- Home

- »

- Communication Services

- »

-

Mobile Marketing Market Size & Share, Industry Report 2030GVR Report cover

![Mobile Marketing Market Size, Share & Trends Report]()

Mobile Marketing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Platform, Services), By Channel (Mobile Web, SMS, Mobile Web, SMS), By Enterprise Size, By End-use (Retail, Media & Entertainment, Travel), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-790-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Marketing Market Summary

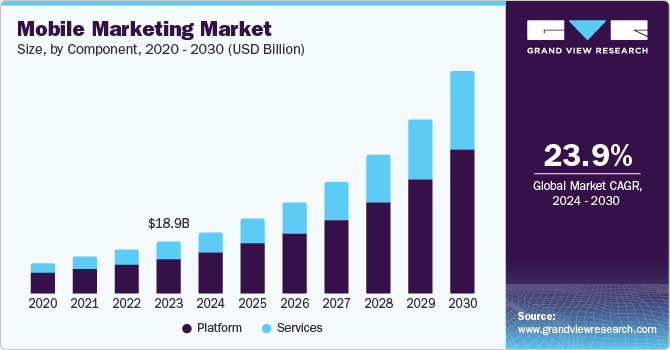

The global mobile marketing market size was valued at USD 18.90 billion in 2023 and is projected to reach USD 81.74 billion by 2030, growing at a CAGR of 23.9% from 2024 to 2030. Mobile marketing is a digital promotional activity that targets audiences through mobile devices, such as smartphones and tablets, using channels such as MMS, SMS, email, websites, social media, and apps.

Key Market Trends & Insights

- North America mobile marketing market dominated the global market with a revenue share of 36.5% in 2023.

- The U.S. mobile marketing market dominated the regional market in 2023.

- Based on component, the platform segment dominated the market and accounted for largest market share of 67.9% in 2023.

- Based on channel, mobile web channel dominated the market and accounted for largest revenue share in 2023.

- Based on enterprise size, large enterprises accounted for the largest revenue share of in 2023.

Market Size & Forecast

- 2024 Market Size: USD 18.90 billion

- 2030 Projected Market Size: USD 81.74 billion

- CAGR (2024-2030): 23.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Research by the Global System for Mobile Communications Association (GSMA) suggests that by the end of 2025, about 75% of mobile users will use smartphones. The increasing use of smartphones and tablets and the growing internet access in developing countries such as India and China will significantly influence the market. Mobile marketing is one of the key digital marketing strategies organizations adopt to promote their products and services. It also helps organizations eliminate paper costs and denotes a fast and convenient means to interact with target customers. It enables the integration of new, innovative advertisement methods with the same marketing strategies to increase their impact and approachability in terms of target users. Several surveys conducted by many companies denote that more than 90% of the youth use smartphones to access information or content. Approximately 49% of smartphone owners use mobile internet to access search engines. Such factors are anticipated to create growth opportunities for the key players operating in the market for mobile marketing.

Geofencing is a technological service that uses Radio Frequency Identification (RFID) and Global Positioning System (GPS) to define geographical boundaries. Organizations procure data from mobile applications and analyze it to understand consumer preferences. Companies use this data to advertise relevant products and services to their target customers. Geofencing for mobile applications is a convenient way for mobile application marketers to take advantage of Location-based Marketing (LBM). It helps organizations design effective campaign strategies and drive sales and audience engagement.

The rising adoption of geofencing across various industries is expected to drive the market significantly over the forecast period. Additionally, the proliferation of Artificial Intelligence (AI) and Augmented Reality (AR) in the retail sector to understand consumer behavior and to send notifications accordingly is projected to propel the growth. A rapid increase in viewers accessing Over the Top (OTT) content is anticipated to create significant opportunities for digital enterprises over the forthcoming years. Smartphone users ' increasing adoption of ad-block software to avoid unwanted ads is the key factor restraining growth. Furthermore, stringent government regulations on mobile ads and privacy and security concerns are anticipated to hamper the growth.

Component Insights

The platform segment dominated the market and accounted for largest market share of 67.9% in 2023. The abundance of mobile apps and social media platforms has generated many platforms for businesses to connect with consumers. Moreover, these platforms provide various advertising choices, such as in-app ads, sponsored content, and influencer marketing, enabling companies to customize their campaigns for certain target groups. Additionally, the advancements in mobile analytics and tracking technologies have allowed marketers to assess the success of their campaigns across different platforms, offering useful information for improvement. The increasing popularity of mobile gaming and social commerce has strengthened the platform segment's dominance in the mobile marketing market.

The services segment is expected to register the fastest CAGR during the forecast period. The increasing intricacy of mobile marketing techniques is fueling the need for specific services such as campaign management, creative development, and data analytics. Businesses need help navigating the constantly changing mobile marketing environment and making the most of their investment. Additionally, the growing usage of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) in mobile marketing requires skill in incorporating these tools for successful targeting, personalization, and campaign improvement. Furthermore, the increasing attention towards data privacy laws such as GDPR and CCPA is resulting in a need for compliant data management and marketing automation services. These elements and the requirement for continuous campaign tracking and performance evaluation drive the services sector toward the most rapid growth path in the mobile marketing market.

Channel Insights

Mobile web channel dominated the market and accounted for largest revenue share in 2023. The increasing accessibility and affordability of smartphones and tablets have made the mobile web a ubiquitous platform for consumers. Additionally, advancements in mobile web technology, such as responsive design and progressive web apps, have improved the user experience and made it easier for businesses to deliver engaging content to mobile users. Furthermore, the growing popularity of social media platforms and other content-rich websites on mobile devices has increased the demand for mobile web advertising. Moreover, the widespread use of mobile search engines and the effectiveness of mobile web banners and display ads have solidified the mobile web channel's position as the leading segment in the mobile marketing market.

QR Codes channel is expected to register the fastest CAGR during the forecast period. The increasing adoption of smartphones and the widespread availability of QR code-scanning apps have made it easier for consumers to interact with QR codes. Additionally, QR codes offer a convenient and contactless way for businesses to provide information, drive website traffic, or offer promotions, making them particularly attractive in the post-pandemic era. Furthermore, advancements in QR code technology, such as dynamic QR codes and QR code analytics, have enhanced their functionality and effectiveness as a marketing tool. These factors, combined with the growing popularity of QR codes in various industries, including retail, events, and hospitality, drive the segment's rapid growth.

Enterprise Size Insights

Large enterprises accounted for the largest revenue share of in 2023. Large enterprises' substantial resources and budgets allow them to invest in advanced mobile marketing technologies and strategies. They often have extensive customer databases, enabling them to target specific demographics and personalize their marketing campaigns. Furthermore, their established brand reputation and wider reach make them more attractive to mobile advertising platforms, providing them access to a broader range of advertising opportunities. Moreover, the increasing importance of mobile marketing in driving business growth and customer engagement has led large enterprises to invest heavily in the market.

Small & medium enterprises are expected to register the fastest CAGR during the forecast period. The growing accessibility of mobile marketing tools and platforms has simplified the entry and competition for SMEs. Furthermore, the growing importance of mobile marketing in reaching and engaging customers has made it necessary for SMEs to stay competitive. Additionally, SMEs often have more flexibility and agility than large enterprises, allowing them to adapt quickly to changing market trends and consumer behaviors. These factors, as well as the growing emphasis on digital transformation among SMEs, are driving the rapid growth of the segment.

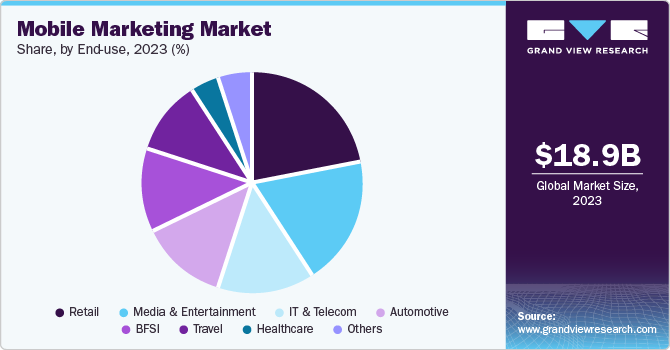

End-use Insights

The retail segment dominated the market in 2023. The increasing adoption of smartphones and tablets has made it easier for consumers to shop online, driving demand for mobile-optimized retail experiences. Additionally, the rise of social media platforms and mobile apps has provided retailers with new channels to engage with customers and promote their products. Furthermore, advancements in mobile payment technologies have simplified the online shopping process, making it more convenient for consumers to make purchases using their mobile devices. Additionally, the growing trend of m-commerce, have propelled the retail segment to the forefront of the mobile marketing market.

The media and entertainment sector is projected to grow at a significant CAGR of over the forecast period.Mobile devices' rising use for digital content consumption has led to an increasing demand for mobile-optimized advertising solutions. Moreover, the emergence of streaming platforms and video-on-demand services has provided new opportunities for marketers to engage with specific audiences via mobile advertising. Additionally, merging mobile technology with traditional media platforms such as TV and radio has expanded the reach and success of mobile marketing strategies within the media and entertainment industry. These factors, combined with the growing popularity of mobile gaming and social media apps within this sector, drive the segment's rapid growth.

Regional Insights

North America mobile marketing market dominated the global market with a revenue share of 36.5% in 2023. The region boasts a high level of smartphone penetration, with a significant portion of the population owning and actively using mobile devices. This, along with advanced technological infrastructure and a developed digital advertising ecosystem, provides a fertile ground for mobile marketing campaigns. Additionally, the region's strong economy, a culture of innovation, and early adoption of new technologies have driven businesses to invest heavily in mobile marketing strategies. Furthermore, North America's growth in digital marketing is supported by major technology centers and a substantial amount of skilled professionals in the region.

U.S. Mobile Marketing Market Trends

The U.S. mobile marketing market dominated the regional market in 2023. Due to the large and diverse population of the U.S., which uses smartphones heavily, marketers have a vast and lucrative audience. Additionally, the U.S. has a well-established digital advertising ecosystem, with numerous tech giants and marketing agencies operating within its borders. This competitive environment has encouraged innovation and investment in mobile marketing technologies and strategies. Furthermore, the country's strong economy, focusing on consumerism and early adoption of new trends, has driven businesses to prioritize mobile marketing as a crucial component of their marketing mix.

Europe Mobile Marketing Market Trends

Europe mobile marketing market was identified as a lucrative region in 2023. The region has a strong presence of smartphones, along with advanced technology and an expanding digital economy. This combination has produced a good setting for mobile marketing campaigns to thrive. Moreover, Europe's diverse cultural landscape and multiple languages present unique opportunities for targeted marketing efforts. Additionally, the robust regulations in the region regarding data privacy and consumer protection have built trust in digital advertising, making it a more appealing market for companies.

The UK mobile marketing market is expected to grow rapidly in the coming years due to the nation's diverse population and numerous languages offering distinctive possibilities for focused marketing campaigns, with the increasing popularity of mobile commerce (m-commerce) fueling the need for efficient mobile marketing strategies.

Asia Pacific Mobile Marketing Market Trends

The Asia Pacific mobile marketing market is anticipated to grow with the fastest CAGR over the forecast period. The region has a rapidly increasing population, with a significant portion adopting smartphones at an unprecedented rate. The growing internet usage and rising middle class form a large and profitable mobile marketing opportunity. Furthermore, the varied cultural environment and multitude of languages in the region offer distinct possibilities for targeted marketing strategies. Moreover, the rising popularity of mobile commerce (m-commerce) and the escalating utilization of social media platforms in Asia fuel the need for successful mobile marketing tactics.

China's mobile marketing market held a substantial market share in 2023 owing to the country's massive population, high smartphone penetration, and a rapidly growing digital economy, creating a vast and lucrative market for mobile marketing. China's homegrown tech giants have also developed powerful mobile platforms and advertising ecosystems, providing businesses with a wide range of tools and opportunities to reach Chinese consumers. Furthermore, the country's strong government support for digital innovation and a culture of early adoption of new technologies has fueled mobile marketing growth in China.

Key Mobile Marketing Company Insights

Some of the key companies in the mobile marketing market include Amobee, Inc., Chartboost, Inc., Flurry., Google Inc., IBM Corporation, InMobi and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amobee, Inc., is a leading mobile marketing technology company that provides comprehensive solutions for advertisers, publishers, and operators. Focusing on delivering targeted and effective campaigns across all screens, Amobee offers a range of services, including audience management, ad serving, and campaign optimization. The innovative platform empowers businesses to reach their desired audience segments and drive measurable results.

-

Chartboost, Inc. is a leading in-app monetization and programmatic advertising platform that connects app developers with advertisers. The company provides a wide range of solutions aimed at helping developers optimize their earnings by acquiring users and monetizing their products. Chartboost's platform allows developers to make money from advertising revenue and will enable advertisers to reach highly involved audiences.

Key Mobile Marketing Companies:

The following are the leading companies in the mobile marketing market. These companies collectively hold the largest market share and dictate industry trends.

- Amobee, Inc.

- Chartboost, Inc.

- Flurry.

- Google Inc.

- IBM Corporation

- InMobi

- Marketo

- AppSamurai

- Oracle

- Salesforce, Inc.

- SAS Institute Inc.

Recent Developments

-

In March 2024, Tenjin and AppSamurai formed a strategic partnership to provide mobile advertisers with advanced growth solutions. The integration with AppSamurai aligns perfectly with the vision and commitment to delivering high-quality growth tools for advertisers.

Mobile Marketing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.65 billion

Revenue forecast in 2030

USD 81.74 billion

Growth Rate

CAGR of 23.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, channel, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amobee, Inc.; Chartboost, Inc.; Flurry.; Google Inc.; IBM Corporation; InMobi; Marketo; AppSamurai; Oracle; Salesforce, Inc.; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Marketing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile marketing market report based on component, channel, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile Web

-

SMS

-

Location-Based Marketing

-

In-App Messages

-

Push Notifications

-

QR Codes

-

MMS

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Media & Entertainment

-

Travel

-

Automotive

-

Healthcare

-

IT & Telecom

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.