- Home

- »

- Medical Devices

- »

-

mRNA Therapeutics Contract Development & Manufacturing MarketGVR Report cover

![mRNA Therapeutics Contract Development & Manufacturing Market Size, Share & Trends Report]()

mRNA Therapeutics Contract Development & Manufacturing Market Size, Share & Trends Analysis Report By Application (Viral Vaccines, Protein Replacement Therapies), By Indication, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-083-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2020 - 2021

- Industry: Healthcare

Report Overview

The global mRNA therapeutics contract development and manufacturing organization market size was estimated at USD 7.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2023 to 2030. The rising application of mRNA in treating infectious and chronic diseases and the adoption of mRNA vaccines, especially during & post-COVID-19 pandemic are key growth drivers for this market. Moreover, funding for the research of these therapeutics is further supporting the market growth.

The COVID-19 pandemic has positively impacted the expansion of the global market owing to the widespread of the virus worldwide, which created an urgent need for vaccines and a high number of funding for the development and manufacturing of mRNA-based COVID-19 vaccines. Additionally, because mRNA vaccines offer a strong defense against new strains of the SARS-COVID-19 virus, demand is still high after the cases of COVID-19 have reduced. The biopharmaceutical companies made a significant number of partnerships with the CDMO during the mRNA COVID-19 vaccine (mRNA-1273). Such partnerships are likely to have supported the market during the pandemic.

mRNA technologies have emerged as a unique and effective strategy to generate new medications that have the potential to change existing therapies or target difficult-to-treat indications such as respiratory, cardiac, metabolic, and autoimmune illnesses, as well as cancer. Advances in mRNA technology and cellular delivery methods, combined with their low cost, ease of manufacture, and capacity to target previously unknown pathways, have endless potential to revolutionize medicine. These factors of mRNA are increasing the demand for mRNA CDMO services and hence are promoting the market.

The high potential of mRNA in treating chronic and infectious diseases has improved the pipeline of mRNA therapeutics. For instance, Lonza, in 2021 stated that there were over 220 mRNAs in the pipeline for the treatment of various diseases. This is expected to improve the demand for CDMO activities and thus promote the market in

The pharmaceutical and biotech industries are key end users for CDMOs because they offer potential capabilities and cost savings over in-house manufacturing. Due to their inability to effectively produce and develop treatments, small and mid-sized CDMOs contract out their development and manufacturing needs. This element is anticipated to boost market expansion.

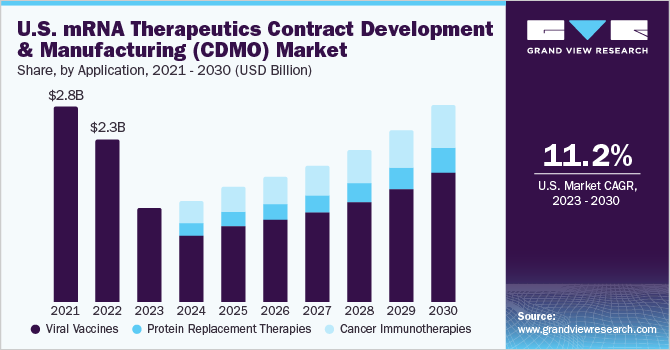

Application Insights

The viral vaccines segment dominated the market and accounted for the entire market revenue share of 100% in 2022. This is due to the launch of various mRNA-based vaccines to control the spread of the COVID-19 virus. For instance, in August 2022, Moderna and Pfizer, Inc.- BioNTech SE bivalent vaccines received FDA approval to be used as a booster dose. Thus, in the short-term the mRNA therapeutics contract manufacturing and development market is only based on COVID-19 vaccine sales. However, the expected potential that the mRNA represents there is an increased investment in R&D for other applications such as oncology and respiratory disorders. Thus, represents a strong product pipeline that is expected to launch by 2024 from where the market revenue will be distributed amongst other applications as well.

The cancer immunotherapies segment is anticipated to undergo maximum growth from 2024-2030 owing to the increasing cancer prevalence and investments to develop novel therapies to combat this growing prevalence. According to the American Society of Cancer, in January 2022, there were an estimated 18.06 million survivors for the 10 most prevalent cancer in the U.S. Thus, the rising cases of cancer demand for the development of new novel therapies and is creating potential opportunities for the mRNA therapeutics CDMO market.

Indication Insights

Infectious diseases dominated the market and solely contributed to 100% of the revenue share in 2022. The increasing adoption of mRNA-based vaccines, a high number of candidates entering clinical trials for various infectious diseases, and the COVID-19 outbreak in late 2019 have led to the dominance of this segment. Moreover, the continued burden of influenza demands for vaccination as a measure to prevent influenza viruses. For instance, according to a research paper, “mRNA vaccines: A novel weapon to control infectious diseases”, published in October 2022, between October 2021 and April 2022, an estimated 7.9 million Americans developed influenza, and 8,200 of them died as a result of the illness.

The metabolic and genetic segment consists of diseases such as cancer and other genetic diseases. It is anticipated to experience maximum growth of 11.65% between 2024-2030 owing to the subsequent number of products under development for these applications. For instance, according to a report published by Thermo Fisher Scientific Inc, in September 2022, oncology and hematology are the leading therapeutic areas leading the drug development pipeline and contributing to about 59% of the total pipeline.

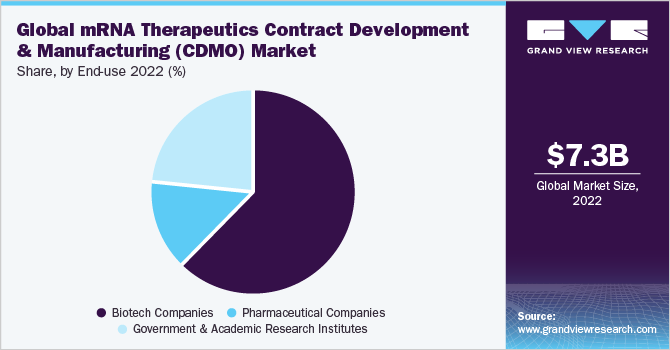

End-user Insights

The biotech companies dominated the market in 2022 with a market share of 62.56%. This is due to quick and accelerated steps taken to address the need for therapeutics for the COVID-19 pandemic. Moreover, strategic initiatives such as partnerships and collaborations with CDMO have helped biotech companies to generate profitable revenues. For instance, according to an article published by PharmTech, in February 2021, about 50% of Lonza’s partners, for example, are represented by emerging, small biotech companies and virtual companies. As a significant market for CDMO firms, these newly established and tiny biotech firms account for over 80% of the current drug development pipeline.

Government and research institutes is anticipated to experience maximum growth over the forecast period with a CAGR of 10.81%. This is due to rising investment by government bodies to develop novel therapies for chronic diseases and an elevated interest in healthcare post the major challenges faced due to the pandemic. For instance, according to a research article published by National Center for Biotechnology Information, in March 2023, for the development, manufacture, and acquisition of mRNA covid-19 vaccines, the U.S. government spent at least $31.9 million, with significant sums made in the three decades prior to the pandemic and continuing until March 2022.

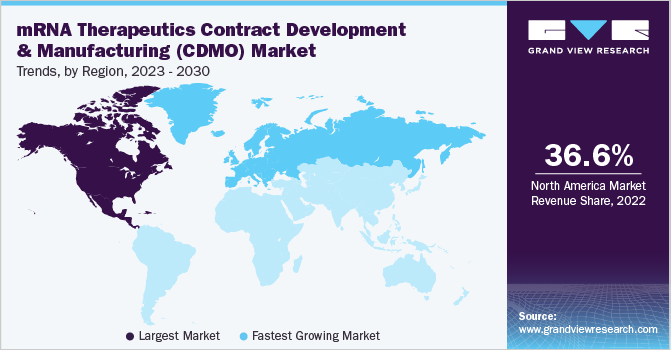

Regional Insight

North America dominated the market and held 36.6% share of the global market in 2022, this is characterized by the presence of several established CDMO companies. According to a report published by Pfizer, Inc., there were approximately 300 pharmaceutical CDMOs supporting the pharmaceutical industry in the U.S. in 2022. Furthermore, the market in North America will also be driven by the availability of sizable research funding, expanding federal programs towards RNA-based therapies, and rising number of clinical studies.

Europe held the second largest market share in 2022 owing to increased patient population and awareness regarding rare genetic diseases. Moreover, the region was badly hit by the pandemic which created high demand for mRNA vaccines to control the severity of COVID-19 virus in the infected population. In addition, expansion by key players operating in the market in the region is also driving the market growth. For instance, in February 2022, Moderna announced its expansion in 6 European Countries as part of U.S. biotech’s expansion plan to “support the delivery of mRNA vaccines and therapeutics locally.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives such as the launch of new product partnerships, collaborations, mergers, and acquisitions aiming to strengthen their service portfolio, and provide a competitive advantage. For instance, in January 2023, Eurogentec expanded its manufacturing capacity for mRNA in Kaneka Eurogentec S.A. with an investment of USD 2.0 million. Such initiatives are likely to support market growth. Some prominent players in the mRNA therapeutics contract development and manufacturing (CDMO) market are:

-

Danaher (Aldevron)

-

Biomay AG

-

Bio-Indication Inc,

-

eTheRNA

-

Kaneka Eurogentec S.A

-

TriLink BioTechnologies

-

ApexBio Technology

-

BioNTech SE.

-

Biocina

-

Lonza

-

Recipharm AB

-

Catalent, Inc.

-

Samsung Biologics

mRNA Therapeutics Contract Development & Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.14 billion

Revenue forecast in 2030

USD 8.35 billion

Growth rate

CAGR of 10.5% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2020 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Application, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Danaher (Aldevron); Biomay AG. Bio-Indication Inc; eTheRNA, Kaneka Eurogentec S.A; TriLink BioTechnologies; ApexBio Technology; BioNTech SE.; Biocina, Lonza; Recipharm AB; Catalent, Inc.; Samsung Biologics

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global mRNA Therapeutics Contract Development & Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global mRNA therapeutics contract development and manufacturing (CDMO) market based on application, indication, end use and region:

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Viral Vaccines

-

Protein Replacement Therapies

-

Cancer Immunotherapies

-

-

Indication Outlook (Revenue, USD Million, 2020 - 2030)

-

Infectious Diseases

-

Metabolic & Genetic Diseases

-

Cardiovascular & Cerebrovascular Diseases

-

-

End use Outlook (Revenue, USD Million, 2020 - 2030)

-

Biotech Companies

-

Pharmaceutical companies

-

Government & Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mRNA Therapeutics Contract Development and Manufacturing (CDMO) market size was estimated at USD 7.31 billion in 2022 and is expected to reach USD 4.14 billion in 2023.

b. The global mRNA Therapeutics Contract Development and Manufacturing (CDMO) market is expected to grow at a compound annual growth rate (CAGR) of 10.54% from 2023 to 2030

b. The biotech companies dominated the market in 2022 with a market share of 62.56%. This is due to quick and accelerated steps taken to address the need for therapeutics for the COVID-19 pandemic

b. Danaher (Aldevron), Biomay AG. Bio-Indication Inc, eTheRNA, Kaneka Eurogentec S.A, TriLink BioTechnologies, ApexBio Technology, BioNTech SE., Biocina, Lonza, Recipharm AB, Catalent, Inc., Samsung Biologics

b. Rising application of mRNA in treating infectious and chronic diseases and adoption of mRNA vaccines especially during & post COVID-19 pandemic are key growth drivers for this market. Moreover, funding for the research of these therapeutics is further supporting the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."