- Home

- »

- Digital Media

- »

-

Mobile Gaming Market Size & Share, Industry Report, 2030GVR Report cover

![Mobile Gaming Market Size, Share & Trends Report]()

Mobile Gaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform, By Device, By Game Genre, By Distribution Channel, Monetization Model, Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-569-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Gaming Market Summary

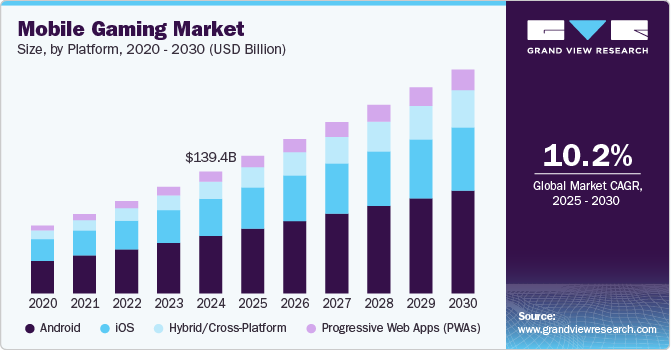

The global mobile gaming market size was estimated at USD 139.38 billion in 2024 and is projected to reach USD 256.19 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The rapid global increase in smartphone usage is the cornerstone of the mobile gaming industry exponential growth.

Key Market Trends & Insights

- Asia Pacific dominated the mobile gaming market with the largest revenue share of 52.30% in 2024.

- The U.S. accounted for the largest market revenue share in North America in 2024

- Based on platform, the android segment led the market with the largest revenue share of 47.2% in 2024

- Based on device, the tablet segment accounted for the largest market in 2024.

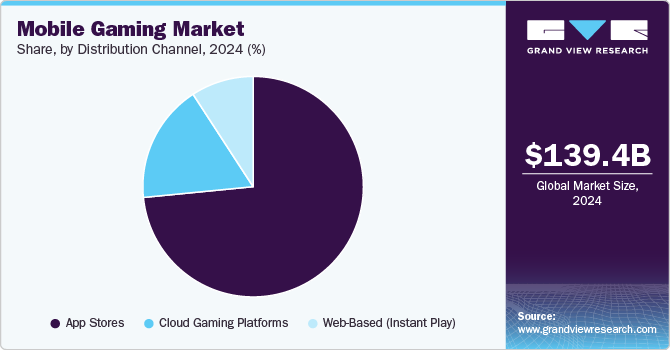

- Based on distribution channel, the app stores segment accounted for the largest market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 139.38 Billion

- 2030 Projected Market Size: USD 256.19 Billion

- CAGR (2025-2030): 10.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Affordable smartphones, coupled with enhanced processing power, are democratizing gaming and making it accessible to a wider audience than ever before.

In many emerging markets, where access to traditional gaming consoles and PCs may be limited, mobile devices often serve as the primary or sole gaming platform. This widespread accessibility has led to a surge in game downloads, higher user engagement, and more frequent in-game purchases, fostering a robust monetization ecosystem. As smartphone adoption continues to expand, especially in developing regions, the user base for mobile gaming is poised to grow even further, ensuring the industry remains a dominant force in the global entertainment sector.

The free-to-play model has revolutionized mobile gaming by removing the upfront cost barrier, significantly broadening its audience. By offering full access without initial payment, developers attract massive install rates and build large user communities. Monetization is skillfully integrated through in-app purchases, ads, and gated premium features that enhance user experience without compromising core gameplay. Successful titles like Clash Royale and Genshin Impact exemplify how compelling content and monetization can coexist. The continued dominance of F2P is reshaping development priorities, placing greater emphasis on long-term user retention, engagement loops, and recurring revenue streams.

In-app purchases have become the cornerstone of mobile gaming monetization, enabling developers to generate revenue while keeping the core experience free. Players readily spend on cosmetic items, exclusive skins, character boosts, and in-game currency, often driven by personalization and status within the game. Developers strategically implement psychological triggers like scarcity, urgency, and social proof to boost IAP conversion rates. These microtransactions offer a non-intrusive way to support ongoing game development and content updates. As a result, IAPs have turned mobile games into scalable digital economies with dynamic pricing models.

Mobile esports are rapidly maturing into a global competitive ecosystem, drawing millions of players and spectators. Games such as PUBG Mobile, Free Fire, and Mobile Legends host high-profile tournaments with multi-million-dollar prize pools and sponsorship deals. The accessibility of smartphones eliminates traditional hardware barriers, allowing broader participation from emerging markets and younger demographics. Spectator platforms like YouTube, Twitch, and TikTok amplify visibility, creating new entertainment formats and monetization channels. This explosive growth is redefining mobile gaming from a casual pastime to a professional, spectator-driven industry.

Latin America is experiencing rapid growth in the mobile gaming industry, driven by increasing internet penetration and the affordability of smartphones. Countries like Brazil and Mexico are leading the charge, with a growing middle class and increasing disposable incomes. Mobile games that cater to local tastes, like soccer-themed games or culturally relevant narratives, are attracting large audiences. The region is also witnessing the rise of mobile esports and live streaming platforms that are fueling community engagement. With more players coming online, Latin America is set to become a key market for mobile gaming in the coming years.

Tencent is a prominent player in the mobile gaming industry, with ownership stakes in some of the biggest game studios, including Riot Games and Epic Games. Tencent’s mobile gaming titles, such as Honor of Kings and PUBG Mobile, are among the most successful globally. The company’s ability to dominate both domestic and international markets through strategic partnerships and investments is a key driver of its success. Tencent also invests heavily in cloud gaming and esports, further cementing its position in the global market. The company’s diversified approach continues to influence mobile gaming trends worldwide.

Platform Insights

The android segment led the market with the largest revenue share of 47.2% in 2024, owing to its widespread adoption across diverse geographies, particularly in emerging markets. With a vast array of affordable devices available from manufacturers like Samsung, Xiaomi, and Realme, Android has become the default gaming platform for billions. The open ecosystem allows developers to publish games easily on platforms like Google Play and third-party app stores, significantly increasing reach. Android also supports a variety of payment options, which helps monetize games effectively in both developed and developing economies. As Android continues to evolve with enhanced graphics capabilities, better security, and 5G support, its role in expanding the mobile gaming ecosystem remains critical.

The hybrid/cross-platform segment is expected to witness at the fastest CAGR of 13% from 2025 to 2030. The demand for hybrid and cross-platform mobile gaming is growing rapidly as players seek seamless experiences across devices. Games like Genshin Impact, Fortnite, and Call of Duty: Mobile allow users to switch between mobile, console, and PC while maintaining progress and user profiles. This interoperability increases player engagement, session time, and retention by offering flexibility in how and where games are played. Developers are increasingly using game engines like Unity and Unreal that support cross-platform development, streamlining the process of launching titles on multiple systems. As cloud gaming becomes more prevalent and 5G networks expand, hybrid gaming experiences are expected to become a core driver of market growth and innovation.

Device Insights

The tablet segment accounted for the largest market revenue share in 2024. Tablets are becoming an increasingly popular choice for mobile gaming due to their larger screens, better graphics, and more comfortable play experiences compared to smartphones. With devices like the Apple iPad, Samsung Galaxy Tab, and other Android tablets offering powerful processors and high-resolution displays, gaming on tablets provides a more immersive experience, especially for strategy, role-playing, and simulation games. The larger form factor allows for more precise controls and easier multitasking, which appeals to both casual and dedicated gamers. Tablets also cater to the growing demand for hybrid gaming experiences, with users often playing across multiple devices such as smartphones, PCs, and consoles. As gaming tablets improve in terms of performance, battery life, and price, their role in the mobile gaming ecosystem is expected to continue expanding.

The smartphones segment is expected to witness at the fastest CAGR from 2025 to 2030. Smartphones continue to drive the growth of the mobile gaming industry by offering an accessible, convenient, and powerful platform for gaming. With improvements in processing power, graphics, and battery life, smartphones can run increasingly sophisticated games that were once limited to PCs and consoles. The global expansion of affordable smartphones, particularly in regions like Asia-Pacific, Latin America, and Africa, is a significant factor in the rising popularity of mobile gaming. Leading smartphone manufacturers like Apple, Samsung, and Xiaomi continue to innovate with features such as enhanced displays, high refresh rates, and AI-powered game optimization, improving the gaming experience. As smartphones become more specialized for gaming with dedicated features, they are expected to remain the primary device for mobile gamers worldwide.

Game Genre Insights

The action & adventure segment accounted for the largest market revenue share in 2024. Action and adventure games continue to dominate the mobile gaming industry, attracting a wide range of players due to their dynamic gameplay and immersive storylines. Titles like PUBG Mobile, Genshin Impact, and Minecraft offer a blend of combat, exploration, and puzzle-solving that keeps players engaged for extended periods. These genres benefit from the growing sophistication of mobile hardware, which supports complex graphics, fluid animations, and large, detailed open worlds. In addition, action and adventure games often incorporate multiplayer elements, allowing for competitive play and social interaction, which drives user retention. As mobile gaming hardware continues to evolve, action and adventure games are expected to become even more visually stunning and feature-rich, driving further market growth.

The role-playing games (RPGs) segment is expected to witness at the fastest CAGR from 2025 to 2030. Role-playing games (RPGs) have seen significant growth in the mobile gaming industry due to their engaging narratives, immersive worlds, and character development mechanics. Titles like Final Fantasy XV: Pocket Edition, Genshin Impact, and The Elder Scrolls: Blades provide players with expansive storylines, character customization, and deep gameplay experiences, all optimized for mobile devices. The evolution of mobile graphics and processing power has enabled developers to create console-quality RPGs that appeal to both casual and hardcore gamers. Furthermore, mobile RPGs often include social features like multiplayer interactions, guilds, and co-op gameplay, which enhance community engagement and retention. As the mobile gaming industry continues to expand, RPGs are likely to remain a cornerstone, with future developments focusing on even more expansive worlds and deeper, player-driven stories.

Distribution Channel Insights

The app stores segment accounted for the largest market revenue share in 2024. App stores, such as Google Play Store and Apple’s App Store, play a critical role in the mobile gaming industry by providing a centralized platform for game distribution, discovery, and monetization. These stores allow developers to reach a massive global audience, and their algorithms for game recommendations and rankings are key factors in a game’s success. Both stores have evolved to provide a more seamless experience for players, offering features such as in-app purchases, subscriptions, and social sharing tools. The introduction of tools like Apple’s App Store subscriptions and Google Play Pass is further driving the monetization of mobile games, offering users access to premium games for a fixed price. As these platforms continue to refine their services and support developers, app stores will remain a vital part of the mobile gaming ecosystem.

The cloud gaming platforms segment is expected to witness at the fastest CAGR from 2025 to 2030. Cloud gaming platforms are revolutionizing the mobile gaming industry by enabling users to play high-quality games without needing powerful hardware. Services like Google Stadia, NVIDIA GeForce NOW, and Xbox Cloud Gaming allow players to stream games directly to their smartphones and tablets, bypassing the limitations of device processing power. This trend is further accelerated by the growth of 5G networks, which provide the fast, low-latency connections required for smooth cloud gaming experiences. Cloud gaming also enables cross-platform play, allowing gamers to seamlessly switch between mobile, console, and PC platforms without losing progress. As cloud gaming technology continues to improve, it is expected to drive wider adoption, especially in regions with limited access to high-end gaming consoles and PCs.

Monetization Model Insights

The free-to-play (F2P) segment accounted for the largest market revenue share in 2024. Free-to-play (F2P) games have become a dominant model in the mobile gaming industry due to their accessibility and monetization strategies. Popular titles like Fortnite, PUBG Mobile, and Candy Crush Saga attract millions of players by offering the core gameplay for free and generating revenue through in-app purchases, ads, and battle passes. This model significantly lowers the entry barrier for players, allowing them to try games without any upfront cost. The F2P model is highly effective in retaining users, as it offers continuous content updates, events, and premium rewards, incentivizing players to spend money over time. As mobile gaming continues to expand, the F2P model is expected to remain a key driver, with more developers focusing on creating engaging in-game economies and social features to boost monetization.

The play-to-earn (P2E) segment is expected to witness at the fastest CAGR from 2025 to 2030. Play-to-Earn (P2E) games are transforming the mobile gaming landscape by allowing players to earn real-world value through gameplay, typically using blockchain technology and digital assets. Games like Axie Infinity and The Sandbox have introduced economic systems where users can trade, sell, or earn tokens and NFTs, creating new income opportunities, especially in emerging markets. This model attracts players looking for both entertainment and financial rewards, fueling higher engagement and community growth. However, P2E also faces challenges such as sustainability, regulation, and scalability, which developers are actively working to address. As technology matures and trust in digital assets grows, P2E games are expected to become a more established and disruptive force within the mobile gaming industry.

Age Group Insights

The millennials/gen y segment accounted for the largest market revenue share in 2024. Millennials, also known as Generation Y, are a major driving force behind mobile gaming growth due to their high smartphone adoption, digital fluency, and willingness to spend on entertainment. This demographic, typically aged between 27 and 43, often favors games that offer competitive gameplay, social interaction, and progression-based rewards, such as Clash Royale, Call of Duty: Mobile, and Among Us. Millennials tend to engage deeply with mobile games, participating in in-app purchases, seasonal events, and multiplayer modes that enhance their sense of achievement and community. In addition, many in this group view mobile gaming to relax, stay connected with friends, and even relive nostalgia through retro-style games. As Millennials continue to embrace mobile games as a key leisure activity, developers are increasingly designing content tailored to their preferences and spending habits.

The gen z segment is expected to witness at the fastest CAGR from 2025 to 2030. Gen Z mobile gamers are increasingly drawn to games that offer personalized experiences, inclusive content, and diverse character representation. This generation values self-expression and identity, leading developers to introduce customizable avatars, gender-neutral options, and inclusive storylines in popular games. Gen Z players also expect games to reflect current social values, often supporting titles that address themes like mental health, sustainability, or cultural diversity. In addition, they engage more deeply with games that allow them to create or influence content, such as through mods, skins, or level design, highlighting their desire to be co-creators rather than passive players. As inclusivity becomes a major expectation, mobile game developers are prioritizing accessibility and representation to connect with this socially conscious and expressive demographic.

Regional Insights

The mobile gaming market in North America is anticipated to grow at the fastest CAGR during the forecast period. The North American market is driven by high smartphone penetration and widespread 5G adoption, enabling smoother gaming experiences. Subscription-based gaming services like Apple Arcade and Xbox Game Pass are gaining traction, offering ad-free and premium content. In addition, strong spending power and a preference for multiplayer and competitive games fuel high in-app purchases.

U.S. Mobile Gaming Market Trends

The mobile gaming market in the U.S. accounted for the largest market revenue share in North America in 2024.In the U.S., mobile esports and streaming integration are reshaping the mobile gaming ecosystem, with games like Call of Duty: Mobile gaining massive popularity. The market also sees strong monetization from advertising in casual and hyper-casual games. Increasing partnerships between game studios and entertainment brands are resulting in cross-media content that attracts broader audiences.

Europe Mobile Gaming Market Trends

The mobile gaming market in Europe was identified as a lucrative region in 2024. Germany’s mobile gamers are highly quality-conscious, favoring premium games or ad-free experiences even in free-to-play models. The country has seen an increase in localization efforts, with games being adapted in the German language and culture to drive adoption. AR-based mobile games, such as Pokémon GO, also continue to perform well due to interest in outdoor gaming experiences.

The Germany mobile gaming market is highly quality-conscious, favoring premium games or ad-free experiences even in free-to-play models. The country has seen an increase in localization efforts, with games being adapted in the German language and culture to drive adoption. AR-based mobile games, such as Pokémon GO, also continue to perform well due to interest in outdoor gaming experiences.

The mobile gaming market in the UK is increasingly driven by cross-platform play that allows seamless gaming between mobile, console, and PC. Popular games often integrate British pop culture, sports, and humor, increasing local engagement. In addition, rising concerns around screen time have led to demand for games with built-in wellness or moderation features.

Asia-Pacific Mobile Gaming Market Trends

Asia Pacific dominated the mobile gaming market with the largest revenue share of 52.30% in 2024. Asia Pacific leads in mobile gaming growth due to a massive user base, affordable smartphones, and a strong mobile-first culture. Mobile gaming is deeply integrated into social platforms, with in-game chatting and live-streaming features boosting user retention. Regional publishers dominate the scene by understanding local preferences and launching culturally relevant content.

The mobile gaming market in China is driven by massive user volume, with popular genres including RPGs, strategy, and competitive multiplayer. Government regulations around screen time and in-game purchases are shaping how games are developed and monetized. Local companies like Tencent and NetEase invest heavily in both domestic and international game development.

The India mobile gaming market is fueled by cheap data plans, budget smartphones, and increasing digital literacy among youth. The popularity of real-money gaming, fantasy sports, and e-sports is rapidly growing, especially in Tier II and Tier III cities. Regional language support and vernacular content are critical for capturing wider user segments.

Middle East & Africa Mobile Gaming Market Trends

The mobile gaming market in the Middle East and Africa (MEA) is witnessing rapid adoption thanks to growing internet access and smartphone availability. Cultural preferences play a significant role, with religious and social norms influencing game content and design. Youth-driven demand for mobile e-sports and competitive multiplayer formats is also accelerating market growth.

The UAE mobile gaming market is anticipated to grow at a significant CAGR during the forecast period. The high disposable income and advanced telecom infrastructure are driving demand for premium and cloud-based mobile games. Gamers in the UAE prefer polished, console-quality graphics and immersive experiences on mobile. In addition, Arabic localization and culturally tailored content are key to attracting and retaining users in the region.

Key Mobile Gaming Company Insights

Some of the key players operating in the market include. Electronic Arts Inc. (EA) and Tencent Holdings Limited

-

Tencent Holdings Limited is the prominent player in the global mobile gaming industry, with ownership stakes in top-performing studios such as Supercell (Clash of Clans), Riot Games, and partnerships with Activision Blizzard. It dominates distribution within China and leverages its extensive ecosystem, including platforms like WeChat, to scale globally. Tencent specializes in game publishing, investment, and regional localization across nearly every genre..

-

Electronic Arts Inc. (EA)is a veteran in the gaming industry with a strong mobile presence through franchises like FIFA Mobile, Madden NFL Mobile, and The Sims. It brings popular console and PC experiences to mobile with a focus on live service and seasonal content updates. EA specializes in sports simulation, strategic monetization, and cross-platform brand integration.

Playrix Holding Ltd and Niantic Inc. are some of the emerging participants in the mobile gaming industry.

-

Playrix Holding Ltd is a rapidly growing mobile game developer, known for casual titles like Gardenscapes, Homescapes, and Township. Its games focus on storytelling and progression mechanics that keep users engaged over long periods. Playrix specializes in the casual and match-3 genre, appealing to a global audience through well-optimized free-to-play models.

-

Niantic Inc. gained global recognition with Pokémon GO, revolutionizing mobile gaming with augmented reality and real-world exploration mechanics. Its AR platform blends physical locations with digital gameplay, creating unique community-based experiences. Niantic specializes in location-based gaming, real-time AR integration, and social engagement through outdoor play.

Key Mobile Gaming Companies:

The following are the leading companies in the mobile gaming market. These companies collectively hold the largest market share and dictate industry trends.

- Tencent Holdings Limited

- Apple Inc.

- Google LLC

- NetEase Inc.

- Activision Blizzard Inc.

- Electronic Arts Inc.

- Nintendo Co, Ltd.

- Take-Two Interactive Software Inc. (includes Zynga Inc.)

- Roblox Corporation

- Supercell Oy

- Playrix Holding Ltd

- Niantic Inc.

Recent Developments

-

In March 2025, Scopely acquired Niantic’s gaming division, including Pokémon GO and other AR games, for USD 3.5 billion. The acquisition also includes Niantic’s AR platforms and companion apps, with Niantic spinning off its geospatial technology division into a separate entity, Niantic Spatial. Scopely plans to keep the development teams and long-term game plans intact to ensure continued updates and support for the acquired titles.

-

In February 2025, Xsolla partnered with Pocket Gamer Connects (PGC) to support mobile game developers by sponsoring key events in San Francisco, Dubai, Barcelona, Shanghai, and Helsinki. At these conferences, Xsolla will share expertise on direct‑to‑consumer monetization, user acquisition strategies, and cross‑platform analytics. Through its AppsFlyer integration, developers can now track Web Shop purchases as in‑app events, attribute Web Shop revenue to mobile campaigns, and optimize ad spending across platforms without any additional coding.

Mobile Gaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 157.60 billion

Revenue forecast in 2030

USD 256.19 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, device, game genre, distribution channel, monetization model, age group, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Tencent Holdings Limited; Apple Inc.; Google LLC; NetEase Inc.; Activision Blizzard Inc.; Electronic Arts Inc.; Nintendo Co, Ltd.; Take-Two Interactive Software Inc.; Roblox Corporation; Supercell Oy; Playrix Holding Ltd; Niantic Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Gaming Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile gaming market report based on platform, device, game genre, distribution channel, monetization model, age group, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Hybrid/Cross-Platform

-

Progressive Web Apps (PWAs)

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphones

-

Tablets

-

-

Game Genre Outlook (Revenue, USD Billion, 2018 - 2030)

-

Action & Adventure

-

Puzzle

-

Role-Playing (RPG)

-

Strategy & Simulation

-

Sports & Racing

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

App Stores

-

Cloud Gaming Platforms

-

Web-Based (Instant Play)

-

-

Monetization Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Free-to-Play (F2P)

-

In-App Purchases

-

Premium (Paid Games)

-

Play-to-Earn (P2E)

-

Subscription-Based

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gen Z

-

Millennials / Gen Y

-

Gen X

-

Baby Boomers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile gaming market size was estimated at USD 139.38 billion in 2024 and is expected to reach USD 157.60 billion in 2025.

b. The global mobile gaming market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 256.19 billion by 2030.

b. Asia Pacific dominated the mobile gaming market with the largest revenue share of 52.30% in 2024. Asia Pacific leads in mobile gaming growth due to a massive user base, affordable smartphones, and a strong mobile-first culture.

b. Some key players operating in the mobile gaming market include Tencent Holdings Limited, Apple Inc., Google LLC, NetEase Inc., Activision Blizzard Inc., Electronic Arts Inc., Nintendo Co. Ltd., Take-Two Interactive Software Inc., Roblox Corporation, Supercell Oy, Playrix Holding Ltd, and Niantic Inc.

b. Key factors that are driving the mobile gaming market growth include the widespread adoption of smartphones and tablets, continuous advancements in mobile game graphics and interactivity, and the growing popularity of in-app purchases and microtransactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.