- Home

- »

- Electronic Devices

- »

-

Multi-mode Receiver Market Size And Share Report, 2030GVR Report cover

![Multi-mode Receiver Market Size, Share & Trends Report]()

Multi-mode Receiver Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (Fixed-Wing, Rotary-Wing), By Fit, By Application (Navigation & Positioning, Landing, Others), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-337-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi-mode Receiver Market Size & Trends

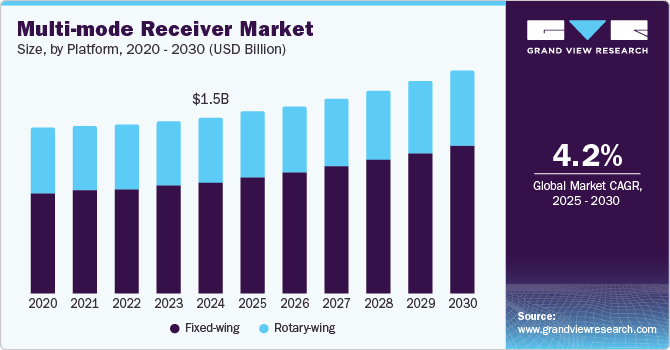

The global multi-mode receiver market size was valued at USD 1.54 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The growth of this market is primarily influenced by the ability of multi-mode receivers to accumulate and combine multiple navigation and guidance functionalities into one compact hardware unit. This ensures improved aircraft navigation, positioning, and landing capabilities.

In recent years, the airline industry has been experiencing significant growth in demand coupled with strenuous schedules. This has resulted in the requirement for a robust ecosystem supported by a large number of employees, infrastructure abilities, efficient aircraft, technology-driven systems, and more. For instance, the U.S. airline industry operates nearly 27,000 flights every day worldwide, carries almost 2.7 million passengers every day across 80 different countries, and moves approximately 61,000 tons of cargo to/from nearly 220 countries.

However, resource restraints, growth in expenditure, and increasing demand for improved customer-friendly services have resulted in multiple problems related to human capital management, passenger safety, aircraft safety, technology advancements, increased susceptibility to weather delays, and more. This has stimulated multiple airline industry participants to incorporate efficient tools and embrace modern technology-assisted systems.

Multi-mode receivers are advanced technology-equipped systems that receive signals from numerous navigation and landing systems and utilize them to guide aircraft. The multi-mode receivers often receive signals from various systems such as Global Positioning System (GPS), VOR (Very High Frequency Omnidirectional Range), MLS (Microwave Landing System), ILS (Instrument Landing System), and others. These signals are then combined to verify each one’s accuracy. The system offers guidance during aircraft landing and approach based on verified signals.

Growing utilization of advanced aircraft such as the Airbus A320, well-liked for its narrow body, Boeing 737 Next Generation planes such as 737-700 and 737-800, and others has led to a significant increase in operational excellence and provided leverage for airlines to schedule more trips. However, companies have been turning to technology and innovation companies for advanced avionics to enhance situational awareness, reduce the workload for pilots, and back the dispatch reliability. This includes the installation of weather radars, guidance systems, collision avoidance abilities, and more.

For instance, in December 2024, Honeywell International Inc. announced Avianca had selected the company’s portfolio of mechanical systems and avionics technologies for utilization in the Airbus A320neo fleet. Honeywell’s 131-9A APU, IntuVue RDR-4000 3D Weather Radar System, Pegasus II A320 Flight Management System (FMS), Integrated Multi-Mode Receiver, Traffic Collison Avoidance System (TCAS) and Enhanced Ground Proximity Warning System (EGPWS) are some of the avionics technologies by Honeywell, which are selected for adoption across a new fleet of Avianca.

Platform Insights

The fixed-wing segment dominated the global multi-mode receiver industry with a revenue share of 63.3% in 2024. Designed for aircraft that generate lift through fixed wings, these multi-mode receivers are an integral part of the airline's passenger carriers and cargo aircraft. Fixed-wing platform-based multi-mode receivers play a vital role in the uninterrupted operations of the airline industry. Increasing growth experienced by the international airline industry, the focus of multiple governments such as India on enhancing infrastructure for the domestic airline market, and technological advancements are likely to develop growth opportunities for this segment.

The rotary-wing segment is expected to experience significant growth during the forecast period. These multi-mode receivers are used in aircraft that utilize rotating blades to develop lift, which enables them to hover, take off vertically, and land according to requirements. The increasing use of helicopters by various industries, such as transportation, aerospace and defense, critical infrastructure management, marine and shipping, logistics, and others, is likely to increase demand.

Fit Insights

The line-fit multi-mode receivers segment held the largest revenue share of the global multi-mode receiver industry in 2024. The line-fit multi-mode receivers are installed during an aircraft's initial phase or development, while retrofit is installed into existing carrier capabilities during the upgrades and enhancements. With increasing focus on passenger safety and aviation security, companies have emphasized incorporating advanced technology-assisted systems and adopting innovation-based technologies. The line-fit installation also enables seamless integrations with the desired compatibility.

New additions to the fleet, plans for expansion, and a focus on capacity enhancements by key airline industry participants are likely to generate growing demand for the line-fit multi-mode receivers segment. For instance, in December 2024, Air India Ltd., one of the prominent international airlines from India, confirmed the purchase order of 100 more Airbus aircraft, including 10 wide-body A350s and 90 narrow-body A320 family aircraft, comprising A321neo. This order of 100 aircraft is in addition to the orders already conveyed to Airbus and Boeing for 470 aircraft during the previous year.

The retrofit multi-mode receivers segment is projected to experience adequate growth from 2025 to 2030. The development of this segment is mainly driven by the fleet upgrade projects initiated by multiple airline industry participants. For instance, in April 2024, American Airlines, one of the airline's industry participants in the U.S., signed an agreement with AIRBUS for numerous airframe upgrades and avionics systems. The agreement is associated with 150 A320ceo family of aircraft in its existing service fleet. This upgrade agreement includes the addition of an innovation-based Satellite Based Augmentation System Multi-Mode Receiver (SBAS MMR), the latest weather radar systems, Air Traffic Services Units (ATSU), and more.

Application Insights

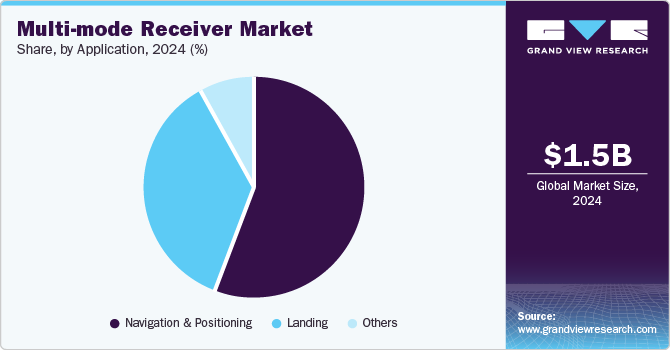

The navigation and positioning segment dominated the global multi-mode receiver industry in 2024. The multi-mode receiver is primarily installed to receive numerous signals from various systems and technologies, combining them for verifications and providing guidance and actionable intelligence. Seamless operations of the airline industry are facilitated by navigation and positioning technologies. Assistance with the system and use of technologies such as GPS and others guide staff in ensuring safe and secure take-offs and landings. Multi-mode receivers, equipped with innovation and technology, provide valuable insights to pilots in maintaining predetermined flight paths during trips. This allows companies to attain operational excellence, improved safety, and reduced risks. Growing incidences of extreme weather conditions leading to delays and increasing workload on pilots driven by significantly rising demand for flight trips are expected to add growth opportunities for this segment.

The landing applications segment is projected to experience the highest growth during the forecast period. This is attributed to factors such as increasing demand for advanced technology-assisted guidance systems, rising incidences of landing delays caused by extreme weather, and growth in air traffic driven by multiple airlines' focus on adding flight trips and enhancing services.

End-use Insights

The aerospace and defense segment held the largest revenue share of the global multi-mode receiver market in 2024. This is attributed to the increasing utilization of advanced multi-mode receivers in commercial airline fleets, business airline fleets, and defense aircraft. MMR delivers navigation, positioning, life, and landing insights. This ensures the safety of passengers, seamless flow of operations for airlines, and security of defense personnel during security forces operations. The aerospace and defense industry relies on flawless technology assistance for lifts, landings, navigation during flight trips, security protocol adherence, knowledge of airspace borders, and more.

The telecommunication segment is anticipated to experience significant growth during the forecast period. Growth of this segment is mainly driven by aspects such as increasing ubiquity of smartphones, growing utilization of connected devices technology, and rising dependency of global businesses on data and data sharing. Additionally, the use of multi-mode receivers in automotive applications for navigation, positioning, and other technology utilization is also contributing to the growth of this segment. Increasing demand for wearables by urban consumers and growing integration of devices and systems with modern technologies such as the Internet of Things (IoT) are anticipated to add growth opportunities.

Regional Insights

North America dominated the global multi-mode receiver market, with a revenue share of 37.6% in 2024. This is attributed to the large number of commercial aerospace industry participants and the increasing demand experienced by the business aerospace solutions market. The presence of multiple manufacturing industry participants for aircraft, aviation technologies, and more is adding to the growth.

U.S. Multi-mode Receiver Market Trends

The U.S. dominated the regional multi-mode receiver industry in 2024. The U.S. is home to numerous aviation technology companies and large enterprises that manufacture aircraft and avionics technology components. This plays a vital role in the growth experienced by this market. Increasing demand for newly made narrow-body aircraft from global customers and the rising focus of multiple organizations on upgrading existing fleets are likely to add growth opportunities for this market.

Europe Multi-mode Receiver Market Trends

Europe was identified as one of the key regions of the global multi-mode receiver industry in 2024. This market is mainly influenced by factors such as the increasing focus of airline industry participants on enhancing cabin technology capabilities and avionics capacity by installing advanced systems and solutions, for instance, in October 2024. Collins Aerospace secured a 10-year contract with Spanish aviation industry participant Air Europa. The company is required to provide comprehensive maintenance, repair, and overhaul (MRO) services for Air Europa's fleet of 787 aircraft as per the contract.

The UK held the largest revenue share of the regional multi-mode receiver market in 2024. This is attributed to factors such as the growing commercial aviation industry, increasing emphasis on enhancing existing avionic technology capabilities, and the availability of advanced solutions delivered by global companies operating in the technology and innovation industry. The UK is visited by many international travelers every year, which adds to the growth experienced by the commercial airline industry in the region. The focus of numerous airline industry companies on reducing the workload of pilots and ensuring the availability of intelligent technologies for a seamless flow of operations is projected to add growth opportunities.

Asia Pacific Multi-mode Receiver Market Trends

Asia Pacific multi-mode receiver market is anticipated to experience the highest CAGR during the forecast period. This is attributed to factors such as increasing growth experienced by the commercial and business aviation industries and the growing focus of multiple governments, such as India, on enhancing domestic airline networks by providing infrastructure and welcoming foreign investments. A significant increase in demand for advanced consumer electronics and connected devices technology in the region also adds to the growth of this market.

China held the largest revenue share of the regional industry in 2024. This market is mainly driven by multiple consumer electronics manufacturers in the country and large enterprises that manufacture components and technology used in electronics. The growing demand for wearables developed by key market participants in the country is anticipated to fuel the growth of this market over the forecast period.

Key Multi-mode Receiver Company Insights

Some of the key companies operating in the multi-mode receiver industry are BAE Systems, Collins Aerospace, Garmin Ltd., Honeywell International Inc., Thales, and others. To address the increasing demand for advanced technologies and innovation-based solutions, the key market participants are embracing strategies such as capacity enhancements, collaborations and partnerships, new launches, a focus on research and development, and more.

-

Collins Aerospace, a company by RTX, develops and delivers innovation-based technology solutions to various industries, including commercial aviation, business aviation, military & defense, helicopters, space, airports, air traffic management, and others. The company’s core capabilities include autonomous operations technologies, cabin experience designs, connected battlespace, digital data solutions, smart products, electrified solutions, innovation manufacturing technology, and others.

-

Honeywell International Inc., a technology and innovation company, offers a wide range of solutions associated with aerospace technologies, automation, energy and sustainability, industrial automation, and more. Its aerospace technologies portfolio entails various elements such as airlines and cargo, business jets, defense, federal solutions, general aviation, ground transportation, helicopters, and others.

Key Multi-mode Receiver Companies:

The following are the leading companies in the multi-mode receiver market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Garmin Ltd.

- Honeywell International Inc.

- Indra Sistemas

- Intelcan Technosystems Inc.

- Leonardo S.p.A.

- Deere & Company

- Collins Aerospace

- Saab AB

- systemsinterface (FREQUENTIS)

- Thales

- Trimble

- VAL Avionics Ltd.

Recent Developments

-

In July 2024, Honeywell International Inc. announced that the company is selected by one of the prominent market participants in the U.S airline industry, United Airlines, for supply of multiple avionics. New 737 MAX is set to enter services over next few years. Honeywell is selected for provision of cockpit technologies for 737 MAX such as integrated multi-mode receiver, weather radar system, collision avoidance system, traffic alert technology, radar altimeter and more.

-

In February 2024, one of the RTX businesses, Collin Aerospace, announced that it had been selected by Air India, one of the major airlines in the Indian domestic market and the global airline industry, for the full avionics hardware suit supply. Air India plans to expand its 737 MAX fleet. Collin Aerospace was selected to provide communication, surveillance equipment, navigation, and air data sensor technology for the newly planned fleet.

Multi-mode Receiver Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.58 billion

Revenue forecast in 2030

USD 1.94 billion

Growth Rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, fit, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

BAE Systems; Garmin Ltd; Honeywell International Inc.; Indra Sistemas; Intelcan Technosystems Inc.; Leonardo S.p.A.; Deere & Company; Collins Aerospace; Saab AB; systemsinterface (FREQUENTIS); Thales; Trimble; VAL Avionics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-mode Receiver Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi-mode receiver market report based on platform, fit, application, end-use, and region.

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-wing

-

Rotary-wing

-

-

Fit Outlook (Revenue, USD Million, 2018 - 2030)

-

Line-fit

-

Retrofit

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigation & Positioning

-

Landing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunications

-

Automotive

-

Aerospace and Defense

-

Marine and Shipping

-

Agriculture

-

Construction and Surveying

-

Transportation and Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.