Modular UPS Market Size & Trends

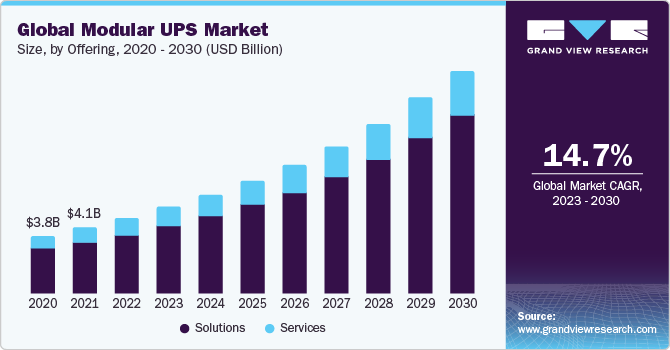

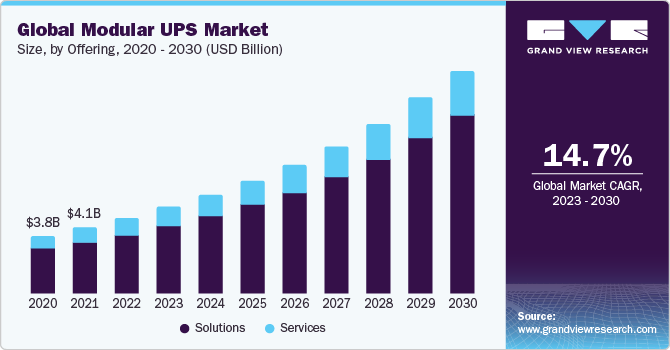

The global modular UPS market size was valued at USD 4.68 billion in 2022 and is expected to grow at a CAGR of 14.7% over the forecast period.There has been a growing demand for technology advancements, cloud computing adoption, digital services, data storage needs, regulatory requirements, expanding user base, and business scalability across regions. These aspects together emerge the need for more storage capacity, efficient infrastructure, and computing power to accommodate the increasing volume of information and online activities.

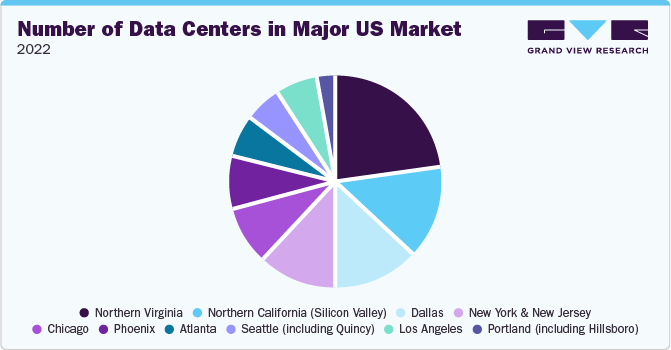

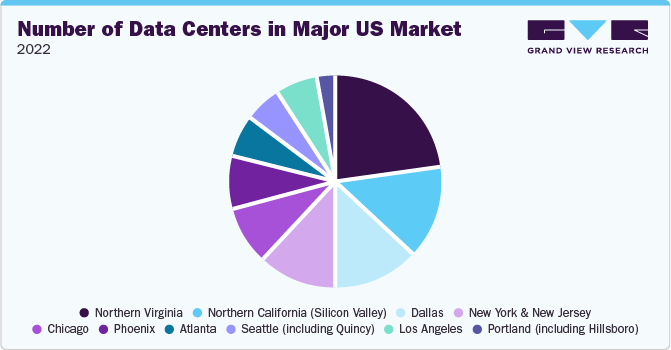

With data centers usually requiring 100% uptime, power supply anomalies can result in data loss, non-availability of important services, hardware risk, and major financial losses. As a result, UPSs are in high demand in the data center industry to ensure continuous power supply and reduce the chance of system failure. As a result of the growing reliance on large-scale applications and cloud services, demand for colocation services has increased, offering new prospects for the modular UPS industry. These key systems are necessary investments for data center providers because they play a critical role in sustaining uptime and preventing data loss, hardware damage, and financial losses.

Offering Insights

Based on the offerings, the modular UPS market is segmented into solutions and services. The solution segment held the largest market share in 2022. The Power requirements for enterprises can increase as they grow, mandating an adaptable power infrastructure. Modularity meets this requirement by providing an extensible UPS solution. A modular UPS design facilitates capacity upgrades and decreases downtime during servicing or expansion by allowing for the simple addition or removal of power modules.

Organization Size Insights

Based on the organization size, the modular UPS market is segmented into SMEs and large enterprises. The large enterprise segment held the largest market share in 2022. Large organizations generate and manage massive amounts of data from various sources, such as client transactions, interactions, and activities. Furthermore, there has been an increase in the use of cloud computing to improve operations, increase scalability, and reduce costs. The data center provides support for sophisticated technologies and applications. The increasing reliance on these setups requires an uninterrupted power supply to avoid downtime. Hence, the demand for modular UPS is expected to grow in large enterprises.

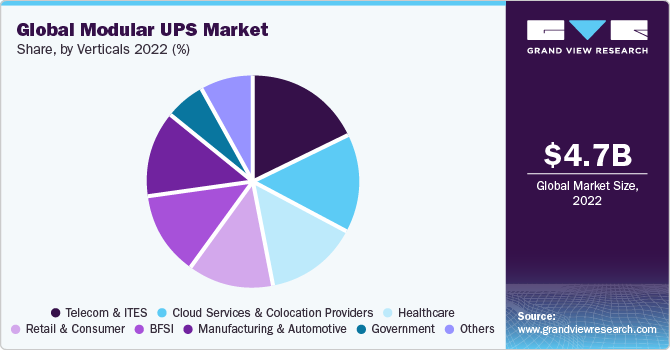

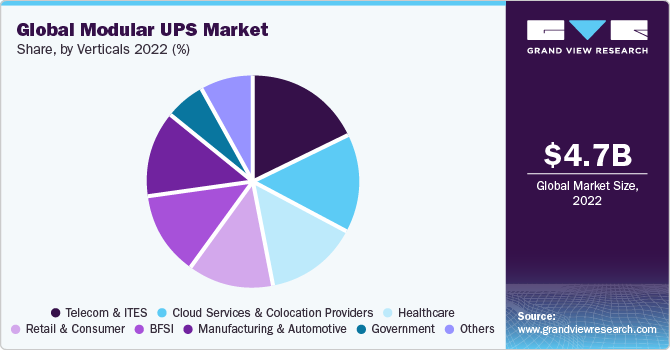

Verticals Insights

Based on the verticals, the modular UPS market is segmented into Telecom & ITES, government, cloud services & colocation providers, BFSI, retail & consumer, healthcare, manufacturing & automotive and others. The telecom & ITES segment held the largest market share in 2022. To manage the growing amount of data processing and storage, cloud computing capabilities in the telecom and ITES industry, power supply plays a pivotal role.

The demand for sustainable power protection to enable continuous operations and avoid data loss expands owing to the nation's increasing reliance on digital technology, data centers, and cloud services. In these instances, UPS systems have become essential to prevent downtime and data corruption, thereby increasing the demand for the market.

Regional Insights

Asia Pacific dominated the market in 2022. The developing IT industry and growing traction towards e-commerce and digital payment throughout Asia are increasing the demand for data centers, which require constant power supply, thereby increasing the demand for modular UPS. Moreover, growing concerns over data or asset theft have also prompted authorities to put regularity compliance in place, which is also driving the market growth. Latin America is expected to witness the fastest CAGR over the forecast period.

Latin America has grown in popularity in recent years. Advanced technologies such as lot, big data, and artificial intelligence are becoming more popular in the region. Cloud use is also accelerating in this sector. In addition to establishing microgrids and local power generation, operators purchase redundant power infrastructure, such as UPS systems, to power their facilities, generating income for system makers and propelling the market forward.

Competitive Insights

Key players operating in the market are ABB Ltd, Emerson Network Power, Huawei Technologies Co. Ltd, Schneider Electric SE, General Electric, Delta Electronics Inc., AEG Power Solutions, Riello Elettronica Group and Eaton Corporation. The market players typically resort to strategic initiatives such as product launches, partnerships, and product enhancement activities. The following are some instances of such initiatives.

-

In July 2023, ABB Ltd announced the launch of MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions in India. ABB's MegaFlex UPS line is aimed at the UL and IEC markets, with a power range of 1.6 and 1.5 MW. The MegaFlex solution provides exceptional availability and dependability while having the smallest footprint on the market, with the IEC version being up to 45 percent less than competitor products of the same power rating.

-

In August 2022, Cyber Power Systems (USA), Inc., a leading developer of power protection and management technology, launched its latest line of three-phase modular online double-conversion UPS systems. These systems are intended to offer industrial-grade power safety in a modular, scalable style. The high-density 10kVA/10kW power modules are easy to install and maintain, and the N+X power redundancies in the UPS system line provide continuous operation and backup power.