- Home

- »

- Next Generation Technologies

- »

-

Microprinting Market Size, Share & Growth Report, 2030GVR Report cover

![Microprinting Market Size, Share & Trends Report]()

Microprinting Market Size, Share & Trends Analysis Report By Type (Color, Monochrome), By Substrate Type, By Ink Type, By Print Type, By Application, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-015-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Technology

Report Overview

The global microprinting market size was valued at USD 694.0 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. The method of printing incredibly small text and graphics that are typically not readable with the naked eye is known as microprinting. Throughout the forecast period, important variables such as the development of the e-commerce business, banking sector legislation and regulations, the introduction of novel products, and increased demand for anti-counterfeiting product offerings are anticipated to grow significantly. Another important element driving the market's growth is the increasing use of microprinting technology in the textile industry. For instance, microprinting on textile fabrics is a new technology that is helping the apparel industry in reducing the duplication of original articles.

In addition, if the microprinted documents, currencies, ID cards, etc., are attempted to be photocopied from basic scanners, the microprinted text and photos appear as tiny dots or a solid line, thus preventing the occurrence of fraudulent activities. Therefore, microprinting technology is broadly used as an anti-counterfeiting technique, owing to its incapability to be easily replicated by using widespread digital methods.

Further, to cut down on fraudulent operations, the European Central Bank and the American Federal Reserve System are increasingly using several counterfeit technologies. The majority of banknotes are printed on cotton-fiber paper to increase their tenacity and uniqueness. On the other hand, high-end personal care products and miniature electrical components use microprinting technology to distinguish their goods from duplication.

Most government organizations are enhancing security features with the help of microprinting on identity cards, documents, and other security equipment, which is anticipated to contribute to the expansion of the microprinting sector as a whole. The market is expanding overall due to the rising counterfeiting of checks and money in several nations. Governments and corporate entities have recently adopted the microprinting process to prevent fraud and reduce misuse of licenses and identity cards. This has helped the market for microprinting grow significantly.

Special inks, infrared ink marking, micro-embossing, UV invisible inks, and magnetic inks are the various inks utilized in microprinting. Technology advancements like the introduction of magnetic ink and other specialty inks are contributing to the growth of the microprinting industry. Microprinting has become more popular in various industries, including consumer electronics, currencies, bank checks, defense, and ID cards. The most common uses of microprinting are on ID cards and packaging, and by the forecast period, it is projected that both categories in the application segment would dominate the market.

COVID-19 Impact

The outbreak of the COVID-19 pandemic has adversely affected various industries, with several manufacturing units across the globe. In various industrial sectors, production and logistics have drastically decreased. Industries have also been impacted by the deteriorating economic situation of several nations. The disruption of the supply chain halted the e-commerce industry, which is almost one of the largest users of microprinting, as the e-commerce industry uses microprinted labels, tags, and packaging.

These elements negatively impacted the overall expansion of the microprinting sector. Additionally, the manufacturing of consumer electronics has been curtailed in a number of nations, particularly in China, which is considered to be the world's largest producer. The important production activities were only conducted during the period of lockdown since China was significantly hit by it. The need for microprinting has considerably decreased in recent years due to China's decreased output of consumer electronics.

Type Insights

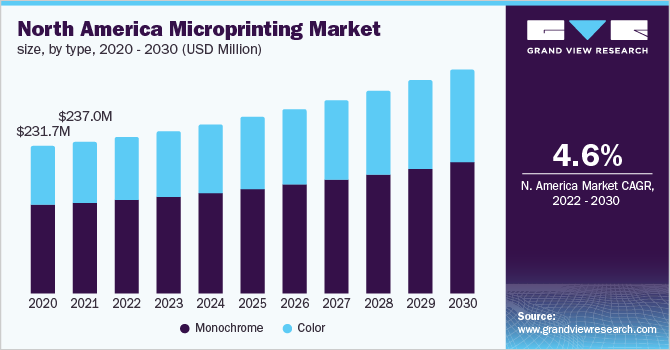

The monochrome segment dominated the overall market with a revenue share of nearly 60% in 2021. Due to its numerous advantages, including its lower cost per printed page, rapid printing speed, and improved text quality, monochrome printing is seeing widespread use in the government, retail, education, commercial, and publishing sectors.

Increased monochrome printing for online order packing and labeling in the e-commerce sector is expected to boost growth. The leading players in e-commerce, including Amazon Inc., Walmart, Alibaba Group, and eBay, heavily employ monochrome printing. These organizations are putting immense effort into labeling products with digital technology since it makes it easier for them to track packages throughout the delivery process.

The color segment is anticipated to grow at a considerable CAGR throughout the forecast period. The rise in demand for color microprinted documents from a variety of end-use industries, including banking and finance, government, corporate, packaging, healthcare, and education, is responsible for the industry’s expansion. The increased awareness of security aspects in documents is also fueling the expansion of color microprinting. For instance, various banks worldwide are giving microprinted colored statements to differentiate between multiple aspects of the information.

Substrate Type Insights

The paper segment held the largest revenue share of more than 46% in 2021. Due to the excellent implementation of microprinting technology in paper banknotes, postage stamps, check slips, payment cards, and ID cards. The paper segment is expected to hold the dominating position over the forecast period owing to its growing usage.

The metal segment is expected to grow with a significant CAGR over the forecast period. Increasing use of microprinting on electronic components by the major manufacturers. Manufacturers are faced with growing demands for an increasing amount of code content to be printed on the components with limited space. Thus, the growing usage of microprinting has become quite popular among the manufacturers of electronic components which in turn is boosting the market growth.

Ink Type Insights

The magnetic inks segment dominated the overall market, gaining the largest market share of more than 33% in 2021. The magnetic ink segment is anticipated to grow at a significant CAGR during the forecast period owing to the security services required due to technological and digital improvements to reduce fraud in banking activities, transaction processes, etc.

For instance, the bank issued debit cards, bonds, and credit cards using magnetic ink so that the information could be read when inserted into the cash dispensing machines. The magnetic ink segment growth is also propelled by the growing usage of Magnetic Ink Character Recognition (MICR), which helps to analyze the documents' authentication.

The UV invisible inks segment is anticipated to grow at the fastest CAGR during the forecast period. UV invisible inks have grown rapidly in recent years, as they are essential for microprinting currency and stamps, a widely used technique to combat counterfeiting. Printing coins, stamps, and bank documents have been expanding steadily, which has contributed to the rapid expansion of UV and infrared ink microprinting.

Print Type Insights

The single-sided segment is expected to dominate by contributing the largest market share of approximately 66% in 2021. In the government sector, single-sided printing is primarily utilized for official documents, postal stamps, and ID cards. To prevent product duplication, the packaging industry is also utilizing this technology in label wrapping. The segment is also expected to be the fastest growing with a significant CAGR during the forecast period.

Application Insights

The currency segment is anticipated to grow at the fastest CAGR during the forecast period. The growing concerns about counterfeit currency have forced legal tender issuers worldwide to increase their currency's security features. The growth is also attributed to the increasing number of notes printed by the government using the microprinting technique. With the use of microprinting on currency notes, it is difficult to counterfeit as it is impossible to reproduce the print accurately with only the use of photocopiers. Thus, governments across the globe are adopting the microprinting technique to avoid the production of fake currency, which in turn is boosting the market growth.

The labels segment dominated the overall market with a revenue share of around 24% in 2021. Security labels protect products from tampering, counterfeiting, and diversion. Security labeling preserves the company's reputation, lowers the chance of lost sales, and reduces liability concerns in addition to authenticating products to consumers. As goods move through the supply chain, security labels can be used to keep an eye on them. Further, the growth of e-commerce, consumer electronics, and apparel industries are the main factors supporting the market growth, as labels provide crucial information about the product's warranty and date of manufacturing.

End-use Insights

The packaging segment is estimated to grow at the highest CAGR from 2022 to 2030. The major factor attributed to the growth is the increasing use of microprinting in the packaging industry. Most industry participants are adopting this technique to prevent the duplication of products. Further, brand protection and product safety are necessary across all industries since counterfeiting can reduce annual revenue. Microprinting is utilized on labels, tags, packaging-related boxes, packages, and tags.

The BFSI segment dominated the overall market, gaining the largest market share of nearly 24% in 2021. The market growth can be attributed to the use of microprinting in various fields by the BFSI, such as employee ID, currencies, bank stamps, bonds, checks, and banking documents. The BFSI is the largest issuer of such business documents, which is the driving factor for market growth.

Regional Insights

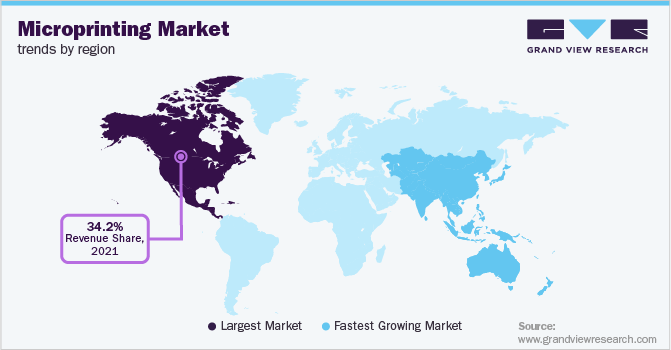

Asia Pacific is expected to emerge as the fastest-growing segment registering the highest CAGR during the forecast period. The growth is attributed to the presence of a large number of banking and finance institutions, governmental organizations, and corporate businesses in APAC, coupled with the increasing usage of microprinting technology-based printers. India's banking and finance industries are heavily utilizing microprinting technology while creating banknotes and checkbooks.

The introduction of counterfeit money and rising instances of fraud are key elements contributing to the market's expansion. The market is expanding as a result of the Asia-Pacific region's increasing per capita income, which resulted in the increased demand for consumer electronics and e-commerce. The product information for consumer electronics is printed on the outer cartages using microprinting. China is the world's major producer of consumer electronics, and exports to other nations are offering up a wide range of prospects for the microprinting industry as a whole.

North America held the largest revenue share of 34.2% in 2021. The growth is attributed to the increasing need for packaged foods and beverages. North America anticipates significant demand for products in the packing industries. The growing packaging industry in the region has a significant impact on the development of the microprinting sector. On the other side, the expansion of the microprinting market is also being fueled by the accessible printing and scanning options available in the region.

According to the U.S. Customs and Border Protection, in September 2021, the Philadelphia officers seized more than USD 6.5 million in counterfeit U.S. currency. This has led to market expansion. Significant contributors to the growth of the North America microprinting industry include the Xerox Corporation, Brady Worldwide, Inc., and HP Development Company L.P.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on business strategies such as mergers & acquisitions, and partnerships & collaborations to integrate microprinting technologies used for creating unique currency as well as sustainable packaging labels and I.D. tags which has intensified the competition among these players. The market players are also collaborating with the government as well as local & regional players to gain a competitive edge over their peers and capture a significant market share. Some prominent players in the global microprinting market include:

-

Xerox Corporation

-

Brady Worldwide, Inc.

-

H.P. Development Company L.P.

-

Zebra Technologies Corp.

-

Videojet Technologies, Inc.

-

Canon Inc.

-

Ricoh

-

Huber Group

-

Matica Technologies Group S.A.

Recent Development

-

In June 2021, Brady Corporation acquired Code Corp. to gain a significant presence in the microprinting market and expand its industrial applications.

-

In April 2021, Brady Corporation announced to acquire Nordic ID Oyj to gain access to a broader product portfolio, a larger customer base, and a stronger global footprint.

Microprinting Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 725.7 million

Revenue forecast in 2030

USD 1.14 billion

Growth rate

CAGR of 5.9% from 2022 to 2030

Historic year

2017 - 2020

Base year for estimation

2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, substrate type, ink type, print type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Brazil

Key companies profiled

Xerox Corporation; Brady Worldwide, Inc.; HP Development Company L.P.; Zebra Technologies Corp.; Videojet Technologies, Inc.; Canon Inc.; Ricoh; Huber Group; Matica Technologies Group SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microprinting Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global microprinting market report based on type, substrate type, ink type, print type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Monochrome

-

Color

-

-

Substrate Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Plastic

-

Paper

-

Metal

-

-

Ink Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Micro-Embossing

-

Special Inks

-

Magnetic Inks

-

UV Invisible Inks

-

Infrared Ink Markings

-

-

Print Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-sided

-

Double-sided

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Currency

-

Stamps

-

Bank Checks

-

Labels

-

ID and Payment Cards

-

Documents

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government

-

Consumer Electronics

-

Healthcare

-

Education

-

IT and Telecom

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global microprinting market size was estimated at USD 694.0 million in 2021 and is expected to reach USD 725.7 million in 2022.

b. The global microprinting market is expected to grow at a compound annual growth rate of 5.9% from 2022 to 2030 to reach USD 1.14 billion by 2030.

b. Asia Pacific is expected to emerge as the fastest-growing market, registering highest CAGR during the forecast period. The growth in the region is attributed to the presence of a large number of banking and finance institutions, governmental organizations, and corporate businesses in APAC, coupled with the increasing usage of microprinting technology-based printers.

b. Some prominent players in the market include Xerox Corporation, Brady Worldwide, Inc., H.P. Development Company L.P., Zebra Technologies Corp., Videojet Technologies, Inc., Canon Inc., Ricoh, Huber Group, and Matica Technologies Group S.A., among others.

b. Throughout the forecast period, important variables such as the development of the e-commerce business, banking sector legislation and regulations, the introduction of novel products, and increased demand for anti-counterfeiting product offerings are anticipated to grow significantly.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."