- Home

- »

- Biotechnology

- »

-

Monoclonal Antibodies Market Size & Share Report, 2030GVR Report cover

![Monoclonal Antibodies Market Size, Share & Trends Report]()

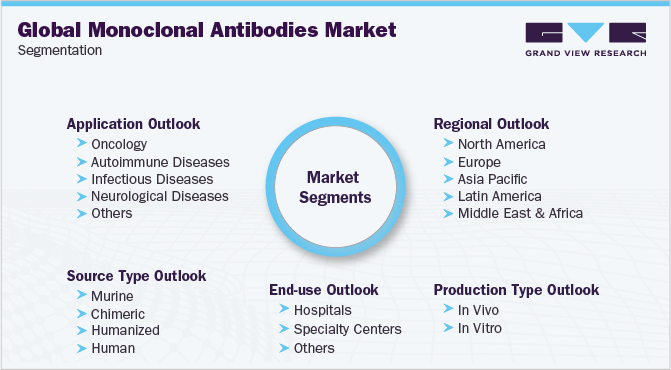

Monoclonal Antibodies Market Size, Share & Trends Analysis Report By Source Type (Chimeric, Murine, Humanized, Human), By Production Type (In Vivo, In Vitro), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-280-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global monoclonal antibodies market size was valued at USD 210.06 billion in 2022 and is projected to exhibit a compound annual growth rate (CAGR) of 11.04% from 2023 to 2030. Rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and others are increasing the demand for biologics, which is anticipated to serve as a key factor driving the monoclonal antibodies (mAbs) market. Similarly, increasing applications of mAb therapies for targeted therapies and rising awareness about such therapies amongst patients and physicians is expected to significantly contribute toward the market growth.

Furthermore, the COVID-19 pandemic has increased the market expansion prospects by fueling the development of several mAbs directed against the SARS-CoV-2 virus. As mAbs represent a promising alternative for mitigation of COVID-19 due to their safety and effectiveness, several such antibodies have attained emergency use authorizations (EUA) from the U.S. FDA. For instance, in February 2022, the U.S. FDA granted a EUA to Eli Lilly’s bebtelovimab for treatment of COVID-19 patients that are at risk of developing severe disease or who may need hospitalization. In addition, the U.S. Department of Health and Human Services announced the distribution of at least 600,000 free bebtelovimab courses, along with an optional purchase of 500,000 additional doses in the future, thus creating new opportunities for growth of mAbs/Key advantages offered by mAb therapies over previous therapies in terms of specificity, effectiveness, and ease of delivery have led to numerous new product launches and approvals in this domain. Over 100 mAb products have been approved by the U.S. FDA and the scope of therapeutic mAb applications is expected to grow further due to the development of antibody fragments, antibody derivatives, and bispecific antibodies, that offer advanced treatment options.

The market is also favored by the strategic initiatives undertaken by key players for the development and marketing of mAb products. For instance, in October 2021, T-Cure Bioscience, Inc. collaborated with Atlas Antibodies AB for the production and supply of CT83 mAbs. Similarly, in January 2022, Ono Pharmaceutical Co., Ltd. and Neurimmune AG collaborated on the creation of mAb drugs against new therapeutic targets for neurodegenerative diseases. Such initiatives are expected to open new growth opportunities and positively affect market growth.

However, high costs associated with the development of mAbs and the resultant increase in prices for mAb therapeutics can impede market growth in the near future. For instance, COVID-19 treatment mAbs such as Regeneron’s REGEN-COV (casirivimab and imdevimab), and GlaxoSmithKline & Vir Biotechnology’s sotrovimab cost around USD 1,250 and USD 2,100 per infusion, respectively. Such high drug prices can limit the access to mAb therapies for the large patient populations in developing countries and restrict mAbs adoption.

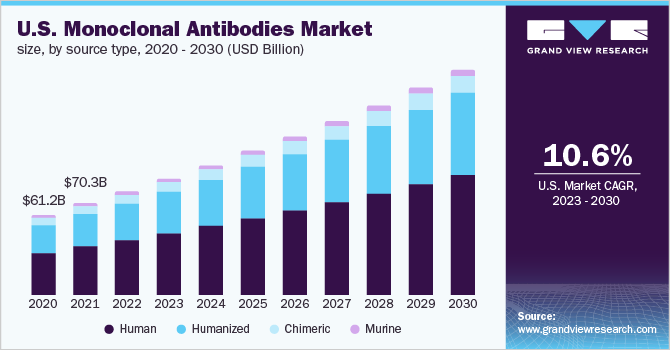

Source type Insights

The human source type held the largest share and accounted for 54.3% of the market value in 2022. Human mAbs offer efficient modulation in effector functions and are less immunogenic as compared to chimeric or humanized mAbs. Such antibodies can be produced through the use of phage display and hybridoma technologies in transgenic mice. As a result, with recent technological progress in genetic engineering, the production of fully human mAbs is anticipated to gain traction in the near future.

Humanized mAbs are expected to grow at the fastest CAGR of 11.6% over the forecast period due to their widespread use against a broad range of target antigens such as cancer cells, or immunosuppressor and immunomodulatory molecules. Demand for such antibodies is also supported by their lower immunogenicity as compared to chimeric mAbs. However, these antibodies are more immunogenic as compared to human mAbs, which may restrict the market growth.

Production Type Insights

IIn vitro production type held the larger market share of 76.9% in 2022 due to its economic viability in long production runs and lower propensity for contamination with foreign antigens. In addition, the availability of serum-free culture media and semi-permeable membrane-based systems has increased the feasibility of biomanufacturing operations and is likely to accelerate segment growth. However, the production type is limited by variations in hybridoma characteristics that can lead to denaturation or inactivation of antibodies and restrict the segment growth.

In vivo production type is expected to grow at a significant rate in the forecast period due to its highly cost-effective production as compared to in vitro techniques and ability to produce a high concentration of mAbs. These mAbs are used in the diagnostic industry, wherein cost considerations are of prime importance, and optimization of in vivo procedures can be done to increase the secretion of mAbs.

Application Insights

Oncology segment dominated the applications market for mAbs and accounted for 49.2% of the market value in 2022. This can be attributed to the high number of regulatory approvals for mAbs aimed at cancer treatment. The surge in the incidence of cancer is a key factor anticipated to drive the growth of mAbs therapeutics as these can have minimal adverse effects as compared to other drugs and chemotherapy interventions. Currently, available mAb therapeutics include those targeted against non-small cell lung, brain tumor, ovarian, breast, gastric, melanoma, colorectal, Hodgkin’s lymphoma, and others.

Applications of mAbs for the treatment of autoimmune diseases are projected to grow at a lucrative rate due to the increasing prevalence of autoimmune conditions such as rheumatoid arthritis. Furthermore, with growth in the number of cytokine proteins identified in inflammatory pathways that can be targeted for disease mitigation, applications of mAbs in this domain are anticipated to witness growth.

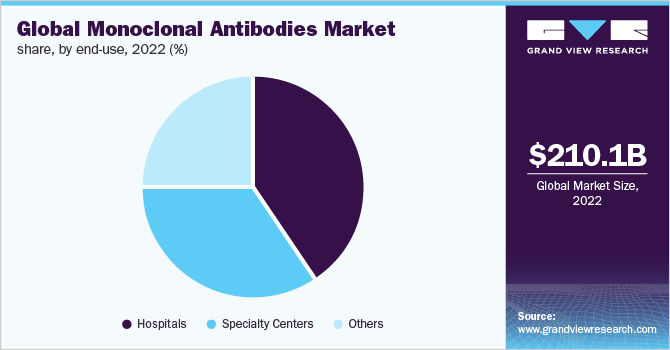

End-use Insights

The hospitals segment held the largest market share of 39.7% in 2022 due to the increasing adoption of mAbs for cancer treatment at hospitals. Rising healthcare expenditure across the world, increasing patient awareness levels, and availability of advanced hospital infrastructure in developed countries are factors expected to result in the dominance of the segment during the forecast period.

Specialty centers accounted for a significant market share in 2021 due to the increasing government support in recent years. For instance, the National Cancer Institute’s Cancer Centers Program is establishing standards for transdisciplinary cancer centers focused on the prevention, diagnosis, and treatment of various types of cancers. Such initiatives are expected to positively affect the segment growth.

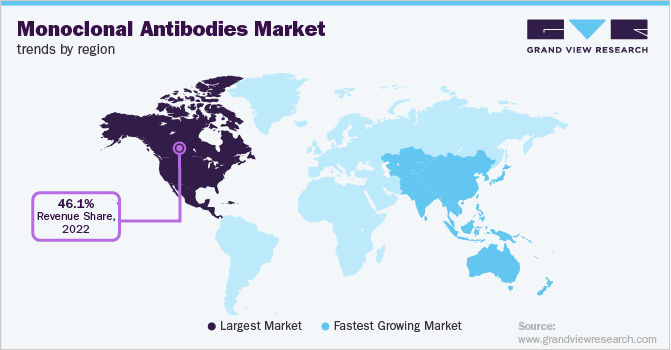

Regional Insights

North America recorded the largest market share of 46.1% in 2022 due to the presence of a highly developed healthcare infrastructure, high patient awareness, and growth in cancer research prospects, among other factors. Moreover, increasing government expenditure for cancer research and the presence of key players such as Pfizer Inc., Amgen, Inc., and Merck & Co., among others, are expected to boost the market growth.

Asia Pacific region is projected to exhibit the fastest growth rate of 12.1% over the forecast period due to the increasing disposable income, availability of a large patient pool for mAb cancer therapeutics, and rising focus on healthcare. Countries such as India and China offer attractive investment opportunities for clinical research and are anticipated to positively drive research and development prospects for mAbs.

Key Companies & Market Share Insights

Key players operating in the market are driving market growth by undertaking strategic initiatives that can strengthen their product portfolio and aid in expansion activities. For instance, in March 2022, Sanofi S.A. and Blackstone Life Sciences entered a collaboration for accelerating the development of a subcutaneous formulation of Sarclisa mAb for the treatment of patients with multiple myeloma. Some of the key players in the global monoclonal antibodies market include:

-

Novartis AG

-

Pfizer Inc

-

GlaxoSmithKline plc

-

Amgen Inc.

-

Merck & Co., Inc.

-

Daiichi Sankyo Company, Limited

-

Abbott Laboratories

-

AstraZeneca plc

-

Eli Lilly And Company

-

Johnson & Johnson Services, Inc.

-

Bayer AG

-

Bristol Myers Squibb

-

F. Hoffman-La Roche Ltd.

-

Viatris Inc.

-

Biogen Inc.

-

Thermo Fisher Scientific, Inc.

-

Novo Nordisk A/S

-

Sanofi S.A.

-

Merck KGaA

Monoclonal Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 237.61 billion

Revenue forecast in 2030

USD 494.53 billion

Growth rate

CAGR of 11.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source type, production type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Kenya; Zimbabwe; Egypt; Nigeria; Morocco; Algeria

Key companies profiled

Novartis AG; Pfizer Inc; GlaxoSmithKline plc; Amgen Inc.; Merck & Co., Inc.; Daiichi Sankyo Company, Limited; Abbott Laboratories; AstraZeneca plc; Eli Lilly And Company; Johnson & Johnson Services, Inc.; Bayer AG; Bristol Myers Squibb; F. Hoffman-La Roche Ltd.; Viatris Inc.; Biogen Inc.; Thermo Fisher Scientific, Inc.; Novo Nordisk A/S; Sanofi S.A.; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Monoclonal Antibodies Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the monoclonal antibodies market based on source type, production type, application, end-use, and regions.

-

Source type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Murine

-

Chimeric

-

Humanized

-

Human

-

-

Production Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

In Vivo

-

In Vitro

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Autoimmune Diseases

-

Infectious Diseases

-

Neurological Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Specialty Centers

- Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Kenya

-

Zimbabwe

-

Egypt

-

Nigeria

-

Morocco

-

Algeria

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the monoclonal antibodies market include Novartis AG, Pfizer, Inc, GlaxoSmithKline plc, Amgen, Inc., Merck & Co., Inc, Daiichi Sankyo Company, Ltd., Abbott, AstraZeneca, Eli Lilly, Johnson & Johnson Services, Inc., Bayer AG, Bristol Myers Squibb Co., Mylan N.V., Biogen Inc., Thermo Fisher Scientific, Inc., Novo Nordisk A/S, Sanofi Genzyme, and F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the market growth include rising incidence of cancer and other chronic diseases, high demand for biologics, and increasing R&D activities in genomics.

b. The global monoclonal antibodies market size was estimated at USD 210.06 billion in 2022 and is expected to reach USD 237.61 billion in 2023.

b. The global monoclonal antibodies market is expected to grow at a compound annual growth rate of 11.04% from 2023 to 2030 to reach USD 494.53 billion by 2030.

b. North America dominated the monoclonal antibodies market with a share of 46.10% in 2022. This is attributable to well-established healthcare infrastructure, increasing government funding for cancer research and technology development, government support in infection control & management, and rising incidence of lifestyle-associated diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."