- Home

- »

- Plastics, Polymers & Resins

- »

-

Molded Pulp Packaging Market Size & Share Report, 2030GVR Report cover

![Molded Pulp Packaging Market Size, Share & Trends Report]()

Molded Pulp Packaging Market Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-Wood Pulp), By Molded Type (Thermoformed, Transfer), By Product, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-856-5

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Molded Pulp Packaging Market Trends

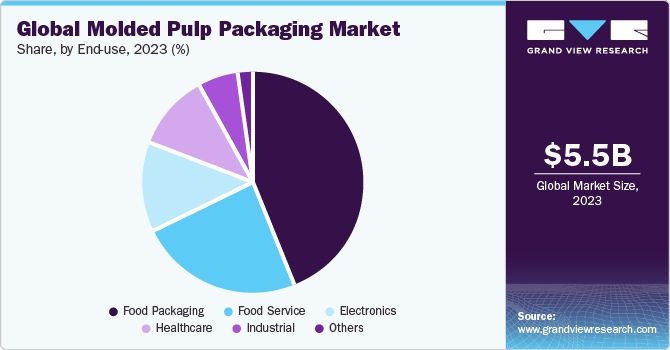

The global molded pulp packaging market size was estimated at USD 5.45 billion in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030. Factors attributing to market growth include increasing demand for sustainable & eco-friendly packaging solutions and increasing demand from end-use industries such as food packaging, healthcare, food service, electronics, and others. Manufacturers are striving for maintain healthy competitive environment across market space by implementing various strategies. For instance, in July 2023, Tekni-Plex, Inc. announced opening of their facility in Ohio, for manufacturing of specialty molded pulp products, especially fiber-based egg cartons.

Food packaging and foodservice industries together dominated North American molded pulp packaging market. This dominance can be correlated to huge demand for packaged food and on-the-go food serving. Commercial food service establishment accounted for over USD 813.4 billion of total food marketing system market and thus, emerged as a major segment of industry. Commercial food service category includes restaurants, caterers, cafeterias, fast-food outlets, and other institutions that prepare, sell, and serve food. With such institutions looking forward to new packaging solutions having minimal carbon footprint, molded pulp packaging market is expected to witness strong growth over coming years.

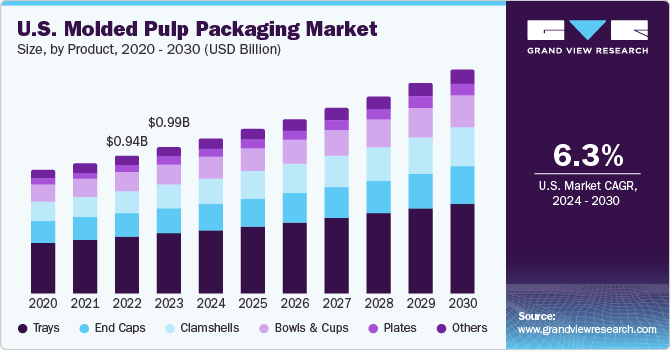

Trays dominated product segment in U.S. owing to growing awareness of environmental benefits of using sustainable packaging solutions, increasing demand for convenient and lightweight packaging options, and rise in e-commerce activities. Trays are widely used for packaging a wide range of products, including food items like fruits, vegetables, eggs, and meat. Demand for molded pulp trays is expected to continue to grow due to increasing demand for eco-friendly and sustainable packaging solutions.

Rising consumption of eggs and fresh fruits and growing demand for sustainable packaging are preponderance for molded pulp packaging market. Eggs are packaged in molded pulp trays and clamshells, which are then sold to restaurants, foodservice operators, and individual buyers. In addition, per capita egg consumption is increasing on a yearly basis across world. Thus, rising consumption of eggs, owing to expanding population, associated health benefits, and increasing demand for higher protein intake, is anticipated to drive demand for molded pulp packaging products, thereby propelling market growth.

Molded pulp bottles are typically made from paper pulp and water. The pulp is molded into the desired bottle shape and then dried. These bottles are used for packaging products like beverages, cosmetics, and other liquid or semi-liquid substances. Molded pulp corner protectors protect the corners of fragile or delicate items during shipping and transportation. They act as a cushion, absorbing shocks and preventing damage to the product.

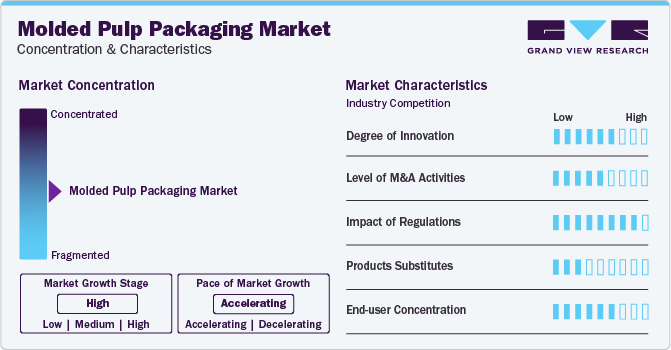

Market Concentration & Characteristics

The molded pulp packaging market is fragmented with the presence of large and medium-sized international companies as well as small-sized domestic players. Key public companies operating in molded pulp packaging market include Huhtamaki, Brødrene Hartmann A/S, Thermoform Engineered Quality LLC (Sonoco Products Company), Pro-Pac Packaging Limited, and UFP Technologies, Inc. Huhtamaki is one of the leading manufacturers of molded pulp packaging. Its portfolio includes a wide array of molded pulp trays, clamshells, bowls, plates, and containers & lids. The company operates through four business segments, namely Foodservice Europe-Asia-Oceania, North America, Flexible Packaging, and Fiber Packaging. It has a significant geographic presence with approximately 77 manufacturing facilities and 24 sales offices in 34 countries.

Governments of different countries across the world are providing subsidies to recyclable paper. According to the American Forest and Paper Association, as of 2021, the U.S. had recycled 68% of all the consumed paper. Furthermore, according to the study of the American Forest and Paper Association, the old, corrugated containers (OCC) recycling rate was 91.4% in 2021. On the other hand, Canada is one of the significant paper recycling countries in the world, with 70% of the cardboard and paper being recycled every year. The OCC recovery rate in Canada stands at about 85% on average. According to the data provided by the Confederation of European Paper Industries, 71.4% of all paper and paperboard consumed in Europe was recycled.

Source Insights

Based on source, wood pulp segment accounted for over 85.0% of revenue share in 2023. This is owing to its abundant availability, cost-effectiveness, and customizable to have different depths, sizes, and shapes to fit various food items which also makes them a popular choice for packaging manufacturers. Wood pulp molded packaging has a wide application in various end-use industries. For instance, it is widely used in food & beverage industry as it offers excellent protection for food products during shipping and storage.

Non-wood pulp segment is anticipated to record a highest growth rate during the forecast period. Growth of non-wood pulp segment is owing to growing concern about deforestation. This pulp is produced with not-wood cellulosic plant material or agricultural waste such as cereal straws, grasses, sugarcane, and others. This is gaining popularity in production of pulp due to its high availability, lower cost, and growing concerns about deforestation.

Molded Type Insights

Based on molded type, transfer molded segment type held the largest market share of over 57.0% in 2023. Transfer molded pulp has a wide application in the food packaging industry due to hygroscopic property of the material, and air permeability which results in longer shelf life of beverages and food products that are to be further shipped. Moreover, molded pulp packaging protects from shocks that cause breakage or damage to the products, especially fruits, vegetables & eggs, and non-alcoholic, and alcoholic beverages.

Thermoformed segment is anticipated to grow at fastest CAGR over the forecast period. This is attributed to the rising concerns about environmental impact of single-use plastics which resulted in a shifting trend of consumers from plastic thermoformed packaging to sustainable molded thermoformed pulp packaging.

Product Insights

Based on products, the tray sub-segment dominated the market with over 41.0% revenue share in 2023 owing to wide application of these trays in food packaging and food service industries. These trays are molded pulp trays that are widely used for packaging of eggs in retail distribution channels as it provides protection from breakage and keeps the product safe.

Molded pulp clamshells are projected to grow at a fast CAGR of 8.5% over the forecast period. Eggs are either packed in plastic clamshells or in molded pulp clamshells. The demand for plastic clamshells has been declining for past few years owing to its increasing demand for molded pulp clamshells. This can be attributed to convenience, in terms of carrying and disposing of, offered by molded pulp clamshells.

End-use Insights

Food packaging emerged as a dominating end-use for molded pulp packaging application segment with a market share of over 44.0% in 2023. Molded pulp packaging is mainly used for packaging of fruits, vegetables, and eggs. Clamshells and trays are considered primary packaging types for eggs due to low price and cushioning offered. In addition, molded pulp trays and clamshells offer extended shelf life of eggs keeping them fresh by ventilation provided in this packaging.

Electronics industry is expected to witness a CAGR of 9.1% over the forecast year owing to high demand from packaging of sensitive electronic devices such as laptops, smartphones, and others. The electronics require molded pulp packaging to transport and store delicate electronic devices that keep them safe from any external damage which is anticipated to drive the demand for molded pulp packaging products.

Regional Insights

Asia Pacific held the largest market share of over 41.0% in 2023. The region is segmented into China, Japan, Malaysia, and India. China accounted for largest market share of molded pulp packaging market in 2023 in Asia Pacific region. This is attributed to large food & beverage industry followed by electronics market owing to high population and increasing disposable income of consumers in country. Moreover, the country is home to several electronic companies such as Huawei Technologies Co., Ltd, Lenovo, Xiaomi, and others which gives rise to demand for molded pulp packaging to store and transport delicate electronic goods.

India Molded Pulp Packaging Market

India has emerged as one of the prominent players in packaging industry with numerous packaging solution providers thriving to meet the market demand. Although no strict regulations are imposed on the usage of plastic as a packaging material, companies and brand owners have made it a point to meet consumer expectations by reducing the usage of plastic and move toward a more sustainable form of packaging. Consumer awareness about environment safety and steps toward reducing landfill is augmenting the market demand. Moreover, molded pulp packaging solutions are widely in demand in the country which can be ascribed to India’s vibrant food service industry and upcoming electronic market.

Australia Molded pulp Packaging Market

The Australia Molded Pulp Packaging Market is witnessing significant growth, as the Australian government has banned the single use such as plastic bags, straws, and cutlery. Key players are started opening centers and offices in Australia to grab the market share. Pro-Pac Packaging Limited offers a wide range of primary, secondary, as well as tertiary packaging products that cater to several industries including food & food processing, retail & FMCG, and agriculture among others. It operates manufacturing, warehousing, and distribution facilities located across Australia, New Zealand, Asia, and Canada.

North America was second leading region for molded pulp packaging in terms of revenue in 2023. Region is home to many food service companies including fast food chains, restaurants, catering services, and others. Ongoing trend of on-the-go food or snack consumption gives rise to molded pulp packaging such as trays, bowls, and cups, as consumers are becoming aware of sustainable packaging and prefer it over single-use plastic packaging.

Key Companies & Market Share Insights

The molded pulp packaging market is highly competitive with presence of both global and regional companies. Companies operating in the market offer a wide range of products that are available in a variety of shapes, sizes, and colors. Moreover, they offer custom packaging products to suit customer-specific requirements.

The market has also witnessed several new product launches and mergers and acquisitions over last few years.

-

In June 2023, ANTAIRA TECHNOLOGIES, LLC., announed their transition to complete molded pulp packaging for its network devices across North America in line with companies moving towards sustainable packaging solutions.

-

In March 2023, Eco-Products, Inc.'s Vanguard clamshell became the first molded fiber product with no added PFAS received approval from Compost Manufacturing Alliance.

-

In February 2023, Huhtamako Oyj announced acquisition of a joint venture foodservice distribution in Australia. With this acquisition, company is serving food services packaging solutions to a wide network of regional and metropolitan wholesalers, restaurant businesses, and others.

Key Molded Pulp Packaging Companies:

The following are the leading companies in the molded pulp packaging market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these molded pulp packaging companies are analyzed to map the supply network.

- Brodrene Hartmann A/S

- Huhtamako Oyj

- CKF Inc

- Thermoform Engineered Quality LLC

- Genpak, LLC

- Eco-Products, Inc.

- Pro-Pac Packaging Limited

- Fabri-Kal

- Hentry Molded Products, Inc.

- Sabert Corporation

- HEFEI CRAFT TABLEWARE CO., LTD.

- Laizhou Guoliang Packing Products Co. Ltd

- MVI ECOPACK

- Pton Molded Fiber Products Co., Ltd

- Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.

- Fuzhou Qiqi Paper Co., Ltd

- Shandong Upmax Packaging Group Co., Ltd.

- Huain, Inc.

Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.81 billion

Revenue forecast in 2030

USD 8.90 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Source, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Brodrene Hartmann A/S; Huhtamako Oyj; CKF Inc; Thermoform Engineered Quality LLC; Genpak, LLC; Eco-Products, Inc. ; Pro-Pac Packaging Limited; Fabri-Kal; Hentry Molded Products, Inc.; Sabert Corporation; HEFEI CRAFT TABLEWARE CO., LTD.; Laizhou Guoliang Packing Products Co. Ltd; MVI ECOPACK; Pton Molded Fiber Products Co., Ltd; Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.; Fuzhou Qiqi Paper Co., Ltd; Shandong Upmax Packaging Group Co., Ltd.; Huain, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Molded Pulp Packaging Market report on the basis of source, product, Application, end-use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

- Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molded pulp packaging market was estimated at USD 5.46 billion in 2023 and is expected to surpass USD 5.84 billion in 2024.

b. The global molded pulp packaging market is expected to grow at a CAGR of 7.7% from 2024 to 2030 to reach USD 9.11 billion by 2030.

b. Asia Pacific region dominated molded pulp packaging market with a revenue share of over 41.8% in 2023 owing to the presence of a large number of end-user industries including food & beverages, electronics, healthcare, and others.

b. The key market player in the molded pulp packaging market includes Brodrene Hartmann A/S; Huhtamako Oyj; UFP Technologies, Inc; Thermoform Engineered Quality LLC; Genpak, LLC; Eco-Products, Inc; Pro-Pac Packaging Limited; Fabri-Kal; Hentry Molded Products, Inc; Sabert Corporation.

b. Increasing demand for sustainable packaging solutions owing to growing awareness regarding plastic waste and its adverse effects on the environment coupled with stringent regulations against single-use plastics is expected to drive the demand for molded pulp packaging.

Table of Contents

Chapter 1 Molded Pulp Packaging Market: Methodology And Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2 Molded Pulp Packaging Market: Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Source Outlook

2.2.2. Molded Type Outlook

2.2.3. Product Outlook

2.2.4. End-use Outlook

2.3. Competitive Landscape Snapshot

Chapter 3 Molded Pulp Packaging Market: Variables, Trends, And Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Source Trends

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.2.4. Sales Channel Analysis

3.3. Technology Trends / Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Unmet Needs & Challenges in Molded Pulp Packaging Industry

3.8. Impact of Environmental, Social, and Governance (ESG) initiatives on the Molded Pulp Packaging Market

3.8.1. Market Differentiation

3.8.2. Regulatory Compliance

3.8.3. Industry Collaboration

3.8.4. Enhanced Brand Value

3.8.5. Addressing Consumer Demands

3.9. Impact 0f Covid-19 Pandemic on the Molded Pulp Packaging Market

Chapter 4. Molded Pulp Packaging Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. Molded Pulp Packaging Market: Price Trend Analysis

5.1. Pricing Trend Analysis, by Source, 2018 – 2030 (USD/Tons)

5.2. Factors Affecting the Pricing Deviation

5.3. Product Price Analysis, By Product Type

5.3.1. Manufacturing Cost

5.3.2. Distribution Cost

5.3.3. Product Cost Breakup

Chapter 6. Molded Pulp Packaging Market: Supply Demand Gap Analysis

6.1. Import Export Analysis, 2018 -2022

6.1.1. Top 10 Importing Countries

6.1.2. Top 10 Exporting Countries

6.2. Potential Opportunities/ Future Scenarios

Chapter 7. Molded Pulp Packaging Market: Source Estimates & Trend Analysis

7.1. Definition & Scope

7.2. Product Movement Analysis & Market Share, 2023 & 2030

7.3. Wood Pulp

7.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

7.4. Non-wood Pulp

7.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Molded Pulp Packaging Market: Molded Type Estimates & Trend Analysis

8.1. Definition & Scope

8.2. Molded Type Movement Analysis & Market Share, 2023 & 2030

8.3. Thick Wall

8.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

8.4. Transfer

8.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

8.5. Thermoformed

8.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

8.6. Processed

8.6.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 9. Molded Pulp Packaging Market: Product Estimates & Trend Analysis

9.1. Definition & Scope

9.2. Product Movement Analysis & Market Share, 2023 & 2030

9.3. Trays

9.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

9.4. End Caps

9.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

9.5. Bowls & Cups

9.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

9.6. Clamshells

9.6.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

9.7. Plate

9.7.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

9.8. Others

9.8.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 10. Molded Pulp Packaging Market: Application Estimates & Trend Analysis

10.1. Definition & Scope

10.2. Application Movement Analysis & Market Share, 2023 & 2030

10.3. Food Packaging

10.3.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

10.4. Food Service

10.4.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

10.5. Electronics

10.5.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

10.6. Healthcare

10.6.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

10.7. Industrial

10.7.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

10.8. Others

10.8.1. market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 11. Molded Pulp Packaging Market: Regional Estimates & Trend Analysis

11.1. Key Takeaways

11.2. Regional Movement Analysis & Market Share, 2023 & 2030

11.3. North America

11.3.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.3.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.3.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.3.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.3.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.3.6. U.S.

11.3.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.3.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.3.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.3.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.3.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.3.7. Canada

11.3.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.3.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.3.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.3.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.3.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.3.8. Mexico

11.3.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.3.8.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.3.8.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.3.8.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.3.8.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4. Europe

11.4.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4.6. Germany

11.4.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4.7. U.K.

11.4.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4.8. France

11.4.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.8.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.8.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.8.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.8.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4.9. Italy

11.4.9.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.9.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.9.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.9.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.9.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.4.10. Spain

11.4.10.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.4.10.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.4.10.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.4.10.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.4.10.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5. Asia Pacific

11.5.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.6. China

11.5.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.7. India

11.5.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.8. Japan

11.5.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.8.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.8.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.8.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.8.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.9. South Korea

11.5.9.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.9.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.9.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.9.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.9.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.10. Australia

11.5.10.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.10.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.10.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.10.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.10.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.5.11. Southeast Asia

11.5.11.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.5.11.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.5.11.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.5.11.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.5.11.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.6. Central & South America

11.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.6.6. Brazil

11.6.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.6.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.6.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.6.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.6.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.6.7. Argentina

11.6.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.6.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.6.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.6.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.6.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.7. Middle East & Africa

11.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.7.6. Saudi Arabia

11.7.6.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.7.6.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.7.6.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.7.6.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.7.6.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.7.7. UAE

11.7.7.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.7.7.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.7.7.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.7.7.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.7.7.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

11.7.8. South Africa

11.7.8.1. market estimates and forecasts, 2018 - 2030 (USD million) (Kilotons)

11.7.8.2. market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

11.7.8.3. market estimates and forecasts, by molded type, 2018 - 2030 (Kilotons) (USD Million)

11.7.8.4. market estimates and forecasts, by product, 2018 - 2030 (Kilotons) (USD Million)

11.7.8.5. market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 12. Start-up Ecosystem Evaluation, 2023

12.1. List of Start-up Companies

12.1.1. Progressive Companies

12.1.2. Responsive Companies

12.1.3. Dynamic Companies

12.1.4. Starting Blocks

12.2. Government Funding for Start-ups across the globe

Chapter 13. Competitive Landscape

13.1. Key Global Players & Recent Developments & Their Impact On the Industry

13.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

13.3. List of key Raw Source Distributors and Channel Partners

13.4. List of Potential Customers, by End-use

13.5. Company Market Share & Position Analysis, 2023

13.6. Company Heat Map Analysis

13.7. Competitive Dashboard Analysis

13.8. Strategy Mapping

13.8.1. Expansion

13.8.2. Collaboration/ Partnerships/ Agreements

13.8.3. New Product launches

13.8.4. Mergers & Acquisitions

13.8.5. Research & Development

13.8.6. Others

Chapter 14. Company Listing / Profiles

14.1. Brødrene Hartmann A/S

14.1.1. Company Overview

14.1.2. Financial Performance

14.1.3. Product Benchmarking

14.2. Huhtamäki Oyj

14.2.1. Company Overview

14.2.2. Financial Performance

14.2.3. Product Benchmarking

14.3. UFP Technologies, Inc.

14.3.1. Company Overview

14.3.2. Financial Performance

14.3.3. Product Benchmarking

14.4. Thermoform Engineered Quality LLC

14.4.1. Company Overview

14.4.2. Financial Performance

14.4.3. Product Benchmarking

14.5. Genpak, LLC

14.5.1. Company Overview

14.5.2. Financial Performance

14.5.3. Product Benchmarking

14.6. Eco-Products, Inc.

14.6.1. Company Overview

14.6.2. Financial Performance

14.6.3. Product Benchmarking

14.7. Pro-Pac Packaging Limited

14.7.1. Company Overview

14.7.2. Financial Performance

14.7.3. Product Benchmarking

14.8. Fabri-Kal

14.8.1. Company Overview

14.8.2. Financial Performance

14.8.3. Product Benchmarking

14.9. Henry Molded Products, Inc.

14.9.1. Company Overview

14.9.2. Financial Performance

14.9.3. Product Benchmarking

14.10. Sabert Corporation

14.10.1. Company Overview

14.10.2. Financial Performance

14.10.3. Product Benchmarking

14.11. HEFEI CRAFT TABLEWARE CO., LTD.

14.11.1. Company Overview

14.11.2. Financial Performance

14.11.3. Product Benchmarking

14.12. Laizhou Guoliang Packing Products Co. Ltd

14.12.1. Company Overview

14.12.2. Financial Performance

14.12.3. Product Benchmarking

14.13. MVI ECOPACK

14.13.1. Company Overview

14.13.2. Financial Performance

14.13.3. Product Benchmarking

14.14. Pton Molded Fiber Products Co., Ltd

14.14.1. Company Overview

14.14.2. Financial Performance

14.14.3. Product Benchmarking

14.15. Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.

14.15.1. Company Overview

14.15.2. Financial Performance

14.15.3. Product Benchmarking

14.16. Fuzhou Qiqi Paper Co., Ltd

14.16.1. Company Overview

14.16.2. Financial Performance

14.16.3. Product Benchmarking

14.17. Shandong Upmax Packaging Group Co., Ltd.

14.17.1. Company Overview

14.17.2. Financial Performance

14.17.3. Product Benchmarking

14.18. Huain, Inc.

14.18.1. Company Overview

14.18.2. Financial Performance

14.18.3. Product Benchmarking

List of Tables

Table 1 Molded wood pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 2 Molded non-wood pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 3 Thick wall molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 4 Transfer wall molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 5 Thermoformed molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 6 Processed molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 7 Molded pulp packaging market estimates and forecasts, by tray, 2018 - 2030 (Kilotons) (USD Million)

Table 8 Molded pulp packaging market estimates and forecasts, by end cap, 2018 - 2030 (Kilotons) (USD Million)

Table 9 Molded pulp packaging market estimates and forecasts, by bowl & cup, 2018 - 2030 (Kilotons) (USD Million)

Table 10 Molded pulp packaging market estimates and forecasts, by clamshells, 2018 - 2030 (Kilotons) (USD Million)

Table 11 Molded pulp packaging market estimates and forecasts, by plate, 2018 - 2030 (Kilotons) (USD Million)

Table 12 Molded pulp packaging market estimates and forecasts, by others, 2018 - 2030 (Kilotons) (USD Million)

Table 13 Molded pulp packaging market estimates and forecasts, by food packaging, 2018 - 2030 (Kilotons) (USD Million)

Table 14 Molded pulp packaging market estimates and forecasts, by foodservice, 2018 - 2030 (Kilotons) (USD Million)

Table 15 Molded pulp packaging market estimates and forecasts, by electronics, 2018 - 2030 (Kilotons) (USD Million)

Table 16 Molded pulp packaging market estimates and forecasts, by healthcare, 2018 - 2030 (Kilotons) (USD Million)

Table 17 Molded pulp packaging market estimates and forecasts, by industrial, 2018 - 2030 (Kilotons) (USD Million)

Table 18 Molded pulp packaging market estimates and forecasts, by others, 2018 - 2030 (Kilotons) (USD Million)

Table 19 North America molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 20 Molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 21 North America molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 22 North America molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 23 North America molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 24 U.S. molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 25 U.S. molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 26 U.S. molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 27 U.S. molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 28 U.S. molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 29 Canada molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 30 Canada molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 31 Canada molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 32 Canada molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 33 Canada molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 34 Mexico molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 35 Mexico molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 36 Mexico molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 37 Mexico molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 38 Mexico molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 39 Europe molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 40 Molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 41 Europe molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 42 Europe molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 43 Europe molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 44 Germany molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 45 Germany molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 46 Germany molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 47 Germany molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 48 Germany molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 49 France molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 50 France molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 51 France molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 52 France molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 53 France molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 54 UK molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 55 UK molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 56 UK molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 57 UK molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 58 UK molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (USD Million)

Table 59 Italy molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 60 Italy molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 61 Italy molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 62 Italy molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 63 Italy molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 64 Asia Pacific molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 65 Molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 66 Asia Pacific molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 67 Asia Pacific molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 68 Asia Pacific molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 69 China molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 70 China molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 71 China molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 72 China molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 73 China molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 74 Japan molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 75 Japan molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 76 Japan molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 77 Japan molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 78 Japan molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 79 India molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 80 India molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 81 India molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 82 India molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 83 India molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 84 Central & South America molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 85 Molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 86 Central & South America molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 87 Central & South America molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 88 Central & South America molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 89 Brazil molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 90 Brazil molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 91 Brazil molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 92 Brazil molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 93 Brazil molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 94 Middle East & Africa molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 95 Molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 96 Middle East & Africa molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 97 Middle East & Africa molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (USD Million)

Table 98 Middle East & Africa molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 99 Saudi Arabia molded pulp packaging market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 100 Saudi Arabia molded pulp packaging market estimates and forecasts, by source, 2018 - 2030 (Kilotons) (USD Million)

Table 101 Saudi Arabia molded pulp packaging market estimates and forecasts, by type, 2018 - 2030 (Kilotons) (USD Million)

Table 102 Saudi Arabia molded pulp packaging market estimates and forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

Table 103 Saudi Arabia molded pulp packaging market estimates and forecasts, By End-use, 2018 - 2030 (Kilotons) (USD Million)

Table 104 Company Market Ranking Analysis

List of Figures

Fig. 1 Information procurement

Fig. 2 Primary research pattern

Fig. 3 Primary research process

Fig. 4 Market research approaches - Bottom-Up Approach

Fig. 5 Market research approaches - Top-Down Approach

Fig. 6 Market research approaches - Combined Approach

Fig. 7 Global Molded Pulp Packaging Market : Market Outlook (USD Million)

Fig. 8 Global Molded Pulp Packaging Market: Segmental Outlook (USD Million) (1/2)

Fig. 9 Global Molded Pulp Packaging Market : Segmental Outlook (USD Million) (2/2)

Fig. 10 Global Molded Pulp Packaging Market : Competitive Outlook (USD Million)

Fig. 11 Green Packaging Market, 2023 (USD Billion)

Fig. 12 Molded Pulp Packaging Market: Penetration & Growth Prospect Mapping

Fig. 13 Molded pulp packaging market: Value chain analysis

Fig. 14 Producer Price Index by Commodity for Pulp, Paper, and Allied Products: Wood Pulp

Fig. 15 Wood pulp production in major countries, 2016 to 2022 (Tons)

Fig. 16 Molded Pulp Packaging Market: Sales Channel Analysis

Fig. 17 Molded Pulp Packaging Market- Market Dynamics

Fig. 18 Global egg production, 2023 (%)

Fig. 19 Molded Pulp Packaging Market: Porter’s Analysis

Fig. 20 Molded Pulp Packaging Market: PESTEL Analysis

Fig. 21 Global Molded Pulp Packaging Market, by Source: Key Takeaways

Fig. 22 Global Molded Pulp Packaging Market, by Source: Market Share by Value, 2023 & 2030

Fig. 23 Global Molded Pulp Packaging Market Estimates & Forecasts, by Wood Pulp, 2018 - 2030 (Kilotons) (USD Million)

Fig. 24 Global Molded Pulp Packaging market estimates & forecasts, by Non-wood Pulp, 2018 - 2030 (Kilotons) (USD Million)

Fig. 25 Global Molded Pulp Packaging Market, by Molded Type: Key Takeaways

Fig. 26 Global Molded Pulp Packaging Market, by Type: Market Share by Value, 2023 & 2030

Fig. 27 Global Molded Pulp Packaging market estimates & forecasts, by Thick Wall, 2018 - 2030 (Kilotons) (USD Million)

Fig. 28 Global Molded Pulp Packaging market estimates & forecasts, by Transfer, 2018 - 2030 (Kilotons) (USD Million)

Fig. 29 Global Molded Pulp Packaging market estimates & forecasts, by Thermofor, 2018 - 2030 (Kilotons) (USD Million)

Fig. 30 Global Molded Pulp Packaging market estimates & forecasts, by Processed, 2018 - 2030 (Kilotons) (USD Million)

Fig. 31 Global Molded Pulp Packaging Market, by Product Type: Key Takeaways

Fig. 32 Global Molded Pulp Packaging Market, by Product Type: Market Share by Value, 2023 & 2030

Fig. 33 Global Molded Pulp Packaging Market Estimates & Forecasts, by Trays, 2018 - 2030 (Kilotons) (USD Million)

Fig. 34 Global Molded Pulp Packaging Market Estimates & Forecasts, by End Caps, 2018 - 2030 (Kilotons) (USD Million)

Fig. 35 Global Molded Pulp Packaging Market Estimates & Forecasts, by Bowls & Cups, 2018 - 2030 (Kilotons) (USD Million)

Fig. 36 Global Molded Pulp Packaging Market Estimates & Forecasts, by Clamshells, 2018 - 2030 (Kilotons) (USD Million)

Fig. 37 Global Molded Pulp Packaging Market Estimates & Forecasts, by Plates, 2018 - 2030 (Kilotons) (USD Million)

Fig. 38 Global Molded Pulp Packaging Market Estimates & Forecasts, by Others, 2018 - 2030 (Kilotons) (USD Million)

Fig. 39 Global Molded Pulp Packaging Market, By End-use: Key Takeaways

Fig. 40 Global Molded Pulp Packaging Market, By End-use: Market Share by Value, 2023 & 2030

Fig. 41 Global Molded Pulp Packaging Market Estimates & Forecasts, by Food Packaging, 2018 - 2030 (Kilotons) (USD Million)

Fig. 42 Global Molded Pulp Packaging Market Estimates & Forecasts, by Food Service, 2018 - 2030 (Kilotons) (USD Million)

Fig. 43 Global Molded Pulp Packaging Market Estimates & Forecasts, by Electronics, 2018 - 2030 (Kilotons) (USD Million)

Fig. 44 Global Molded Pulp Packaging Market Estimates & Forecasts, by Healthcare, 2018 - 2030 (Kilotons) (USD Million)

Fig. 45 Global Molded Pulp Packaging Market Estimates & Forecasts, by Industrial, 2018 - 2030 (Kilotons) (USD Million)

Fig. 46 Global Molded Pulp Packaging Market Estimates & Forecasts, by Others, 2018 - 2030 (Kilotons) (USD Million)

Fig. 47 Molded Pulp Packaging Market revenue, by region, 2023 & 2030 (Kilotons) (USD Million)

Fig. 48 North America Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 49 U.S. Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 50 Canada Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 51 Mexico Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 52 Europe Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 53 Germany Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 54 France Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 55 UK Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 56 Italy Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 57 Asia Pacific Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 58 China Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 59 Japan Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 60 India Molded Pulp Packaging Market Estimates & Forecast 2018 - 2030 (Kilotons) (USD Million)

Fig. 61 Central & South America Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 62 Brazil Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 63 Middle East & Africa Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 64 Saudi Arabia Molded Pulp Packaging Market Estimates & Forecast, 2018 - 2030 (Kilotons) (USD Million)

Fig. 65 Company Market PositioningWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Molded Pulp Packaging Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Wood Pulp

- Non-Wood Pulp

- Molded Pulp Packaging Molded Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Molded Pulp Packaging Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Molded Pulp Packaging End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Molded Pulp Packaging Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- North America Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- North America Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- North America Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- U.S.

- U.S. Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- U.S. Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- U.S. Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- U.S. Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- U.S. Molded Pulp Packaging Market, By Source

- Canada

- Canada Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Canada Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Canada Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Canada Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Canada Molded Pulp Packaging Market, By Source

- Mexico

- Mexico Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Mexico Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Mexico Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Mexico Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Mexico Molded Pulp Packaging Market, By Source

- North America Molded Pulp Packaging Market, By Source

- Europe

- Europe Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Europe Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Europe Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Europe Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Germany

- Germany Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Germany Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Germany Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Germany Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Germany Molded Pulp Packaging Market, By Source

- France

- France Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- France Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- France Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- France Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- France Molded Pulp Packaging Market, By Source

- UK

- UK Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- UK Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- UK Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- UK Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- UK Molded Pulp Packaging Market, By Source

- Italy

- Italy Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Italy Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Italy Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Italy Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Italy Molded Pulp Packaging Market, By Source

- Spain

- Spain Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Spain Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Spain Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Spain Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Spain Molded Pulp Packaging Market, By Source

- Europe Molded Pulp Packaging Market, By Source

- Asia Pacific

- Asia Pacific Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Asia Pacific Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Asia Pacific Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Asia Pacific Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- China

- China Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- China Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- China Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- China Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- China Molded Pulp Packaging Market, By Source

- India

- India Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- India Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- India Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- India Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- India Molded Pulp Packaging Market, By Source

- Japan

- Japan Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Japan Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Japan Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Japan Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Japan Molded Pulp Packaging Market, By Source

- South Korea

- South Korea Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- South Korea Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- South Korea Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- South Korea Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- South Korea Molded Pulp Packaging Market, By Source

- Australia

- Australia Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Australia Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Australia Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Australia Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Australia Molded Pulp Packaging Market, By Source

- Southeast Asia

- Southeast Asia Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Southeast Asia Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Southeast Asia Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Southeast Asia Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Southeast Asia Molded Pulp Packaging Market, By Source

- Asia Pacific Molded Pulp Packaging Market, By Source

- Central & South America

- Central & South America Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Central & South America Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Central & South America Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Central & South America Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Brazil

- Brazil Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Brazil Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Brazil Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Brazil Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Brazil Molded Pulp Packaging Market, By Source

- Argentina

- Argentina Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Argentina Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Argentina Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Argentina Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Argentina Molded Pulp Packaging Market, By Source

- Central & South America Molded Pulp Packaging Market, By Source

- Middle East & Africa

- Middle East & Africa Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Middle East & Africa Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Middle East & Africa Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Middle East & Africa Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Saudi Arabia

- Saudi Arabia Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- Saudi Arabia Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- Saudi Arabia Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- Saudi Arabia Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- Saudi Arabia Molded Pulp Packaging Market, By Source

- UAE

- UAE Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- UAE Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- UAE Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- UAE Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- UAE Molded Pulp Packaging Market, By Source

- South Africa

- South Africa Molded Pulp Packaging Market, By Source

- Wood Pulp

- Non-Wood Pulp

- South Africa Molded Pulp Packaging Market, By Molded Type

- Thick Wall

- Transfer

- Thermoformed

- Processed

- South Africa Molded Pulp Packaging Market, By Product

- Trays

- End Caps

- Bowls & Cups

- Clamshells

- Plates

- Others

- South Africa Molded Pulp Packaging Market, By End-use

- Food Packaging

- Food Service

- Electronics

- Healthcare

- Industrial

- Others

- South Africa Molded Pulp Packaging Market, By Source

- Middle East & Africa Molded Pulp Packaging Market, By Source

- North America

Molded Pulp Packaging Market Dynamics

Drivers: Rising Consumption Of Eggs And Fresh Fruits

Eggs are a rich source of high-quality proteins. Eggs contain several minerals and vitamins that are an essential part of a healthy diet. Egg white has over half of an egg's proteins and vitamin B2. Eggs are an incredible source of selenium, vitamins B12, B6, and D, and minerals such as iron, zinc, and copper. In addition, egg yolks are a source of fat-soluble vitamins such as vitamins A, E, D, and K and lecithin. According to various studies, eating eggs regularly can increase high-density lipoprotein (HDL), commonly known as good cholesterol, and lower heart disease risk.

Eggs are packaged in molded pulp trays and clamshells and then sold to restaurants, food service operators, and individual buyers. In addition, per capita egg consumption is increasing every year in the world. Thus, the rising consumption of eggs, owing to the expanding population, associated health benefits, and increasing demand for higher protein intake, is anticipated to drive the demand for molded pulp packaging products, thereby propelling market growth.

The rising consumption of eggs has increased the production of eggs. The graph below represents the total production of eggs in the world in the year 2020. Eggs are packed in plastic and molded pulp trays and clamshells, which are further sold to retail chains and food service operators. The U.S., Netherlands, and Turkey are among the top exporters of eggs in the world. Molded pulp packaging can also be used for storing and transporting eggs, which is expected to drive the market over the forecast period.

Growing Demand For Sustainable Packaging

Plastic is one of the major materials used for packaging in various industries, including food and beverage, healthcare, cosmetics and personal care, and consumer goods. However, plastic is a non-biodegradable, unsustainable material and can hurt the life of humans as well as animals. In addition, the recycling rate of plastic waste products is lower than the consumption rate, which ultimately pollutes land, ocean, and drinking water. According to the UN, 300 million tons of plastic waste is generated every year globally, which is nearly equivalent to the weight of the global human population.

To curb this humongous amount of plastic waste generated annually, many regulatory bodies and governments around the world have imposed restrictions on the generation of primary plastic waste over the years. For instance, several cities, states, and countries have voted to ban a range of single-use plastics to curb plastic pollution, which is projected to impact the growth of the molded pulp packaging market positively.

Restraints: Availability Of Substitute Packaging Products

Although pulp is a sustainable material for manufacturing packaging solutions, it can be substituted by bioplastics as these offer superior properties such as aesthetic appeal and moisture barrier, among others, as compared to molded pulp. Bioplastics are derived from renewable sources such as cellulose, starch, vegetable fats, and vegetable oils, among others. Bioplastics may or may not be biodegradable and can be bio-based or fossil-based. Bioplastics such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and polybutylene succinate (PBS) are bio-based biodegradable plastics. Packaging products manufactured using these bioplastics are substitutes for various molded pulp packaging products. Polylactic acid (PLA) is a thermoplastic aliphatic polyester derived from renewable sources such as sugarcane, corn starch, tapioca roots, chips, or starch. It is one of the largest consumed bioplastics across the globe in terms of volume. PLA offers several advantages, such as biodegradability, compostability, recyclability, and non-toxicity.

What Does This Report Include?

This section will provide insights into the contents included in this molded pulp packaging market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.