- Home

- »

- Pharmaceuticals

- »

-

Missouri Legal Cannabis Market Size & Share Report, 2030GVR Report cover

![Missouri Legal Cannabis Market Size, Share & Trends Report]()

Missouri Legal Cannabis Market Size, Share & Trends Analysis Report By Product (Flowers, Oils & Tinctures, Pre-rolls, Concentrates, Edibles, Others), By End-use (Recreational, Medical), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-033-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

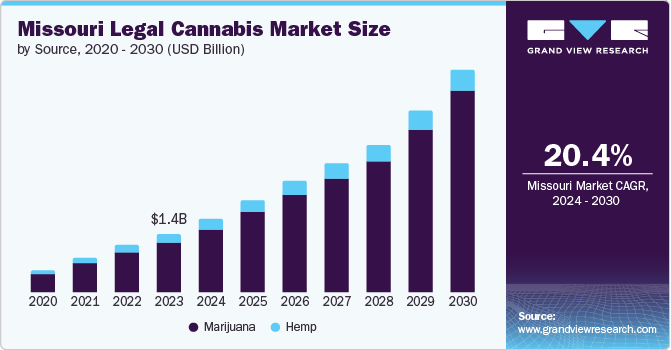

The Missouri legal cannnabis market size was estimated at USD 1.44 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 20.4% from 2024 to 2030. Growing disease burden of chronic pain and increasing requirement for pain management therapies across Missouri are the key factors driving this growth. In addition, rising legalization and awareness of health benefits of cannabis consumption are expected to drive demand. Growing research on benefits of marijuana on human health, patient awareness, and prevalence of chronic diseases are also contributing to market expansion. For instance, in December 2022, Missouri legalized the purchase, sale, and use of cannabis for people aged 21 and above for recreational purposes .

Additionally, the state's legalization of cannabis significantly expanded the potential for industry expansion. Missouri has permitted the cultivation, distribution, and manufacturing of medicinal cannabis since November 2018. Since then, a sharp increase in sales has been recorded, driving market growth. The presence of a large number of government-authorized dispensaries across the state can also be attributed to this growth. A strong presence of local players along with increasing research activities undertaken by various players to study cannabis benefits is also contributing to market growth. In November 2022, Missouri passed Amendment 3, which legalized the possession, purchase, sale, and manufacturing of recreational cannabis in the state.

The COVID-19 pandemic has further impacted industry expansion. During this period, there was a temporary halt on the licensing and launch of medicinal and recreational marijuana throughout Missouri, as the state and municipal governments sped up to finish tasks and paperwork required to move their marijuana program ahead. Moreover, coronavirus lockdowns led to a decrease in customers buying from offline or retail markets. Several major players promptly shifted their focus to marketing and selling products via social media and e-commerce platforms. There was a substantial growth in the number of patients who consumed medical marijuana in Missouri during this period.

End-use Insights

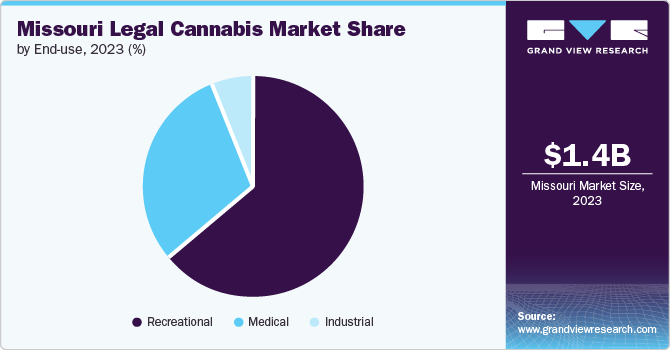

Recreational segment dominated the market with the largest market share of 64.4% and is anticipated to register the fastest CAGR from 2024 to 2030. Cannabis is also becoming popular among young people across Missouri. In addition, concerning Missouri, legalization is anticipated to generate considerable tax money for the government while also aiding their efforts to suppress illegal marijuana trade.

Medical use accounted for the second largest revenue share Potency and effectiveness for treating a variety of illnesses are the subjects of several research studies, which have led to a rise in medical use of cannabis. Legalization has also been a major driver for market growth. Medical use has received widespread acceptance, which bodes well for this segment’s growth. Medical professionals are now finding it simpler to prescribe cannabis to patients who request it because of the ease of laws and regulations around its usage. The stigma associated with marijuana usage has considerably decreased as a result of increased public understanding of its advantages.

Market Dynamics

The legalization of cannabis in various U.S. states can be attributed as a key growth driver. Increased instances of doctors' prescriptions for cannabis-based treatments for chronic diseases such as Alzheimer’s have led to an increase in the market penetration of cannabis. CBD oils are currently used for treating arthritis, Parkinson’s disease, and cancer-induced nausea, among others. An increasing preference of patients for cannabis-based treatments over traditional drugs is attributed to be a critical factor for market growth. A publication in the Journal of Pancreatic Cancer has shown that CBD helps prevent cancer spread by suppressing cancer cells’ growth in the body, thereby reducing the need for chemotherapy-based drugs. The use of CBD oils is less toxic compared to other chemotherapy drugs. Such factors are expected to positively impact market growth through 2030.

Missouri's legal cannabis market is witnessing strong growth and is expected to expand considerably in the coming years. The acceptance of cannabis has been varied in the medical community as a legitimate treatment course for illnesses such as childhood seizures, post-traumatic stress disorder (PTSD), bipolar disorder, schizophrenia, glaucoma, and chemotherapy-induced weight loss. It is still federally prohibited as a Schedule drug, and it is unclear how the current administration will address recreational use.

Product Insights

In 2023, flower accounted for the largest revenue share of 35.8% and is anticipated to register a significant CAGR from 2024 to 2030. This growth can be attributed to the benefits, ease of utilization, and lower cost of cannabis flowers compared to other products.

Pre-rolls are expected to grow at the fastest CAGR from 2024 to 2030, owing to rising adoption of pre-rolls by Missourians and legalization of marijuana for recreational purposes. Pre-rolls are considered one of the most common methods of smoking cannabis. Pre-rolls are gaining popularity owing to their ease of use and easy availability of these in multiple dispensaries across the state.

Key Companies & Market Share Insights

Cannabis products offer various health advantages, which has increased demand for usage in treating a range of chronic diseases. Hence, the products are quickly gaining traction. Key players are launching new products and investing in partnerships, mergers and acquisitions, collaborations with other companies, and other strategic activities to gain greater shares. For instance, in January 2022, Organic Remedies Missouri announced the introduction of its product line for patients using medicinal marijuana. Such activities will assist industry expansion.

Key Missouri Medical Cannabis Companies:

- BeLeaf Medical

- Blue Sage Cannabis Co.

- Show Me Alternatives

- Heya Wellness

- Missouri Wild Alchemy

- Organic Remedies

- Holistic Industries

- Kansas City Cannabis

- LOCAL CANNABIS COMPANY

- MOcann Extracts

Missouri Legal Cannabis Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 1.82 billion

Revenue forecast in 2030

USD 5.52 billion

Growth rate

CAGR of 20.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast data

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, and end- use, cultivation

State scope

Missouri

Key companies profiled

BeLeaf Medical; Blue Sage Cannabis Co.; Show Me Alternatives; Heya Wellness; Missouri Wild Alchemy; Organic Remedies; Holistic Industries; Kansas City Cannabis; LOCAL CANNABIS COMPANY; MOcann Extracts

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Missouri Legal Cannabis Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Missouri legal cannabis market report based on source, derivatives, cultivation, and end- use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp CBD

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post-traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s

-

Diabetes

-

Parkinson's

-

Glaucoma

-

Others

-

-

Recreational Use

-

Frequently Asked Questions About This Report

b. The Missouri legal cannabis market size was valued at USD 680.0 million in 2023 and is expected to reach USD 877.1 million in 2024.

b. The Missouri legal cannabis market is expected to grow at a compound annual growth rate of 22.0% over the forecast period from 2024 to 2030 to reach USD 2.9 billion in 2030.

b. In 2023, the flower segment accounted for the largest revenue share of over 35.8% owing to the benefits provided by the flower, ease of utilization of the flower, and lower cost as compared to other product types.

b. Some prominent players in the Missouri medical cannabis market include BeLeaf Medical, Blue Sage Cannabis Co., Show Me Alternatives, Heya Wellness, Missouri Wild Alchemy, Organic Remedies, Holistic Industries, Kansas City Cannabis, LOCAL CANNABIS COMPANY, MOcann Extracts

b. The growing disease burden of chronic pain and the increasing requirement for pain management therapies across the state are driving the growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."