsurance market size was valued at USD 72.85 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The market growth is driven by the emergence of new and innovative channels to market and sell microinsurance. As the insurance industry transforms digitally, insurers find opportunities to collaborate with insurtech companies and market & sell microinsurance products more conveniently and efficiently. Digital platforms that employ gig workers or remittance platforms for migrant workers are also forming an ecosystem that can digitally design and distribute insurance to low-income populations. In addition, the increasing number of microinsurance start-ups making market foray with innovative microinsurance plans is expected to drive market growth.

For instance, in April 2021, PNB General Insurers Company, Incorporated (PNBGen) teamed up with Palawan Pawnshop, a prominent pawnshop chain in the Philippines. This partnership aimed at offering two affordable microinsurance products across the latter's vast network of over 3,000 outlets spread throughout the country. The products include ProtekTODO Premium Pamilya Max 300, which covers the entire family and provides extensive personal accident coverage for an annual premium of PHP 300 (USD 5.47), and ProtekTODO Eskwela Max, a student accident insurance policy with annual premiums of either PHP 50 (USD 0.91) or PHP 30 (USD 0.54).

Microinsurance providers are increasingly exploring using Artificial Intelligence (AI) and Machine Learning (ML) to improve operations and better serve customers. AI and ML can automate claims processing by using algorithms to analyze and classify incoming claims based on various factors, such as the type of claim, the severity of the claim, and the policy coverage. The process can be done in real-time, significantly reducing the time and cost involved in manual claims processing. In addition, AI and ML have been used to detect fraudulent claims by analyzing patterns and identifying anomalies in the data. This helps microinsurance providers prevent fraud and reduce losses, ultimately resulting in lower customer premiums.

Regulatory compliance is critical in this industry to protect consumers and providers. Microinsurance providers must adhere to regulatory requirements to ensure their products are legal, transparent, and trustworthy. Regulatory compliance ensures that microinsurance products are designed to protect the interests of consumers, especially those with limited resources. Regulatory bodies set minimum standards for designing, pricing, and delivering microinsurance products to prevent the exploitation of the vulnerable population. For instance, The Insurance Business Law in Vietnam took effect on January 01, 2023. It allows mutual organizations to offer microinsurance products with less stringent financial, personal, and professional requirements than those imposed by conventional insurance companies.

A lack of awareness and understanding of microinsurance products and their benefits can be a significant challenge for the industry. Many low-income individuals and communities may not know about microinsurance or understand how it works, making it challenging for microinsurance providers to reach their target market. Microinsurance providers may also face distribution challenges in reaching their target market due to limited infrastructure, lack of access to technology, or remote locations. This can make it difficult to provide affordable and accessible insurance products to low-income individuals and communities.

COVID-19 Impact Analysis

The COVID-19 pandemic had a slightly positive impact on global market growth. The COVID-19 pandemic increased awareness about the importance of health and life insurance, which has led to increased demand for microinsurance products. People are more aware of the importance of insurance to protect themselves and their families against unforeseen events, such as illness or death. Furthermore, the pandemic forced microinsurance providers to innovate in terms of product design and distribution to meet customers’ changing needs. Providers have introduced new products and services, such as COVID-19-specific insurance products, online distribution channels, and mobile-based platforms.

Provider Insights

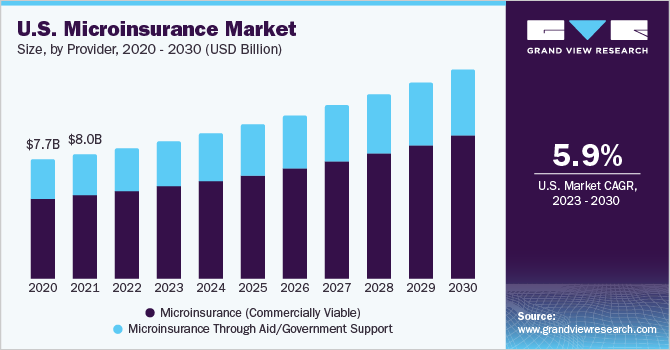

The microinsurance (commercially viable) segment dominated the market in 2022 and accounted for a revenue share of more than 67.0%. Microinsurance (commercially viable) products are designed to meet the needs of impoverished people, who typically face more significant risks and vulnerabilities than those in higher income brackets. Microinsurance (commercially viable) providers are focusing on developing new products tailored to the specific needs of low-income individuals and communities. These products include weather index-based insurance, which provides coverage for crop losses due to adverse weather conditions, and health insurance, which covers specific illnesses.

The microinsurance through aid/government support segment is anticipated to grow significantly over the forecast period. Aid and government support help microinsurance providers overcome financial and regulatory barriers that make it challenging to provide affordable and accessible insurance products to populations with low income. Through aid/government support, several microinsurance providers are integrating their products with digital platforms, such as mobile banking and digital wallets. For instance, in February 2022, the Kenyan government launched, a digital microinsurance platform allowing customers to purchase and manage their insurance policies using mobile phones.

Model Type Insights

The partner agent model segment dominated the market in 2022 and accounted for a revenue share of more than 42.0%. Microinsurance providers can benefit from working closely with partner agents who deeply understand their clients' needs and preferences. Through such collaboration, insurance providers can customize their products and services to meet the specific demands of the local market, making their offerings more attractive to potential customers. Moreover, the partner agent model is highly scalable and can be easily expanded by adding more agents in new areas.

The full-service model segment is anticipated to grow significantly over the forecast period due to several factors, including the increasing demand for high-quality services, the rising disposable income of consumers, and the growing popularity of full-service models in various industries. The full-service model in microinsurance is gaining popularity as it addresses the unique needs and challenges low-income individuals and families face. For example, many low-income households do not have access to traditional banking services, making it difficult to save money or access credit. Full-service microinsurance providers can help address such issues by offering financial education and products.

Product Type Insights

The life insurance segment dominated the market in 2022 and accounted for a revenue share of 48.0%. The dominance of life insurance in the global market can be attributed to the combination of lower risk, greater demand, simplified underwriting, and lower premiums. Life insurance is often considered necessary in many cultures, particularly in developing countries. Low-income households may prioritize life insurance over other types of insurance because they want to ensure that their families are financially protected after their death.

The health insurance segment is anticipated to grow significantly over the forecast period. The segment’s growth can be attributed to the rising healthcare costs globally. Healthcare costs are rising globally, and low-income individuals and families are particularly vulnerable to financial hardship caused by unexpected medical expenses. Health insurance help mitigate this risk and provides affordable access to healthcare services.

Distribution Channel Insights

The financial institutions segment dominated the market in 2022 and accounted for a revenue share of 31.0%. Microinsurance is predominantly distributed through financial institutions, with a significant share of the market being served by banks that specialize in micro-enterprise offerings. Many Microfinance Institutions (MFIs), credit unions, and commercial and cooperative banks provide financial services to low-income customers. Financial institutions, such as banks and Microfinance Institutions (MFIs), have established infrastructure and distribution networks that they can leverage to offer microinsurance products.

This allows them to reach many low-income individuals and families who may not have access to traditional insurance products. The digital channel segment is anticipated to grow significantly over the forecast period. The microinsurance industry is experiencing growth in adopting digital marketing channels to distribute its products. Digital marketing involves promoting services or products through digital platforms, such as social media, websites, emails, search engines, and mobile applications. This shift towards digital marketing has become vital for microinsurance companies due to the increasing popularity of digital channels in developing markets.

End-use Insights

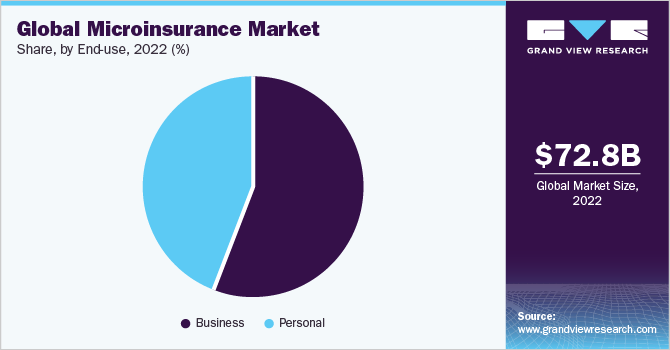

The business segment dominated the market in 2022 and accounted for a global revenue share of over 56.0%. Small business owners adopt microinsurance to manage financial risks associated with operating a business. It protects against potential losses due to business interruption, damage to equipment or property, or liability claims from employees or customers. Microinsurance companies are focusing on providing insurance to these underserved sectors. For instance, in February 2022, CARD Pioneer Microinsurance Inc. (CMPI) collaborated with the Philippine Crop. Insurance Corp. (PCIC), a government-owned entity, to improve access to insurance products and services, particularly for small farmers in the Philippines.

The personal segment is anticipated to register significant growth over the forecast period. The increasing adoption of microinsurance products by low-income individuals owing to their vast benefits propels segment growth. A rise in the middle-class population in many developing countries has led to an increase in disposable income and a greater willingness to invest in insurance products. In addition, microinsurance providers increasingly offer affordable and accessible personal insurance products, such as health and life insurance, to meet the needs of low-income individuals and families.

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a more than 31.0% revenue share due to the presence of a large pool of underserved populations, low insurance penetration, a supportive regulatory environment, and technological innovation. Many governments in the Asia Pacific region support microinsurance initiatives and have implemented policies to promote their development. For example, some countries, such as the Philippines and Indonesia, have exempted microinsurance providers from specific regulatory requirements, such as capitalization and solvency rules. For instance, in the Philippines, the Microinsurance Act of 2013 establishes a simplified regulatory framework for microinsurance.

The North America regional market is expected to grow significantly over the forecast period. The growth of digital platforms and mobile technology has made it easier and more cost-effective to offer microinsurance products to consumers. This has led to the emergence of new players in the market, including insurtech startups, which are leveraging technology to reach underserved populations. North America also has a well-established regulatory framework for insurance products, creating a stable environment for microinsurance providers.

Key Companies & Market Share Insights

The trend towards digitization and the use of technology enables microinsurance providers to reach more customers, reduce costs, and increase the efficiency of their operations. Microinsurance providers are adopting digital payment systems to make it easier for customers to pay premiums and receive payouts. This includes using mobile money, digital wallets, and other electronic payment methods. Microinsurance providers are also using data analytics to understand their customers’ needs and develop products that meet those needs. This includes using machine learning algorithms to analyze customer data and develop risk models.

Prominent companies are investing in strategic initiatives, such as product launches, partnerships, and mergers & acquisitions, to stay ahead of the competition and offer innovative solutions to their customers. In October 2021, MicroEnsure, a Micro Insurance Company (MIC) subsidiary, formed a strategic partnership with Chamasure, an insurance platform based in Nairobi, that aims to provide insurance solutions for underserved communities. As a result of this partnership, MicroEnsure was able to offer digital insurance services to people in underserved communities throughout Kenya, providing comprehensive support for enrollment and claims settlement processes. Some of the prominent players in the global microinsurance market include:

-

The Hollard Insurance Company

-

afpgen.com.ph

-

American International Group, Inc.

-

Bharti AXA Life Insurance Company Ltd.

-

SBI Life Insurance Company Ltd.

-

ICICI Prudential Life Insurance Co. Ltd.

-

Banco do Nordeste Brasil S.A.

-

Climbs

-

Allianz SE

-

Bajaj Allianz Life Insurance Co. Ltd.

Microinsurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 77.11 billion

Revenue forecast in 2030

USD 121.18 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Provider, model type, product type, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; South Korea; Japan; Philippines; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

The Hollard Insurance Company; afpgen.com.ph; American International Group, Inc.; Bharti AXA Life Insurance Company Ltd.; SBI Life Insurance Company Ltd.; ICICI Prudential Life Insurance Co. Ltd.; Banco do Nordeste Brasil S.A.; Climbs; Allianz SE; Bajaj Allianz Life Insurance Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microinsurance Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the microinsurance market based on provider, model type, product type, distribution channel, end-use, and region:

-

Provider Outlook (Revenue, USD Billion, 2017 - 2030)

-

Microinsurance (Commercially Viable)

-

Microinsurance Through Aid/Government Support

-

-

Model Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Partner Agent Model

-

Full-Service Model

-

Provider Driven Model

-

Others

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Life Insurance

-

Health Insurance

-

Property Insurance

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Direct Sales

-

Financial Institutions

-

Digital Channels

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Business

-

Personal

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Philippines

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microinsurance market size was estimated at USD 72.85 billion in 2022 and is expected to reach USD 77.11 billion in 2023.

b. The global microinsurance market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 121.18 billion by 2030.

b. Asia Pacific dominated the microinsurance market with a share of 31.74% in 2022. The Asia Pacific region dominates the microinsurance market due to a large underserved population, low insurance penetration, supportive regulatory environment, and technological innovation.

b. Some key players operating in the microinsurance market include The Hollard Insurance Company; afpgen.com.ph; American International Group, Inc.; Bharti AXA Life Insurance Company Limited; SBI Life Insurance Company Limited; ICICI Prudential Life Insurance Co. Ltd.; Banco do Nordeste Brasil S.A.; Climbs; Allianz; and Bajaj Allianz Life Insurance Co. Ltd.

b. Key factors that are driving the market growth include the emergence of new, innovative channels to market and sell microinsurance and the increasing number of microinsurance start-ups making market foray with innovative microinsurance plans

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.