- Home

- »

- Medical Devices

- »

-

Mobile Cardiac Telemetry Systems Market Report, 2030GVR Report cover

![Mobile Cardiac Telemetry Systems Market Size, Share & Trends Report]()

Mobile Cardiac Telemetry Systems Market Size, Share & Trends Analysis Report By Application (Lead-based, Patch-based), By End use (Hospitals, Cardiac Centers), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-779-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 – 2020

- Industry: Healthcare

Report Overview

The global mobile cardiac telemetry systems market size was estimated at USD 833.8 million in 2021 and is expected to register a compound annual growth rate (CAGR) of 12.1% from 2022 to 2030. The increasing prevalence of cardiovascular disorders and associated mortality has increased awareness about the benefits of Mobile Cardiac Telemetry (MCT) devices, which is propelling market growth. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2017, 800,000 deaths were reported due to cardiac disorders in the U.S., which is also the leading cause of death in the country. Furthermore, physical inactivity due to a sedentary lifestyle coupled with tobacco smoking and obesity has increased cardiac disorder morbidities.

The COVID-19 outbreak caused due to SARS-CoV-2, already affected millions of people globally as of June 2020. The contagious coronavirus is also having an economic impact and implications on most of the sectors including the medical device industry. Initially, the patients showed improvement with the combined usage of hydroxychloroquine and azithromycin, but it has a risk of prolonging the QT interval. Mobile cardiac telemetry is widely used in such patients to remotely monitor them to reduce hospitalization.

Moreover, the device is also helpful for the rapid detection of arrhythmogenic risks for such COVID-19 patients in the outpatient setting. Hospitals are currently overburdened with patients due to the pandemic and in such cases, these devices are very helpful for remote monitoring, which is further boosting the growth of the market for the mobile cardiac telemetry system. For instance, in March 2020 Biotelemetry, Inc. expanded its mobile cardiac outpatient telemetry monitoring program to COVID-19 patients in various institutions in the U.S. to monitor QT prolongation associated with hydroxychloroquine and azithromycin medication.

The increasing prevalence of arrhythmia is one of the major factors contributing to the growth of the market for mobile cardiac telemetry system. According to the Centres for Disease Control and Prevention (CDC), around 12.1 million people are expected to suffer from atrial fibrillation (AFib), a type of heart arrhythmia, by 2030. As per the same source, AFib was mentioned on 183,321 death certificates in the U.S. in 2019. The industry players are constantly trying to develop micro-sized handy devices to sustain their market share. For instance, in September 2019, iRhythm Technologies, Inc. collaborated with Verily Life Sciences to combine iRhythm’s AI-based system with Verily’s data analytical technology to screen, monitor, and diagnose atrial fibrillation.

Application Insights

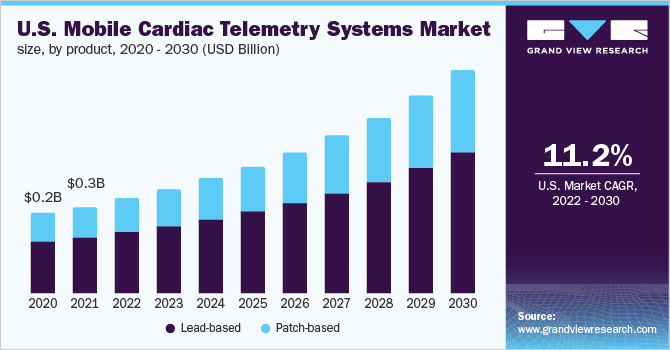

The lead-based segment dominated the market for mobile cardiac telemetry system and held a revenue share of over 65.0% in 2021 because lead-based MCTs are light weighted, user-friendly, and therefore preferred among several patients. There are a few disadvantages associated with lead-based MCTs such as lead failure and telemetry disruption which can limit the growth in the forthcoming years.

The patch-based segment is expected to showcase lucrative growth in the market for mobile cardiac telemetry system over the forecast period. Patch-based Continuous Cardiac Rhythm Monitoring (CCRM) has emerged in the outpatient setting as a useful clinical tool for the quantification and surveillance of bradyarrhythmia and tachyarrhythmia. These patch-based CRM devices have been studied in the outpatient setting as an alternative to traditional Holter monitoring and have emerged as feasible and patient-friendly options for the detection of clinically meaningful arrhythmia, which is fueling the demand.

End-use Insights

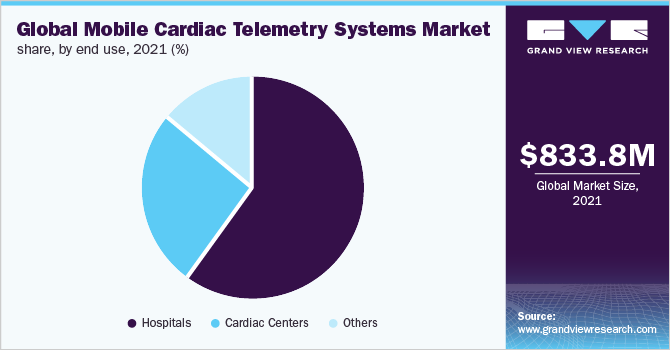

The hospitals' segment dominated the market for mobile cardiac telemetry system and accounted for revenue share of more than 60.0% in 2021. The growth can be attributed to the increased number of minimally invasive surgeries under these facilities. Moreover, hospitals are omnipresent and easily accessible, thus more preferable over other facilities. Furthermore, favorable reimbursement policies are expected to fuel the demand in the forthcoming years.

Based on end-use, the market for mobile cardiac telemetry system is segmented into hospitals, cardiac centers, and others. The cardiac center segment is expected to witness the fastest growth over the forecast period. The growth can be attributed to an increased number of cardiac centers and the easy availability of surgeons under these facilities. The ambulatory surgical centers are also expected to gain popularity during the forecast period due to increased demand for outpatient services. Furthermore, cost-effective treatment and shorter stay duration are some factors propelling segment growth.

Regional Insights

North America dominated the mobile cardiac telemetry system market and accounted for a revenue share of around 37.0% in 2021. This growth can be attributed to various factors such as the increasing geriatric population, prevalence of cardiac disorders, and rising healthcare expenditure. For instance, according to the report published by the Administration for Community Living, there has been a 33% increase in the geriatric population in the U.S. in the past decade. Moreover, the presence of major service providers with improved healthcare solutions is expected to fuel the market growth during the forecast period.

In the Asia Pacific, the market for mobile cardiac telemetry systems is expected to exhibit a lucrative CAGR of around 13.5% in the forecast period. Factors such as dietary habits and the rising adoption of a sedentary lifestyle leading to physical inactivity are contributing to the increased cardiovascular morbidities in the region. According to the Ministry of Health Labor and Welfare, around 170,000 deaths were attributed to cardiovascular diseases each year in Japan. Moreover, several multinational companies are setting up their manufacturing business in the region due to low manufacturing costs and skilled labor. The aforementioned factors are further fueling the demand for mobile cardiac telemetry devices.

Key Companies & Market Share Insights

The market for mobile cardiac telemetry system is competitive. Some of the major industry players are involved in strategic collaborations, regional expansions, and new product launch to increase their market penetration. For instance, in May 2021, VitalConnect launched the VitalPatch RTM mobile cardiac telemetry solution. The solution has a flexible and programmable platform, which covers various cardiac monitoring needs. In July 2019, Biotelemetry acquired ADEA Medical AB. This acquisition is aligned with BioTelemetry’s longer-term strategy to expand its international business in the Nordics and other European countries. Some of the prominent players in the mobile cardiac telemetry systems market include

-

BioTelemetry, Inc.

-

ScottCare

-

Biotricity Inc.

-

Welch Allyn

-

Applied Cardiac Systems Inc.

-

Medicomp Inc.

-

Preventice Solutions

-

Telerhythmics LLC

-

Zoll Medical Corporation

-

iRhythm Technologies, Inc.

Mobile Cardiac Telemetry Systems Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 0.9 billion

Revenue forecast in 2030

USD 2.3 billion

Growth Rate

CAGR of 12.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; Australia; India; Mexico; Brazil; South Africa; Saudi Arabia

Key companies profiled

BioTelemetry Inc.; ScottCare; Biotricity Inc.; Welch Allyn; Applied Cardiac Systems Inc.; Medicomp Inc.; Preventice Solutions; Telerhythmics LLC; iRhythm Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global mobile cardiac telemetry systems market report based on application, end use, and region:

- Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Lead-based

-

Patch-based

-

- End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Cardiac centers

-

Others

-

- Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

- Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

- Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

- Latin America

-

Brazil

-

Mexico

-

- Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mobile cardiac telemetry systems market size was estimated at USD 833.8 million in 2021 and is expected to reach USD 0.9 billion in 2022.

b. The global mobile cardiac telemetry systems market is expected to grow at a compound annual growth rate of 12.1% from 2022 to 2030 to reach USD 2.3 billion by 2030.

b. North America dominated the mobile cardiac telemetry systems market with a share of 37% in 2021. This is attributable to the increasing geriatric population, the prevalence of cardiac disorders, rising healthcare expenditure, and constant research and development initiatives.

b. Some key players operating in the mobile cardiac telemetry systems market include BioTelemetry Inc., ScottCare, Biotricity Inc, Welch Allyn, Applied Cardiac Systems Inc, Medicomp Inc, Preventice Solutions, and Telerhythmics LLC.

b. Key factors driving the mobile cardiac telemetry systems market growth include physical inactivity due to a sedentary lifestyle coupled with tobacco smoking and obesity, the prevalence of cardiovascular disorders, and favorable government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."