- Home

- »

- Beauty & Personal Care

- »

-

Natural Cosmetics Market Size, Share & Growth Report 2030GVR Report cover

![Natural Cosmetics Market Size, Share & Trends Report]()

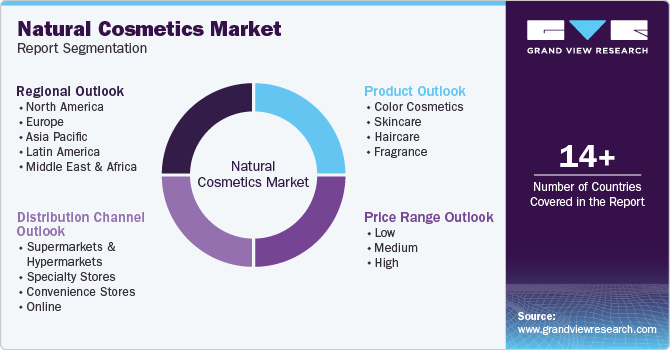

Natural Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Color Cosmetics), By Price Range (Low, Medium, High), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-857-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Cosmetics Market Summary

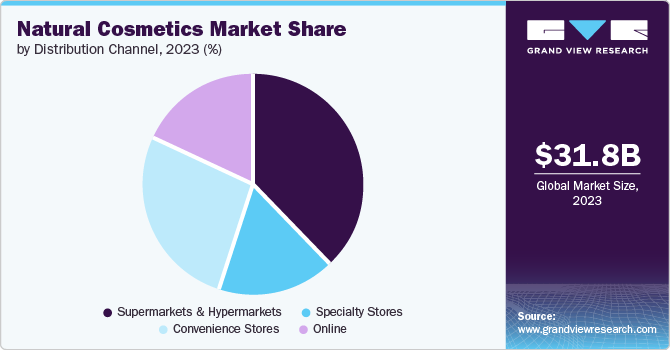

The global natural cosmetics market size was valued at USD 31.84 billion in 2023 and is projected to reach USD 45.60 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The major factors that propel the market growth include the rise in spending on healthy cosmetics and a growing concern of customers regarding the content of chemicals in various cosmetics and their effects on skin and cosmetics.

Key Market Trends & Insights

- North America had a global market share of 27.0% in 2023.

- The U.S. natural cosmetics market accounted for a leading position in North America based on an increased demand by Gen-Z and an expanding LGBTQ community.

- By product, the color cosmetics segment dominated with a market share of 30.1% in 2023.

- By distribution channel, supermarket & hypermarket dominated with a global market share of 38.1% in 2023.

- By price range, medium price range segment dominated with a market share of 44.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 31.84 Billion

- 2030 Projected Market Size: USD 45.60 Billion

- CAGR (2024-2030): 5.3%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The rise in the working population worldwide, government support in terms of policies and regulations, increase in the usage of Internet, and booming e-commerce. In addition, raw materials, technology advancements, rising awareness, changes in consumer trends, and the dominance of online stores have created better opportunities. All these factors indicate a positive growth of the organic cosmetics market within the forecast period. Furthermore, constant skin issues related to synthetic compounds in beauty products and cosmetics are expected to drive the market. The other synthetic forms are methyl paraben, propylparaben, and n-butyl paraben. These products result in developing skin allergies, breakouts of acne, blemishes, rashes, and other skin-related ailments. As a countermeasure, the major players are venturing into organic products.

Moreover, the market growth for natural cosmetics is high due to the rise in online business activities, and effective distribution techniques. Different players in the market are gearing up for digital marketing with interactive advertisements and social media campaigns, which in turn augments the product demand. Advances in social media and the rising Internet connectivity lure consumers to e-commerce to purchase personal care products.

Product Insights

The color cosmetics segment dominated with a market share of 30.1% in 2023 owing to the rising spending on cosmetic products, rapid urbanization, growing disposable income, and a growing awareness about the benefits of natural color cosmetics. The presence of natural products on various platforms has further propelled the market growth.

Hair care is anticipated to be the fastest-growing segment with a CAGR of 5.3% over the forecast period. The increase in awareness and rise in the women population in countries such as India, China, and Brazil are the major reasons for segment growth. Additionally, the shift to natural products has created novel opportunities for companies to expand. Besides, the growing cases of head scalp issues and baldness are further propelling the market growth.

Distribution Channel Insights

The supermarket & hypermarket dominated with a global market share of 38.1% in 2023. The major factors for the segment growth include easy accessibility to physical stores, dominance of online platforms, and buyer convenience. Supermarkets are growing in terms of quantity as the retail market demand for natural cosmetics has leaped high in the post-pandemic times.

The online platform is expected to be the fastest-growing segment with a CAGR of 8.8% over the forecast period. The availability of the internet and the massive reach of online platforms are estimated to be the major factors for the segment growth. The online platforms have accounted for a variety of several product lines. The high connectivity and availability of several products have bolstered the demand for cosmetic products. Moreover, an increase in demand for smartphones, seamless bandwidth, and secure payment options are further propelling the market growth.

Price Range Insights

The medium price range segment dominated with a market share of 44.9% in 2023. The prevalence of middle-class groups is a major factor for the dominance of this segment as the products offered in this range are of better quality and are available at attractive prices for the middle and upper-middle-class income groups. Additionally, the demand in these countries further propels the market in emerging countries including India, China, and Brazil.

The low price range segment is anticipated to grow at the fastest rate with a CAGR of 6.1% during the forecast period. The factors for the growth of this segment are the increase in internet usage that solves communication and accessibility issues, and awareness about the benefits of these products. The low-price range products are mostly popular with middle-aged consumers. Low-priced products such as hair oil, face creams, moisturizers, and lotions have become prominent in the past few years.

Regional Insights

North America had a global market share of 27.0% in 2023. Factors such as growing competition among key players have been a prominent reason for the market growth. Additionally, the demand for beauty products is high due to a rise in use by the LGBTQ community, which has been a major factor in the segment's growth. Overall, the factors influencing the market growth are an increase in the reach of influencer marketing and an increase in populational awareness.

U.S. Natural Cosmetics Market Trends

The U.S. natural cosmetics market accounted for a leading position in North America based on an increased demand by Gen-Z and an expanding LGBTQ community. These demographics follow beauty and beauty care products with enormous spending on cosmetic products. For instance, fitness enthusiasts and amateurs are most often seen spending on these products. The trend is also shaping in the suburban parts, which has influenced the regional population to opt for beauty products. Thus, an increasing awareness about the side effects of chemically prepared cosmetic products has created a wave of demand for organic products in suburban.

Europe Natural Cosmetics Market Trends

Europe natural cosmetics market dominated with a global share of 38.1% in 2023. Factors such as a shift in trends towards the usage of natural products have largely influenced the population to use organic products, as consumer awareness of personal care and hygiene is high. The companies also focus on addressing customer issues and offer solutions without any side effects on their body. Therefore, these factors have been the major growth factors in Europe.

UK natural cosmetics market led the European region in 2023 owing to growth factors such as a population rise, demand for organic products, and focus on customer well-being. Cosmetics-producing companies are now emphasizing the distribution of natural and organic products with an approach focusing on recyclability and sustainability. Additionally, the buying patterns from Gen Z and millennials have a huge impact on market growth based on their perception of well-being and beauty concepts.

Asia Pacific Natural Cosmetics Market Trends

Asia Pacific natural cosmetics market is fastest-growing with a CAGR of 5.4% during the forecast period. The major reasons attributed to the market expansion in the region include increasing awareness about the benefits of the products and an increase in disposable income. An increase in government regulation by the region's countries in support of natural ingredients has also influenced regional market growth.

China natural cosmetics market accounted for a significant position in 2023 owing to the growing demand for organic products in the female population. China is a highly populous country and has become a manufacturing hub at global levels. The availability of a huge consumer base, advertising spending, and an increase in manufacturing budgets have augmented the scope of the regional market. Celebrity endorsements have further led to a rise in the consumption of cosmetic products.

India is one of the fast-growing markets based on the rise in disposable income and increase in middle and lower income groups in the country which has influenced them in buying these products. The female population is constantly growing in the country, followed by a growing significance of Ayurveda and organic products have largely influenced the use of natural cosmetic products, Additionally, the increasing awareness about skin health and overall appearance has been further driving the market.

Key Natural Cosmetics Company Insights

Some key players in the natural cosmetics market are L’Oreal S.A., Burt’s Bees, 100% PURE, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

L'Oréal S.A. is a worldwide organization in beauty products offer a wide range of both skin and hair products. These well-being products cater to a wide range of needs and concerns in consumers making them the most desired beauty products.

-

Korres is a Greek company of natural cosmetic products that has a wide range of products from skincare to hair care and they are famous for using natural ingredients sourced such as Greek Yogurt, olive oil, and wild rose in their products.

Key Natural Cosmetics Companies:

The following are the leading companies in the natural cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oréal S.A

- Burt’s Bees

- 100% PURE

- KORRES S.A.

- Avon Products, Inc

- Coty Inc

- Bare Escentuals Beauty Inc

- AVEENO

- Weleda

- ARBONNE INTERNATIONAL, LLC

Recent Developments

-

In January 2023, L’Oreal officially launched two new technology prototypes, HAPTA which is specifically designed for users with limited arm and hand mobility, and Brow magic, an electronic eyebrow makeup applicator enabling the customers with personalized brow looks.

-

In February 2024, Soul Tree launched the Soumya Rasa, an ayurvedic product that cleanses and rejuvenates the skin by eliminating the impurities from the body. The company has taken measures to create environmental sustainability through effective glass packaging. The glass packaging elegantly reduces plastic waste and appeals to consumers as well.

Natural Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.46 billion

Revenue forecast in 2030

USD 45.60 billion

Growth Rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Russia; Brazil; South Africa

Key companies profiled

L'Oréal S.A; Burt’s Bees; 100% PURE; KORRES; The Avon Company; Coty Inc; Bare Escentuals Beauty Inc.; AVEENO.; Weleda; ARBONNE INTERNATIONAL, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural cosmetics market report based on product, price range, distribution, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Color Cosmetics

-

Skincare

-

Haircare

-

Fragrance

-

-

Price Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Russia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.