- Home

- »

- Water & Sludge Treatment

- »

-

Middle East Process Chemicals for Water Treatment Market Report 2025GVR Report cover

![Middle East Process Chemicals For Water Treatment Market Size, Share & Trends Report]()

Middle East Process Chemicals For Water Treatment Market Size, Share & Trends Analysis Report By Application (Sugar & Ethanol, Fertilizers, Geothermal, Petrochemical Manufacturing, Refining), By Country, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-993-7

- Number of Report Pages: 79

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Industry Insights

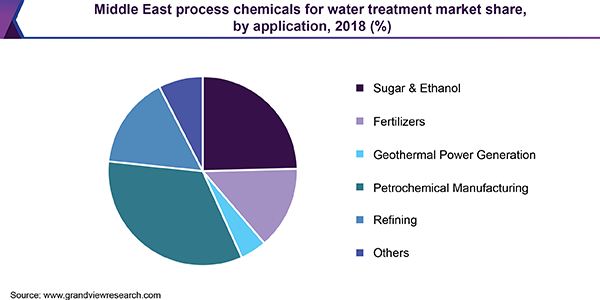

The Middle East process chemicals for water treatment market size was valued at USD 0.54 billion in 2018 and is expected to register a CAGR of 6.4% over the forecast period. The growing need for water treatment in the sugar & ethanol, fertilizers, geothermal power generation, petrochemical manufacturing, and refining industries, specifically in emerging economies of the Middle East are expected to drive the market growth. Regulatory policies are expected to play a pivotal role in shaping the dynamics of the market for the Middle East process chemicals for water treatment over the forecast period. Turkish REACH regulation formed by the Turkish Ministry of Environmental and Urbanization (MoEU) monitors chemicals and their safe use. It deals with the registration, evaluation, authorization, and restriction of chemical substances, including process chemicals. The need for efficient water desalination process is also expected to rapidly increase and this is anticipated to offer lucrative growth opportunities for the market players in the Middle East region.

The adoption of process chemicals is higher in wastewater treatment plants. These plants use biocides and decoloring agents to cleanse & regenerate adulterated water supplied from the flaming circuit and the cooling circuit. They are also focusing on complying with the mandates imposed for maintaining the quality of wastewater discharged from the plants. Following the degradation of contaminants and sludge separation, a part of the stream of regenerated water is recycled to the factory for reuse in the plumbing circuit.

The limited supply of water for industrial applications has propelled the demand for process chemicals for water treatment, especially in the fertilizers, petrochemical manufacturing, and refining verticals. These sectors collectively account for a major revenue share of the Middle East process chemicals for the water treatment market. The expansion of the petrochemical industry has considerably contributed to the economic growth of the region. All these factors are expected to propel the demand for process chemicals in the Middle East.

The demand for water in the Middle East region is growing owing to increasing agricultural activities. Various industries in the Middle East have adopted water-recycling systems in recent years owing to the scarcity of water. Additionally, the market players are adopting several water treatment technologies to reuse the water discharged from industries, such as petroleum and refining, for other applications. All these factors are expected to drive market growth over the forecast period.

Applications Insights

Biocides are the most prominently used process chemicals owing to its high demand in the petrochemical manufacturing industry. Biocides are extensively used for the desalination process; it is widely used in the Middle East region for water treatment. The use of water in the fertilizer manufacturing process for various operations is higher. Water is used in greater volumes for cooling towers, steam generation, and in production of phosphates & nitrogen liquids. These factors have bolstered the consumption of process chemicals in the fertilizer industry.

Geothermal power generation involves the production of geothermal steam and condensed water with different chemical compositions of contaminants. Critical issues such as sediment formation, deposition of impurities, and so on the face by the geothermal power plants are in line with those faced by conventional power facilities. These plants are also dependent on water treatment chemicals as they rely on the purity level of water for maximizing efficiency and power generation. The Middle East petrochemical industry has witnessed rapid growth over the past few decades owing to the easy availability of gas feedstocks at a low price. The petrochemical manufacturing segment is anticipated to account for the largest market share by 2025.

Country Insights

Azerbaijan is one of the prominent markets in the Middle East region and is expected to grow at the second-highest CAGR over the forecast period. Various projects are being implemented in the region for the reconstruction of water supply and sewage systems. These projects are implemented through close cooperation with the Asian Development Bank, World Bank, and the Japan International Cooperation Agency, among others. The Azersu Open Joint Stock Company (OJSC) is playing a vital role in the implementation of water supply and sanitation services in the Republic of Azerbaijan. Bilateral relations of Azersu OJSC with SUEZ, Budapest Water Works, and Halla Korea, among others, have further supported the implementation of new technologies and modern facilities in the country.

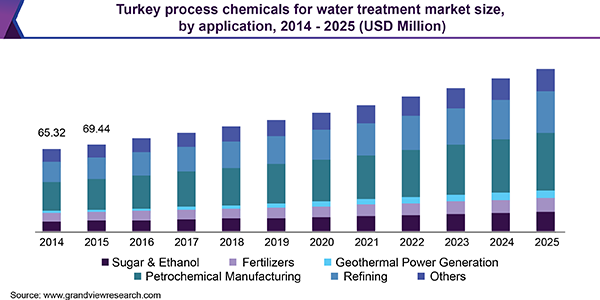

Furthermore, the construction of a new water treatment facility close to the Shamkirchay reservoir is nearing its completion. The facility has a capacity of 1.6 cubic meters per second and is expected to be built next to the reservoir. Such factors are likely to drive the demand for process chemicals for water treatment over the forecast period. Rapid industrialization & urbanization, plans of accession to the EU, and the growing popularity of the nation as a tourist destination are vital factors boosting the water & wastewater treatment industry in Turkey. Moreover, nearly 75% of industrial wastewater in Turkey is disposed of without treatment. These factors have encouraged the country’s government to make investments in the development of water treatment facilities.

Middle East Process Chemicals for Water Treatment Market Share Insights

Manufacturers in the Middle East depict a higher degree of integration with in-house raw material production facilities and long-term supply contracts with raw material suppliers. Products manufactured by the companies are sold in domestic and international markets through various distribution channels, including direct supply agreements and third-party suppliers, which not only procure the finished products from manufacturers but also distribute them across the region through an extensive product distribution network worldwide. The key players operating in the market are SUEZ; BASF SE; Ecolab; Solenis; Nouryon; Kemira; Baker Hughes; Dow; SNF Group; Cortec Corporation; Solvay; Johnson Matthey; Veolia. In January 2019, BASF SE and Solenis merged their paper and water chemical businesses intending to add value to their product offerings and boost the sales of process chemicals.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2019 to 2025

Regional scope

Middle East

Country scope

Azerbaijan, Uzbekistan, Turkey, Turkmenistan, Iran, Kazakhstan, and Georgia

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Segments Covered in the reportThis report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the Middle East process chemicals for water treatment market report based on application and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Sugar & Ethanol

-

Fertilizers

-

Geothermal Power Generation

-

Petrochemical Manufacturing

-

Refining

-

Other

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Azerbaijan

-

Uzbekistan

-

Turkey

-

Turkmenistan

-

Iran

-

Kazakhstan

-

Georgia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."