- Home

- »

- Next Generation Technologies

- »

-

Mutual Fund Assets Market Size And Share Report, 2030GVR Report cover

![Mutual Fund Assets Market Size, Share & Trends Report]()

Mutual Fund Assets Market (2023 - 2030) Size, Share & Trends Analysis Report By Investment Strategy, By Type, By Distribution Channel, By Investment Style, By Investor Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-105-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mutual Fund Assets Market Summary

The global mutual fund assets market size was estimated at USD 553.80 billion in 2022 and is projected to reach USD 936.10 billion by 2030, growing at a CAGR of 6.9% from 2023 to 2030. The mutual fund Asset Under Management (AUM) was valued at USD 56.2 trillion in 2022.

Key Market Trends & Insights

- North America dominated the market in 2022 and accounted for a revenue share of more than 30.0%.

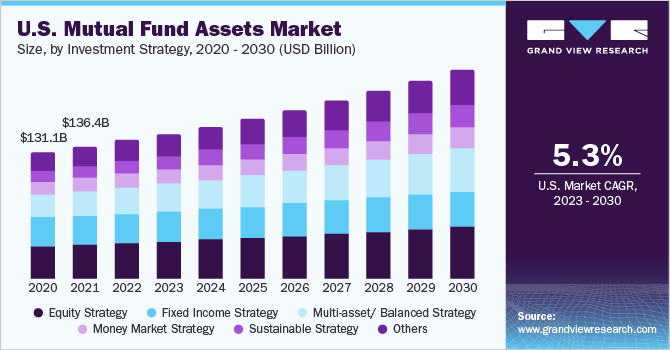

- By investments, the equity strategy segment dominated the market in 2022 and accounted for a revenue share of more than 26.0%.

- By type, the open-ended segment dominated the market in 2022 and accounted for a revenue share of more than 82.0%.

- By distribution channel, the direct sales segment dominated the market in 2022 and accounted for a revenue share of over 35.0%.

- By investment style, the active segment dominated the market in 2022 and accounted for a revenue share of over 71.0%.

Market Size & Forecast

- 2022 Market Size: USD 553.80 Billion

- 2030 Projected Market Size: USD 936.10 Billion

- CAGR (2023-2030): 6.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Diversification is a significant growth driver of the global market. Mutual funds allow investors to diversify their investments across a broad range of assets, such as stocks, bonds, and commodities. This diversification helps mitigate risk by spreading investments across various sectors and asset classes, potentially leading to more stable and consistent returns. Mutual funds provide professional management, further driving the market growth.

Investors who lack the time, expertise, or resources to manage their own portfolios can benefit from the expertise of professional fund managers. These managers conduct thorough research, analysis, and decision-making on behalf of investors, aiming to achieve the fund's investment objectives. The presence of experienced fund managers instills confidence in investors and attracts them to invest in mutual funds. Enhanced liquidity is a prominent driver propelling the growth of the market. Unlike certain alternative investment options, mutual funds offer investors seamless access to their funds. The flexibility provided by mutual funds allows investors to transact in fund shares at the prevailing Net Asset Value (NAV) on any business day.

This liquidity feature empowers investors to make investment decisions aligned with their financial objectives and adapt to evolving market conditions, fostering a favorable investment environment. The simplicity and convenience associated with investing in mutual funds serve as key drivers for market growth. Mutual funds offer a user-friendly investment vehicle that caters to a diverse investor base, including those with limited investment expertise. Investors can enter the market with modest investment amounts and gain access to professionally managed and diversified portfolios, alleviating the need for extensive market analysis or individual stock selection.

This accessibility and ease of use contribute to the widespread appeal of mutual funds, fostering market expansion. However, the growth is restrained by the potential for market volatility and investment risk. Mutual funds are subject to fluctuations in the financial markets, which can result in the loss of principal for investors. In addition, certain types of mutual funds, such as those focused on specific sectors or emerging markets, may carry higher levels of risk. To overcome this restraint, investors can adopt a diversified investment approach by spreading their investments across multiple asset classes and fund categories.

COVID-19 Impact Analysis

The COVID-19 pandemic has increased investor interest and participation in the market. As traditional investment avenues, such as real estate and fixed deposits, faced uncertainties during the pandemic, investors sought alternative options, with mutual funds being one of them. This increased demand has led to a growth in mutual fund assets as more investors allocate their funds to these investment vehicles. Moreover, the pandemic has accelerated the adoption of digital platforms and online investing. With lockdowns and social distancing measures in place, investors turned to online platforms to access and manage their investments.

Investment Strategy Insights

The equity strategy segment dominated the market in 2022 and accounted for a revenue share of more than 26.0%. Investing in equity mutual funds offers the advantage of gaining exposure to a diverse portfolio of companies, mitigating the risks associated with holding individual stocks. This diversification strategy allows investors to access various markets and styles, enabling the construction of well-rounded portfolios tailored to their specific financial objectives. By spreading investments across multiple companies, equity mutual funds provide a comprehensive approach to achieving investment goals while minimizing the vulnerability associated with relying solely on a single stock.

The sustainable strategy segment is anticipated to register significant growth over the forecast period. In recent years, sustainable investing has gained prominence as investors prioritize addressing global challenges, such as climate change, income inequality, and corporate governance. There are multiple offerings aligned with sustainability available for investors, such as ESG Integration Funds, Negative Screening Funds, and Impact Funds, among others. These funds help investors lower risk exposure and, at the same time, align their investments with personal values, fueling the segment's growth.

Type Insights

The open-ended segment dominated the market in 2022 and accounted for a revenue share of more than 82.0%. The dominance can be attributed to its flexibility and liquidity features. Open-ended mutual funds do not have a fixed number of shares and can redeem existing shares or issue new shares based on investor demand. This allows investors to buy or sell shares anytime, providing easy access to their investments. The open-ended structure also enables the fund manager to actively manage the portfolio by adjusting holdings based on market conditions and investment objectives. This flexibility and convenience have made open-ended mutual funds the preferred choice for many investors, contributing to their dominance in the market.

The close-ended segment is anticipated to register significant growth over the forecast period. Close-ended mutual funds often invest in specialized or niche sectors with the potential for higher growth and profitability. This attracts investors who are seeking potentially higher returns on their investments. In addition, the limited number of shares in close-ended funds creates a sense of exclusivity, which can generate demand and drive up prices. Furthermore, the fixed maturity period of close-ended funds appeals to investors looking for long-term investment opportunities with a clear exit strategy.

Distribution Channel Insights

The direct sales segment dominated the market in 2022 and accounted for a revenue share of over 35.0%. Direct sales offer investors the convenience and flexibility to purchase mutual fund units directly without intermediaries, such as brokers or financial advisors. This gives investors greater control over their investment decisions and potentially saves on distribution fees or commissions. Moreover, direct sales provide transparency and direct communication between the mutual fund company and the investor, allowing for a better understanding of the fund's performance, fees, and investment strategy.

The financial advisor segment is anticipated to register significant growth. Many investors seek professional advice and guidance when making investment decisions, particularly those with complex financial situations or long-term goals. Financial advisors have the knowledge and expertise to help investors navigate the intricacies of mutual fund investing and create tailored investment strategies. Moreover, financial advisors provide personalized investment recommendations based on their clients' risk tolerance, financial objectives, and time horizon. This customized approach appeals to investors who value a personalized investment experience.

Investment Style Insights

The active segment dominated the market in 2022 and accounted for a revenue share of over 71.0%. Active management aims to outperform the market by carefully selecting and managing investments based on in-depth research and analysis. This approach appeals to investors who seek the potential for higher returns and believe in professional fund managers' expertise. Moreover, an active investment style offers active decision-making, allowing fund managers to adjust their portfolios based on market conditions and investment opportunities. This flexibility and adaptability attract investors who want their investments to be actively managed and responsive to market changes.

The passive segment is anticipated to register significant growth over the forecast period. Passive investing involves tracking a specific market index or benchmark, such as the S&P 500, rather than attempting to outperform it. This approach appeals to investors prioritizing broad market exposure and long-term stability over actively managed strategies. Moreover, passive mutual funds typically have lower management fees compared to actively managed funds, as they require less active decision-making and research. This cost-effectiveness attracts investors who are conscious of fees and seek to optimize their investment returns.

Investor Type Insights

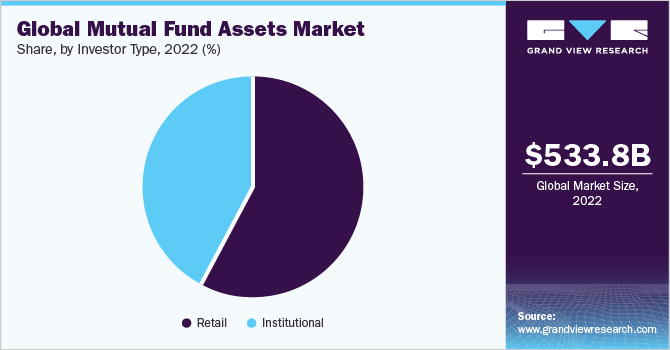

The retail segment dominated the market in 2022 and accounted for a global revenue share of over 58.0%. Mutual funds provide retail investors with a wide range of investment options, including equity funds, bond funds, and hybrid funds, catering to different risk preferences and investment objectives. This versatility allows retail investors to customize their investment strategy according to their financial goals and risk tolerance. Moreover, mutual funds often have lower investment minimums compared to other investment vehicles, making them more accessible to retail investors with limited capital. This lower barrier to entry allows retail investors to participate in the market and benefit from professional management and potential market returns.

The institutional segment is anticipated to register significant growth over the forecast period. Institutional investors, such as pension funds, insurance companies, and sovereign wealth funds have substantial financial resources and long-term investment objectives. They seek diversified investment opportunities to achieve their specific investment goals, including generating stable returns, managing risk, and meeting the needs of their beneficiaries or policyholders. Mutual funds offer a wide range of investment strategies and asset classes that cater to the specific requirements of institutional investors.

Regional Insights

North America dominated the market in 2022 and accounted for a revenue share of more than 30.0%. The region has a well-developed and mature financial market, with a strong presence of asset management companies and financial institutions that offer mutual funds. The depth and breadth of the North American financial industry attract a large number of investors, both institutional and retail, who trust and rely on mutual funds as a preferred investment vehicle. Moreover, North America has a culture of investing and a high level of financial literacy among its population. The region's investors are well-informed and actively seek investment opportunities to grow their wealth, with mutual funds being a popular choice.

The Asia Pacific regional market is anticipated to register the fastest CAGR from 2023 to 2030. The region is witnessing significant economic growth and rising middle-class populations, leading to an increase in disposable income and a growing appetite for investment opportunities. As individuals and households accumulate wealth, they are increasingly turning to mutual funds as a means of investment to diversify their portfolios and seek potential returns. Moreover, the development of financial markets and the liberalization of investment regulations in many Asia Pacific countries have opened up opportunities for both domestic and international fund managers to offer a wide range of mutual funds.

Key Companies & Market Share Insights

The competitive landscape of the market is characterized by a diverse range of players, including mutual fund companies, asset management firms, and financial institutions. Major players in the market compete based on factors, such as fund performance, brand reputation, investment strategies, and customer service. Established mutual fund companies with a strong track record and a wide range of fund offerings often have a competitive advantage. However, the market also sees the presence of smaller, specialized firms that focus on niche investment strategies or cater to specific investor preferences.

In July 2023, Franklin Templeton, a prominent global fund manager, introduced the Franklin Sealand China A-shares fund, aiming to provide retail investors in Singapore with an opportunity to invest in the China A-shares market. The fund's primary focus is on investing in China A-shares and equity securities of Chinese companies listed on the local stock exchange, with the objective of achieving long-term capital appreciation. The fund portfolio will comprise approximately 35 to 55 stocks, encompassing various industries, sectors, and market capitalizations. Some of the prominent players in the global mutual fund assets market include:

-

BlackRock, Inc.

-

The Vanguard Group, Inc.

-

Charles Schwab & Co., Inc.

-

JPMorgan Chase & Co.

-

FMR LLC

-

State Street Corporation

-

Morgan Stanley

-

BNY Mellon Securities Corp.

-

Amundi US

-

Goldman Sachs

-

Franklin Templeton

Mutual Fund Assets Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 586.47 billion

Revenue forecast in 2030

USD 936.10 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Investment strategy, type, distribution channel, investment style, investor type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Luxembourg; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

BlackRock, Inc.; The Vanguard Group, Inc.; Charles Schwab & Co., Inc.; JPMorgan Chase & Co.; FMR LLC; State Street Corp.; Morgan Stanley; BNY Mellon Securities Corp.; Amundi U.S.; Goldman Sachs; Franklin Templeton

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mutual Fund Assets Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the mutual fund assets market report based on investment strategy, type, distribution channel, investment style, investor type, and region:

-

Investment Strategy Outlook (Revenue, USD Billion, 2017 - 2030)

-

Equity Strategy

-

Fixed Income Strategy

-

Multi-asset/Balanced Strategy

-

Sustainable Strategy

-

Money Market Strategy

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Open-ended

-

Close-ended

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Direct Sales

-

Financial Advisor

-

Broker-dealer

-

Banks

-

Others

-

-

Investment Style Outlook (Revenue, USD Billion, 2017 - 2030)

-

Active

-

Passive

-

-

Investor Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail

-

Institutional

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Luxembourg

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mutual fund assets market size was estimated at USD 553.80 billion in 2022 and is expected to reach USD 586.47 billion in 2023.

b. The global mutual fund assets market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 936.10 billion by 2030.

b. North America dominated the mutual fund assets market with a share of 30.48% in 2022. The region has a well-developed and mature financial market, with a strong presence of asset management companies and financial institutions that offer mutual funds.

b. Some key players operating in the mutual fund assets market include BlackRock, Inc.; The Vanguard Group, Inc.; Charles Schwab & Co., Inc.; JPMorgan Chase & Co.; FMR LLC; State Street Corporation.; Morgan Stanley; BNY Mellon Securities Corporation; Amundi US; Goldman Sachs; Franklin Templeton.

b. Key factors that are driving the market growth include diversification of investments and enhanced liquidity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.