- Home

- »

- Communications Infrastructure

- »

-

Modular Instruments Market Size, Industry Report, 2030GVR Report cover

![Modular Instruments Market Size, Share & Trends Report]()

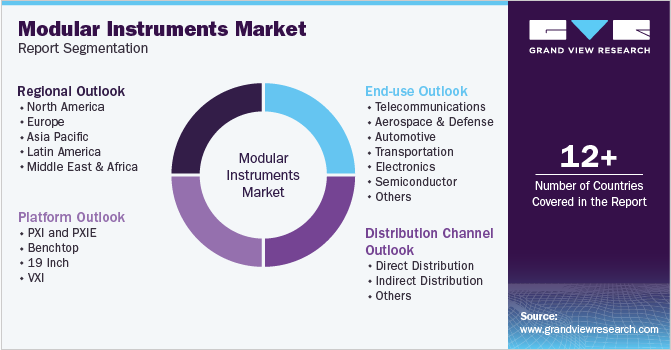

Modular Instruments Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (PXI and PXIE, Benchtop, 19 Inch, VXI), By Distribution Channel (Direct Distribution, Indirect Distribution, Others), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-640-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modular Instruments Market Summary

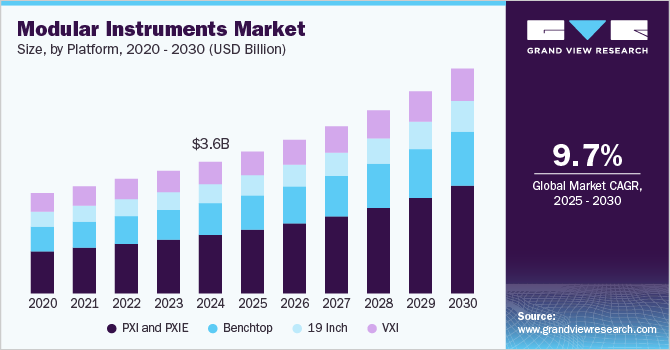

The global modular instruments market size was estimated at USD 3,550.8 million in 2024 and is projected to reach USD 6,066.8 million by 2030, growing at a CAGR of 9.7% from 2025 to 2030. The growth of the market can be attributed to the enhanced capabilities of modular instruments to integrate with software-defined platforms.

Key Market Trends & Insights

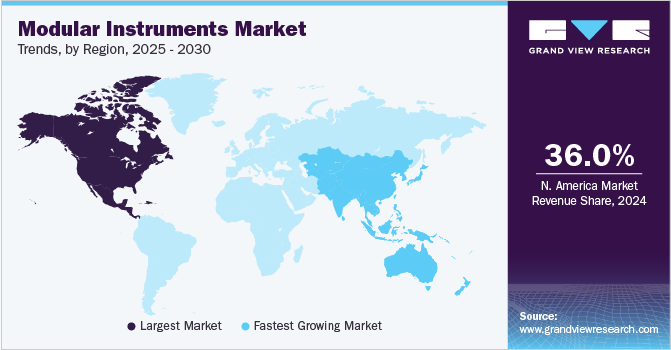

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the Philippines is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, pxi and pxie accounted for a revenue of USD 1,719.6 million in 2024.

- PXI and PXIE are the most lucrative platform segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,550.8 Million

- 2030 Projected Market Size: USD 6,066.8 Million

- CAGR (2025-2030): 9.7%

- North America: Largest market in 2024

Incumbents of industries, such as semiconductor manufacturing and automotive testing, increasingly rely on automation and precision. At the same time, as Internet of Things (IoT) and 5G technologies advance, the demand for adaptable testing solutions that can handle high-speed data transmission and multifaceted connectivity scenarios is poised to grow. Such factors are expected to contribute to the growth of the market.

The adoption of Industry 4.0 principles and the Internet of Things (IoT) is significantly driving the growth of the global modular instruments market. Industry 4.0 refers to integrating smart technologies, automation, data exchange, and cyber-physical systems in manufacturing. It involves innovations such as advanced robotics, AI-driven analytics, machine learning, and the widespread use of connected devices that communicate and share data in real-time. This industrial transformation has created an increasing demand for flexible, high-precision measurement tools that adapt to modern manufacturing environments' diverse needs. Modular instruments are particularly well-suited for Industry 4.0 environments due to their scalability, adaptability, and ability to integrate with other smart systems.

Integrating artificial intelligence (AI) and machine learning (ML) with modular instruments represents a significant growth opportunity for the modular instruments market, as it enables industries to leverage advanced data processing and analysis capabilities for enhanced performance and operational efficiency. Modular instruments designed to be flexible and easily customizable to meet specific testing and measurement needs can benefit greatly from the predictive and analytical power of AI/ML algorithms. These tools allow modular instruments to not only collect data but also to interpret it in real time, detecting patterns, predicting outcomes, and automating corrective actions in ways that traditional instruments cannot. This integration is increasingly relevant across industries, such as telecommunications, automotive, aerospace, and healthcare, where complex data is generated, and high precision is critical.

Platform Insights

The PXI and PXIE segment dominated the modular instruments industry with a revenue share of 44.4% in 2024. PXI offers high-speed data transfer, superior synchronization, and a scalable architecture, making it suitable for the aerospace, automotive, and telecommunications industries, where precision testing and automation are crucial. As enterprises adopt more complex electronic systems, the need for efficient, adaptable testing platforms like PXI is rising, driving demand across sectors looking for enhanced performance and reliability in their operations.

The benchtop segment is anticipated to grow significantly with a CAGR of 9.5% over the forecast period. The growth of the benchtop segment is driven by the continued demand for research and development (R&D) across industries such as electronics, automotive, aerospace, telecommunications, and pharmaceuticals. Benchtop instruments offer high accuracy, ease of use, and the flexibility needed in laboratory settings, making them ideal for engineers and researchers who require reliable and repeatable measurements. In the medical device sector, benchtop instruments are used for testing and validating complex diagnostic equipment and electronic components, particularly in the context of wearable health devices and medical imaging systems. These tools enable quick adjustments and fine-tuning during the design and prototyping stages, helping accelerate time-to-market for new devices.

Distribution Channel Insights

The direct distribution segment dominated the modular instruments industry with the revenue share of 51.5% in 2024. The rise of e-commerce platforms and digital marketing strategies drives the direct distribution channel’s growth. This allows manufacturers to directly sell their modular instruments to a global customer base, reducing the reliance on intermediaries, cutting costs, and providing customers with more competitive pricing. The digital transformation in the industry also plays a role, as online channels and digital platforms make it easier for companies to showcase their product offerings, deliver product specifications, and enable customers to make informed purchasing decisions.

The indirect distribution segment is expected to witness the fastest CAGR of over 10.8% over the forecast period. The increased reliance on value-added resellers (VARs) drives the indirect distribution channel's growth. These resellers distribute the products and offer additional technical support, installation, training, and system integration services. In aerospace, defense, telecommunications, and automotive industries, where customers require more than the hardware, VARs become essential partners in providing complete, tailored solutions. The growing trend of channel partnerships and collaboration in technology ecosystems fuels the growth of the indirect distribution model. Many modular instrument manufacturers collaborate with complementary technology providers to create integrated solutions.

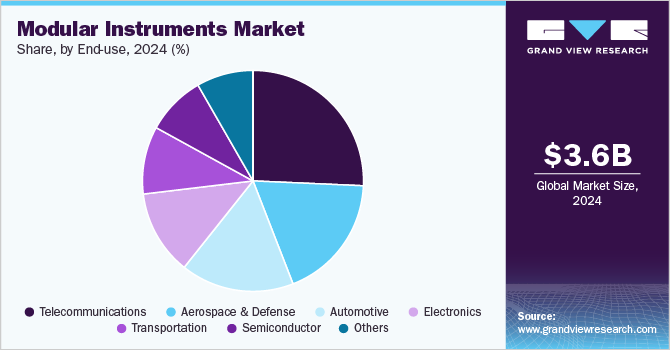

End Use Insights

The telecommunications segment dominated the market and accounted for a 25.7% share of the global revenue in 2024. The rapid deployment of 5G networks worldwide is a significant growth driver of the telecommunications segment. Measurement instruments are crucial for testing, calibrating, and maintaining the complex platform required for 5G, including base stations, antennas, and user equipment. As 5G demands high-frequency testing, low latency, and wide bandwidth capabilities, instruments like signal generators, network analyzers, and spectrum analyzers are in high demand. The evolution toward 6G technologies also promises further growth as new testing challenges emerge. According to the GSM Association, by 2025, 5G networks are expected to reach one-third of the global population, with approximately 1.2 billion connections anticipated worldwide.

The automotive segment is expected to witness the fastest CAGR of over 10.9% over the forecast period. The global shift towards electric vehicles (EVs) has significantly increased the demand for testing instruments. EV components such as battery management systems (BMS), power electronics, inverters, and chargers require rigorous testing for efficiency, safety, and reliability. Instruments like source measure units (SMUs), high-voltage testers, and thermal analysis tools are essential to validate the performance of EV batteries and ensure their ability to handle high power loads. The development of autonomous vehicles (AVs) is a major driver of advanced testing solutions. AVs rely on a network of sensors, cameras, and lidar/radar systems, all requiring precise validation to ensure safe and reliable operation. Measurement instruments are used to test the accuracy, range, and real-time responsiveness of these systems and simulate complex driving environments.

Regional Insights

North America Modular Instruments Market Trends

North America held a significant share of around 36.0% in 2024. The rise of edge computing is propelling the North American modular instruments industry. The North America market benefits significantly from the presence of established industry leaders, including companies specializing in test and measurement technologies. These key players are continually investing in research and development to introduce innovative solutions that meet the demands of various industries. This competitive landscape promotes technological advancements, driving the adoption of modular instruments across sectors. Growing investments in automation and electronics further support this growth, as companies aim to optimize operations and improve accuracy in manufacturing and testing processes. Automation, in particular, has been a major focus for industries looking to streamline workflows, reduce human error, and achieve higher efficiency.

U.S. Modular Instruments Market Trends

The U.S. dominated the modular instruments industry in 2024. The U.S. government's focus on modernizing defense systems and aerospace technologies is a significant growth driver of the country's modular instruments. Modular instruments are critical in developing and testing advanced radar systems, electronic warfare equipment, and avionics. These instruments' ability to adapt to changing requirements without significant hardware overhauls makes them cost-effective in high-stakes environments. For instance, in August 2024, Dirac, a U.S.-based assembly automation software provider, and Hadrian, a U.S.-based advanced manufacturing company focused on future-ready factories, partnered to revolutionize manufacturing for aerospace and defense industries. Their collaboration introduces a groundbreaking enterprise platform for "model-based manufacturing," inspired by digital twin technology, to streamline the entire production lifecycle from prototyping to large-scale assembly.

Europe Modular Instruments Market Trends

The modular instruments industry in Europe is anticipated to register a considerable growth from 2025 to 2030. Europe’s stringent regulations and standards for product quality and safety encourage companies to adopt advanced testing equipment. Regulatory frameworks such as CE marking, the RoHS (Restriction of Hazardous Substances) directive, and ISO certifications compel industries to rigorously test their products for safety, performance, and environmental compliance. These regulations ensure that products meet strict criteria before entering the European market, safeguarding consumers and maintaining industrial integrity. Modular instruments play a crucial role in this ecosystem by offering highly accurate, reliable, and customizable testing capabilities, enabling companies to adhere to these regulations without compromising efficiency.

The Germany modular instruments market held a substantial revenue share in 2024. Germany's leadership in the automotive sector, particularly in electric vehicles (EVs) and autonomous driving technologies, has significantly contributed to the market growth. The development of EVs requires rigorous testing of various components, including batteries, power electronics, and communication systems, to ensure safety, performance, and reliability. Modular instruments are designed to handle multiple testing needs, from battery life and performance testing to high-voltage measurements and real-time diagnostics. According to the German automotive industry association VDA, Germany leads Europe in electric vehicle production and ranks second globally, behind China. In 2023, Germany produced 4.1 million cars, with 1.27 million featuring electric engines, including battery electric and plug-in hybrid models. Of these, 955,000 were fully electric vehicles.

The modular instruments market in France is expected to grow rapidly during the forecast period. The digitalization of manufacturing is a significant growth driver for the market in France. The demand for modular instruments surges as industries increasingly adopt Industry 4.0 technologies. These instruments, which offer customizable and flexible testing, measurement, and automation solutions, are well-suited for digitalized manufacturing environments. In particular, modular instruments are integral to integrating advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and automation into manufacturing processes.

Asia Pacific Modular Instruments Market Trends

Asia Pacific region is expected to achieve the fastest CAGR of 11.4% during the forecast period in the market. The Asia Pacific region has become a global hub for technological advancements, with countries like China, Japan, South Korea, and India leading in developing and deploying cutting-edge technologies. The demand for modular instruments is closely linked to the need for high-performance, flexible, and scalable testing and measurement solutions across the electronics, telecommunications, and automotive industries. Adopting 5G technology, Internet of Things (IoT) devices, and artificial intelligence (AI) drives a greater need for modular test equipment to handle increasingly complex systems.

The China modular instruments market held a substantial market share in 2024. China has become a global hub for electronics and semiconductor manufacturing, with increasing investments in research and development (R&D) and the production of high-tech devices. Modular instruments, which are essential for testing and validating complex electronic components, are in high demand. The growth of these industries drives the need for advanced testing solutions, contributing to the market expansion.

The modular instruments market in India is expected to grow rapidly during the forecast period. India's rapidly growing electronics and telecommunications sectors are strongly demanding modular instruments. These instruments are used for various testing and measurement purposes, including signal analysis, spectrum monitoring, and RF testing. For instance, in September 2024, the government of India established the 5G O-RAN testing lab. The lab is designed to support the development of a fully Indian 5G ecosystem, covering areas such as core, access, orchestration, transport, cloud, and security.

Key Modular Instruments Company Insights

Some of the key players operating in the market include Thermo Fisher Scientific; Delta Electronics, Inc.; and Yokogawa Electric Corporation.

-

Thermo Fisher Scientific is a global provider of scientific instrumentation, reagents, and consumables committed to enabling customers to make the world healthier, cleaner, and safer. The company specializes in modular and test instruments, providing customizable, scalable, and flexible solutions for various sectors, including pharmaceuticals, biotechnology, and environmental testing. The company’s modular instruments include data acquisition systems, signal generators, oscilloscopes, and power supplies, allowing users to configure systems that meet specific testing and measurement requirements. These instruments are critical for precise measurements, quality control, and research applications, offering a wide range of capabilities such as real-time analysis, high accuracy, and integration with other technologies.

Picotest Corp, Pickering, and Rohde & Schwarz are some of the emerging participants in the target market.

-

Picotest Corp specializes in high-precision test and measurement solutions, particularly for power-related applications. The company offers advanced tools, such as Vector Network Analyzers (VNAs) and oscilloscopes, designed for power integrity testing and detailed circuit analysis within its modular instrument range. The company’s products cater to professionals requiring high-resolution, accurate measurements, with additional support available through extensive technical resources and customer-driven innovations. The company collaborates with leading brands such as Tektronix, Inc. and Keysight to enhance its modular instrument offerings.

Key Modular Instruments Companies:

The following are the leading companies in the modular instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies

- Advantest Corporation

- AMETEK, Inc.

- Astronics Corporation

- Delta Electronics, Inc.

- Fortive Corporation

- Keysight Technologies

- Picotest Corp

- Pickering

- Rohde & Schwarz

- Thermo Fisher Scientific

- Teledyne Technologies Incorporated

- Teradyne Inc

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

Recent Developments

-

In November 2024, Pickering launched its next-generation single-slot PXIe embedded controller named Model 43-920-002. This powerful and compact 3U controller for the PXI Express platform aimed to advance Pickering's offerings by adding enhanced performance and space-saving solutions for modular instrumentation in electronic testing.

-

In October 2024, AMETEK, Inc. acquired Virtek Vision International, an advanced laser-based projection and inspection system company. Virtek Vision International’s 3D laser projectors and AI-driven machine vision solutions enhanced AMETEK, Inc.’s modular instruments portfolio, expanding its automated 3D scanning, inspection, and quality control capabilities for aerospace, defense, and industrial sectors.

-

In June 2024, Agilent Technologies announced the acquisition of Sigsense Technologies, a San Francisco-based AI-powered startup. Sigsense Technologies' technology enhances lab operations by monitoring modular instruments' utilization and performance. Integrated with Agilent Technologies' CrossLab Connect, it delivers actionable insights across diverse scientific assets, optimizing modular instrumentation efficiency and ensuring improved lab productivity.

Modular Instruments Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 3.83 billion

Revenue Forecast in 2030

USD 6.07 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Actual Data

2018 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Platform, distribution channel, end use, and region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Agilent Technologies; Advantest Corporation; AMETEK, Inc.; Astronics Corporation; Delta Electronics, Inc.; Fortive Corporation; Keysight Technologies; Picotest Corp

Pickering, Rohde & Schwarz, Thermo Fisher Scientific, Teledyne Technologies Incorporated, Teradyne Inc, VIAVI Solutions Inc., Yokogawa Electric Corporation

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Instruments Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global modular instruments market report based on platform, distribution channel, end use, and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

PXI and PXIE

-

Measurement Instruments

-

Signal Generation Instruments

-

Other PXI and PXIE Instruments

-

PXI and PXIE Chassis

-

-

Benchtop

-

19 Inch

-

VXI

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Distribution

-

Indirect Distribution

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecommunications

-

Aerospace & Defense

-

Automotive

-

Transportation

-

OEMs

-

Suppliers & Integrators

-

Others

-

-

Electronics

-

Consumer Electronics

-

Commercial Electronics

-

-

Semiconductor

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global modular instruments market size was estimated at USD 3.55 billion in 2024 and is expected to reach USD 3.83 billion in 2025.

b. The global modular instruments market is expected to grow at a compound annual growth rate of 9.7% from 2019 to 2027 to reach USD 6.07 billion by 2030.

b. North America dominated the modular instruments market with a share of 36.0% in 2024. The rise of edge computing is propelling the North American modular instruments industry. The North American modular instruments market benefits significantly from the presence of established industry leaders, including companies specializing in test and measurement technologies

b. Some key players operating in the modular instruments market include Agilent Technologies, Advantest Corporation, AMETEK, Inc., Astronics Corporation, Delta Electronics, Inc., Fortive Corporation, Keysight Technologies, Picotest Corp

b. The growth of the market can be attributed to the enhanced capabilities of modular instruments to integrate with software-defined platforms and the adoption of Industry 4.0 principles and the Internet of Things (IoT)

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.