- Home

- »

- Next Generation Technologies

- »

-

Mining Automation Market Size, Share & Growth Report, 2030GVR Report cover

![Mining Automation Market Size, Share & Trends Report]()

Mining Automation Market Size, Share & Trends Analysis Report By Solution (Software Automation, Services), By Application (Metal Mining, Mineral Mining), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-386-7

- Number of Report Pages: 159

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global mining automation market was valued at USD 4.90 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. The rapid advancement in technology, such as Artificial Intelligence (AI) and robotics, has resulted in increased usage of mining automation solutions as a means of boosting production efficiency. The increasing trend of deploying innovative technologies is driving the growth of automated mining solutions. The emergence of the Internet of Things (IoT) in this sector offers mine management with real-time data and analytics with the help of visualization tools. Several operators are teaming up with technology companies to deploy wireless networks underground.

For instance, in April 2021, International Business Machines Corp. (IBM) announced the acquisition of myInvenio, an Italian startup company. The Company builds and operates process mining software. The initiative aims to MyInvenio’s process and task mining technology into IBM Cloud for Robotization, a platform for structuring and running robotization operations. The company will benefit from the data-driven software and tools that help them track sales, production, procurement, and accounting. The increasing need for mine and worker safety is providing an impetus to industry growth. Previously, the traditional mining techniques have compromised the safety of the mine workers resulting in increased hazards at the mining site.

Therefore, providers have developed smart mining solutions and equipment to ensure the safety of workers. For instance, in November 2020, ABB launched the ABB Ability safety plus, a suite for the mine hoist. It is considered the mining industry’s first fully independently certified Safety Integrity Level 3 (SIL 3), which is very specific and rare for risk reduction and safety hazards for the mine hoist solution with the proper security by offering three solutions: safety plus brake system, safety plus hoist monitor, and safety plus hoist protector. The initiative aims to enhance the environment for mining to be safe for workers and types of equipment.

Solution Insights

The software automation segment dominated the market in 2022 and accounted for a share of more than 42.10% of the global revenue. Furthermore, the equipment automation segment is expected to show significant growth over the forecasted period. The development of robust technology-based vehicles, such as autonomous trucks, remote control equipment, and teleoperated mining equipment, is expected to fuel the segment's growth. Rapid advancements in hardware automation technology are expected to persistently streamline the way large-scale mining is undertaken across the globe.

Rio Tinto is a U.K.-based mining and metals company in the production of copper, minerals, iron ore, and aluminum. It has deployed nearly 400 Autonomous Haulage Systems (AHS)-enabled haul trucks at the Pilbara mine in Australia. In addition, the company is estimated to expand its driverless truck program by retrofitting Caterpillar Inc. trucks and 29 Komatsu Ltd. haul trucks for Brockman 4 mining operation, allowing the mine to run entirely in driverless mode. Furthermore, teleoperated mining equipment, such as wireless sensors, cameras, and Radio Frequency Identification (RFID), materials have emerged as common applications in the mining industry.

Wireless technologies have migrated to instruments and device networks for efficient monitoring and asset management strategy. For instance, in July 2021, Caterpillar Inc., a manufacturer of diesel and natural gas, construction, and mining equipment, announced an acquisition with Minetec, one of the prominent players in supplying data communication and high-precision tracking technical touch mining. The initiative aims to help manufacturing services for productivity, high precision tracking, and security solutions that will help them under hard rocks. Minetec supports Caterpillar Inc. monitoring in real-time and regulators of mining operations, allowing miners to visualize the full mine to optimize productivity and safety.

Application Insights

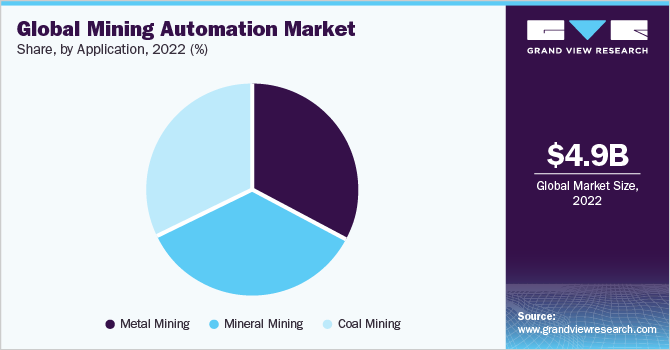

The mineral mining segment dominated the market in 2022 and accounted for the largest share of more than 34.85% of the global revenue. The metal mining application is presumed to show significant growth over the forecast period. The growth can be attributed to the increased convention of autonomous technology in metal exploration activities. Moreover, the rising demand for metals, such as copper, zinc, lead, and nickel, by application industries is expected to contribute to revenue growth. Furthermore, metal mining witnessed a surging demand for automated solutions to meet the rising demand for base metals.

For instance, in February 2022, UltimateSuite, a SaaS company, provided Task Mining results for automated business process analysis. It announced the launch of Robotic Process mining software on its platform to improve task discovery. The new extension helps its clients to automatically distinguish duplicative tasks, which can be automated or simplified to maximize effectiveness and boost business return on investment. The company’s software produces data, including the frequency of the task, total time spent on an activity, and the number of users. It also processes it to identify actions based on repetitious patterns, which can be excluded, simplified, or automated to make cost savings. The coal mining segment is expected to have a significant share. The increasing need to improve the mining conditions at coal sites has contributed to deploying autonomous solutions at the site.

The Commonwealth Scientific and Industrial Research Organization (CSIRO) has partnered with the Australian coal industry for the development of an underground automation system that isolates workers from mining hazards while improving productivity. For instance, in April 2021, IBM, a multinational technology company that deals in cloud-based services and produces and sells software and hardware for computers, commenced a partnership with Celonis. This data processing company sells SaaS to enhance business processes. The initiative aims to improve process mining software and identify incapability across the business process. The software will help rectify every business process from finance, supply chain, HR, or customer experience, which will help them understand how their operations are working to make appropriate changes accordingly.

Regional Insights

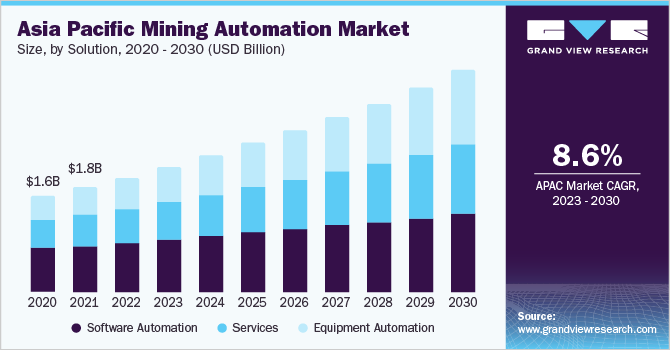

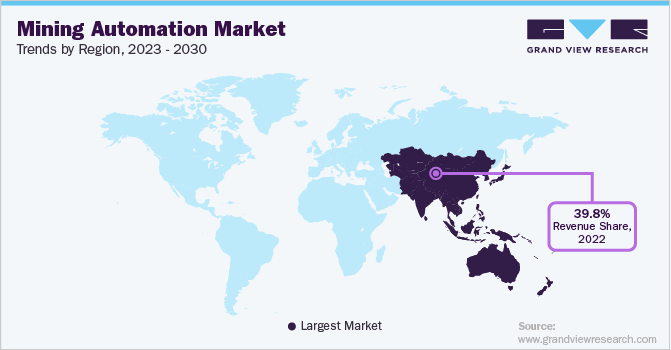

Asia Pacific dominated the industry in 2022 and accounted for over 39.75% of the overall revenue share. Increased adoption of automation technology in Australia is presumed to drive the regional market. The Australian economy witnesses the use of robots and remote-controlled equipment for the extraction of minerals safely and efficiently. The untapped drilling and exploration potential in economies, such as China and India, are expected to provide substantial opportunities for growth over the forecast period. For instance, in 2022, Sandvik AB acquired Deswik, an Australian company that offers a wide range of mining-integrated software and consulting solutions.

It includes operations planning, mining data management, computer 3D mine designs, and geological mapping. The initiative aims to pack a value chain gap in the mining sector and Rock solutions' offering. North America is expected to be a promising region due to the presence of high growth potential in the U.S. and Canada. The mines in Alberta, Canada have deployed autonomous haul trucks from Komatsu Ltd. to unearth and transport the oil sands for processes into crude oil. Moreover, growing opportunities for mineral exploration, resources, and infrastructure are increasing in the MEA region with the increasing government initiatives in Africa.

The rising demand for metal mining in the region is significantly contributing to regional growth. For instance, in December 2020, MSALABS supplies a complete variety of geochemical laboratory offerings, particularly for mining & exploration industries. It announced the use of PhotonAssay to deliver on-site analysis services to the mine. PhotonAssay technology uses energy X-rays to analyze silver, gold, and complementary metals in less than two minutes. It allows samples of over 500gm to be measured and presents the reading of impartial chemicals or the physical forms of the piece. The X-ray assay method did not destroy the sample and can now be used for further analysis.

Key Companies & Market Share Insights

The players focus on offering autonomous solutions that provide benefits, such as productivity and cost efficiency, in mining operations. The providers are offering products with tele-remote operation, AHS, and ADS solutions, thereby enhancing their product offerings. Several providers are either retrofitting autonomous technology in their existing line of equipment or are introducing a new line of automated machines to gain a foothold in the market. Currently, Caterpillar Inc. and Komatsu Ltd. have their lineup of autonomous trucks whereas Rio Tinto Group has retrofitted 19 Cat 793F mining trucks aimed at autonomous operations.

Moreover, Caterpillar Inc. has installed Cat Command for Hauling software intended for the operation of the autonomous fleet. For instance, in April 2022, Microsoft acquired Minit as one of the prominent players in process mining technology and helps businesses convert the way they analyze, cover, and optimize their processes. The initiative aims to boost the process mining in power automation, to help clients digitally transform & drive functional excellence by creating a complete image of their business processes, allowing every function to be fluently and automatically analyzed and refined. Some of the prominent players in the global mining automation market include:

-

Atlas Copco AB

-

Autonomous Solution Inc.

-

Caterpillar

-

Epiroc AB

-

Hexagon AB

-

Hitachi, Ltd.

-

Komatsu Ltd.

-

Liebherr Group

-

MST (Mine Site Technologies)

-

Rio Tinto

-

Rockwell Automation, Inc.

-

RPM Global Holdings Ltd.

-

Sandvik AB

-

Siemens

-

Trimble Inc.

Mining Automation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.28 billion

Revenue forecast in 2030

USD 8.64 billion

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Australia; Brazil; Mexico

Key companies profiled

Atlas Copco AB; Autonomous Solutions Inc.; Caterpillar Inc.; Hexagon AB; Hitachi Construction Machinery Co., Ltd.; Komatsu Ltd.; Rio Tinto; Rockwell Automation, Inc.; Sandvik AB; Siemens; Trimble Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

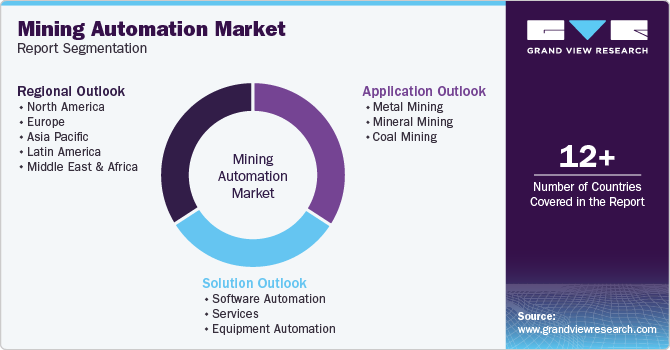

Global Mining Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining automation market report based on solution, application, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software Automation

-

Services

-

Implementation & Maintenance

-

Training

-

Consulting

-

-

Equipment Automation

-

Autonomous Trucks

-

Remote Control Equipment

-

Teleoperated Mining Equipment

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Mining

-

Mineral Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global mining automation market size was estimated at USD 4.90 billion in 2022 and is estimated to reach USD 5.28 billion in 2023.

b. The global mining automation market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 8.64 billion by 2030.

b. The mineral mining application segment dominated the global mining automation market with a share of 35.20% in 2022. This is attributable to the increasing adoption of autonomous solutions in metal exploration activities.

b. Some of the key players in the global mining automation market include Caterpillar, Inc.; Rio Tinto Group; Komatsu Ltd.; and Rockwell Automation, Inc.

b. Key factors driving the mining automation market growth include growing concern for mine and labor safety and the introduction of technologically advanced equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."