- Home

- »

- Next Generation Technologies

- »

-

Military And Commercial Parachutes Market Report, 2030GVR Report cover

![Military And Commercial Parachutes Market Size, Share & Trends Report]()

Military And Commercial Parachutes Market Size, Share & Trends Analysis Report By Type (Round, Cruciform, Ram-air), By Application (Cargo/Extraction, Deceleration, Emergency), By Region, and Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-919-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

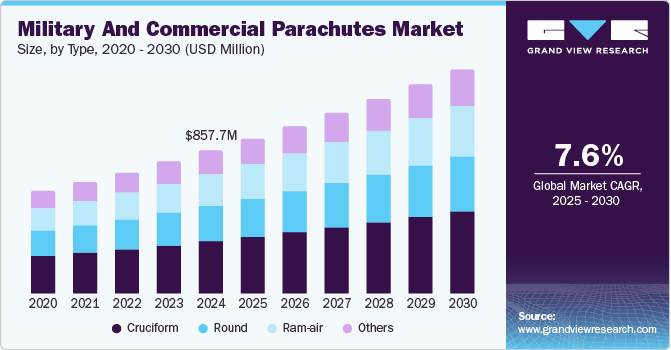

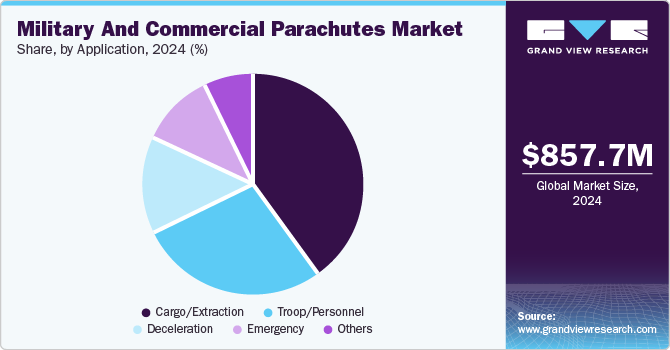

The global military and commercial parachutes market size was valued at USD 857.7 million in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. An increase in defense expenditures by various countries, driven by geopolitical tensions and the need for enhanced military capabilities, has led to a higher demand for advanced parachute systems. In addition, the growing use of parachutes in both military operations and recreational activities has contributed to market growth. Moreover, the ongoing modernization programs within armed forces worldwide aim to improve operational readiness and safety, further boosting the demand for innovative parachute solutions.

Technological advancements play a significant role in shaping the current market landscape. Manufacturers increasingly incorporate lightweight materials and advanced design features into parachute systems, enhancing their performance and safety. For instance, the development of Ram-air parachutes has gained traction due to their superior maneuverability and reliability compared to traditional round parachutes. This shift toward more sophisticated designs is attracting investments from both military and commercial sectors, leading to a more competitive environment in military and commercial parachutes industry.

Moreover, the rising number of international conflicts and security concerns will likely increase the demand for reliable airborne operations. As countries continue to invest in their defense capabilities, the need for efficient and effective parachute solutions remains strong. According to the Stockholm International Peace Research Institute (SIPRI), global military spending reached USD 2,443 billion in 2023, reflecting a real-term increase of 6.8% from the previous year. This rise marks the highest level of military expenditure ever recorded and is attributed to ongoing conflicts and rising geopolitical tensions.

In addition, the growing interest in adventure sports and recreational activities involving parachuting is anticipated to fuel market expansion. The increasing popularity of skydiving and other related activities has impelled the demand for commercial parachutes. As more individuals seek thrilling experiences, manufacturers respond with innovative designs catering to safety and performance. This trend enhances consumer engagement and contributes significantly to the market's overall growth.

Type Insights

The cruciform segment dominated the market with a revenue share of 36.8% in 2024, owing to its versatility and effectiveness in various applications. Cruciform parachutes are designed for stability and control, making them ideal for precision landings in both military operations and recreational activities. Their ability to handle diverse payloads and conditions has made them a preferred choice for cargo drops and personnel deployment, thus solidifying their position in the military and commercial parachutes industry.

The Ram-air segment is projected to grow at the fastest CAGR during the forecast period, driven by significant advancements in parachute technology. Ram-air parachutes feature a unique design that allows them to inflate with air during descent, creating a wing-like structure that offers superior maneuverability and glide performance compared to traditional designs. This capability makes them highly desirable for both military applications, such as troop insertion and cargo delivery, and civilian uses, such as skydiving and paragliding. For instance, the Hi-5 Ram Air Parachute by Airborne Systems represents the latest advancement in military parachute technology. This unique parachute excels in Ram air glide performance while enabling rapid altitude loss, similar to traditional troop parachutes.

Application Insights

The cargo/extraction segment dominated the market with the largest share in 2024 due to its critical role in logistics and supply chain operations. Military forces rely heavily on cargo parachutes for delivering essential supplies, equipment, and humanitarian aid in remote or hostile environments where ground transportation may be impractical or dangerous. The ability to deploy large payloads accurately and safely is vital for operational success, particularly in scenarios requiring rapid resupply without ground access. In addition, advancements in cargo parachute technology, such as improved deployment mechanisms and enhanced payload capacity, are further solidifying this segment's significance.

The troop/personnel segment is expected to grow at the fastest CAGR over the forecast period. Modern warfare demands that armed forces be able to insert troops quickly into various environments, often behind enemy lines or in disaster-stricken areas where conventional access is limited. The demand for advanced personnel parachutes is driven by innovations that enhance safety features, such as automatic activation devices and improved canopy designs that reduce descent speeds. Moreover, training programs are evolving to incorporate advanced parachuting techniques that leverage these new technologies, further boosting adoption rates among military personnel. As governments continue to invest in modernization efforts for their armed forces amid rising global security threats, the troop/personnel segment will remain a focal point of growth within the military and commercial parachutes industry.

Regional Insights

The North America military and commercial parachutes market dominated the global market with a revenue share of 36.2% in 2024, driven by significant investments in defense and advanced military technologies. The region accounted for a substantial market share due to the presence of leading defense contractors and manufacturers, such as Airborne Systems, Raytheon Technologies, and Safran Group. These companies focus on innovation and production of high-performance parachute systems tailored to diverse operational needs. North America's geopolitical strategy emphasizes rapid deployment capabilities and operational readiness, further fueling the demand for reliable parachuting solutions.

U.S. Military And Commercial Parachutes Market Trends

The U.S. military and commercial parachute market dominated the regional military and commercial parachute industry in 2024. The U.S. military allocates a significant portion of its budget to modernizing its capabilities, including procuring advanced parachute systems for various missions. According to SIPRI, U.S. military expenditure increased by 2.3% in 2023, reaching USD 916 billion. Moreover, the T-11 parachute, developed by Airborne Systems, exemplifies this commitment to innovation and operational effectiveness. Furthermore, the increasing complexity of modern warfare necessitates specialized parachutes that can accommodate diverse scenarios, from troop insertion to cargo delivery.

Europe Military And Commercial Parachutes Market Trends

The Europe military and commercial parachutes market is expected to witness significant growth over the forecast period, driven by increasing defense budgets and a growing focus on enhancing military capabilities among NATO member states. Countries such as the UK, Germany, and France are investing significantly in their military sectors, including the modernization of parachute systems for troop insertion and cargo delivery. The rising need for paratroopers and advanced parachuting technologies is prompting governments to prioritize the procurement of high-performance parachutes. In addition, the growing popularity of adventure sports in Europe, including skydiving and paragliding, further supports market expansion.

Asia Pacific Military And Commercial Parachutes Market Trends

The Asia Pacific military and commercial parachutes market is anticipated to grow rapidly over the forecast period due to rising defense expenditure and modernization efforts among several countries. Major countries, including India, Japan, and South Korea, are enhancing their military capabilities, which drives the demand for advanced parachute systems tailored for various operational needs. The increasing frequency of joint military exercises and international collaborations in defense further stimulates the market as countries seek to improve their airborne operations and logistics support.

China is experiencing growth in its energy landscape, primarily driven by significant investments in its defense sector. In 2021, China allocated approximately USD 293 billion to its military budget, marking a 4.7% increase from the previous year. This commitment underscores China's focus on modernizing its armed forces, including the procurement of advanced parachute technologies for both personnel and cargo applications. As China continues to develop its military capabilities amid regional security challenges, the demand for reliable and efficient parachute systems is expected to grow, positioning the country as a key contributor in the military and commercial parachute industry.

Key Military And Commercial Parachutes Company Insights

The military and commercial parachutes industry is characterized by several key players contributing to its growth and innovation. Notable companies include Aerodyne, known for its advanced parachute technologies tailored for low altitude jumps; Airborne Systems, which specializes in high-performance parachute systems for military applications; BAE Systems, a major defense contractor providing a range of airborne solutions; and Butler Parachute Systems, recognized for its reliable parachute products designed for both military and commercial use.

-

Airborne Systems specializes in designing and manufacturing various parachute systems for military and commercial applications. The company offers products such as troop parachutes, GPS precision-guided cargo delivery systems, and various rescue and survival equipment. With facilities in the U.S. and Europe, Airborne Systems focuses on innovation and quality to meet the diverse needs of its clients, including advanced deployment systems for military operations.

-

BAE Systems is a global defense, security, and aerospace company that provides various solutions, including military parachutes. The company develops advanced technologies and systems for air, land, and naval forces, emphasizing safety and reliability. BAE Systems collaborates with military organizations worldwide to deliver customized solutions that enhance operational effectiveness across various environments. Its portfolio includes parachute systems designed for personnel and cargo applications, reflecting the company’s commitment to supporting defense capabilities.

Key Military And Commercial Parachutes Companies:

The following are the leading companies in the military and commercial parachutes market. These companies collectively hold the largest market share and dictate industry trends:

- Aerodyne

- Airborne Systems

- BAE Systems

- Butler Parachute Systems

- Complete Parachutes Solutions

- FXC Corporation.

- Mills Manufacturing

- Fujikura Parachute CO., LTD.

- SPEKON

- Safran

Recent Development

-

In November 2024, the Defence Research and Development Organisation (DRDO) handed over the P-7 heavy drop parachute system to the Indian Army, which can airdrop loads of up to 9.5 tons from IL-76 aircraft at altitudes of 4 kms. This advanced system, manufactured by Gliders India Limited (Ordnance Parachute Factory) in Kanpur, enables the swift deployment of critical equipment, such as light field guns and jeeps, into border and high-conflict areas, thereby enhancing operational readiness.

-

In April 2023, the German armed forces successfully conducted initial tests for the latest EPC-B parachute at the Altenstadt air/airborne transport school. This Belgian-made parachute, Ensemble de Parachutage du Combattant, is intended to replace the older T-10 parachute and features improved control and a lower descent rate, which helps reduce the risk of injury during jumps.

Military And Commercial Parachutes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 929.1 million

Revenue forecast in 2030

USD 1,338.8 million

Growth Rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia., South Africa

Key companies profiled

Aerodyne; Airborne Systems; BAE Systems; Butler Parachute Systems; Complete Parachutes Solutions; FXC Corporation.; Mills Manufacturing; Fujikura Parachute CO., LTD.; SPEKON; Safran

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Military And Commercial Parachutes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global military and commercial parachutes market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Round

-

Cruciform

-

Ram-air

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Troop/Personnel

-

Cargo/Extraction

-

Deceleration

-

Emergency

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."