- Home

- »

- HVAC & Construction

- »

-

Mobile Crane Market Size, Share & Growth Report, 2030GVR Report cover

![Mobile Crane Market Size, Share & Trends Report]()

Mobile Crane Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Truck Mounted Crane, Trailer Mounted Crane, Crawler Crane), By Application (Construction, Industrial, Utility), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-407-9

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Crane Market Summary

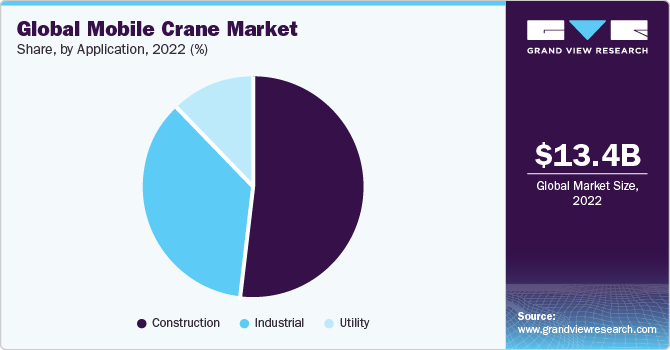

The global mobile crane market size was valued at USD 13.40 billion in 2022 and is anticipated to grow at a CAGR of 6.7% from 2023 to 2030. Mobile cranes are crucial for construction projects as they help in moving components and materials within the construction site, as well as between offsite facilities and the construction site.

Key Market Trends & Insights

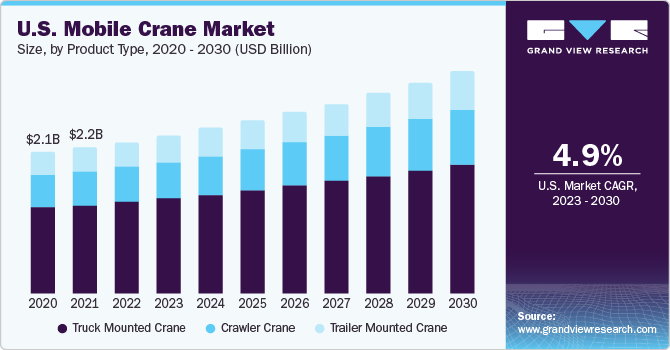

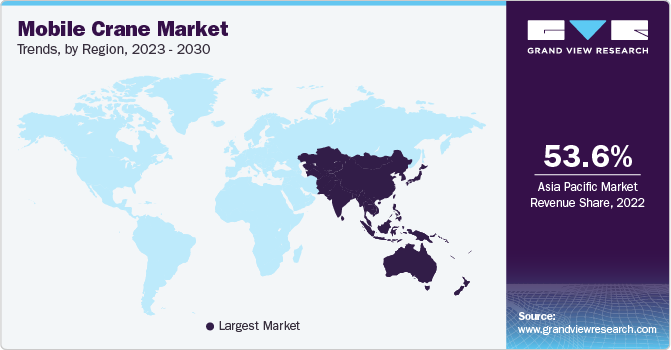

- Asia Pacific held the largest revenue share of 53.6% in 2022.

- By application, the construction segment held the largest revenue share of 52.2% in 2022.

- By product, the truck-mounted crane segment accounted for the largest revenue share of 63.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 13.40 Billion

- 2030 Projected Market Size: USD 22.32 Billion

- CAGR (2023-2030): 6.7%

- North America: Largest market in 2022

The continued urbanization and subsequent initiatives being pursued toward developing new infrastructure and upgrading the existing infrastructure are expected to drive the demand for these equipment over the forecast period. Advances in technology, continued innovations, and a strong emphasis on automation and machine safety bode well for the industry’s growth. Most innovations are aimed at developing customized solutions for these types of equipment.

With the integration of the latest technologies, the modern equipment is offering innovative features, such as GPS tracking, fleet management, and telematics solutions. For instance, Terex Corporation's products are offered with the IC-1 Plus control system, which helps operators calculate the lifting capacity for each position of the boom. Thus, the integration of advanced systems, such as telematics, is anticipated to fuel the growth of the market.

The growth of the market is also anticipated to create significant opportunities for OEMs. Customers prefer renting as it allows them to save on the costs associated with the procurement and maintenance of new equipment. Renting equipment also greatly reduces overall project costs. The growing preference for renting equipment is opening up opportunities for manufacturers to collaborate with rental equipment companies as part of efforts to augment their sales.

On the other hand, rental companies are focusing on procuring new equipment and expanding their fleet size to cater to the rising demand for rental products. The growing demand for new equipment from rental companies is expected to drive the growth of the mobile cranes industry over the forecast period.

However, high procurement and operating costs associated with mobile cranes, changing customer requirements, and varying compliance and specification requirements across regions are some factors expected to restrain market growth. As the application portfolio of mobile cranes continues to widen, their specifications are also changing rapidly. As such, a standard mobile crane can no longer cater to diverse customer needs. Product specifications can also change according to the region. A mobile crane that suits the European market may not be suitable for the North American market.

Cranes are crucial for construction projects as they help in moving components and materials within the construction site as well as between offsite facilities and the construction site. Construction companies prefer prefabricating different construction blocks offsite and transporting the readymade blocks to the construction site for assembly as part of their efforts to save time and avoid traffic congestion and onsite accidents.

Mobile cranes boast high weight-lifting capacities and facilitate convenient material handling; as a result, they are used to transfer prefabricated construction blocks from offsite facilities to construction sites. Thus, most of the production equipment on construction sites is being gradually replaced by transportation equipment, such as mobile cranes. A large number of construction projects that are underway in different parts of the world are driving the demand for mobile cranes.

Initiatives being pursued for upgrading the existing infrastructure are also expanding the market for mobile cranes. Several projects involving the refurbishment of existing infrastructure are underway across the globe. For instance, China is currently upgrading the infrastructure of the Beijing International Airport. The expansion of the international airport is scheduled for completion by 2025. Asia Pacific countries, such as India, China, and Indonesia, are strongly focusing on infrastructure development to cope with the growing population. These countries are investing aggressively in projects to build hospitals, schools, houses, government buildings, and airports, among others.

For instance, in India, the government is expected to invest INR 50 trillion to improve the country's infrastructure. Similarly, in China, the government is pursuing the "One Belt, One Road" initiative, which envisages developing infrastructure, including highways, railways, roads, and bridges, between India, China, Pakistan, and Europe. All such ongoing and proposed infrastructural construction activities and investments in infrastructure development bode well for the strong growth of the mobile crane market.

Advances in technology, coupled with a strong emphasis on automation and machine safety, bode well for market expansion. Innovations are aimed at developing customized solutions for mobile cranes. With the integration of the latest technologies, modern mobile cranes are offering innovative features, such as GPS tracking and fleet management & telematics solutions, which is expected to advance market growth through the forecast period.

Application Insights

The construction segment held the largest revenue share of 52.2% in 2022 in the mobile cranes market. Continued residential and commercial infrastructure projects across the globe are expected to support the growth of the segment. Tower cranes, once installed, can only be moved once the project is completed. Hence, builders working on numerous projects usually prefer mobile cranes as they are easy to move. Deployment of mobile cranes can also reduce the idle time of the equipment and subsequently enhance productivity.

The utility segment, on the other hand, is expected to expand at the fastest CAGR of 7.3% over the forecast period. The growth of the segment can be attributed to the extensive use of mobile cranes in oil & gas projects, power projects, and utility projects, among others involving critical applications, such as underground construction. Utility companies require these types of equipment at construction sites as well as in their respective yards.

Regional Insights

Asia Pacific held the largest revenue share of 53.6% in 2022 and is expected to expand at the fastest CAGR during the forecast period, owing to the rapid pace of construction activities in emerging economies such as China, India, and the Philippines. The Indian government's "Bharatmala Pariyojana" infrastructure development scheme envisages improvements in the country’s road network. The Asian Infrastructure Investment Bank (AIIB) already invested USD 200 million in the National Investment & Infrastructure Fund (NIIF) in 2018 to contribute to India's infrastructure development.

The promising expansion of the infrastructure development and manufacturing sectors is driving the adoption of mobile cranes in China. Favorable government initiatives, such as the Belt and Road Initiative (BRI), are expected to lead to aggressive investments in new development projects. As of January 2021, around 140 countries have joined the BRI by signing a Memorandum of Understanding (MoU) with China. The list of BRI countries varies from economically underprivileged to financially stronger countries.

For underprivileged countries, the BRI is a foundation of development funds for infrastructural aspects such as highways, bridges, and ports, as well as an access route to markets in China and other countries to be connected by the BRI. It also allows such countries to reduce their dependency on financial and infrastructure support from developed countries and, in turn, allows the domestic Chinese mobile crane manufacturers to foray into these untapped markets.

The MEA is projected to register significant growth over the forecast period. The growth can be attributed to the increasing investment in residential and commercial infrastructure projects in the region. East African countries such as Kenya, Ethiopia, and Rwanda are investing aggressively in infrastructure development. For instance, in 2018, the Kenyan government announced 'the Big Four,' an ambitious infrastructure development project aimed at encouraging manufacturing, providing affordable housing and healthcare facilities, and ensuring food security.

An increase in Chinese investments in African countries are expected to boost the region's overall construction sector. The main motive of Chinese firms to provide aid in African countries is to gain access to and expand their regional presence. The recent business expansion of New Hope Group, an investment firm, in Egypt is one such instance that suggests the increasing Chinese influence in the region.

Turkey is also a rapidly growing market in the Middle East & Africa region. Favorable government initiatives, such as the new economic policy announced in March 2021, are likely to favor the growth of the mobile crane market over the forecast period. However, current high inflation and ongoing geopolitical events between Russia and Ukraine are likely to have a significant impact on the MEA region.

Product Type Insights

The truck-mounted crane segment accounted for the largest revenue share of 63.3% in 2022. The rising demand for mobile machinery in power and utilities, construction, and other industries and verticals is expected to boost the growth of the segment. Truck-mounted equipment offers a high loading capacity and can help in transporting goods easily from one place to another. These products are typically used in construction projects, such as bridge construction, railway projects, and hydropower projects.

The crawler crane segment is expected to advance at the fastest CAGR of 7.6% during the forecast period. Crawler cranes are compact and offer the ease of accessibility required in small construction sites, especially in urban areas. Crawler cranes are considered the most powerful cranes for use in different projects involving heavy industrial materials and other large-scale construction activities. Nevertheless, crawler cranes and trailer-mounted cranes accounted for a smaller share of the market as compared to truck-mounted cranes, owing to their limited operational capabilities.

Key Companies & Market Share Insights

Key players offer a wide range of products catering to various industries, including construction, power, and utilities. These vendors are undertaking aggressive research & development activities to develop technologically advanced products. For instance, in October 2020, Liebherr-International AG announced the launch of its LTM 1150-5.3 telescopic boom crane. The LTM 1150-5.3 offers a maximum lifting capacity of 150 tons and a 66-meter telescopic boom. Similarly, in October 2020, Manitowoc announced the launch of its National Crane NBT60XL boom truck. The truck features a counterweight with a hydraulic removable configuration from zero to 16,000 lbs.

Key Mobile Crane Companies:

- Bauer AG

- KATO WORKS CO., LTD.

- KOBELCO Construction Machinery Co., Ltd.

- Liebherr-International AG

- LiuGong Machinery Co., Ltd.

- Manitex International

- PALFINGER AG

- SANY HEAVY INDUSTRY INDIA PRIVATE LIMITED

- Sarens NV

- Sumitomo Heavy Industries, Ltd.

- Tadano Ltd.

- Terex Corporation

- XCMG GROUP

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Recent Developments

-

In April 2022, SeaPort Manatee, in collaboration with Logistec USA Inc., added two mobile harbor cranes, further increasing its cargo-handling capabilities. These cranes possess the capacity to lift 125 metric tons of goods each, totaling a combined capability of handling over 200 metric tons load. The addition of these mobile cranes is expected to enhance the cargo handling capabilities at SeaPort Manatee significantly

-

In December 2021, XCMG, a prominent Chinese mobile crane manufacturer, unveiled the XCMG XCT25_EV. This groundbreaking truck crane is recognized as the world's first that incorporates advanced hybrid technology. With a lifting capacity of 25 tons, the XCMG XCT25_EV offers the flexibility to switch between various operating modes, including hybrid, pure electricity, pure oil, and plug-in, enabling users to adapt to different requirements and conditions

-

In February 2021, Manitex Valla, a mobile crane manufacturer headquartered in Italy, introduced the V110 R Electric Mobile Crane to the market. This innovative crane is battery-powered and can be operated remotely. It is equipped with front-wheel drive and has an impressive lifting capacity of up to 11 tons, allowing it to reach a service height of 10.4 meter

Mobile Crane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.20 billion

Revenue forecast in 2030

USD 22.32 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Bauer AG; KATO WORKS CO., LTD.; KOBELCO Construction Machinery Co., Ltd.; Liebherr-International AG; LiuGong Machinery Co., Ltd.; Manitex International; Manitowoc Company, Inc.; PALFINGER AG; SANY HEAVY INDUSTRY INDIA PRIVATE LIMITED; Sarens NV; Sumitomo Heavy Industries, Ltd.; Tadano Ltd.; Terex Corporation; XCMG GROUP; Zoomlion Heavy Industry Science & Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

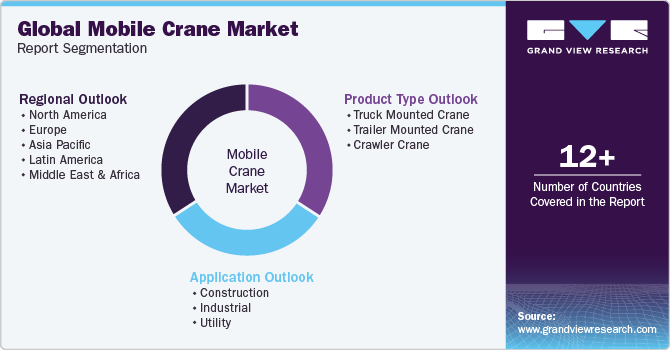

Global Mobile Crane Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global mobile crane market report on the basis of product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Truck Mounted Crane

-

Trailer Mounted Crane

-

Crawler Crane

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Construction

-

Industrial

-

Utility

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mobile crane market size was estimated at USD 13.40 billion in 2022 and is expected to reach USD 14.20 billion in 2023.

b. The global mobile crane market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 22.32 billion by 2030.

b. Asia Pacific dominated the mobile crane market with a share of 53% in 2022. This is attributable to the high growth of the construction market in the region owing to the rising urbanization.

b. Some key players operating in the mobile crane market include Liebherr International AG, Manitowoc, XCMG Group, Kobelco Constriction Machinery Co. Ltd., and Mammoet Holding BV.

b. Key factors that are driving the mobile crane market growth include rising government investments on infrastructure development, and growing construction equipment rental market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.